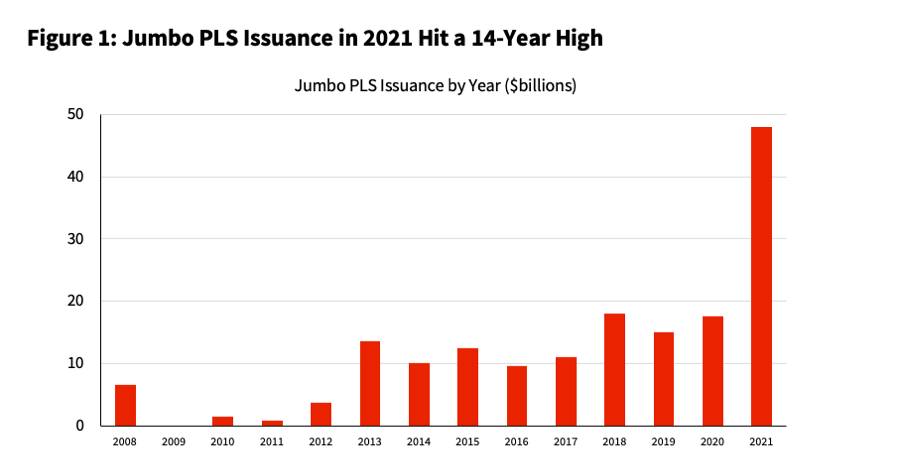

Highest issuance in 14 years with greater credit score high quality too

An surprising aspect impact of the pandemic has been the extraordinary rise in residence costs throughout 2021. That has elevated the necessity for jumbo loans — mortgage loans that exceed the mortgage limits of Fannie Mae and Freddie Mac.

When mortgage charges dropped on the onset of the pandemic in 2020, the results have been felt instantly out there for conforming loans — mortgages that may be packaged into federally backed mortgage securities. Mortgage charges on jumbo loans have been slower to return down and reached an all-time low throughout 2021. Evaluation of CoreLogic public information confirmed that 2021 had the biggest greenback quantity of jumbo mortgage originations since 2005 attributable to record-low jumbo rates of interest and ever greater residence values.

Whereas many jumbo loans are held in financial institution portfolios, some are positioned in private-label securities. Jumbo mortgage securitization greater than doubled in 2021 from the prior 12 months and was the biggest issuance since 2007.

Supply: CoreLogic Vector Securities

© 2022 CoreLogic,Inc., All rights reserved.

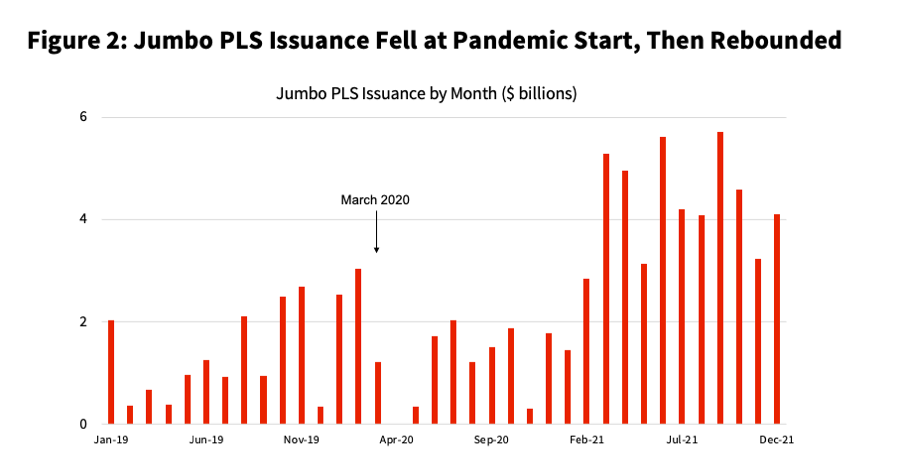

The resurgence in jumbo securitization is noteworthy given the non permanent dearth of issuance when the pandemic started. Issuance dried up in April 2020, and Might of that 12 months noticed solely about one-tenth of February’s quantity. Quantity picked up beginning in the summertime of 2020 earlier than taking off in 2021.

Supply: CoreLogic Vector Securities

© 2022 CoreLogic,Inc., All rights reserved.

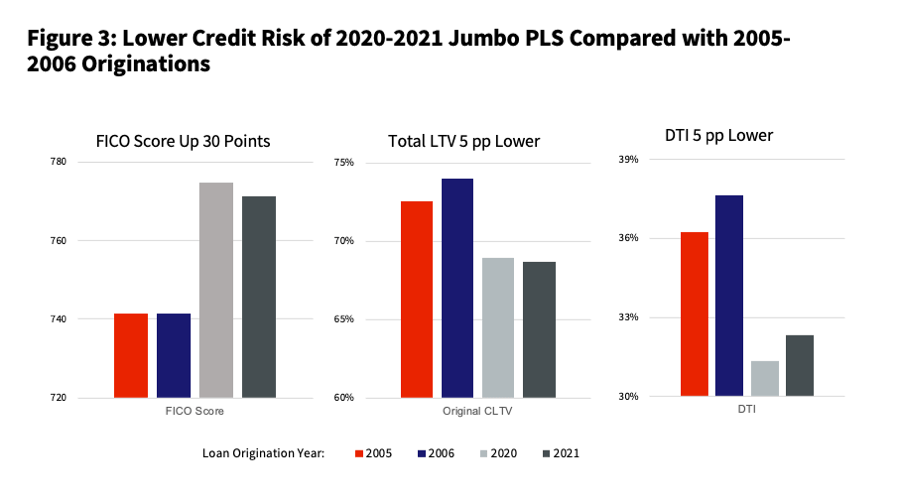

Credit score high quality of the jumbo loans packaged in in the present day’s securities is much greater than those who have been securitized throughout the housing bubble of 2005 and 2006. When in comparison with housing bubble debtors, debtors whose jumbo mortgage was securitized in 2021 had, on common, a credit score rating that was 30 factors greater and a loan-to-value ratio and a debt-to-income ratio that have been every 5 proportion factors decrease.

Supply: CoreLogic Vector Securities

© 2022 CoreLogic,Inc., All rights reserved.

We count on jumbo mortgage originations and securitization in 2022 to be lower than final 12 months for 3 causes.

First, the conforming mortgage restrict was raised 18% in the beginning of 2022, shrinking the jumbo mortgage market. Second, the CoreLogic Residence Value Index Forecast initiatives a moderation in value positive factors throughout 2022, thus slowing the jumbo market enlargement throughout the 12 months. Lastly, greater mortgage charges in 2022 will cut back jumbo refinance.

Abstract:

- File-low jumbo mortgage charges and fast residence value development elevated jumbo lending in 2021.

- The beginning of the pandemic in March 2020 briefly stopped jumbo safety issuance.

- Jumbo mortgage securitization doubled from 2020 to 2021, reaching the biggest quantity since 2007.

- As a result of greater credit score scores, decrease LTV and decrease DTI, the jumbo loans securitized from 2020-2021 had decrease credit score threat than the loans securitized throughout the 2005-2006 bubble.

Acknowledgment: Patrick Kiser obtained the information for the figures from CoreLogic Vector Securities.

Methodology Word:

In CoreLogic VectorTM Securities, jumbo mortgage-backed securities (MBS) are characterised by loans which have a mortgage stability larger than the present Freddie Mac and Fannie Mae conforming mortgage restrict. These swimming pools may comprise conforming loans that the issuer determined to not promote to Freddie Mac or Fannie Mae. The loans in these swimming pools are, generally, made below a conventional set of underwriting pointers to debtors with good to excellent credit score. The next traits are typical of jumbo MBS swimming pools:

- Very excessive proportion of full doc loans (> 75%)

- Very low proportion of non-owner-occupied properties (< 6%)

- Excessive weighted common FICO (> 700)

- Low weighted common coupon (relies upon upon mortgage age and when issued however lower than ALT-A or sub-prime offers)

- Low weighted common margin for ARM loans (usually < 3%)

The prospectus complement for the associated deal signifies nothing uncommon concerning the collateral associated to underwriting requirements and/or collateral threat. As well as, most prime loans are made by well-known nationwide prime lenders.

2022 CoreLogic, Inc. , All rights reserved.