[ad_1]

| France’s Minister for the Economic system, Finance and Restoration Bruno Le Maire introduced the rise to the Livret A Feb. 13. Supply: Thierry Monasse/Getty Photographs Information by way of Getty Photographs Europe. |

France’s largest banks face added strain on their earnings following a authorities determination to extend the speed on the favored Livret A regulated financial savings scheme by 100 foundation factors to three%.

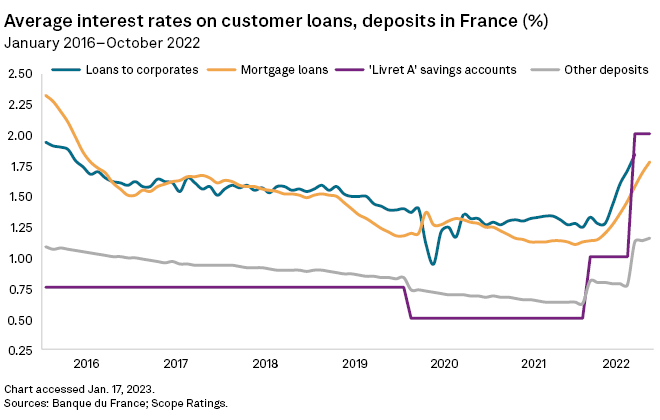

The most recent hike to the speed, introduced Jan. 13 and which takes impact Feb. 1, means deposit prices on Livret A accounts have elevated by 250 bps for French banks since February 2022. The Livret A price additionally offers a benchmark for charges on different common regulated financial savings merchandise in France, representing lots of of billions of euros in extra deposits.

“The Livret A dampens French banks’ profitability,” Johann Scholtz, financial institution fairness analyst at Morningstar, stated in an interview. “It is one of many causes all French banks nonetheless battle to get constant, double-digit returns on fairness.”

The most recent enhance to the Livret A and different regulated financial savings accounts’ charges will price French banks virtually €2.4 billion in extra deposit prices, in response to Fitch Scores. This represents round 1.4% of annual internet banking earnings for the French banking sector and 4% of annual NBI for retail banking actions, Fitch stated.

The rise in deposit prices for French banks comes as different income headwinds mount. The largely fixed-rate profile of their mortgage books means they’re but to see the identical surge in lending earnings that many different European banks did in 2022.

French banks are additionally anticipated to disclose a slowdown in earnings from different streams akin to funding banking, asset administration and car leasing — all of which helped produce bumper earnings in 2021 — when full-year 2022 outcomes are introduced in February.

Sturdy inflows

Inflows into Livret A accounts, that are tax-free and might maintain as much as €22,950, have surged within the final 12 months as the speed has risen. Some €25.78 billion was deposited into the accounts in first 11 months of 2022, a lot from life insurance coverage accounts that provide decrease charges.

France’s largest listed lenders have various levels of publicity to regulated financial savings accounts. Société Générale SA had the biggest portion of regulated deposits as a share of complete buyer deposits, at 14.4% as of the top of September, in response to financial institution information and Jefferies. Crédit Agricole SA, or CASA, and BNP Paribas SA had just below 10%.

SocGen’s higher reliance on French retail banking for its revenues and earnings additionally means will increase to the Livret A price have a extra important affect on it than its home friends. Home banking comprised virtually 33% of working earnings and round 27% of pre-tax revenue for SocGen in 2021, the final full-year for which information is accessible, Market Intelligence information reveals. This compares to only over 16% of working earnings and virtually 14% of revenue earlier than tax for CASA. BNP’s French retail banking enterprise generated 13.5% of revenues and eight.4% of pre-tax earnings in 2021, in response to firm filings.

Regulated financial savings accounts at CASA’s French retail banking enterprise Lcl Le Crédit Lyonnais had been anticipated to price the financial institution round €150 million in 2022, Deputy CEO Jérôme Grivet stated throughout a third-quarter earnings name. This determine would rise to €350 million in 2023 based mostly on the expectation that the Livret A price averages 3.5% over the course of the 12 months.

“That is going to have a unfavorable strain on the web curiosity earnings [at] all banks which have a big quantity of Livret A and merchandise of this type,” stated Grivet.

The Livret A is the preferred of a number of regulated financial savings schemes operated in France. Others embody the Livret de Développement Sturdy, used to finance environmentally sustainable tasks, the Livret d’Epargne Populaire — set to rise to six.1% from 4.6% as a part of the federal government’s current determination — that provides engaging charges for savers on low incomes, and the Plan Epargne Logement for these saving to purchase a home.

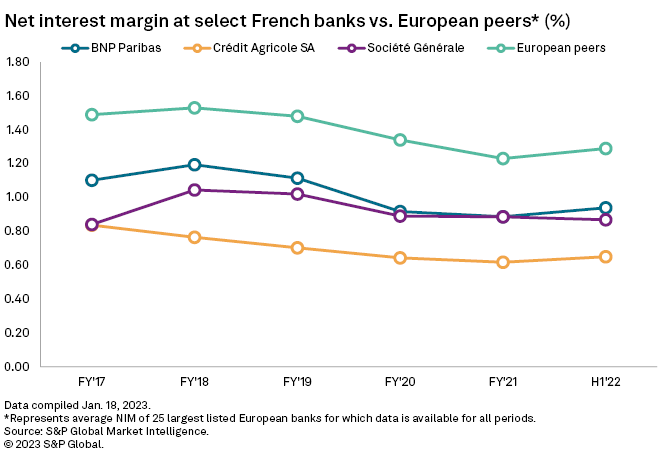

French banks’ internet curiosity margins — the distinction between the curiosity earnings lenders’ obtain from debtors and the curiosity they pay out to depositors — had been already considerably decrease than these of European friends earlier than the Livret A started to rise final February. The common NIM of France’s massive three listed banks on the finish of 2021 stood at 0.8% in comparison with a mean of 1.23% for a pattern of 25 of Europe’s largest lenders, Market Intelligence information reveals.

Different European lenders additionally obtained an even bigger increase from rising charges within the first half of 2022 than the three French banks, the most recent interval for which NIM information is accessible for the Gallic establishments. NIM for the European lenders within the pattern rose 6 foundation factors on common to 1.29% over the six months, in comparison with a mean enhance of simply 2bps for France’s three largest lenders.

“There was already a repricing of deposits in France that has very a lot restricted the NIM growth,” stated Flora Bocahut, European financial institution fairness analyst at Jefferies. “And the explanation for that’s the Livret A.”

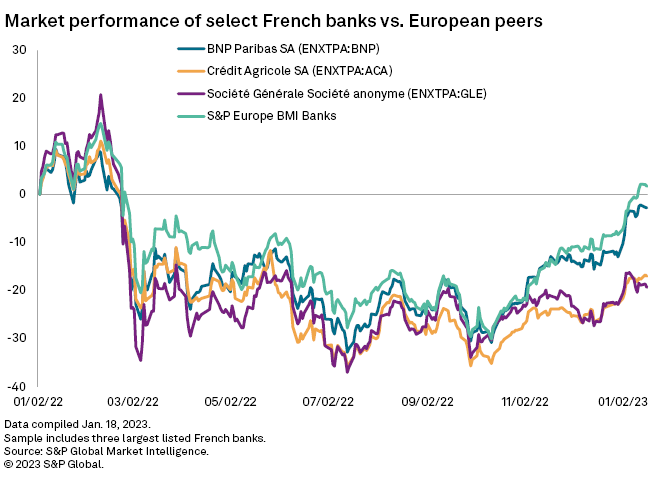

The unfavorable affect of rising deposit prices on French banks’ internet curiosity earnings has weighed on their share costs. Because the first enhance within the present Livret A cycle price took impact Feb. 1, 2022, SocGen’s share worth has fallen virtually 24%, CASA’s virtually 20% and BNP’s just below 5%. This compares to a drop of simply 0.3% for the S&P Europe BMI Banks Index, which captures the share worth efficiency of the broader European banking sector.

Will increase to the Livret A price ought to sluggish in 2023. The components for calculating the speed is partially based mostly on inflation, which is predicted to drop to round 4% in 2023, in response to France’s Ministry of the Economic system and Finance. Inflation in France fell to six.7% in December from 7.1% in November, information from nation’s statistics workplace confirmed.

Napoleonic money owed

The Livret A was initially created by Louis XVIII in 1818 to repay money owed from the Napoleonic Wars. This system is now used to finance social housing organizations and different public investments by France’s state-owned funding group Caisse des Dépôts et Consignations.

Till 2009, France’s publicly listed lenders had been unable to supply Livret A accounts. All French banks are required to redirect 65% of their Livret A and Livret de Développement Sturdy deposit quantity to CDC, which pays the banks a payment in return.

The Livret A and different regulated financial savings schemes’ affect on French banks’ profitability shouldn’t be the one consideration when assessing their worth, stated Sam Theodore, senior advisor at Scope Insights. The merchandise additionally play an necessary position within the banks assembly their obligation to enhancing France’s society and economic system, Theodore stated.

“For those who take a look at every part purely from the margin perspective, then French banks usually are not actually worthwhile when in comparison with the U.S. banks,” added Theodore. “However then within the U.S., 24% of households are both unbanked or underbanked, whereas the French have 100% financial institution protection.”

[ad_2]

Supply hyperlink