[ad_1]

Mario Tama/Getty Pictures Information

The next phase was excerpted from this fund letter.

Basic Motors (GM)

Regardless of my enthusiasm for GM’s aggressive positioning within the years to return, it’s the decidedly unsexy legacy operations that preserve GM’s money registers ringing within the right here and now. On that entrance, investor enthusiasm for the present manufacturing – and financing – of inner combustion engines stays fairly muted by most measures. And understandably so:

- GM’s operations are capital intensive,

- GM’s market is very aggressive (and with extra capability as well),

- GM’s provide chain is tremendous complicated (e.g., semi scarcity, tariffs, and so on),

- GM’s labor pressure is (VERY) unionized,

- GM’s liabilities are aplenty and long-dated (e.g., warranties, remembers, lawsuits, and so on),

- GM’s operations have ample – and unavoidable – commodity publicity (in each uncooked supplies & the ensuing influence on product demand/combine), and

- There’s no scarcity of debt to think about.1

Though that hardly represents a complete accounting of the dangers that crowd GM’s disclosures, it’s greater than ample to obscure the many positives to be discovered beneath GM’s hood. Of specific observe is GM’s robust exhibiting throughout seemingly each side of the adjustments looming over the broader automotive trade:

- Inside Combustion Engines (ICE): When you assume all of the discuss electrical and/or autonomous autos is both whole hogwash or nonetheless many years into the longer term . . . GM’s legacy enterprise has you coated. For so long as shoppers proceed to demand ICE powered autos, GM will capably meet stated demand. In truth, regardless of the numerous headwinds confronted by your entire automotive trade in 2021, GM nonetheless capably offered ~6.3 million autos, and generated ~$113.6 billion of automotive-related revenues.

- Electrical Autos (EVs): When you imagine that the online results of the approaching transformation is 1) a change from hydrocarbons to electrons, 2) with out any significant deterioration in world automobile demand (in items) . . . GM is as soon as once more favorably positioned to leverage its Ultium battery expertise, spectacular scale, and appreciable manufacturing chops in direction of the whole lot concerned in attaining the corporate’s acknowledged purpose of including 30+ EVs to their automobile portfolio by 2025.

- Transportation as a Service (TaaS): When you assume it’s apparent that 1) the way forward for transportation shall be each electrical and autonomous, and a pair of) that the ensuing “convergence” of these applied sciences will nullify the long-standing necessity of car possession . . . GM – through their acquired Cruise phase – seems to be shockingly properly positioned.

Given the mountain of uncertainties that the automotive trade should navigate within the coming years, GM’s adaptability/flexibility is each advantageous, and easily with out comparability amongst its friends. Nowhere is that aggressive distinction extra obvious than with respect to their Cruise subsidiary – the first driver of my bullishness for GM’s future.

Cruise

In distinction to the pace courting and partnerships galore that has dominated the autonomous plans of its friends, GM’s plan of assault has been distinctive in not less than two notable respects. Not solely did GM not accomplice with any of the brand new firms began by the unique DARPA individuals, GM didn’t truly accomplice with anybody in any respect.

As an alternative, GM paid handsomely to purchase a comparatively unknown startup. Though a mere three years previous on the time of acquisition, Cruise’s ~40 workers had already properly deserted their preliminary efforts to promote self-driving kits – presciently concluding that:

a full software-hardware integration can be paramount.

Whereas entry to GM’s monetary may has actually helped to fund Cruise’s efforts, the acquisition’s actual differentiator was the entry it granted to GM’s formidable manufacturing and logistical capabilities. Accordingly, beneath GM’s wings, Cruise was in a position to iterate concurrently on each the expertise and the autos to deploy it on. To additional leverage that distinctive benefit, and in sharp distinction to the sanitized testing grounds most popular by its opponents, Cruise accelerated their studying curve by deploying their autos to roam the very busy/difficult streets of San Francisco.

By nearly each measure, the Cruise acquisition was a daring belt. Whereas most of GM’s friends proceed to eagerly body autonomy as a premium characteristic, an upsell of types, that shall be added to autos of the longer term, Cruise has all the time -and unabashedly – been a wager on TaaS.

In truth, regardless of the broadly held view {that a} TaaS-like future – the place autos are one thing we use slightly than personal – is more likely to rework (presumably even decimate) your entire present automotive ecosystem . . . GM remains to be the solely main automaker that has dedicated to construct a TaaS-specific automobile in quantity.

The Cruise “Origin” is that automobile – a boxy-looking, totally autonomous automobile, purpose-built for a future the place TaaS is the prevailing norm. Somewhat than the sense of adventurism, romanticism, and/or standing that the automotive trade has traditionally relied on to market their in any other case costly hunks of steel, the squat Origin is kind of the distinction – seemingly customized to embody Cruise’s broader mission: higher transportation at decrease value.

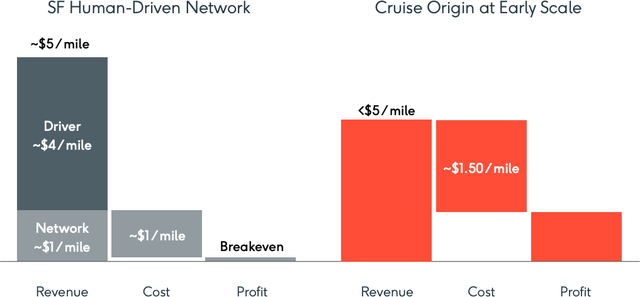

On the fee entrance, in comparison with autos which have been retrofitted with autonomous applied sciences, the Origin is anticipated to start life with a per-mile value benefit of greater than 60%. And, because the beneath graphic makes clear, with out the necessity to compensate human drivers, the Origin will take pleasure in not less than one different vital value benefit vis-à-vis its ridehail friends:2

As is all the time the case with all new applied sciences, widespread adoption will each rely on, and assist facilitate, a big discount of the expertise’s value curve. On that entrance, as a result of each facet of the Origin has been vertically built-in beneath only one roof, GM/Cruise are uniquely positioned to materially widen their value benefit within the years to return, and reap the advantages of doing so.

Though it actually gained’t occur in a single day . . . there’s little doubt that the prices of autonomous choices will ultimately fall beneath – in all probability far beneath – in the present day’s appreciable prices of car possession. And, as these prices start their years-long descent, the ensuing “whole addressable market,” as calculated by GM, turns into nearly laughably massive:3

Since elevated scale is more likely to be an necessary driver in lowering the expertise’s prices within the years to return . . . the Origin formally left the prototype stage when the first-batch went into pre-production in June of 2021. Wanting ahead, GM is now guiding for full(er) manufacturing to start someday in early 2023, and scale quickly within the years thereafter. Some delays are in all probability inevitable, however scaling ought to play to GM’s strengths. With that in thoughts, right here’s how GM describes the anticipated fast scale up:4

“In [2023], we’ll be constructing [Origins] measured in hundreds. In 2024, we’ll be desirous about issues measured in tens of hundreds, and it will probably ramp-up fairly rapidly to a whole lot of hundreds from there.”

Within the meantime, Cruise is hardly idling in impartial:

- 9/2021: California’s DMV granted each Google’s Waymo and Cruise a “DMV Driverless Deployment (paid)” allow. Whereas Cruise was authorized to offer rides in its AVs with out a security driver, Waymo is barely allowed to deploy its AVs with a human monitor behind the wheel.5

- 11/2021: Cruise’s Co-Founder and CTO, Kyle Vogt, grew to become the primary passenger of the very first totally autonomous taxi to (legally) drive the streets of San Francisco.6 In recognition of this milestone, and as obligated by their preliminary funding, the Softbank Imaginative and prescient Fund elevated their Cruise funding by a further $1.35 billion.

- 2/2022: Whereas Cruise remains to be ready for California’s bureaucrats to grant the ultimate allow wanted to cost for autonomous taxi companies,7 Cruise has nonetheless introduced that members of the general public can now join its autonomous taxi service, and trip totally free.8

Simply days earlier than Cruise invited members of the general public to start out hailing driverless rides, GM’s CEO hailed a trip of her personal. Within the ~3 minute video posted to YouTube, Ms. Barra and different GM executives seem nearly giddy as Cruise’s expertise safely navigates the nighttime streets of San Francisco. As Ms.

Barra says within the video:9

“. . . I can’t cease smiling . . . it’s like a spotlight of my profession as a result of we all know what this expertise can do . . .”

Realizing Cruise’s full potential will undoubtedly come on the expense of present segments of the present automotive ecosystem. As a substantial participant/beneficiary of that very ecosystem . . . GM won’t solely have to withstand the urge to guard its legacy operations by throttling Cruise’s progress, but in addition defly reduce any ensuing monetary carnage alongside the best way.

The transition is unlikely to be straightforward or comfy . . . however GM’s distinctive positioning warrants far more optimism than is at present evident in its anemic inventory value. Now that Ms. Barra “[knows] what the expertise can do,” the one remaining unknown is that if GM’s administration will keep out of Cruise’s approach, and achieve this with the gusto a brand new expertise calls for.

Footnotes

1 Sure, the majority of GM’s whole debt is expounded to GM Monetary, and the majority of GM Monetary’s debt is collateralized. Higher but, a few of GM Monetary’s debt is ring-fenced (through VIEs). Even so, there is no such thing as a scarcity of liabilities that warrant consideration right here.

2 10.2021: GM Analyst/Investor Day

3 10.2021: GM Analyst/Investor Day

4 2021 GM Analyst/Investor Day

5 TechCrunch – “Cruise, Waymo Get OK To Launch RoboTaxi Service In SF:” Cruise obtained permission “to make use of its fleet of autonomous Chevy Bolt-based autos for business companies on public floor streets inside sure elements of SF between 10 p.m. and 6 a.m., at a most pace of 30 mph. Waymo can use its fleet of light-duty AVs inside elements of SF & San Mateo counties, on public roads with a pace restrict of as much as 65 mph, with no obvious time restrictions. Each [companies] can function in rain and lightweight fog.”

6 The milestone was dutifully documented on each Twitter and YouTube.

7 The California Public Utilities Fee is the gatekeeper for the ultimate allow that Cruise must cost for its autonomous taxi rides.

8 Cruise: “Welcome, Riders”

9 YouTube: GM CEO Mary Barra Takes Her First Driverless Journey

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Supply hyperlink