A number one determine in European telecoms has criticised a number of the largest corporations within the sector for being overly advanced, too centralised and failing to hearken to prospects after a tumultuous 12 months by which their worth has tumbled.

Dutch businessman Olaf Swantee, who ran EE for 5 years between 2011 and 2016 and is seen by trade insiders as one of many frontrunners to grow to be chief govt of Vodafone, stated: “incumbent telcos have too many layers [and] an excessive amount of paperwork”. He referred to as for this to be loosened to spice up efficiency.

Swantee didn’t title any group particularly however the sector has had a bruising 5 years by which a number of the main teams, together with BT and Vodafone within the UK, Telefónica in Spain and Orange in France, have had their valuations slashed by as much as 65 per cent.

In the beginning of the 12 months there have been hopes that, following years of heavy funding, their fortunes would enhance with a number of corporations beginning to implement above-inflation value rises and a trickle of market consolidation. However hovering power costs and inflation have elevated their price of capital and threatened to curtail shopper spending, whereas dealmaking exercise has been lacklustre.

Vodafone has come below explicit strain from activist investor Cevian and a number of other of its largest shareholders to simplify its sprawling enterprise, shed poorly performing items and decentralise its international operations.

The board in the end determined earlier this month to half methods with chief govt, Nick Learn, who will step down on the finish of the 12 months.

Out of the incumbents solely Deutsche Telekom has managed to buck the sector pattern, largely due to its thriving enterprise within the US which has bolstered group income and enabled the corporate’s share value to rise round 28 per cent over 5 years.

“Telcos don’t present in a short time that they’re in hassle. It takes some time earlier than they crumble,” stated Swantee, who has additionally been an govt at Orange however is now an investor within the sector.

He’s strategic adviser to Warburg Pincus, in addition to govt chair at Neighborhood Fibre, one of many largest various networks within the UK, and chair of T-Cell Netherlands, each owned by the non-public fairness group.

Swantee additionally spent two months as a non-executive director on Vodafone’s board final 12 months earlier than deciding to step down. He declined to touch upon rumours that he’s being thought-about for the highest job at Vodafone or on latest developments on the FTSE 100 firm.

“The non-public fairness mannequin, the place you possibly can make investments loads to enhance a telco, offers it the liberty to behave, to maneuver. It should usually strengthen that enterprise,” he stated, referring to challengers like MasMovil in Spain, Dawn in Switzerland and the broadband fibre market, which has attracted billions from buyers.

“Not simply within the UK, it’s in Germany, France, Switzerland, you’re seeing this explosion of fibre, and with it a gap up of a market that was very a lot closed, the place prospects would stick round endlessly,” he stated.

Swantee stated that publicly listed telcos may study from the extra agile mannequin of privately owned challengers, and have been usually not “customer-centric sufficient” and too “far-off from buyer providers, individuals, and the entrance line”.

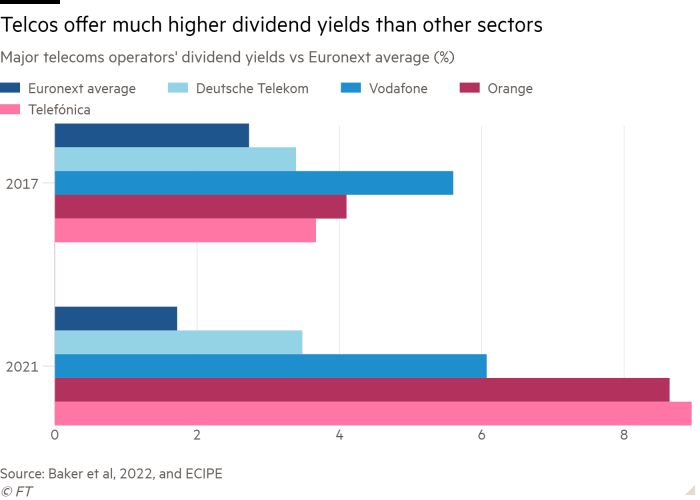

He additionally warned that many telecoms teams had bought themselves right into a “dying spiral” of providing buyers excessive dividends, which was stifling their potential to take a position and innovate.

“While you don’t have development in your mannequin, and also you simply have a dividend story, the chance is that over an extended time frame, you possibly can’t remodel your online business anymore, you’re only a financial institution to your buyers,” he stated. “The telcos which can be caught in a excessive debt/ebitda ratio . . . they’re having a more durable time to remodel themselves efficiently.”