Fearing Russia’s elite will evade financial sanctions by changing their wealth to cryptocurrency, high-profile US Democratic senator Elizabeth Warren has launched a invoice into US Congress to stymie Russian crypto transactions.

Warren warned a Senate committee listening to:

So nobody can argue that Russia can evade all sanctions by shifting all its property into crypto. However for Putin’s oligarchs who’re making an attempt to cover, , a billion or two of their wealth, crypto seems to be like a fairly good choice.

The invoice doesn’t search to impose a blanket ban on all Russian cryptocurrency transactions. However it will give the US authorities the authority to ban US corporations from processing cryptocurrency transactions linked to sanctioned Russian accounts, and to use secondary sanctions to international cryptocurrency exchanges doing enterprise with sanctioned Russian people, corporations or authorities companies.

However is it even essential?

Despite the fact that the proof reveals that Russian cryptocurrency transactions have been growing in each quantity and worth previously month, the dimensions suggests patrons are abnormal Russians looking for to carry on to their financial savings as the worth of the ruble crashes.

Table of Contents

Focusing on sanctions

The financial sanctions imposed on Russia for invading Ukraine are naturally hurting all the Russian economic system. Their meant goal, although, is to hit Putin and the billionaire oligarchs who help his rule the place it hurts most.

A cornerstone of this technique is stopping these people from utilizing or shifting their wealth round by freezing the property they maintain abroad and blocking monetary transactions.

However the continued operation of cryptocurrency exchanges in Russia, corresponding to Binance, Yobit and Native Bitcoins, has been worrying US officers for a while. Even earlier than Russia’s newest invasion of Ukraine, the US Treasury Division warned cryptocurrencies may undermine the sanctions already imposed on Russia over its 2014 annexation of Crimea.

Ruble’s falling worth

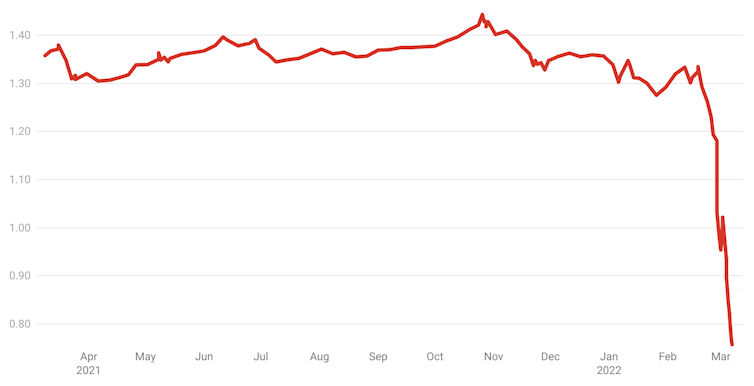

Our first graph under reveals why abnormal Russians have good cause to purchase cryptocurrency.

For the reason that February 24 invasion of Ukraine, the ruble’s worth in opposition to the US greenback has fallen by as a lot as 40%, from $US1 being price 76 rubles to 132 rubles. On the time of publication, $US1 was price about 109 rubles.

The ruble falls off a cliff

Buying and selling Economics

Extra rubles going into Bitcoin

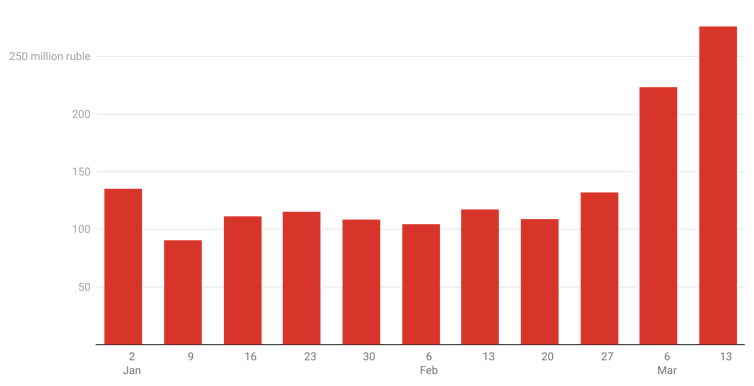

The subsequent graph reveals the worth of Bitcoin transactions by Russian accounts in rubles.

Bitcoin will not be the one cryptocurrency Russians may purchase, however it’s by far essentially the most traded and trusted of all cryptocurrency choices, so is a helpful proxy for the market. This knowledge comes from Coin Dance, a number one Bitcoin statistics and companies firm.

For the reason that conflict started on February 24 till time of publication, spending on Bitcoin utilizing rubles has elevated by 260%.

Bitcoin buying and selling volumes by Russian accounts in rubles (weekly)

Coindance

That is a powerful rise, however much less spectacular when the devaluation of the ruble is factored in. The weekly worth of rubles being transformed into Bitcoin was about $US28 million final week, in contrast with about $US14 million in mid-February. That is a 100% rise.

In world phrases, that is nonetheless a tiny proportion of the cash going into Bitcoin. Based on cryptocurrency knowledge supplier Kaiko, every week between $US20 billion to US$40 billion is spent on Bitcoin. So the Bitcoin-ruble commerce represents lower than 0.14% of the entire.

Small transaction dimension

It is usually vital to contemplate the variety of accounts and dimension of common transactions.

Based on Glassnode, one other cryptocurrency knowledge service, the variety of Russian Bitcoin accounts has elevated from 39.9 million to 40.7 million for the reason that February invasion. (The Russian inhabitants is about 144 million.)

The each day common dimension of every Bitcoin-ruble transaction – based mostly on knowledge from the the most important alternate in Russia, Binance – has risen to $US580 by mid-February. This compares to the typical worth of American transactions being $US2,198 on the similar time.

Learn extra:

Bitcoin helps each side in Ukraine battle, nevertheless it will not wreck Russian sanctions

The capability to place giant quantities of rubles by way of crypto exchanges working in Russia can also be closely constrained by the comparatively low liquidity in Russian crypto commerce.

Liquidity refers back to the ease with which an asset or safety – on this case Bitcoin – will be transformed from or into money with out affecting its market value. When a market has extra patrons and sellers, it turns into simpler to finish a transaction, and the much less impression there’s on the alternate price. With fewer patrons and sellers, it’s tougher.

A measure of the liquidity of the Russian Bitcoin exchanges is the worth of orders submitted by patrons and sellers at any given time. That is about US$200,000, in contrast with $US22 million for US-based crypto exchanges – a quantity 110 occasions bigger.

These statistics recommend anybody wishing to commerce giant volumes of Bitcoin in opposition to the ruble can have difficulties.

Small-time buyers

The proof due to this fact factors to many of the uptick in Russian cryptocurrency buying and selling being dominated by small-time buyers.

It’s potential that Putin and his cronies might be utilizing tons of or hundreds of accounts to carry out many small-scale transactions to maneuver their fortunes round.

But it surely’s extra doubtless their wealth is usually invested by way of shell corporations in property in locations like Monaco, the British Virgin Islands, Eire and even the US district of Delaware.

Learn extra:

The subsequent Pandora Papers exposé is inevitable – except governments do extra on two key reforms

There may be little argument in opposition to the technique of utilizing financial sanctions to fight recalcitrant regimes. Aside from direct navy intervention, there are few different significant weapons accessible. However an in depth evaluation of any proposed sanction beforehand is required in order to not overestimate its doubtless effectiveness.