Aon plc AON bought actuarial software program platform Tyche to spice up its insurance coverage consulting capabilities for shoppers. Nevertheless, additional particulars of the deal have been saved underneath wraps. The main insurance coverage dealer purchased the actuarial modelling system Tyche from the expertise and software program agency RPC Tyche.

This newest strategic transfer provides to the insurance coverage brokerage participant’s present functionalities that in flip will assist re/insurer shoppers take knowledgeable enterprise selections. The addition of Tyche permits Aon to supply a single expertise platform for insurance coverage shoppers to combine capital modelling, pricing and reserving.

Tyche gives providers to among the main life, non-life, and composite insurers and pension companies plus skilled providers suppliers. Aon’s administration expects the answer to succeed in the underpenetrated markets, enhancing its portfolio additional.

That is anticipated to decrease dangers and regulatory necessities of the insurance coverage dealer. Aon undertakes strategic buyouts every so often to spice up its capabilities and supply superior options to shoppers. In September 2021, AON acquired 51% of Aon India Insurance coverage Brokers Restricted (previously generally known as Anviti Insurance coverage Brokers Personal Restricted). AON spent $14 million on buyouts final 12 months and has sealed many acquisition offers over the previous few years. Its acquisitions primarily intention at increasing its well being and advantages enterprise, flood insurance coverage options, and danger and insurance coverage options operations.

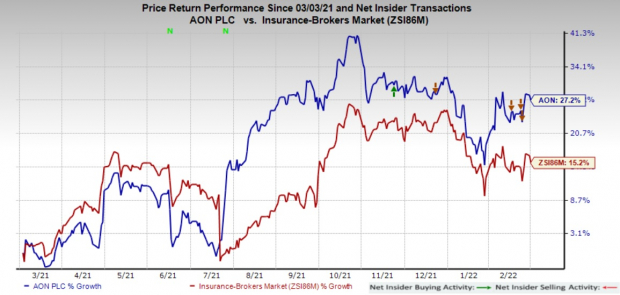

Shares of AON have gained 27.2% in a 12 months’s time, outperforming its business’s progress of 15.2%. The inventory carries a Zacks Rank #3 (Maintain), presently. You may see the entire checklist of at this time’s Zacks #1 Rank (Robust Purchase) shares right here.

Picture Supply: Zacks Funding Analysis

Given the insurance coverage business’s ample capital stage, gamers like Brown & Brown Inc. BRO, Arthur J. Gallagher & Co. AJG and First American Monetary Company FAF are pursuing strategic mergers and acquisitions.

Brown & Brown’s subsidiary Brown & Brown Lone Star Insurance coverage Providers bought HARCO to spice up its presence in Texas. BRO and its subsidiaries repeatedly make strategic acquisitions to increase globally, add capabilities and increase operations. Additionally, these strategic buyouts assist BRO improve commissions and charges, which in flip, drive revenues. BRO lately agreed to purchase the overall insurance coverage working firms of BdB.

Arthur J. Gallagher & Co. acquired Threat Switch Insurance coverage Company, LLC. AJG additionally purchased Romford, Essex-based Devitt Insurance coverage Providers in the UK. Its spectacular inorganic story encompasses a sturdy merger and acquisition pipeline with about $400 million revenues related to practically 50 time period sheets both agreed upon or being ready. The insurance coverage dealer estimates greater than $2.5 billion of mergers and acquisitions, consisting of $1 billion money, about $650 million of web money technology within the second half of 2021, and $600-$700 million of borrowing capability.

First American Monetary agreed to amass Mom Lode Holding Firm to broaden its publicity within the essential progress markets, improve its capabilities to higher serve prospects throughout the strongest housing markets and fortify its presence in america. In keeping with its strategic initiatives, FAF actively pursues acquisitions to spice up and increase its core enterprise. The title insurer additionally pursued small title company buyouts within the areas that it identifies as progress markets.

Shares of Brown and Brown, Arthur J. Gallagher and First American have gained 42.8%, 27.6% and 21%, respectively, in a 12 months’s time.

Bitcoin, Just like the Web Itself, Might Change The whole lot

Blockchain and cryptocurrency has sparked one of the crucial thrilling dialogue matters of a technology. Some name it the “Web of Cash” and predict it may change the best way cash works without end. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early levels of this expertise, and because it grows, it’s going to create a number of investing alternatives.

Zacks’ has simply revealed 3 firms that may assist traders capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them straight.

See 3 crypto-related shares now >>

Click on to get this free report

Aon plc (AON): Free Inventory Evaluation Report

First American Monetary Company (FAF): Free Inventory Evaluation Report

Arthur J. Gallagher & Co. (AJG): Free Inventory Evaluation Report

Brown & Brown, Inc. (BRO): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.