Dutch multinational banking big ING has determined to limit financing for brand new oil and gasoline fields whereas on the identical time rising renewable vitality efforts to push ahead the vitality transition.

The choice is a part of ING’s Terra method to steer its portfolio in the direction of conserving the rise in world temperatures to 1.5 levels Celsius to realize net-zero by 2050.

ING mentioned that it labored exhausting through the years to construct an influence technology lending e-book that’s 60 p.c renewables, ‘outperforming by far probably the most bold’ local weather objective of the Paris Settlement.

“At present we go a step additional and announce that we intention to develop new financing of renewable vitality by 50 p.c by year-end 2025 and can not present devoted finance to new oil and gasoline fields,” ING acknowledged.

These steps are aligned with the ‘Internet-Zero Emissions by 2050 Roadmap’ by the Worldwide Vitality Company. Large funding is required in clear vitality and infrastructure, which can then result in a lower in demand for fossil fuels, in accordance with the roadmap. That decreased demand ought to be met by present oil and gasoline fields, which signifies that in each the IEA’s and ING’s view, no new fields ought to be wanted.

These steps additionally assist the European Union’s ‘Match for 55’ and ‘REPowerEU’ plans. Additionally there, key components are oil and gasoline provides from present fields, investments in clear vitality, infrastructure for the electrified financial system, and vitality effectivity.

“The easiest way to cut back dependency on fossil fuels is to verify there are sufficient reasonably priced inexperienced options accessible,” mentioned Michiel de Haan, head of ING’s vitality sector. “These steps assist that and present we’re severe about placing our financing to work to facilitate the vitality transition.”

The financial institution acknowledged that it balances three pursuits in growing ING’s vitality technique – the necessity to decarbonize to battle local weather change, the necessity for vitality to stay reasonably priced for individuals and firms, and the necessity for safety of the vitality provide.

The steps introduced by ING comply with actions the financial institution began years in the past. Taking a look at its energy technology portfolio, ING pledged in 2017 to exit coal-fired energy vegetation by 2025 and has since then decreased its publicity by 80 p.c. On the identical time, it greater than doubled its financing of energy technology from renewable vitality sources similar to photo voltaic and wind, which now makes up virtually 60 p.c of ING’s energy technology portfolio.

The restriction refers to devoted upstream finance – lending or capital markets – for oil and gasoline fields accredited for growth after December 31, 2021.

“On the identical time, we’ll proceed to supply financing to purchasers lively in conserving oil and gasoline flowing, according to efforts to maintain vitality safe and reasonably priced throughout the low-carbon transition,” ING mentioned.

To see how shortly the vitality transition is taking form and forcing sure entities to look previous oil and gasoline, there is no such thing as a must look previous ING.

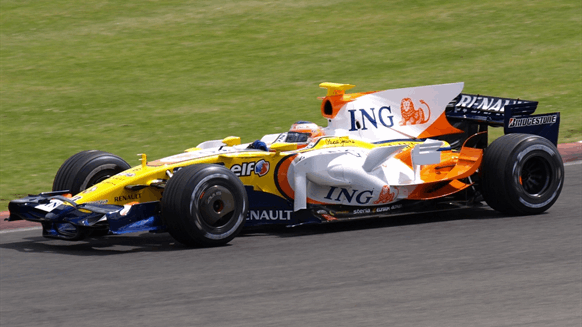

From 2007 to 2010, they had been the first sponsor of a staff competing in in all probability the most important fuel-spending sport in existence – Components 1. The staff in query, Renault, even added the financial institution’s identify in its official race staff identify and known as itself ING Renault Components 1 Staff. They had been even usually sponsors of races held within the F1 championship.

With this new announcement, it’s extremely seen that some entities try to ship a transparent message that oil and gasoline is not the way in which to go for them, regardless of the alternative being true comparatively not too long ago.

Additionally, ING is thus far the most important financial institution to step away from new oil and gasoline investments. The Dutch banking big as of the tip of 2020 was the thirtieth largest financial institution on the earth. The highest 4 banks are Chinese language, with the Industrial and Business Financial institution of China taking the highest spot. The highest financial institution exterior of China is JPMorgan Chase in fifth place.

To contact the writer, electronic mail bojan.lepic@rigzone.com