Pure gasoline futures floundered again into freefall Wednesday – the case of a majority of buying and selling periods early within the new yr – as manufacturing climbed, benign climate endured and the market braced for an anemic storage withdrawal.

At A Look:

- Immediate month sheds 27.5 cents

- Manufacturing hits 102 Bcf/d

- Climate forecasts wobble

After a 16.7-cent achieve a day earlier, the February Nymex gasoline futures contract settled at $3.311/MMBtu on Wednesday, down 27.5 cents day/day. March shed 14.2 cents to $3.111.

NGI’s Spot Gasoline Nationwide Avg. slid 18.5 cents to $5.930. It had climbed 90.5 cents on Tuesday.

Reflecting momentum gathered in 2022 following lofty home demand and calls from Europe for U.S. exports, manufacturing topped 102 Bcf/d in Bloomberg’s Wednesday estimate, placing it in step with report ranges.

Nevertheless, due to seasonally delicate climate throughout massive swaths of the nation – from the South to the East – to start out 2023, demand has tapered and costs have dropped greater than 50% from late final yr. Forecasts present a return of extra widespread winter climate within the remaining week of January, however the climate outlook has fluctuated every day and left merchants doubting the depth and length of the approaching chilly.

Each the American and European climate fashions marketed hotter developments in a single day for the ultimate week of January, in keeping with NatGasWeather.

“In a single day information maintains very mild nationwide demand the subsequent three days, mild this weekend into the beginning of subsequent week, however nonetheless robust demand Jan. 26-31,” NatGasWeather stated Wednesday. Nevertheless, the outlook within the newest mannequin runs was “merely not as spectacular with the quantity of chilly into the U.S. and in addition not as aggressive in advancing subfreezing air into the southern and jap U.S.”

Forecasts wanted to keep up or strengthen chilly within the outlook for late January to keep away from “frustration/promoting” out there, the agency added.

StoneX Monetary Inc.’s Thomas Saal, senior vice chairman of power, echoed that sentiment.

“Mom Nature is fairly delicate proper now and with out a change, it’s wanting like a comparatively heat winter,” Saal informed NGI. “Now, there’s lots left of the season, however for probably the most half, the market is ready to see. And within the meantime, there’s loads of provide, and that’s weighing on costs.”

Storage, Freeport Wildcards

Given a specific weak climate begin to the yr – the primary half in January might show the warmest in practically 20 years, in keeping with DTN – Saal stated the market is braced for an additional bearish storage print this week. It might observe the uncommon January injection of 11 Bcf that the U.S. Vitality Data Administration (EIA) reported for the week ended Jan. 6.

The EIA report protecting the week ended Jan. 13 “goes to be approach beneath any historic common,” Saal stated. “It’s only a matter of how far beneath and the way it compares” to analysts’ expectations.

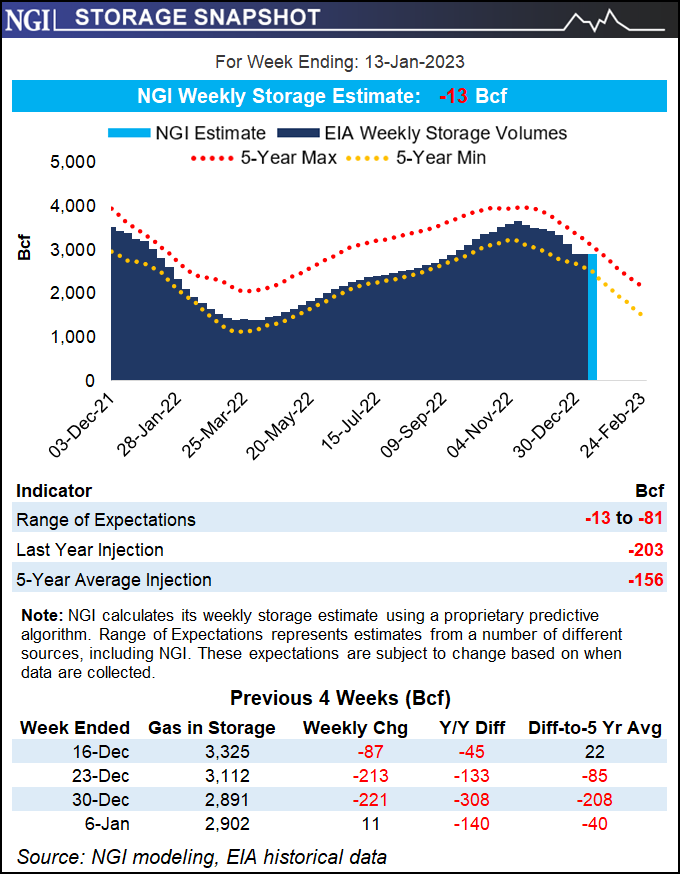

Estimates submitted to Reuters ranged from declines of 53 Bcf to 81 Bcf, with a median of 73 Bcf.

Bloomberg’s ballot discovered analysts on the lookout for a median pull of 75 Bcf. Withdrawal estimates spanned from 61 Bcf to 85 Bcf.

A Wall Avenue Journal survey landed at a median draw of 72 Bcf, with responses starting from decreases of 61 Bcf to 81 Bcf.

The estimates evaluate with a five-year common draw of 156 Bcf and a year-earlier pull of 203 Bcf.

The injection for the Jan. 6 interval in contrast with a five-year common pull of greater than 150 Bcf. It lifted inventories to 2,902 Bcf, leaving shares barely beneath the five-year common of two,942 Bcf and the year-earlier stage of three,042 Bcf.

Except for a possible shift within the climate, the opposite potential catalyst for pure gasoline futures is the anticipated return of Freeport LNG in Texas. The liquefied pure gasoline exporter stated it expects to relaunch later this month, following a June fireplace and a number of restart delays final yr tied to regulatory hurdles.

The corporate hopes to ramp as much as 2 Bcf/d of capability but this winter, although full restoration to 2.38 Bcf/d might not occur till the spring. That gasoline, destined for export, would come from current home provides and will assist align provide/demand balances, stated Marex North America LLC’s Steve Blair, senior account govt.

Nonetheless, he informed NGI the market stays doubtful concerning the timing of Freeport’s return, regardless of the corporate’s current assurances, leaving bulls “dissatisfied” at this stage within the younger yr.

Nevertheless, “earlier than winter is over, hopefully, Freeport will take 2 Bcf/d off of the home market,” Blair stated.

Money Costs Fall

Spot gasoline costs rallied to start out the week amid rounds of winter climate within the West. However with temperatures typically snug elsewhere, modest demand and broader bearish sentiment sapped the momentum on Wednesday

Chicago Citygate declined 13.0 cents day/day to common $2.985, whereas Henry Hub misplaced 31.0 cents to $3.105 and Houston Ship Channel dipped 9.0 cents to $2.620.

Costs within the Rockies and California, whereas easing Wednesday, remained lofty relative to the remainder of the nation. Snow and freezing air impacted elements of the Rocky Mountain area, whereas chilly air lingered in California following a rash of heavy rains this month.

Demand has eased in California this week, as Wooden Mackenzie analyst Quinn Schulz famous, however costs within the state stay excessive partly due to provide constraints that left gasoline flows lighter than consumption at some hubs.

This included PG&E Citygate, the place common costs fell $2.090 Wednesday however remained elevated at $20.075.

Within the Rockies, Northwest Sumas shed 46.0 cents to $18.230

Wanting forward, Nationwide Climate Service (NWS) information for the remainder of this week and early subsequent pointed to above-average temperatures throughout the South and East.

Chillier air that descended from Canada into elements of the West and northern Plains Wednesday was anticipated to unfold throughout a lot of the Midwest and Nice Lakes by subsequent week. NWS forecasts indicated these circumstances might advance to the South and East late within the month, driving extra heating demand.