Practically a 12 months after receiving federal approval, Kinder Morgan Inc. has sanctioned the two Bcf/d Evangeline Go pipeline mission that may feed Enterprise International LNG Inc.’s Plaquemines LNG export facility.

In a name with traders on Wednesday to debate 3Q2022 earnings, CEO Steven Kean mentioned Kinder is transferring ahead with the $678 million Evangeline Go mission after receiving credit score help from Enterprise International to proceed with building.

The 2-phase mission contains modifications and enhancements to the Tennessee Gasoline Pipeline and Southern Pure Gasoline Co. techniques in Mississippi and Louisiana.

The pipelines’ in-service dates can be aligned with Enterprise International’s dates for the Plaquemines liquefied pure gasoline export terminal. Enterprise International estimates one-half of capability for the primary part of the mission – 13.33 million metric tons/12 months – may come on-line in 2024, adopted by the second half by the top of 2025.

Kean mentioned the proximity of Kinder’s midstream community all through Texas and Louisiana gives the Houston-based firm a “nice benefit” within the LNG sector. Particularly, he mentioned Kinder’s entry to a number of manufacturing basins, together with reservoir and salt storage, places it in a “nice place to take part within the LNG export story.

“We’ve talked about 50% as being our market share” on the subject of transferring pure gasoline to LNG services, Kean mentioned. “That’s the place we’re right this moment. We positively imagine our volumes are going to proceed to develop, nevertheless it’s arduous to name balls and strikes whether or not we’re going to fulfill or exceed 50% going ahead. However I really feel actually good about our place to take part in that.”

Alongside that entrance, building is underway on the 550 MMcf/d growth of the Permian Freeway Pipeline (PHP), which is ready to ramp by November. Nonetheless, administration mentioned there’s a “potential alternative” for an earlier in-service. Utilizing further compression, deliveries from the Waha space of West Texas would transfer extra provide to mainline connections to Gulf Coast markets.

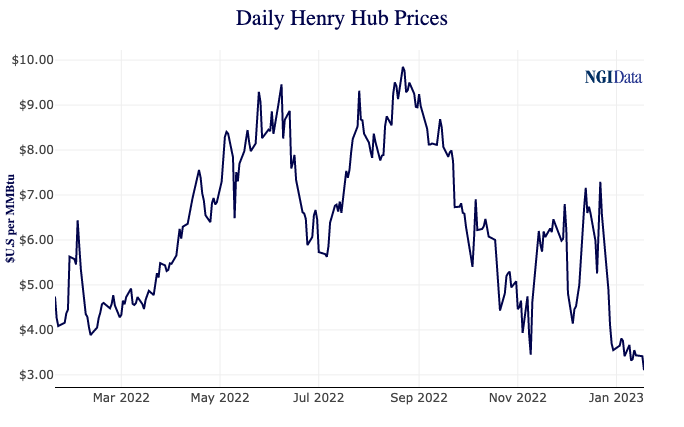

Kinder in 2022 started business discussions to increase one other Permian Basin gasoline pipeline, the Gulf Coast Specific. Nonetheless, an open season “hasn’t been very lively,” Kean mentioned, “though with decrease costs now, there could also be some alternatives there.”

Kean mentioned “gasoline price was a little bit of a headwind for us on that growth mission.” With gasoline costs within the sub-$4.00 vary, “which will carry that yet one more into actional alternative.”

Primarily based on conversations with prospects, the necessity for incremental capability from the Permian could also be late 2026 or early 2027, in keeping with Kean. “The general market nonetheless wants that capability,” he mentioned. Nonetheless, the duty is figuring out when and the place the volumes will probably be wanted.

Sturdy Pure Gasoline Volumes

President Kim Dang mentioned pure gasoline transport volumes continued to rise within the fourth quarter of 2022.

The 4% 12 months/12 months enhance was pushed by stronger demand from energy era and native distribution corporations, on account of climate and coal retirements, partially offset by decrease LNG volumes from Freeport LNG. Freeport has been shut since final June. Softer exports to Mexico additionally weighed on transportation volumes, in keeping with Dang.

Pure gasoline gathering volumes had been up 6% in 4Q2022, pushed by Haynesville Shale volumes, which had been up 44% 12 months/12 months.

Though volumes had been flat sequentially on the KinderHawk gathering system within the Haynesville due to capability constraints, administration expects “a pleasant uplift as we head into 2023.” Kean mentioned some capital can be focused towarding debottlenecking the gathering system, however administration additionally sees “some good interstate charge enhance and utilization alternatives as we go ahead.”

Permian Carbon Seize

Kinder’s Power Transition Ventures enterprise unit has set its sights on the Permian for a carbon seize mission, which might be certainly one of a number of on the desk by different corporations. Kinder executed a time period sheet with Pink Cedar Gathering Co. to offer transportation on Kinder’s carbon dioxide (CO2) pipelines and sequester the emissions at an current Class II injection effectively.

Pink Cedar additionally has a mission within the works to seize CO2 from two pure gasoline treating services in southern Colorado for as much as 400,000 metric tons/12 months. It will ship the captured CO2 to Kinder’s Cortez pipeline in New Mexico. Pink Cedar is a three way partnership between the Southern Ute Indian Tribe Development Fund (51%) and Kinder (49%).

Commissioning additionally is ready to start on the Twin Bridges Landfill by the top of March, with building ongoing on the Prairie View and Liberty landfills. The three renewable pure gasoline (RNG) services had been a part of the property acquired from Kinetrex Power in 2021. The websites are anticipated to be positioned in service this 12 months.

Kinder is also starting building this month to transform Autumn Hills, certainly one of seven websites included in its acquisition of North American Pure Assets Inc., to an RNG facility.

Administration Shake-Up

In the meantime, Kean is ready to retire on Aug. 1, however he would stay a board member. Dang has been tapped as CEO. Kean, who has been CEO for eight years, mentioned he seemed ahead to “having the pliability to undertake work in different areas of curiosity to me sooner or later.” He mentioned “the perfect is but to return” for the midstream firm and expressed his help for Dang.

Pure Gasoline Group President Tom Martin would develop into the corporate’s president in August. Midstream Gasoline Group President Sital Mody in February is to succeed Martin as president of the Pure Gasoline Group.

For 4Q2022, web earnings was $670 million (30 cents/share), in contrast with $637 million (28 cents) in 4Q2021. Distributable money circulation (DCF) was $1.22 billion, in contrast with $1.09 billion a 12 months earlier.

For 2022, web earnings was $2.55 billion ($1.12/share), in contrast with $1.78 billion (78 cents) in 2021. DCF was $4.970 billion, down 9% from $5.46 billion in 2021.

In 2023, Kinder administration expects to generate web earnings of $2.5 billion ($1.12/share). Dividends are focused at $1.13/share, a 2% enhance from the dividends declared for 2022. The corporate additionally has budgeted to generate 2023 distributable money circulation (DCF) of $4.8 billion ($2.13/share).