[ad_1]

Riddy/iStock by way of Getty Photos

This text was coproduced with Dividend Sensei.

The correction of 2022 is now 65 days outdated and will doubtlessly final one other eight to 10 weeks, based on Morgan Stanley and JPMorgan.

Why?

Properly, there are numerous bricks in Wall Road’s wall of fear, however one of many largest is inflation.

Because of the provision chain disruptions of the pandemic, mixed with document extra financial savings from trillions in stimulus and a booming economic system, inflation has soared to 7.9%.

Even excluding unstable meals and gas prices, core inflation is 6.4%. And because of hovering power costs, largely a results of Russia’s invasion of Ukraine, Goldman Sachs thinks inflation may get a bit worse within the subsequent month.

Goldman estimates that we may see about 8.5% inflation in March, and in a worst-case situation of $200 crude, about 10.5% within the coming months.

However guess what?

Excessive inflation tends to trigger rising rates of interest and that is a boon to monetary blue chips like Manulife Monetary (MFC).

YCharts

The truth is, worth tends to do greatest relative to development when charges are rising, and you’ll see that from MFC’s 4% positive factors this yr, that are 20% higher than the Nasdaq.

As we speak I need to share with you the three the reason why Manulife is among the greatest high-yield blue chips you’ll be able to safely purchase in these troubled instances.

Not solely does it provide a really secure 5.2% yield as we speak, nevertheless it may enable you to retire in security and splendor within the coming years and a long time.

The truth is, MFC is an anti-bubble Buffett-style “fats pitch” that analysts count on to ship 32% whole returns within the subsequent yr and doubtlessly triple over the following half-decade.

Or to place it one other method, Manulife Monetary is a 5.2% yielding blue-chip set to soar and too low-cost to disregard.

Cause One: One Of The World’s Highest High quality Firms

The Dividend Kings’ total high quality scores are primarily based on a 238-point mannequin that features:

-

dividend security

-

steadiness sheet energy

-

credit score scores

-

credit score default swap medium-term chapter danger knowledge

-

quick and long-term chapter danger

-

accounting and company fraud danger

-

profitability and enterprise mannequin

-

development consensus estimates

-

historic earnings development charges

-

historic money stream development charges

-

historic dividend development charges

-

historic gross sales development charges

-

price of capital

-

long-term risk-management scores from MSCI, Morningstar, FactSet, S&P, Reuters’/Refinitiv and Simply Capital

-

administration high quality

-

dividend pleasant company tradition/revenue dependability

-

long-term whole returns (a Ben Graham signal of high quality)

-

analyst consensus long-term return potential

It truly consists of greater than 1,000 metrics should you rely every thing factored in by 12 score businesses we use to evaluate elementary danger.

How do we all know that our security and high quality mannequin works effectively?

In the course of the two worst recessions in 75 years, our security mannequin predicted 87% of blue-chip dividend cuts in the course of the final baptism by hearth for any dividend security mannequin.

How does MFC rating on one of many world’s most complete security fashions?

MFC Dividend Security

|

Score |

Dividend Kings Security Rating (147 Level Security Mannequin) |

Approximate Dividend Minimize Threat (Common Recession) |

Approximate Dividend Minimize Threat In Pandemic Degree Recession |

|

1 – unsafe |

0% to twenty% |

over 4% |

16+% |

|

2- beneath common |

21% to 40% |

over 2% |

8% to 16% |

|

3 – common |

41% to 60% |

2% |

4% to eight% |

|

4 – secure |

61% to 80% |

1% |

2% to 4% |

|

5- very secure |

81% to 100% |

0.5% |

1% to 2% |

|

MFC |

91% |

0.5% |

1.5% |

|

Threat Score |

Low Threat (84th business percentile consensus) |

A secure outlook credit standing 0.66% 30-year chapter danger |

15% OR LESS Max Threat Cap Suggestion |

Lengthy-Time period Dependability

|

Firm |

DK Lengthy-Time period Dependability Rating |

Interpretation |

Factors |

|

Non-Reliable Firms |

21% or beneath |

Poor Dependability |

1 |

|

Low Dependability Firms |

22% to 60% |

Under-Common Dependability |

2 |

|

S&P 500/Trade Common |

61% (58% to 70% vary) |

Common Dependability |

3 |

|

Above-Common |

71% to 80% |

Very Reliable |

4 |

|

Very Good |

81% or greater |

Distinctive Dependability |

5 |

|

MFC |

85% |

Distinctive Dependability |

5 |

General High quality

|

MFC |

Last Rating |

Score |

|

Security |

91% |

5/5 very secure |

|

Enterprise Mannequin |

80% |

2/3 above-average |

|

Dependability |

85% |

5/5 distinctive |

|

Complete |

88% |

12/13 Tremendous SWAN |

|

Threat Score |

3/3 Low Threat |

|

|

15% OR LESS Max Threat Cap Rec |

10% Margin of Security For A Doubtlessly Good Purchase |

MFC: The 81st Highest High quality Grasp Checklist Firm (Out of 509) = 84th Percentile

The DK 500 Grasp Checklist consists of the world’s highest high quality firms together with:

-

All dividend champions

-

All dividend aristocrats

-

All dividend kings

-

All international aristocrats (equivalent to BTI, ENB, and NVS)

-

All 13/13 Extremely Swans (as near excellent high quality as exists on Wall Road)

-

47 of the world’s greatest development shares (on its method to 100)

MFC’s 88% high quality rating means its related in high quality to such blue-chips as

-

Nordson (NDSN) – dividend king

-

Pepsi (PEP) – dividend king

-

Altria (MO) – dividend king

-

Kimberly-Clark (KMB) – dividend king

-

Ecolab (ECL) – dividend aristocrat

-

Caterpillar (CAT) – dividend aristocrat

-

A.O Smith (AOS) – dividend aristocrat

-

McCormick (MKC) – dividend aristocrat

Even among the many most elite firms on earth, MFC is greater high quality than 84% of them.

Why?

Manulife was based in 1999 in Toronto, Canada.

Manulife offers life insurance coverage and wealth administration services to people and group prospects in Canada, america, and Asia.

Manulife is considered one of Canada’s Huge Three Life Insurance coverage firms (the opposite two are Solar Life and Nice-West Life). As of Dec. 31, 2020, Manulife reported property below administration or administration of about CAD $1.3 trillion.” – Morningstar

It is the third-largest insurance coverage firm in Canada and the seventh-largest publicly-traded insurance coverage firm on earth.

However it’s additionally extremely diversified globally.

Funding Thesis: Enhancing Profitability Fueling Trade-Main Development

“Manulife, together with Solar Life and Nice-West Life, are the Huge Three Canadian life insurers. Whereas Manulife has tried to reposition itself from the worldwide monetary disaster, it’s nonetheless arguably the worst place of the three because it usually has the lowest returns on fairness.

Not solely does Manulife pay out the highest share of advantages to premiums, however the agency’s asset-management operations don’t generate the pretax margins that Solar Life’s does, whereas Nice-West has a bigger retirement record-keeping enterprise by way of Empower.” – Morningstar

MFC’s development prospects are the very best of the CA huge three because of its margins having essentially the most room for enlargement.

In different phrases, identical to House Depot (HD) has superior profitability to Lowe’s (LOW) for a few years, it is the flexibility to spice up margins that may ship superior long-term development and doubtlessly life-changing long-term returns.

“Asia has been a giant focus for Manulife and presently generates round 30% of the agency’s revenue. Manulife’s Asia enterprise stretches throughout the continent because the agency offers insurance coverage and wealth merchandise in Japan, Hong Kong, Singapore, mainland China, and Southeast Asian nations. As well as, Manulife just lately entered right into a three way partnership to offer asset and wealth administration options in India.” – Morningstar

MFC is investing closely in Asia, which it sees as the very best long-term development runway within the insurance coverage business.

“Within the fourth quarter, we introduced a dividend enhance of $0.05 per share leading to a complete quarterly frequent shareholder dividend of $0.33 per share or an 18% enhance. This enhance resumed our monitor document of sustained gradual dividend will increase which stays considered one of our high capital deployment priorities. We additionally just lately launched a Regular Course Issuer Bid to repurchase as much as 5% of excellent frequent shares.” – CEO, This fall convention name (emphasis added)

MFC plans to extend the dividend yearly going ahead and shopping for again extra inventory than it traditionally has.

“On a cumulative foundation, we freed up $6.3 billion of capital via varied efforts throughout a number of legacy blocks. And our dedication and deal with optimizing our long-term care and variable annuity companies are as sturdy as ever. And we goal to realize our 2025 supplemental aim of decreasing core earnings contributions from these companies for lower than 15% of whole core earnings and wish to see this decline additional to lower than 10% with inorganic actions…

I am happy to report that in 2021, we lowered the core earnings contribution from our long-term care and variable annuity companies to twenty%, supported by the rising contributions from our highest potential companies. As well as, we entered into an settlement within the fourth quarter to reinsure a good portion of our legacy US Variable Annuity Block with Venerable Holdings, Inc. ” – CEO, This fall convention name

Legacy companies like long-term care (nursing houses) and annuities have bedeviled insurance coverage firms for the final decade. MFC is engaged on getting these insurance policies all the way down to lower than 10% of its enterprise over time.

“I am happy to verify the transaction closed on February 1st and is predicted to end in roughly $2 billion of capital launched in 2022. This transaction positions us effectively to realize our 2025 supplemental aim…

We plan to deploy a good portion of the capital launch to purchase again frequent shares to neutralize the influence of the transaction on core EPS. We stay dedicated to optimizing our legacy portfolio particularly LTC and VA and we’ll proceed to hunt alternatives to cut back danger and unlock worth.” – CEO, This fall convention name

MFC is executing effectively on that plan to grow to be a extra worthwhile and financially versatile firm sooner or later.

MFC has a great market share in a extremely fragmented international business.

-

#1 in Canadian retirement plans

-

#2 in Canadian group profit plans

-

#3 in Canadian insurance coverage

-

tenth largest financial institution in Canada

-

#1 in Hong Kong retirement plans

-

#1 in Vietnam insurance coverage

-

#2 in Singapore insurance coverage

-

#5 in HK insurance coverage

-

#8 in Indonesian insurance coverage

-

#8 in Malaysian insurance coverage

-

#9 in US insurance coverage

MFC simply signed a 16-year take care of considered one of Vietnam’s largest banks and bought a Vietnam insurance coverage firm.

Why?

-

Vietnam’s economic system has grown at 9% yearly over the past decade (one of many fastest-growing economies on earth)

-

simply 1.6% insurance coverage era (lengthy development runway)

-

Manulife’s Vietnam insurance policies have been rising at 27% CAGR over the past 5 years

-

its estimated Vietnam new enterprise worth has been rising at 51% CAGR

This is only one instance of how MFC is ready to ship a few of the greatest development charges within the insurance coverage business.

Administration thinks it may develop at 10% to 12% over time whereas delivering secure dividends by way of a 30% to 40% payout ratio (50% is secure based on score businesses).

Conservative Funding Methods Retirees Can Belief

MFC’s $333 billion funding portfolio is 83% invested in bonds, 97% of that are funding grade.

-

7% shares

-

10% options like actual property, infrastructure, personal fairness, and timberland and farmland

-

15% of MFC’s bond portfolio (13% of its portfolio) is AAA-rated sovereign debt

-

72% is A-rated bonds (59% of its portfolio)

75% of its portfolio is investing in Canada and the US, and one other 9% in Japan and Europe.

Its securities debt is 72% AAA, and 92% A-rated or higher.

Not a single company bond is greater than 1% of its portfolio, and it has publicity to each sector.

Its top quality business actual property portfolio is diversified globally

-

42% US

-

42% Canada

-

14% Asia

-

2% Australia and different

MFC owns $11.25 billion in business actual property in a few of the world’s most essential monetary facilities.

-

Toronto

-

LA

-

San Diego

-

Boston

-

Singapore

-

Vancouver

-

San Francisco

-

Hong Kong

-

Chicago

-

Washington

-

New York

-

Melbourne

-

Atlanta

-

Tokyo

Backside Line: Manulife Is A 5.2% Yield Retirees Can Belief

The truth is, a minimum of Warren Buffett suppose one other monetary disaster is all however unimaginable.

The banks is not going to get this nation in bother, I assure it” – Warren Buffett

New monetary rules post-Nice Recession have been so strict that even in 2013 Buffett assured the world that one other disaster was not possible.

MFC Credit score Rankings: Very Little Basic Threat

|

Score Company |

Credit score Score |

30-12 months Default/Chapter Threat |

Probability of Dropping 100% Of Your Funding 1 In |

|

S&P |

A secure |

0.66% |

151.5 |

|

Fitch |

A secure |

0.66% |

151.5 |

|

DBRS |

A+ secure |

0.60% |

166.7 |

|

AmBest |

A- |

2.50% |

40.0 |

|

Consensus |

A secure |

1.11% |

90.5 |

(Supply: S&P, Fitch, DBRS, AMBest)

MFC’s steadiness sheet and risk-management look nothing like the corporate that needed to reduce its dividend twice in the course of the Nice Recession.

And MFC’s subsidiary monetary energy scores are much more spectacular.

-

AM Finest: A+ (2nd place out of 13 friends)

-

DBRS/Morningstar AA (third place out of twenty-two friends)

-

Fitch AA- (4th place out of 21 friends)

-

Moody’s A+ (fifth place out of 21 friends)

-

S&P AA- (4th place out of 21 friends)

At least 4 credit standing businesses estimate an approximate 1% danger of dropping all of your cash shopping for this firm as we speak.

MFC’s capital reserves are 41% above regulatory minimums.

How do MFC’s credit score scores evaluate to its two largest friends?

Solar Life Credit score Rankings

|

Score Company |

Credit score Score |

30-12 months Default/Chapter Threat |

Probability of Dropping 100% Of Your Funding 1 In |

|

S&P |

A+ secure |

0.60% |

166.7 |

|

DBRS |

A+ secure |

0.60% |

166.7 |

|

AmBest |

A |

0.66% |

151.5 |

|

Consensus |

A secure |

0.62% |

161.3 |

(Supply: S&P, DBRS, AMBest)

Nice-West Credit score Rankings

|

Score Company |

Credit score Score |

30-12 months Default/Chapter Threat |

Probability of Dropping 100% Of Your Funding 1 In |

|

S&P |

A+ secure |

0.60% |

166.7 |

|

Fitch |

A+ Adverse Outlook |

0.60% |

166.7 |

|

DBRS |

A+ secure |

0.60% |

166.7 |

|

AmBest |

A |

0.66% |

151.5 |

|

Consensus |

A secure |

0.62% |

162.6 |

(Supply: S&P, Fitch, DBRS, AMBest)

MFC’s credit score scores usually are not fairly pretty much as good as SLF and GWO’s however score businesses agree it is a low-risk steadiness sheet and with a basically very low danger of default and chapter.

Like with Canadian banks, even the decrease high quality Canadian insurance coverage firm remains to be one of many world’s most secure firms.

MFC Bond Profile

-

$1.7 billion in liquidity

-

well-staggered debt maturities (little downside refinancing maturing bonds)

-

bond buyers are so assured in MFC’s new safer enterprise mannequin that they’re keen to lend to it for 20 years at 4.1%.

Profitability: Wall Road’s Favourite High quality Proxy

MFC’s profitability has been bettering in recent times, as administration’s cost-cutting efforts take maintain.

MFC”s profitability is comparatively secure over the past decade and its free money stream margins at the moment are almost 40%.

MFC Revenue Margin Consensus Forecast

|

12 months |

EBIT (Working) Margin |

Internet Margin |

|

2020 |

7.0% |

7.0% |

|

2021 |

10.6% |

10.6% |

|

2022 |

9.6% |

8.9% |

|

2023 |

11.1% |

10.1% |

|

2024 |

15.1% |

12.0% |

|

Annualized Development |

21.20% |

14.51% |

(Supply: FactSet Analysis Terminal)

MFC’s profitability is predicted to considerably enhance within the coming years, although a few of that is as a result of anticipated short-term lower in gross sales.

MFC Dividend Development Consensus Forecast

|

12 months |

Dividend Consensus |

EPS/Share Consensus |

Payout Ratio |

Retained (Put up-Dividend) Earnings |

Buyback Potential |

|

2021 |

$0.92 |

$2.57 |

35.8% |

$3,206 |

8.36% |

|

2022 |

$1.03 |

$2.79 |

36.9% |

$3,420 |

8.92% |

|

2023 |

$1.11 |

$3.00 |

37.0% |

$3,672 |

9.58% |

|

2024 |

$1.13 |

$3.30 |

34.2% |

$4,216 |

11.00% |

|

Complete 2021 By way of 2024 |

$4.19 |

$11.66 |

35.9% |

$14,514.21 |

37.85% |

|

Annualized Price |

7.09% |

8.69% |

-1.47% |

9.56% |

9.56% |

(Supply: FactSet Analysis Terminal)

Score businesses contemplate a 50% payout ratio secure for this business.

MFC is predicted to common 36% and permit it to retain $14.5 billion in post-dividend earnings over the following few years.

That is doubtlessly sufficient to purchase again virtually 40% of its shares at present valuations.

MFC is not identified for aggressive buybacks although it simply approved a 5% buyback program to make the most of its low valuation.

Mainly, MFC affords high-yield revenue buyers every thing they may need.

-

a beneficiant and secure yield

-

that grows yearly together with in the course of the worst recession in 75 years

-

a fortress steadiness sheet confirmed by a minimum of 5 credit standing businesses

However MFC’s 5.2% yield is simply the place to begin for its unimaginable long-term funding proposition.

Cause Two: Some Of The Finest Development Prospects In The Trade

MFC has some spectacular development levers to tug, and analysts are optimistic about its medium-term and long-term development prospects.

MFC Medium-Time period Development Consensus Forecast

|

12 months |

Gross sales |

EBIT (Working Revenue) |

Internet Revenue |

|

2020 |

$62,211 |

$4,349 |

$4,349 |

|

2021 |

$48,845 |

$5,164 |

$5,164 |

|

2022 |

$59,517 |

$5,687 |

$5,292 |

|

2023 |

$55,938 |

$6,191 |

$5,642 |

|

2024 |

$49,142 |

$7,413 |

$5,906 |

|

Annualized Development |

-5.73% |

14.26% |

7.95% |

(Supply: FactSet Analysis Terminal)

MFC’s effectivity efforts are anticipated to beat the medium-term gross sales headwinds analysts count on.

|

Metric |

2020 Development Consensus |

2021 Development Consensus |

2022 Development Consensus |

2023 Development Consensus (Bond Market Recession Forecast) |

2024 Development Consensus |

|

Gross sales |

0% |

-19% |

28% |

-6% |

-12% |

|

Dividend (Native Foreign money) |

12% |

5% |

14% (official) |

7% |

2% |

|

EPS |

-3% |

18% |

9% |

9% |

9% |

|

Working Money Movement |

-3% |

23% |

NA |

NA |

NA |

|

Guide Worth |

8% |

7% |

10% |

7% |

19% |

(Supply: FAST Graphs, FactSet Analysis Terminal)

Whereas income could be unstable on this business what issues is that MFC is predicted to ship very constant earnings and e-book worth development, in addition to dividend will increase each single yr.

And this is the explanation Dividend Sensei simply advisable MFC for DK members and added it to the DK correction watchlist.

MFC Lengthy-Time period Development Outlook

-

8% to 13% development consensus vary

-

13% median development estimate from all 16 analysts

-

10% to 12% administration steerage

Popping out of the monetary disaster MFC suffered a few years of disappointing earnings development, lacking expectations till it started modestly beating expectations began in 2017.

-

smoothing for outliers 30% margins of error to the draw back and 5% to the upside

-

5% to 14% CAGR margin-of-error adjusted development consensus vary

-

70% likelihood that MFC grows inside this vary over time

-

80% likelihood it grows a minimum of at 5% (and delivers 10.2% long-term returns)

Within the trendy regulatory and low charge period, MFC’s development charges have ranged from 7% to 19% CAGR.

Analysts count on development just like the final six years (13.4% CAGR), and administration says it may ship long-term development just like the final 12 years (10.4%).

What does all this imply for long-term high-yield buyers?

|

Funding Technique |

Yield |

LT Consensus Development |

LT Consensus Complete Return Potential |

Lengthy-Time period Threat-Adjusted Anticipated Return |

Lengthy-Time period Inflation And Threat-Adjusted Anticipated Returns |

|

Manulife (Analyst Consensus) |

5.20% |

13% |

18.2% |

12.7% |

10.6% |

|

Manulife (Administration Steerage) |

5.2% |

11.0% |

16.2% |

11.3% |

9.2% |

|

Dividend Development |

1.6% |

12.6% |

14.2% |

9.9% |

7.8% |

|

Worth |

2.1% |

12.1% |

14.1% |

9.9% |

7.7% |

|

Excessive-Yield |

2.8% |

11.3% |

14.1% |

9.9% |

7.7% |

|

Excessive-Yield + Development |

1.7% |

11.0% |

12.7% |

8.9% |

6.7% |

|

Secure Midstream |

5.8% |

6.3% |

12.1% |

8.5% |

6.3% |

|

Secure Midstream + Development |

3.3% |

8.5% |

11.8% |

8.3% |

6.1% |

|

Nasdaq (Development) |

0.8% |

10.7% |

11.5% |

8.1% |

5.9% |

|

Dividend Aristocrats |

2.2% |

8.9% |

11.1% |

7.8% |

5.6% |

|

REITs + Development |

1.8% |

8.9% |

10.6% |

7.4% |

5.2% |

|

S&P 500 |

1.4% |

8.5% |

9.9% |

6.9% |

4.8% |

|

REITs |

3.0% |

6.5% |

9.5% |

6.6% |

4.4% |

|

60/40 Retirement Portfolio |

1.9% |

5.1% |

7.0% |

4.9% |

2.7% |

|

10-12 months US Treasury |

1.9% |

0.0% |

1.9% |

1.4% |

-0.8% |

(Sources: Morningstar, FactSet, Ycharts)

MFC has the potential to ship a 5.2% very secure and quickly rising yield as we speak and life-changing 16% to 18% returns sooner or later.

-

excess of the S&P, Nasdaq, and aristocrats

-

or any main funding technique

MFC Inflation-Adjusted Lengthy-Time period Return Potential: $1,000 Preliminary Funding

|

Time Body (Years) |

7.8% CAGR Inflation-Adjusted S&P Consensus |

8.9% Inflation-Adjusted Aristocrat Consensus |

14.0% CAGR MFC Steerage |

Distinction Between MFC Steerage And S&P |

|

5 |

$1,453.07 |

$1,531.58 |

$1,925.41 |

$472.34 |

|

10 |

$2,111.43 |

$2,345.73 |

$3,707.22 |

$1,595.80 |

|

15 |

$3,068.06 |

$3,592.68 |

$7,137.94 |

$4,069.88 |

|

20 |

$4,458.12 |

$5,502.47 |

$13,743.49 |

$9,285.37 |

|

25 |

$6,477.98 |

$8,427.47 |

$26,461.92 |

$19,983.94 |

|

30 |

$9,412.99 |

$12,907.33 |

$50,950.16 |

$41,537.17 |

(Supply: DK Analysis Terminal, FactSet)

|

Time Body (Years) |

Ratio Aristocrats/S&P |

Ratio MFC Steerage and S&P |

|

5 |

1.05 |

1.33 |

|

10 |

1.11 |

1.76 |

|

15 |

1.17 |

2.33 |

|

20 |

1.23 |

3.08 |

|

25 |

1.30 |

4.08 |

|

30 |

1.37 |

5.41 |

Is it price paying 6.9X earnings for a high-quality 5.2% yielding insurance coverage firm to doubtlessly earn 5.4X the market’s inflation-adjusted long-term returns?

I believe so.

And this is why MFC is such a doubtlessly wonderful funding alternative as we speak.

MFC Funding Resolution Rating

DK Funding Instrument

DK Funding Instrument

The truth is, for anybody comfy with its danger profile, MFC is a near an ideal high-yield dividend development blue-chip as you should purchase in as we speak’s market.

Cause Three: A Ridiculously Enticing Valuation

Within the trendy regulatory, low-interest charge period, tens of tens of millions of buyers have paid between 10 and 12.5X earnings for MFC.

|

Metric |

Historic Truthful Worth Multiples (12-year) |

2021 |

2022 |

2023 |

2024 |

12-Month Ahead Truthful Worth |

|

5-12 months Common Yield |

4.28% |

$21.50 |

$24.05 |

$24.05 |

$26.40 |

|

|

13-12 months Median Yield |

3.72% |

$24.73 |

$27.67 |

$27.67 |

$30.38 |

|

|

Earnings |

10.99 |

$28.24 |

$30.66 |

$32.97 |

$36.27 |

|

|

Common |

$24.52 |

$27.19 |

$27.77 |

$30.50 |

$27.30 |

|

|

Present Value |

$19.63 |

|||||

|

Low cost To Truthful Worth |

19.93% |

27.81% |

29.30% |

35.63% |

28.10% |

|

|

Upside To Truthful Worth (NOT Together with Dividends) |

24.90% |

38.52% |

41.45% |

55.36% |

39.08% (44% together with dividend) |

|

|

2022 EPS |

2023 EPS |

2022 Weighted EPS |

2023 Weighted EPS |

12-Month Ahead EPS |

12-Month Common Truthful Worth Ahead PE |

Present Ahead PE |

|

$2.79 |

$3.00 |

$2.25 |

$0.58 |

$2.83 |

9.6 |

6.9 |

I conservatively estimate MFC is price 9.6X earnings, and as we speak it trades at 6.9x.

|

Analyst Median 12-Month Value Goal |

Morningstar Truthful Worth Estimate |

|

$24.89 (8.3 PE) |

$22.50 (8 PE) |

|

Low cost To Value Goal (Not A Truthful Worth Estimate) |

Low cost To Truthful Worth |

|

21.13% |

12.76% |

|

Upside To Value Goal (Not Together with Dividend) |

Upside To Truthful Worth (Not Together with Dividend) |

|

26.80% |

14.62% |

|

12-Month Median Complete Return Value (Together with Dividend) |

Truthful Worth + 12-Month Dividend |

|

$25.92 |

$23.53 |

|

Low cost To Complete Value Goal (Not A Truthful Worth Estimate) |

Low cost To Truthful Worth + 12-Month Dividend |

|

24.27% |

16.57% |

|

Upside To Value Goal ( Together with Dividend) |

Upside To Truthful Worth + Dividend |

|

32.04% |

19.86% |

Morningstar’s 8 PE honest worth estimate is 90% more likely to be too conservative primarily based on market-determined historic honest values.

However even when Morningstar is correct, MFC nonetheless has 20% upside potential to honest worth.

And analysts count on 32% whole returns within the subsequent yr alone.

|

Score |

Margin Of Security For Low-Threat 13/13 Extremely SWAN High quality Firms |

2022 Value |

2023 Value |

12-Month Ahead Truthful Worth |

|

Doubtlessly Affordable Purchase |

0% |

$27.19 |

$27.77 |

$27.30 |

|

Doubtlessly Good Purchase |

10% |

$24.47 |

$24.99 |

$24.57 |

|

Doubtlessly Sturdy Purchase |

20% |

$21.75 |

$22.21 |

$21.84 |

|

Doubtlessly Very Sturdy Purchase |

30% |

$17.13 |

$19.44 |

$19.11 |

|

Doubtlessly Extremely-Worth Purchase |

40% |

$16.31 |

$16.66 |

$16.38 |

|

At the moment |

$19.63 |

27.81% |

29.30% |

28.10% |

|

Upside To Truthful Worth (Not Together with Dividends) |

38.52% |

41.45% |

39.08% |

For anybody comfy with MFC’s danger profile, it is a doubtlessly sturdy purchase and really near a really sturdy purchase, and this is why.

Consensus Complete Return Potential That Knock Your Socks Off

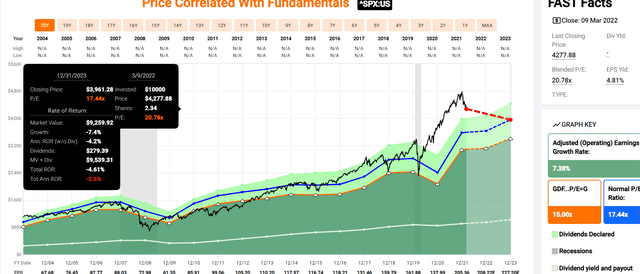

For context, this is the return potential of the 12% overvalued S&P 500.

|

12 months |

EPS Consensus |

YOY Development |

Ahead PE |

Blended PE |

Overvaluation (Ahead PE) |

Overvaluation (Blended PE) |

|

2021 |

$206.39 |

50.44% |

20.5 |

23.1 |

19% |

31% |

|

2022 |

$223.03 |

8.06% |

19.0 |

19.7 |

10% |

12% |

|

2023 |

$245.83 |

10.22% |

17.2 |

18.1 |

0% |

3% |

|

2024 |

$272.94 |

11.03% |

15.5 |

16.4 |

-10% |

-7% |

|

12-Month ahead EPS |

12-Month Ahead PE |

Historic Overvaluation |

PEG |

25-12 months Common PEG |

S&P 500 Dividend Yield |

25-12 months Common Dividend Yield |

|

$225.60 |

18.762 |

11.48% |

2.21 |

3.62 |

1.43% |

2.01% |

(Supply: DK S&P 500 Valuation And Complete Return Instrument) up to date weekly

Shares have already priced in 90% EPS development from 2020 via 2024 and are buying and selling at 18.5X ahead earnings.

S&P 500 2023 Consensus Return Potential

FAST Graphs

Analysts count on the S&P 500 to ship doubtlessly -4% whole returns over the following two years.

|

12 months |

Upside Potential By Finish of That 12 months |

Consensus CAGR Return Potential By Finish of That 12 months |

Likelihood-Weighted Return (Annualized) |

Inflation And Threat-Adjusted Anticipated Returns |

|

2027 |

42.90% |

7.40% |

5.55% |

2.10% |

(Supply: DK S&P 500 Valuation And Complete Return Instrument) up to date weekly

Adjusted for inflation, the risk-expected returns of the S&P 500 are about 2% for the following 5 years.

|

S&P Earnings Yield |

10-12 months US Treasury Yield |

Incomes Yield Threat-Premium (3.7% 10 and 20-year common) |

|

5.33% |

1.98% |

3.35% |

|

Theoretical Curiosity Price Justified Market Truthful Worth Ahead PE |

Present PE |

Theoretically Curiosity Price Justified Market Decline |

|

17.62 |

18.76 |

6.10% |

(Supply: DK S&P 500 Valuation And Complete Return Instrument) up to date weekly

Even adjusting for low (and rising) rates of interest, shares nonetheless require a 6% correction earlier than they grow to be theoretically pretty valued.

However this is what buyers shopping for MFC as we speak can moderately count on (5% to 14% development and 10 to 12.5X earnings)

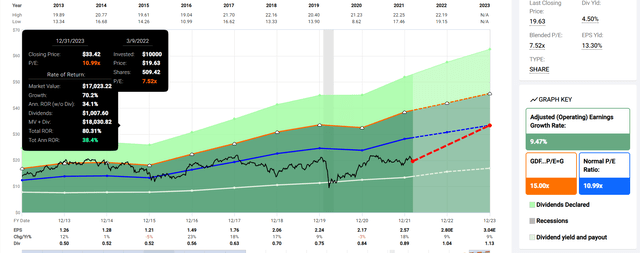

MFC 2023 Consensus Complete Return Potential

FAST Graphs

If MFC grows as anticipated and returns to historic honest worth by 2023 that is doubtlessly 80% whole returns or 38% yearly.

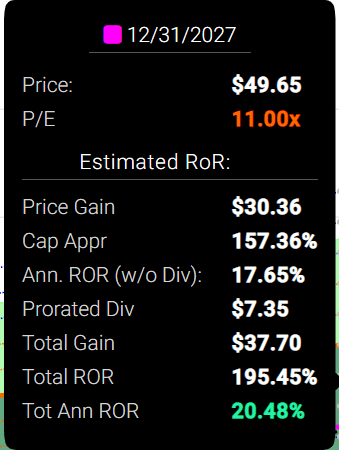

MFC 2027 Consensus Return Potential (Administration Steerage)

FAST Graphs

If MFC grows as anticipated and returns to historic mid-range honest worth

However earlier than you get too excited, and begin measuring the drapes on your penthouse, do not forget that even low-risk Tremendous SWANs nonetheless have danger profiles you must be comfy with earlier than investing.

Threat Profile: Why Manulife Is not Proper For Everybody

There are not any risk-free firms and no firm is correct for everybody. It’s a must to be comfy with the elemental danger profile.

MFC’s Threat Profile Abstract

“Due to its steadiness sheet, Manulife is delicate to adjustments in rates of interest and fairness markets. Manulife discloses {that a} 50-basis-point lower in rates of interest would cut back internet revenue by about $100 million excluding adjustments to honest worth.

As well as, Manulife’s asset administration enterprise is delicate to adjustments in fairness markets. Over the previous a number of years, the corporate has taken steps equivalent to adjusting its enterprise combine and implementing hedge actions to lower earnings sensitivity however hedging could be expensive and add extra dangers. Manulife doesn’t try to totally hedge out all dangers of its merchandise.

From an environmental, social, and governance perspective, we view the biggest dangers as stemming from enterprise ethics and product governance points. For instance, U.S. life insurer MetLife didn’t pay hundreds of employees’ pension funds and has settled with the SEC associated to weak inner controls in its annuity enterprise.

As well as, with CAD 764 billion in property below administration or administration, an operational failure might be expensive. Lastly, given the tens of millions of consumers, failure to maintain private knowledge safe and personal may hurt the corporate. We consider administration has adequately managed ESG dangers thus far.” – Morningstar

-

financial cyclicality danger: principally via rates of interest and asset administration charges

-

every 1% lower in rates of interest = 4% decline in internet revenue

-

every 1% enhance = 4% enhance in internet revenue

-

regulatory danger (domestically and internationally, pertaining to capital buffers)

-

M&A danger

-

margin compression danger: SFL and GWO are bigger and have higher economies of scale

-

labor retention danger (tightest job market in over 50 years and finance is a excessive paying business) – rising wage pressures

-

foreign money danger (rising over time as Asian enterprise is the fastest-growing a part of the enterprise)

The Asian market is a aggressive one with home firms usually having main market share and corporations are topic to numerous rules. For instance, Manulife, together with different insurers, suspended promoting company-owned life insurance coverage insurance policies in Japan due to uncertainty concerning the tax remedy of those insurance policies. Income development in Asia has been sturdy however we might deal with earnings because it has slipped and we consider development is just accretive if it generates ample returns on fairness.” – Morningstar

World enlargement is a chance, however one which brings its fair proportion of challenges and dangers.

Normally, greater rates of interest ought to profit the agency’s funding revenue. That stated, greater inflation is more likely to weigh on expense development. Core expense development was 5% in 2021 versus a modest decline in 2020. The expense effectivity ratio improved to 48.9% in 2021 from 52.9% in 2020. Manulife expects to be below 50% for 2022.” – Morningstar

MFC is doing a great job managing its prices however greater inflation around the globe may put strain on its labor prices and make it tougher to realize the anticipated development that administration and analysts are forecasting.

What Would Break/Weaken The Thesis On MFC

-

Basic security falls to 40% or much less (unsafe) – would require MFC’s core enterprise mannequin to fail dramatically

-

development consensus falls to lower than 4.8% CAGR for six years

-

if development consensus fell to lower than 4.8% CAGR for six years then I might promote my shares

-

MFC’s position in any portfolio is to generate steadily rising revenue and 10+% CAGR long-term whole returns with minimal elementary danger

-

Excessive-yield defensive sectors like midstream, utilities, REITs, healthcare, shopper staples, and so on, have 8+% whole return necessities

-

non-defensive sectors have 10+% return necessities to remain on the Phoenix listing (and in my portfolio)

How lengthy it takes for a corporation’s funding thesis to interrupt relies on the standard of the corporate.

|

High quality |

Years For The Thesis To Break Fully |

|

Under-Common |

1 |

|

Common |

2 |

|

Above-Common |

3 |

|

Blue-Chip |

4 |

|

SWAN |

5 |

|

Tremendous SWAN |

6 |

|

Extremely SWAN |

7 |

|

Excellent 100% High quality – solely MA for the time being |

8 |

These are my private rule of thumb for when to promote a inventory if the funding thesis has damaged.

How will we quantify, monitor, and monitor such a fancy danger profile? By doing what huge establishments do.

Materials Monetary ESG Threat Evaluation: How Massive Establishments Measure Complete Threat

“ESG is simply regular danger by one other identify.” Simon MacMahon, head of ESG and company governance analysis, Sustainalytics” – Morningstar

ESG elements are considered, alongside all different credit score elements, after we contemplate they’re related to and have or might have a cloth affect on creditworthiness.” – S&P

ESG is a measure of danger, not of ethics, political correctness, or private opinion.

S&P, Fitch, Moody’s, DBRS (Canadian score company), AMBest (insurance coverage score company), R&I Credit score Score (Japanese score company), and the Japan Credit score Score Company have been utilizing ESG fashions of their credit score scores for many years.

Dividend Aristocrats: 67th Trade Percentile On Threat Administration (Above-Common, Medium Threat)

MFC Lengthy-Time period Threat Administration Consensus

|

Score Company |

Trade Percentile |

Score Company Classification |

|

MSCI 37 Metric Mannequin |

93.0% |

AA Trade Chief – optimistic pattern |

|

Morningstar/Sustainalytics 20 Metric Mannequin |

87.8% |

17.9/100 Low-Threat |

|

Reuters’/Refinitiv 500+ Metric Mannequin |

87.1% |

Good |

|

S&P 1,000+ Metric Mannequin |

61.0% |

Above-Common- Secure Pattern |

|

FactSet |

90.0% |

Trade Chief- Constructive Pattern |

|

Consensus |

84% |

Very Good |

(Sources: Morningstar, Reuters’, S&P, JustCapital, FactSet Analysis)

MFC’s Lengthy-Time period Threat Administration Is The forty fifth Finest In The Grasp Checklist (91st Percentile)

-

grasp listing common: 62nd percentile

-

dividend kings: 63rd percentile

-

aristocrats: 67th percentile

-

Extremely SWANs: 71st percentile

MFC’s risk-management consensus is within the high 9% of the world’s highest high quality firms and just like that of such different firms as

-

Merck (MRK)

-

Mastercard (MA)

-

Cummins (CMI)

-

British American Tobacco (BTI) – international aristocrat

-

AbbVie (ABBV) – dividend king

-

Equinix (EQIX)

-

Digital Realty Belief (DLR.PK)

-

Prologis (PLD)

-

Utilized Supplies (AMAT)

-

W. W. Grainger (GWW) – dividend king

-

Lowe’s (LOW) – dividend king

-

Blackrock (BLK)

-

Pepsi (PEP) – dividend king

The underside line is that each one firms have dangers, however MFC is superb at managing theirs.

How We Monitor MFC’s Threat Profile

“When the details change, I modify my thoughts. What do you do sir?” – John Maynard Keynes

There are not any sacred cows. Wherever the basics lead we at all times comply with. That is the essence of disciplined monetary science, the mathematics retiring wealthy and staying wealthy in retirement.

Backside Line: Manulife Is A 5.2% Yielding Blue-Chip Set To Soar And Too Low cost To Ignore

We dwell in troubled instances.

It is comprehensible that many buyers, spoiled by an unimaginable bull market, is likely to be scared proper now.

After three years through which the market delivered 25% annual returns, it is simple to neglect that corrections like what we’re dwelling via now are regular, wholesome, and useful.

“Volatility is not danger, it is the supply of future returns.” – Joshua Brown, CEO of Ritholtz Wealth Administration

However by specializing in the basics that drive 97% of long-term inventory returns, you’ll be able to sleep effectively at evening it doesn’t matter what is going on with geopolitics, inflation, the economic system, or rates of interest.

-

MFC is among the world’s most secure, most reliable, and highest high quality firms

-

a really secure 5.2% yield = 3.5X the S&P 500’s yield

-

a thriving Asian enterprise has administration forecasting 10% to 12% development

-

because of a 5% buyback authorization analysts count on 13% development

-

MFC’s buyback potential is nearly 40% of shares at present valuations via 2024

-

6.9X ahead earnings = anti-bubble worth pricing in -3.2% long-term development

-

28% low cost to honest worth = doubtlessly good purchase

-

traditional Buffett-style “great firm at a beautiful worth”

-

195% consensus whole return upside over the following 5 years = 4.5x the S&P consensus

-

15% CAGR 5-year risk-adjusted anticipated return is 3X that of the S&P 500

I can not let you know when the market will cease declining or attain a brand new document excessive.

-

Morgan Stanley and JPMorgan suppose the underside is coming within the subsequent eight to 10 weeks

-

the bond market thinks shares won’t backside till February or March…of 2023 and never hit a document excessive till March or April…of 2024

What I can let you know is that the world’s highest high quality high-yield blue-chips are at all times a secure place on your long-term discretionary financial savings.

That is very true when they’re buying and selling at anti-bubble valuations of 6.9X earnings.

All of which means that should you’re seeking to make your personal luck on Wall Road, Manulife Monetary is among the most affordable and prudent selections you can also make as we speak.

The truth is, it is as near an ideal high-yield blue-chip alternative as exists on Wall Road as we speak.

Writer’s Observe: Brad Thomas is a Wall Road author, which implies he isn’t at all times proper together with his predictions or suggestions. Since that additionally applies to his grammar, please excuse any typos it’s possible you’ll discover. Additionally, this text is free: written and distributed solely to help in analysis whereas offering a discussion board for second-level pondering.

[ad_2]

Supply hyperlink