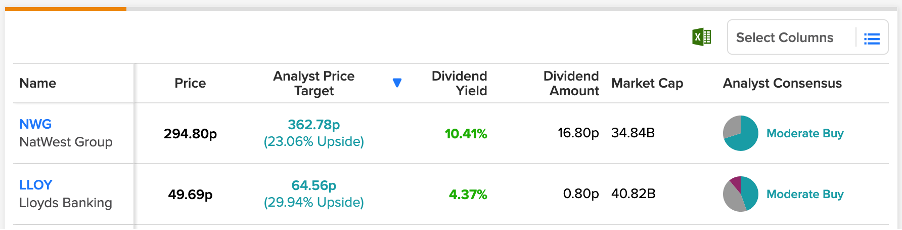

Utilizing the TipRanks instrument for Prime UK Financial institution Shares, we have now picked up the 2 banks with the very best dividend yields. The comparability instrument from TipRanks makes it handy for the investor to select shares from a specific sector.

Lloyds Banking Group (GB:LLOY) and NatWest Group (GB:NWG) are among the many main banks within the UK market. These banks present retail and industrial banking providers globally. The present financial state of affairs does pose a risk to the banks, leading to unstable share costs. Nonetheless, after the 2008 monetary disaster, these banks are higher ready this time to face such headwinds.

Let’s take a look at them intimately.

Table of Contents

Lloyds Banking Group Plc

As one of the trusted banks within the UK, Lloyds Financial institution enjoys a loyal buyer base of round 30 million.

The inventory is a prime decide amongst buyers for its dividends. The financial institution believes in constructing robust shareholder returns after stopping dividends through the pandemic. The entire dividend for 2021 was 2.0p per share, as in comparison with 0.57p per share in 2020. The interim dividend for 2022 was 0.8p per share, 20% greater than the 0.67p in 2021.

Transferring ahead, Citigroup analyst Andrew Coombs expects a complete dividend of two.4p in 2022. Different analysts are additionally bullish and anticipate this quantity to be 2.7p and three.0 p per share in 2023 and 2024, respectively.

When it comes to its earnings era, Lloyds is extra depending on its mortgage banking division, which makes it just a little extra uncovered to the dangers. The slowdown within the housing market and growing defaults on dwelling loans stay a priority for the financial institution. However, the financial institution’s greater money reserves and curiosity earnings present the proper cushion to maintain its dividends.

Lloyds’ inventory has gained round 18% within the final six months, having fallen by 5% within the final yr.

What’s the Goal Value for Lloyds?

The common goal worth for Lloyds’ inventory is 64.56p, which means an upside potential of just about 30%. The value has a excessive forecast of 105p and a low forecast of 46p.

General, the inventory has a Reasonable Purchase score on TipRanks, based mostly on 4 Purchase, 4 Maintain, and one Promote suggestions.

NatWest Group Plc

As in comparison with Lloyds, NatWest has a extra diversified base of earnings streams. NatWest’s inventory has outperformed its friends on the inventory market, after gaining 21.5% within the final yr. Within the final six months, the inventory has jumped by virtually 35%, largely pushed by its good set of third-quarter outcomes.

The financial institution’s quarterly attributable revenue was £187 million. The web curiosity margin elevated by 27 foundation factors to 2.99% within the quarter. The corporate expects its web curiosity earnings to additional improve in 2023.

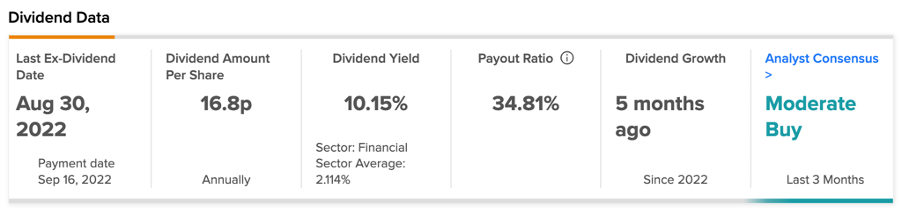

Speaking in regards to the dividends, NatWest not solely has the highest dividend yield of 10.15% within the UK banking sector however, can be among the many highest on the FTSE 100 index. The banking sector’s common dividend yield is 2.1%. Together with an interim dividend of three.5p per share in 2022, the financial institution additionally permitted a particular dividend of 16.8p per share.

Is NatWest a Good Share to Purchase?

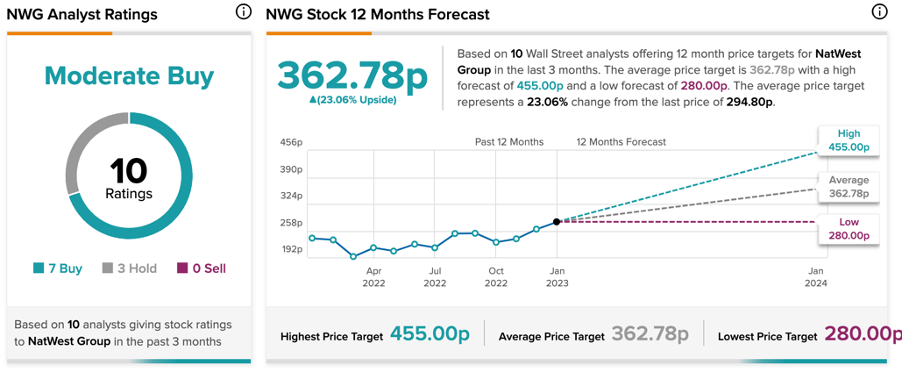

Based on TipRanks’ score consensus, NatWest inventory has a Reasonable Purchase score, with seven Purchase suggestions.

The NWG common goal worth is 362.8p, which represents a development of 23.06% on the present worth degree.

Conclusion

The analysts really feel the UK banks have robust money reserves, which makes them a secure guess through the recessionary setting. The rising rates of interest push their earnings greater, which comfortably covers their dividend payouts.