[ad_1]

As Masayoshi Son tried to influence traders of the knowledge of buying some of the profitable chip corporations on the planet in 2016, the SoftBank chief had one clear message: “For the period of the ‘web of issues’, I believe the champion shall be Arm.”

However the idea of connecting billions of on a regular basis and industrial gadgets to the web has been a lot slower than anticipated to materialise.

Son’s drive to seize the chip design marketplace for the web of issues (IoT) was the primary wager he made on Arm that has not paid off. The second was a $66bn sale of the corporate to Nvidia that unravelled final week.

Arm stays the dominant participant in designing chips for smartphones, nonetheless essentially the most ubiquitous type of computing however a supply of a lot slower progress lately. Forward of an preliminary public providing that would come as quickly as this yr, the corporate is racing to solidify its place in new markets that it has underexploited up to now, whereas attempting to drive up earnings to attraction to a brand new set of traders.

Rene Haas, Arm’s incoming chief govt, advised the Monetary Occasions that its merchandise have been now “much more aggressive” in knowledge centres and vehicles than when SoftBank purchased the Cambridge-based firm.

“Making trade-offs about the place to speculate, the place to not make investments . . . these are the trade-offs that public corporations and even non-public corporations must do day-after-day,” he stated. “The corporate is in nice form.”

When Son spearheaded the $31bn buy of Arm, he noticed it as a wager on the way forward for the whole know-how trade, which was crystallising at the moment across the IoT idea. He proceeded to push the chief group firmly on the course to designing chips for this way forward for machine connectivity.

5-and-a-half years later, it has turn out to be more and more clear that the IoT gamble was a expensive misadventure. Furthermore, it distracted Arm from attacking Intel’s dominance within the a lot bigger knowledge centre market.

As Son’s imaginative and prescient collided with actuality, SoftBank quietly revised its market calculations. A presentation from 2018 forecast that by 2026, the IoT controller market could be value $24bn, and the server market $22bn.

However, the same presentation from 2020 predicted that by 2029, the IoT chip market would attain solely $16bn, whereas the server market — of which Arm had to this point solely captured a 5 per cent share — would attain $32bn. The Japanese know-how group additionally revised down its estimate of the worth of the IoT market, from $7bn in 2017 to $4bn in 2019.

Tudor Brown, who co-founded Arm in 1990 and was an govt on the firm for 22 years, described its heavy funding in IoT as “unusual” provided that “there was by no means going to be any cash in that market”. He added: “Specializing in that, they didn’t concentrate on the large prize, which was the server.”

In Arm’s regulatory filings in December, the corporate made a powerful case in opposition to pursuing an IPO and in favour of a Nvidia sale, outlining how shareholder strain might stifle the corporate’s capacity to spend money on the info centre and PC markets, which had been “troublesome to crack” and the place it had made solely “restricted inroads”. Public-market traders would “demand profitability and efficiency”, which means cost-cutting and an absence of economic firepower to spend money on modern new companies, Arm’s submitting added.

“We all the time felt that the Nvidia acquisition would give us a incredible alternative to speculate and do extra,” stated Haas. “Now that we’re on to the [IPO], I really feel superb about our prospects.”

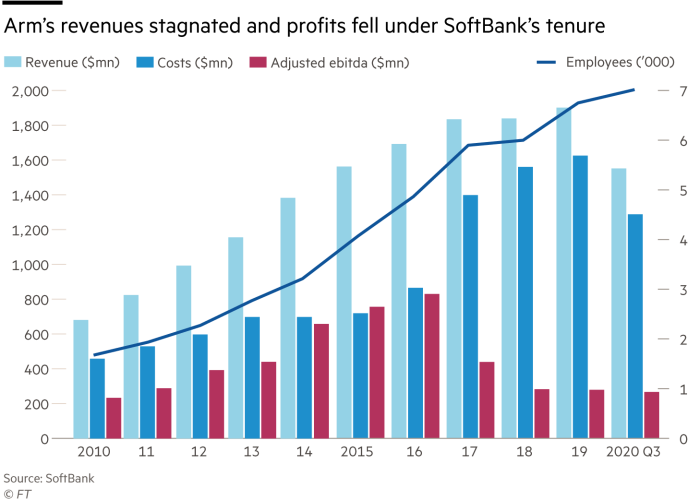

Son additionally underestimated simply how costly delivering innovation in semiconductors might be, despite the fact that Arm doesn’t manufacture its personal silicon. Arm’s prices elevated from $716mn in 2015 to $1.6bn in 2019, in accordance with SoftBank knowledge. Revenues gained 20 per cent to $1.9bn whereas earnings plunged virtually 70 per cent to $276mn by 2019.

Arm has extra just lately begun to course-correct, investing extra closely within the rising server and PC market over the previous 4 years, profitable allies reminiscent of Amazon Internet Providers, which is now on the third technology of its Arm-based Graviton chip, and Apple, which is shifting its total vary of Mac computer systems from Intel to its personal M1 processors, constructed on Arm’s designs.

Haas conceded: “Whereas IoT remains to be a massively essential space to us, we’re very, very targeted on the pc house,” he stated, referring to chips for servers and PCs. He refused to reveal what portion of Arm’s revenues got here from areas exterior its core cell enterprise, citing the “heavy regulatory course of” surrounding the Nvidia deal.

Arm’s executives argue they’re solely now starting to reap the rewards of strategic investments made a number of years in the past. Arm’s chip designs are licensed to semiconductor corporations and digital producers as they start to develop new merchandise; it could take a number of years for preliminary design wins to translate into royalties from product gross sales.

The corporate’s royalty income, which accounts for greater than half of its whole gross sales, rose 22 per cent previously 9 months, supporting Haas’ claims of a turnround. These have been “numbers in contrast to Arm has ever seen earlier than and better than it was pre-SoftBank”, he stated.

“Masa had all the time stated that having Arm be a public firm some day was actually the purpose,” Haas stated, including that now the Nvidia deal had fallen by means of, Arm was “again to the unique Plan A”.

#techFT

#techFT brings you information, remark and evaluation on the large corporations, applied sciences and points shaping this quickest shifting of sectors from specialists based mostly around the globe. Click on right here to get #techFT in your inbox.

[ad_2]

Supply hyperlink