Worldwide Basic Insurance coverage Holdings Ltd. (NASDAQ:IGIC) shareholders are most likely feeling somewhat disenchanted, since its shares fell 3.7% to US$7.45 within the week after its newest quarterly outcomes. It seems to have been a good end result general – whereas income fell marginally wanting analyst estimates at US$115m, statutory earnings beat expectations by a notable 46%, coming in at US$0.35 per share. This is a crucial time for buyers, as they’ll observe an organization’s efficiency in its report, have a look at what skilled is forecasting for subsequent 12 months, and see if there was any change to expectations for the enterprise. With this in thoughts, we have gathered the newest statutory forecasts to see what the analyst is anticipating for subsequent 12 months.

View our newest evaluation for Worldwide Basic Insurance coverage Holdings

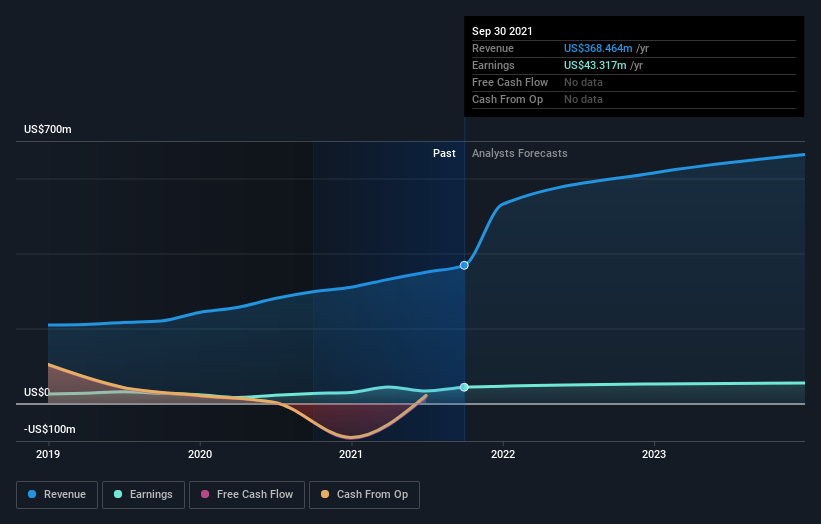

After the newest outcomes, the one analyst overlaying Worldwide Basic Insurance coverage Holdings are actually predicting revenues of US$664.1m in 2022. If met, this could replicate a considerable 80% enchancment in gross sales in comparison with the final 12 months. Per-share earnings are anticipated to bounce 35% to US$1.20. But previous to the newest earnings, the analyst had been anticipated revenues of US$587.7m and earnings per share (EPS) of US$1.10 in 2022. Sentiment actually appears to have improved after the newest outcomes, with a pleasant improve in income and a modest elevate to earnings per share estimates.

Consequently, it could be a shock to see thatthe analyst has reduce their value goal 9.1% to US$10.00, which may counsel the forecast enchancment in efficiency shouldn’t be anticipated to final.

After all, one other method to have a look at these forecasts is to position them into context in opposition to the business itself. The analyst is unquestionably anticipating Worldwide Basic Insurance coverage Holdings’ development to speed up, with the forecast 60% annualised development to the tip of 2022 rating favourably alongside historic development of 16% every year over the previous 5 years. Examine this with different firms in the identical business, that are forecast to develop their income 2.6% yearly. Factoring within the forecast acceleration in income, it is fairly clear that Worldwide Basic Insurance coverage Holdings is predicted to develop a lot sooner than its business.

The Backside Line

Crucial factor right here is that the analyst upgraded their earnings per share estimates, suggesting that there was a transparent improve in optimism in the direction of Worldwide Basic Insurance coverage Holdings following these outcomes. Fortunately, additionally they upgraded their income estimates, and are forecasting revenues to develop sooner than the broader business. Moreover, the analyst additionally reduce their value targets, suggesting that the newest information has led to larger pessimism concerning the intrinsic worth of the enterprise.

With that in thoughts, we would not be too fast to come back to a conclusion on Worldwide Basic Insurance coverage Holdings. Lengthy-term earnings energy is far more vital than subsequent 12 months’s earnings. Not less than one analyst has offered forecasts out to 2023, which might be seen free of charge on our platform right here.

You need to at all times take into consideration dangers although. Living proof, we have noticed 2 warning indicators for Worldwide Basic Insurance coverage Holdings you have to be conscious of.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to carry you long-term centered evaluation pushed by basic knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.