[ad_1]

Prague, Czech republic – Could 22, 2017: 3M Inventory Could Be Presenting an Alternative josefkubes/iStock Editorial by way of Getty Photos 3M Inventory is Down Proper Now

The Set-Up: How We Obtained to As we speak

3M (NYSE:MMM) is a big cap firm with a long-term earnings development charge round 7.5% and annual dividend development charge round 8%.

Historically, 3M has been a sluggish, “steady-eddie” firm and inventory.

As we speak 3M is dealing with present authorized uncertainties that are weighing on the inventory worth. If this matter isn’t in your radar, in late January the corporate was hit with a $110 million greenback verdict by a Florida jury as a consequence of considerations about earplugs and alleged damages brought on by defective product.

Of 11 trials thus far, the rating is about even: six wins for Plaintiffs, and 5 wins for 3M. 5 extra trials are scheduled for later this 12 months.

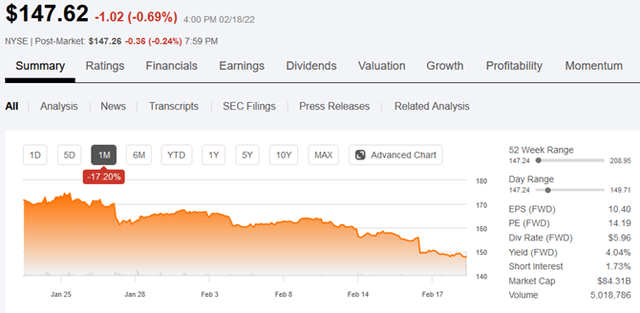

The authorized scenario has weighed on the inventory worth as shares have fallen over 17% previously month.

3M Worth Efficiency the previous month (In search of Alpha)

For a lot of buyers, the predictable firm development and reliable dividend have made 3M a core holding in taxable accounts and retirement accounts.

But now the latest worth pullback begs the questions: is the authorized uncertainty momentary, and is that this the time to think about shopping for/including to positions?

How this Article Provides to the Present 3M Dialog

With a moniker “PatientValueInvestor” as a information to non-public investing choices, the thought is to create a portfolio of high-quality corporations with a monitor file of success which might be undervalued for some short-term purpose.

The important thing factor of this strategy is valuation. That’s, decide what shares are value relative to that firm’s personal norm in comparison with the inventory worth.

Then add a key ingredient: time. Give the corporate time to beat the short-term problem and revert again towards regular outcomes sooner or later.

This text seeks so as to add to the 3M dialog by providing the reason why 3M will probably survive the present uncertainty, a valuation idea based mostly on a return to regular outcomes, and dangers to the valuation.

Why 3M Will Survive the Uncertainty

Little doubt the authorized uncertainty presents 3M administration with vital challenges within the short-term. Buyers rightfully marvel the way to issue within the dangers of the potential legal responsibility and what it means for future 3M earnings.

For my part, listed here are 4 major causes 3M will survive the present uncertainty and normalize efficiency over the lengthy haul:

The possibility to win on enchantment: The authorized course of is underway, and little doubt armies of attorneys are energetic on all sides of the argument to advocate for shoppers. It’s potential that 3M will prevail in future appeals, or no less than amend monetary choices.

Product innovation drives sustainable margins: The analysis and improvement division has created a exceptional suite of merchandise and the corporate hardly ever grants licenses. The result’s that the corporate is ready to keep wholesome margins, even in an inflationary setting. As well as, the corporate is well-positioned in higher-margin areas akin to healthcare to reap the benefits of demographic tendencies going ahead.

Revenue drivers are intact – whatever the authorized uncertainties: Covid and Covid variants and different infectious ailments will proceed to be a big concern for employers, governments and people. 3M is well-positioned within the private protecting gear area to satisfy this want. Diabetes and persistent illness charges are rising internationally. These medical issues create demand for enhanced medical dressings and medical software program to reinforce case administration. And the commercial adhesives and tapes product traces probably have future tailwinds as corporations redesign processes and innovate within the new setting. These tendencies, mixed with 3M authorized patent protections bode properly for long term revenue sustainability.

Firm dimension: with a market cap over $100 billion, even with vital authorized liabilities, the corporate has dimension and scale to soak up unfavorable impacts and develop ahead into the longer term.

Assuming Outcomes Normalize, What are 3M Shares Price?

We affected person worth buyers like to think about investments over years and many years, not the brief run. Assuming 3M normalizes and continues to construct on its lengthy monitor file of rising earnings, what are 3M shares value as the corporate works by way of this season of authorized uncertainty?

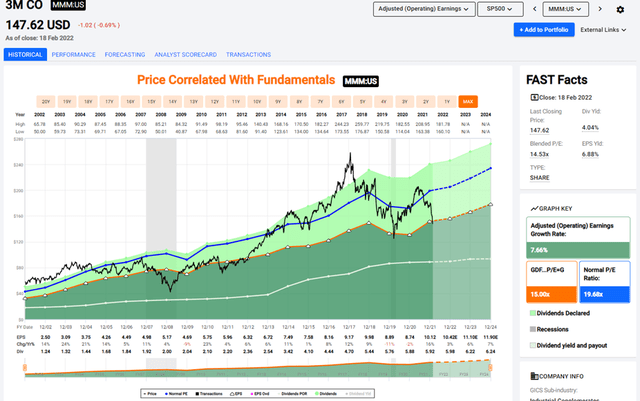

The picture from FastGraphs beneath is instructive when reviewing the value to valuation historical past. Be aware the orange line represents the expansion of earnings per share over a 20-year interval. The blue line is the normalized PE ratio over the interval, and the black line is the inventory worth.

Look intently at earlier low factors on the black worth line. Over the previous 20 years, 3M has bottomed out at round 14X-16X only a handful of occasions.

At present costs and earnings estimates, this is likely one of the extra enticing shopping for alternatives previously 15 years.

20 12 months 3M Worth and Earnings Progress (FastGraphs)

A Affordable Goal Worth

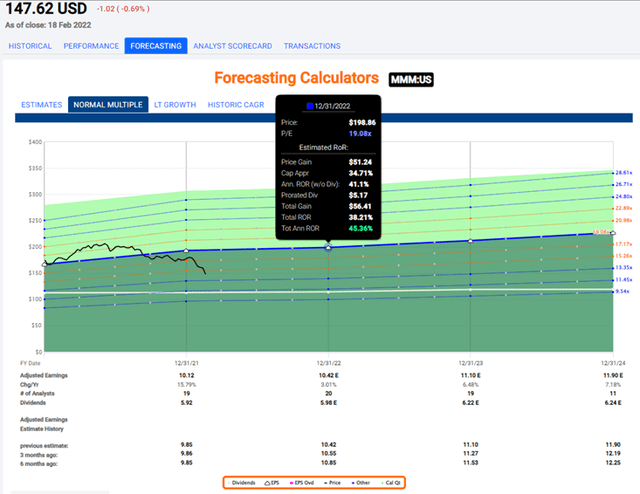

Traditionally over the previous 20 years, the 3M common PE ratio is about 19X. Assuming earnings per share of $10.40 for 2022, the ahead PE is 14X.

If we apply the normalized 19X to anticipated earnings, we may anticipate a valuation round $198, and complete return (capital recognize and dividends) of 43% over the subsequent 12-18 months.

And bear in mind: shareholders receives a commission a dividend north of 4% at present worth ranges whereas ready for a return to regular.

Estimated 3M Valuation Primarily based on Regular PE (FastGraphs)

Dangers to this Valuation

Actually the most important danger to this valuation is the authorized publicity round earplugs and PFAS chemical claims. Jury choices far past what is predicted may make a serious distinction in future earnings.

Provide chain disruptions proceed to have an effect. Whereas it’s hoped these considerations will lower sequentially over the approaching months, unanticipated continued disruptions may happen.

Lastly, slowing development or macroeconomic shocks may weigh on outcomes. Whereas the corporate is properly positioned to soak up difficulties, the size and diploma could exceed expectations.

Conclusion

We worth buyers don’t wish to waste time making an attempt to know the unknowable. Frankly, nobody is aware of how the juries will reply in future 3M trials, and nobody is aware of the result of future appeals processes.

Why attempt to know the unknowable?

What is understood is that 3M has a monitor file of rising earnings and different fundamentals over the previous decade or extra, and that, with sufficient time, ultimately the authorized uncertainties will probably be resolved. Little doubt the consequence might be very unfavorable. However the matter will resolve nonetheless.

Irrespective of the fast headlines, from my perch the secret’s valuation. At present costs, 3M is obtainable at a beautiful entry level based mostly on the corporate’s personal historic norms, dimension, and market place to revenue sooner or later.

These looking for to determine or add to a place ought to take a detailed look right here.

[ad_2]

Supply hyperlink