[ad_1]

It is solely pure that many traders, particularly those that are new to the sport, choose to purchase shares in ‘horny’ shares with a great story, even when these companies lose cash. Sadly, excessive danger investments typically have little chance of ever paying off, and plenty of traders pay a worth to study their lesson.

Within the age of tech-stock blue-sky investing, my selection could appear quaint; I nonetheless choose worthwhile corporations like Vertoz Promoting (NSE:VERTOZ). Even when the shares are absolutely valued at the moment, most capitalists would acknowledge its earnings because the demonstration of regular worth era. As compared, loss making corporations act like a sponge for capital – however in contrast to such a sponge they don’t at all times produce one thing when squeezed.

View our newest evaluation for Vertoz Promoting

How Quick Is Vertoz Promoting Rising?

In case you imagine that markets are even vaguely environment friendly, then over the long run you’d anticipate an organization’s share worth to comply with its earnings per share (EPS). Subsequently, there are many traders who like to purchase shares in corporations which might be rising EPS. We are able to see that within the final three years Vertoz Promoting grew its EPS by 4.3% per yr. Whereas that type of progress fee is not wonderful, it does present the enterprise is rising.

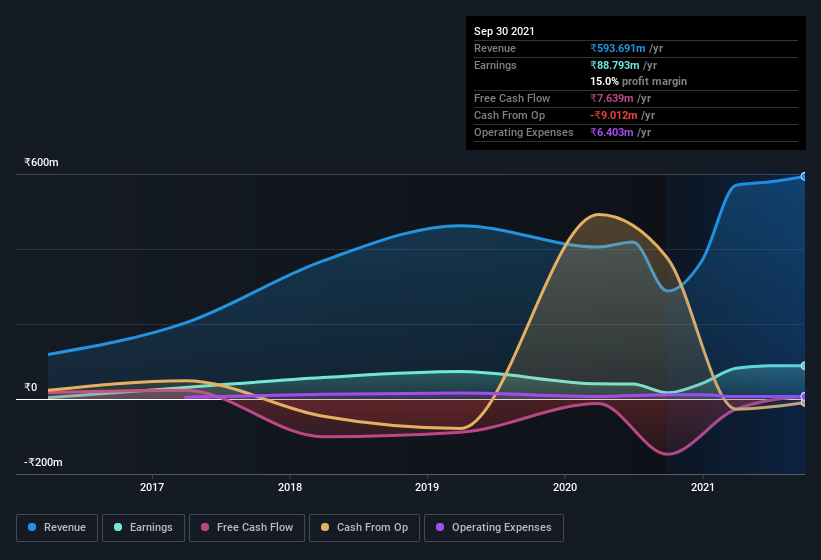

I like to try earnings earlier than curiosity and (EBIT) tax margins, in addition to income progress, to get one other tackle the standard of the corporate’s progress. The excellent news is that Vertoz Promoting is rising revenues, and EBIT margins improved by 15.6 share factors to 18%, during the last yr. That is nice to see, on each counts.

Within the chart beneath, you may see how the corporate has grown earnings, and income, over time. Click on on the chart to see the precise numbers.

Vertoz Promoting is not an enormous firm, given its market capitalization of ₹1.2b. That makes it additional vital to examine on its stability sheet energy.

Are Vertoz Promoting Insiders Aligned With All Shareholders?

Like the youngsters within the streets standing up for his or her beliefs, insider share purchases give me cause to imagine in a brighter future. As a result of oftentimes, the acquisition of inventory is an indication that the customer views it as undervalued. After all, we will by no means make certain what insiders are considering, we will solely choose their actions.

In twelve months, insiders bought -₹500k price of Vertoz Promoting shares. However the silver lining to that cloud is that Rohit Vaghadia, the Non-Government Impartial Director, spent ₹2.0m shopping for shares at a median worth of ₹257. So, on stability, that is optimistic.

On high of the insider shopping for, we will additionally see that Vertoz Promoting insiders personal a big chunk of the corporate. In truth, they personal 63% of the corporate, so they’ll share in the identical delights and challenges skilled by the atypical shareholders. This makes me suppose they are going to be incentivised to plan for the long run – one thing I prefer to see. Valued at solely ₹1.2b Vertoz Promoting is absolutely small for a listed firm. Which means insiders solely have ₹780m price of shares, regardless of the massive proportional holding. That is not an enormous stake in absolute phrases, however it ought to assist hold insiders aligned with different shareholders.

Ought to You Add Vertoz Promoting To Your Watchlist?

As I already talked about, Vertoz Promoting is a rising enterprise, which is what I prefer to see. On high of that, we have seen insiders shopping for shares despite the fact that they already personal lots. To me, that every one makes it effectively price a spot in your watchlist, in addition to persevering with analysis. It’s best to at all times take into consideration dangers although. Living proof, we have noticed 2 warning indicators for Vertoz Promoting you have to be conscious of.

The excellent news is that Vertoz Promoting shouldn’t be the one progress inventory with insider shopping for. Here is a listing of them… with insider shopping for within the final three months!

Please observe the insider transactions mentioned on this article seek advice from reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to carry you long-term centered evaluation pushed by basic information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Supply hyperlink