[ad_1]

The VA mortgage is a vital financing software for VA-eligible debtors to attain their homeownership dream. In 2021 one in two VA debtors was a first-time homebuyer (FTHB).

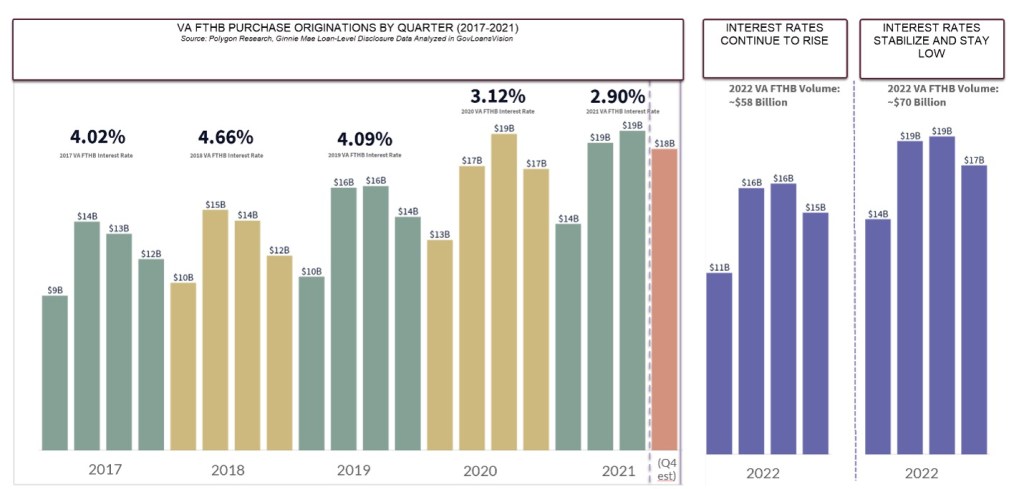

Final yr, mortgage rates of interest reached document lows. The typical VA FTHB’s rate of interest was 2.90% and the quarterly FTHB VA buy mortgage quantity stayed elevated. In Q3 2021, it reached a document stage of over $19 billion for that quarter, $174 million greater than Q3 2020. And since 2017, VA buy loans helped roughly 200,000-230,000 VA-eligible first-time dwelling consumers per yr turn into owners.

This interprets into a mean of $56 billion in mortgage originations per yr. In 2021, the VA FTHB section reached an estimated $69 billion, based on Ginnie Mae loan-level disclosure information up to date by means of January 2022, analyzed in GovLoansVision.

So, what will 2022 appear like for the VA FTHB debtors?

Our scratch pad calculations inform us that if rates of interest proceed to climb, we may see a decrease VA FTHB quantity of round $58 billion in 2022. However, if charges stabilize and keep in low to mid 3’s, we would see the VA FTHB buy quantity at $70 billion in 2022.

Determine 1: VA FTHB Buy Originations Forecast

Supply: Polygon Analysis. Forecasts are up to date month-to-month.

What’s the Measurement of the VA Borrower Addressable Market?

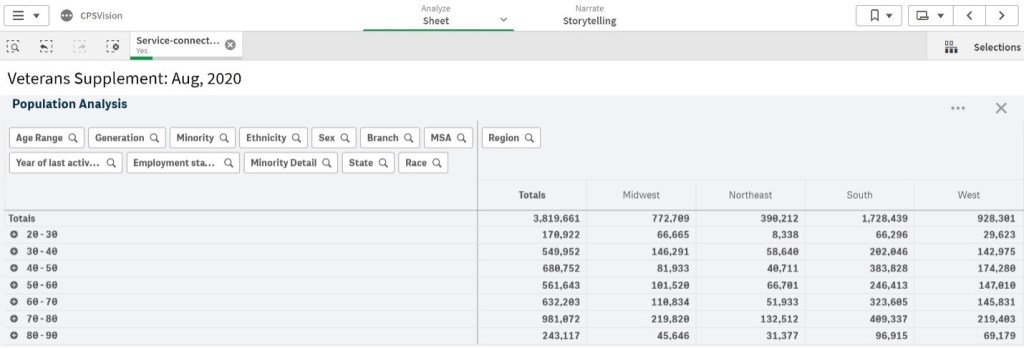

VA FTHB debtors will largely come from the U.S. Veteran inhabitants (with the remaining from present service members and eligible veteran relations). The U.S. Veteran inhabitants stood at 18.44 million in 2020 with median age of 68 years previous, based on CPS Veteran Complement (2020), analyzed by Polygon Analysis in CPSVision. To slim the sizing of the VA Borrower Addressable Market, we examine two subsegments: Veterans with service-related incapacity and Veterans 50 years-old or youthful.

In 2020, 3.82 million Veterans had service-connected incapacity, making them eligible for a variety of advantages, together with waiver of VA funding price on a mortgage mortgage. Determine 2 offers a breakdown of those Veterans by age vary and site.

Determine 2: Veterans with Service-Linked Incapacity by Age Vary and Geography (Area)

Supply: Polygon Analysis, CPSVision, Veterans Complement August 2020

Mortgage originators can educate themselves concerning the Veterans with service-related incapacity of their communities and markets and search for alternatives to supply top quality schooling and financing in an environment friendly and clear method.

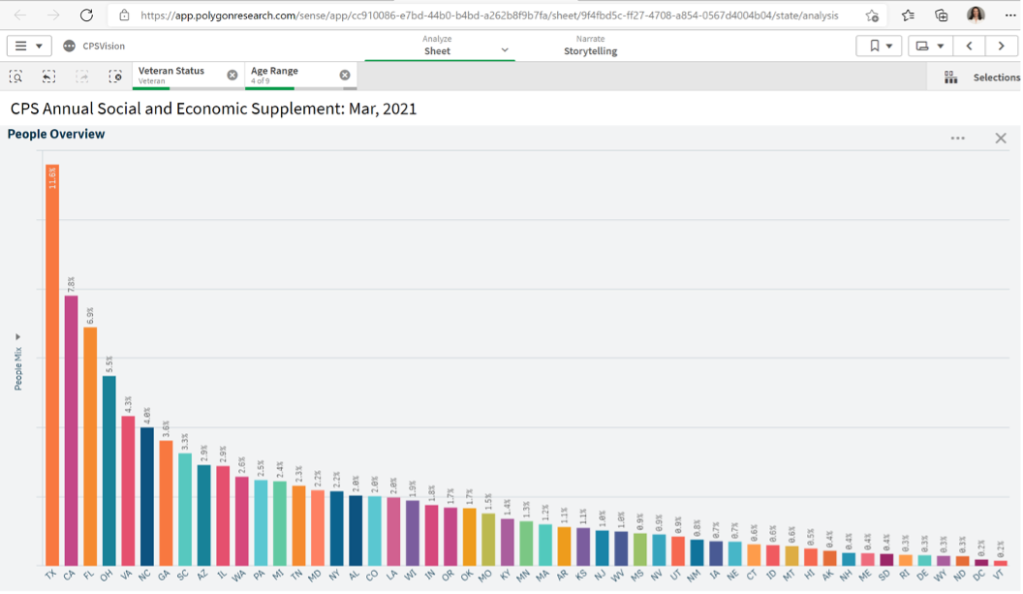

Broadening the scope to incorporate all Veterans inside a sure age vary no matter incapacity standing, we estimate that about 4 million Veterans are below the age of fifty, with a median family earnings of $91,400 based on March 2021 ASEC. (supply: Polygon Analysis, CPSVision).

Determine 3: Distribution of Veterans 50 Years–Outdated or Youthful by State

Supply: Polygon Analysis, CPSVision, ASEC March 2021

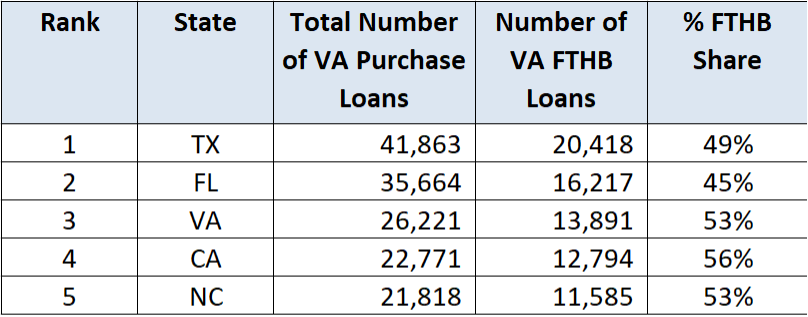

This statistical distribution of Veterans (50-years or youthful) by state in Determine 3 intently follows the VA FTHB buy mortgage originations information discovered within the Ginnie Mae loan-level disclosure information. The highest 5 states for Veterans who have been first-time dwelling consumers and used VA buy loans to purchase properties have been TX, FL, VA, CA, and NC – Determine 4.

Determine 4: High 5 States by Variety of VA FTHB Debtors

Supply: Polygon Analysis, GovLoansVision up to date by means of January 2022

What was the credit score profile of VA First-Time Dwelling Patrons?

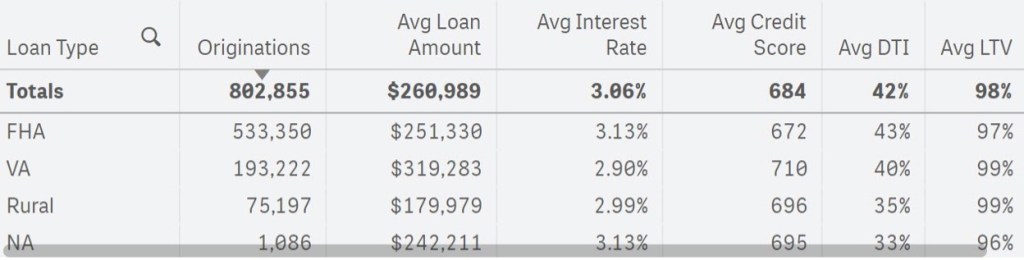

In 2021, the common VA first-time dwelling purchaser had a credit score rating of 710, DTI of 40%, borrowed 99% LTV loans of $319,000 at 2.90% (see Determine 5). VA FTHB debtors had greater credit score rating and decrease DTI than FHA FTHB debtors. In the Vetted VA neighborhood, as a managed pattern, the common VA buy borrower (each FTHB and repeat) had a credit score rating of 717 and a DTI of 40.7% and borrowed 98% LTV loans of $394,000 at 2.69%.

Determine 5: 2021 First-Time Dwelling Purchaser Buy Originations

Supply: Polygon Analysis, GovLoansVision, up to date by means of January 2022

Given the good creditworthiness of VA debtors, and particularly first-time homebuyers, and given the measurement of the VA FTHB lending market – an estimated $58B to $70B – mortgage originators and corporations could discover VA lending as a superb enterprise alternative in 2022.

However with this chance comes a terrific duty – offering the best service to our Energetic Obligation, Veterans, and their spouses, and defending them from abusive lending practices. Understanding the VA-eligible borrower and understanding the financing instruments to serve their credit score wants will not be solely an moral factor to do, but additionally a needed skilled ability with a purpose to obtain scale and profitability.

Knowledge: VA First-Time Dwelling Purchaser (FTHB) Borrower is the precise reported information present in Ginnie Mae loan-level disclosure information units containing 800 million+ rows and modeled in GovLoansVision by Polygon Analysis.

Veteran evaluation is extracted from CPSVision, which incorporates month-to-month CPS information by means of December 2021, the ASEC of March 2021, and the Veteran Complement of August 2020.

Statistical data of 325+ million individuals and 127+ million households.• Forecast are up to date month-to-month.

Nathan Knottingham is the COO of Vetted VA.

This column doesn’t essentially replicate the opinion of RealTrends’ editorial division and its homeowners.

To contact the creator of this story:

Nathan Knottingham at [email protected]

To contact the editor chargeable for this story:

Sarah Wheeler at [email protected]

[ad_2]

Supply hyperlink