Heap Of Cash mgkaya/E+ by way of Getty Photographs

After rallying 27% final 12 months, the S&P 500 has fallen 12% year-to-date. A wide range of financial and geopolitical elements have contributed to the S&P 500’s correction via the primary two and a half months of this 12 months.

However maybe not shocking to anybody that has adopted me on Searching for Alpha over the previous a number of years is the truth that many dividend development shares have considerably outperformed the broader market this 12 months.

The property and casualty insurer Allstate (ALL) is one such inventory. Regardless of the 4% rise in Allstate’s inventory value year-to-date, I nonetheless imagine the inventory is a purchase. Let’s dig into Allstate’s fundamentals and valuation to higher perceive my thought course of.

Table of Contents

Dividend Protection Stays Very Sturdy

Final month, Allstate declared a 4.9% improve in its quarterly dividend to $0.85 per share. Whereas it is usually stated that the most secure dividend is the one which’s simply been raised, I prefer to be sure that a inventory can afford its dividend regardless.

The primary means that I accomplish that is by evaluating a inventory’s dividend yield to its trade common. Allstate’s 2.76% dividend yield is sort of double the insurance coverage – property and casualty trade common of 1.44%. That is materially larger than the trade common, however nobody metric can inform the entire story.

Allstate reported $13.48 in adjusted diluted EPS in 2021 (in keeping with web page 1 of Allstate’s This fall 2021 earnings press launch) in opposition to $2.97 in dividends per share paid through the 12 months. That is equal to a 22% adjusted diluted EPS payout ratio.

And analysts are forecasting $9.86 in adjusted diluted EPS for this 12 months (and a restoration to $13.31 in 2023 as insurance coverage claims normalize). Stacked in opposition to the $3.36 in dividends per share set to be paid this 12 months, this can be a nonetheless manageable 34.1% adjusted diluted EPS payout ratio.

On condition that Allstate was in a position to generate 16% annual earnings development over the past 5 years, I imagine that the corporate will have the ability to put up 7% to eight% annual earnings development for the foreseeable future. That is the premise of why I imagine Allstate will have the ability to develop its dividend at a 7.5% annual fee over the lengthy haul.

Allstate Carried out Properly Given The Circumstances

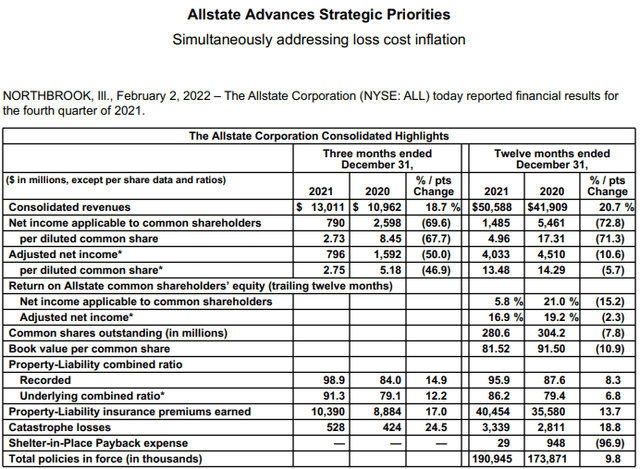

Allstate This fall 2021 Earnings Press Launch

When contemplating the obstacles that Allstate confronted and the tough comparability interval, I imagine the inventory produced admirable working and monetary outcomes for its shareholders in 2021.

Allstate was in a position to enhance its complete insurance policies in drive by 9.8% year-over-year to 190.9 million in 2021 (in keeping with web page 1 of Allstate’s This fall 2021 earnings press launch). Together with a doubling in web funding revenue to $3.3 billion through the 12 months, this led Allstate’s consolidated income 20.7% larger year-over-year to $50.6 billion through the 12 months (knowledge sourced from pages 5 and 1 of Allstate’s This fall 2021 earnings press launch).

Nonetheless, Allstate’s adjusted diluted EPS of $13.48 in 2021 represented a 5.7% decline in opposition to the year-ago interval (particulars in keeping with web page 1 of Allstate’s This fall 2021 earnings press launch). Though a decline in earnings is rarely what buyers wish to see, it is necessary to place issues in context.

Allstate’s exceptionally excessive earnings base in 2020 was powered by fewer clients submitting claims as a result of their decreased journey stemming from the COVID-19 pandemic.

As extra clients started to return to work and journey in 2021, auto accidents and claims volumes elevated. This was additionally exacerbated by the present inflationary setting, which pushed the prices to settle claims larger. This prompted Allstate’s underlying mixed ratio to surge 680 foundation factors larger year-over-year to 86.2% in 2021 (knowledge factors per web page 1 of Allstate’s This fall 2021 earnings press launch).

In response, Allstate has just lately raised auto insurance coverage charges and brought steps to scale back its prices. As pent-up demand for journey fades, claims exercise ought to normalize.

Allstate’s elevated working effectivity and auto insurance coverage charges ought to result in a resurgence in profitability in 2023 and past.

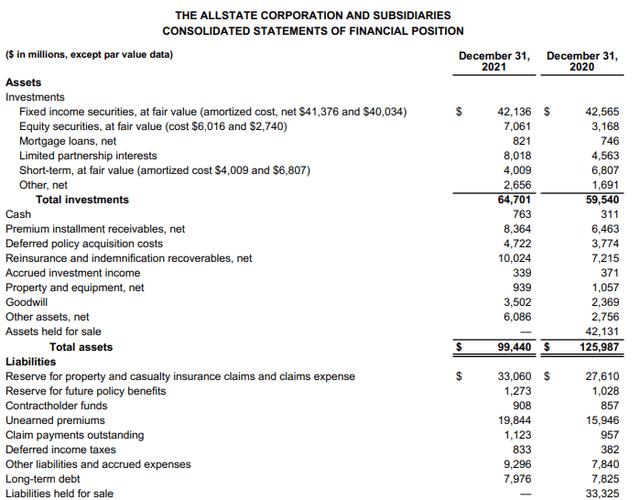

Allstate This fall 2021 Earnings Press Launch

The opposite tailwind that may assist Allstate going ahead would be the rate of interest hikes that the Federal Reserve has deliberate for this 12 months.

This can be a buoy to Allstate’s $64.7 billion funding portfolio, which is able to push web funding revenue significantly larger within the quarters and years forward ($64.7 billion determine sourced from web page 7 of Allstate’s This fall 2021 earnings press launch).

Taking these elements into consideration, Allstate’s development outlook past this 12 months can be simply nice. And on the proper valuation, the inventory might be a profitable funding for shareholders over the long run.

Dangers To Think about:

As a result of Allstate is a inventory, which means it carries its share of dangers. Traders can be well-served to know the dangers, to allow them to sometimes verify in to make sure that the funding thesis stays intact. In consequence, I’ll go over just a few main dangers going through Allstate as outlined in its most up-to-date 10-Okay.

The primary danger to Allstate is from an inflationary standpoint (web page 22 of Allstate’s current 10-Okay).

As an illustration, the CPI for February 2022 skilled a 7.9% improve over the year-ago interval. That is the very best inflation fee since July 1981 (per web page 1 of the February 2022 CPI report), which is able to push up the price of auto and residential insurance coverage claims. If Allstate is unable to move these prices onto its customers because it has been in a position to do up to now, the corporate’s profitability might be harmed.

One other danger to Allstate is a possible downgrade in its investment-grade credit score scores (web page 23 of Allstate’s current 10-Okay). Whereas that is unlikely, such an incidence might lead to limitations to its borrowing capability and will increase in its value of capital. This might be detrimental sufficient to Allstate’s working and monetary outcomes to restrict its future development.

One last danger to Allstate is that the corporate operates in a extremely regulated trade (pages 27-28 of Allstate’s current 10-Okay).

Modifications to present legal guidelines that govern the insurance coverage trade, or the passage of latest laws might require elevated compliance bills on Allstate’s half, result in elevated authorized publicity, or extra restrictive reserve necessities. This might restrict Allstate’s profitability and development prospects as effectively, which might harm the funding thesis.

Whereas I’ve gone over just a few key dangers related to Allstate, there are different dangers that I excluded for the sake of conciseness. I might encourage readers to go to pages 21-29 of Allstate’s most up-to-date 10-Okay, in addition to my prior article on the inventory for a extra full dialogue of the corporate’s danger profile.

Allstate Is Nonetheless A Good Worth Regardless of Its Current Outperformance

Allstate is a dividend inventory of such prime quality that it may possibly assist buyers to beat the volatility of the inventory market with out even batting an eyelash. Nonetheless, buyers nonetheless have to pay the correct value for the inventory to attenuate draw back danger and maximize beginning yield and annual complete return potential.

Thus, I’ll make the most of two valuation fashions to calculate the truthful worth of Allstate’s shares.

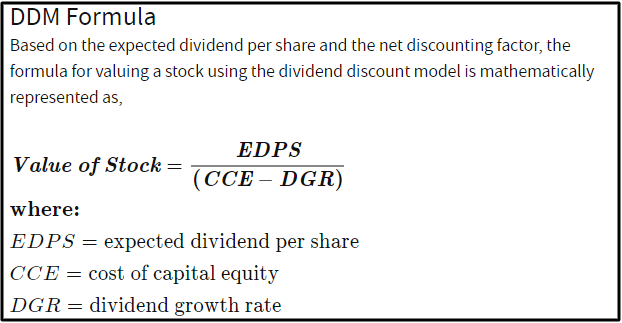

Investopedia

The primary valuation mannequin that I am going to use to worth shares of Allstate is the dividend low cost mannequin, which accommodates three inputs.

The primary enter into the DDM is the anticipated dividend per share, which is one other means of stating a inventory’s annualized dividend per share. Following its dividend improve, Allstate’s annualized dividend per share is at the moment $3.40.

The subsequent enter for the DDM is the price of capital fairness, which is the annual complete return fee that an investor requires from their funding portfolio. My private choice is 10%, so that is what I can be utilizing.

The ending enter into the DDM is the annual dividend development fee or long-term DGR.

Whereas the primary two inputs for the DDM are easy, appropriately predicting the long-term DGR requires an investor to consider a number of components: These embody a inventory’s dividend payout ratios (and whether or not these payout ratios are poised to remain the identical, develop, or contract over the long term), annual earnings development sooner or later, the well being of a inventory’s stability sheet, and trade fundamentals.

As Allstate’s claims actions revert to pre-COVID ranges and funding revenue begins to rise, I imagine that high-single-digit annual earnings development will return for the corporate. Together with the low dividend payout ratio, this must be sufficient handy out 7.5% common annual dividend will increase over the following few a long time.

Contemplating these three inputs, I’m left with a good worth output of $136.00 a share. This signifies that Allstate’s shares are buying and selling at a 9.3% low cost to truthful worth and may present a ten.2% upside from the present value of $123.38 a share (as of March 12, 2022).

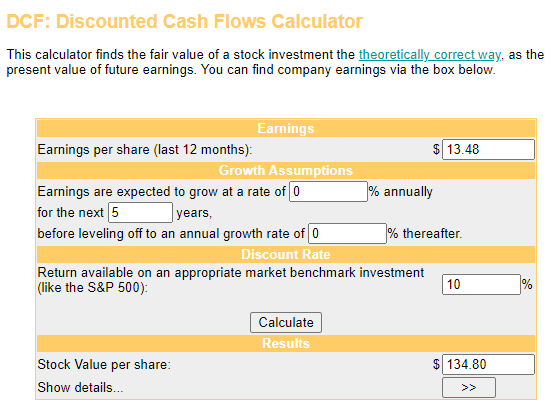

Cash Chimp

The opposite valuation mannequin that I am going to make use of to assign a good worth to Allstate’s shares is the discounted money flows mannequin, which has three inputs.

The primary enter for the DCF mannequin is the prior twelve months of adjusted diluted EPS. As I famous earlier, Allstate produced $13.48 in adjusted diluted EPS final 12 months.

The second enter into the DCF mannequin is development assumptions. The DCF mannequin is simply pretty much as good as a person’s development projections, so I might argue that it is best to err on the facet of conservatism right here.

I’ll assume that earnings over the previous 12 months keep sideways into perpetuity. That is though I imagine from 2023 onward, Allstate’s earnings will develop at a high-single-digit annual fee over the medium time period.

The third enter for the DCF mannequin is the low cost fee, which is the required annual complete return fee. I’ll follow 10% right here.

These inputs into the DCF mannequin level me to a good worth of $134.80 a share. This indicators that shares of Allstate are priced at an 8.5% low cost to truthful worth and provide 9.3% capital appreciation from the present share value.

Averaging these two truthful values collectively, I compute a good worth of $135.40 a share. This means that Allstate’s shares are buying and selling at an 8.9% low cost to truthful worth and may present a 9.7% upside from the present share value.

Abstract: An All-Climate Dividend Grower At An Enticing Valuation

Allstate just lately prolonged its dividend development streak to 12 years straight (per information from the inventory’s dividend web page). Whereas the mid-single-digit payout improve paled compared to the prior 12 months’s 50% hike, I think dividend development will speed up into the high-single-digits once more. That is due to Allstate’s protected dividend payout ratio and the expectation that wholesome development will resume.

And Allstate appears to be like to be 9% undervalued utilizing my inputs for the DDM and DCF mannequin. That is why I am satisfied that Allstate will proceed to beat the broader market shifting ahead. Subsequently, I fee shares of the inventory a purchase.