Michael M. Santiago/Getty Photographs Information

Dealerships are extensively understood and have been shunned by many traders. That is regardless of the typical dealership having good underlying economics. Asbury Automotive Group Inc. (ABG) is without doubt one of the winners of this favorable market, which has undergone consolidation within the final 60 years. The corporate’s embrace of ecommerce places it in a robust place to win an more and more digital-first world. The corporate’s actual property portfolio provides it draw back safety and is a plus as sellers adapt to ecommerce. The chain stays considerably undervalued in opposition to the market.

Table of Contents

What Asbury Does

Asbury owns auto dealerships throughout the nation. In response to the corporate’s 2020 annual report, as of December 31, 2020, Asbury owned and operated 112 new automobile franchises, promoting 31 completely different automotive manufacturers in 91 dealership places, 25 collision facilities, and one auto public sale in 16 cities in 9 states. The corporate sells a variety of automotive services and products, reminiscent of new and used automobiles; elements and repair or “P&S”; and finance and insurance coverage merchandise (“F&I”).

Dealerships Function in a Favorable Trade

Trade dynamics matter. It is very important search for companies whose common traits are favorable, quite than to attempt to discover nice companies in horrible industries. Since automobile gross sales collapsed within the wake of the 2008 recession, the automotive dealership {industry} has steadily improved its profitability.

In response to the Nationwide Car Sellers Affiliation (“NADA”), the typical return on fairness of car sellers for the yr thus far in October 2021, was 47.7%, in comparison with 31.1% for a similar interval within the yr prior.

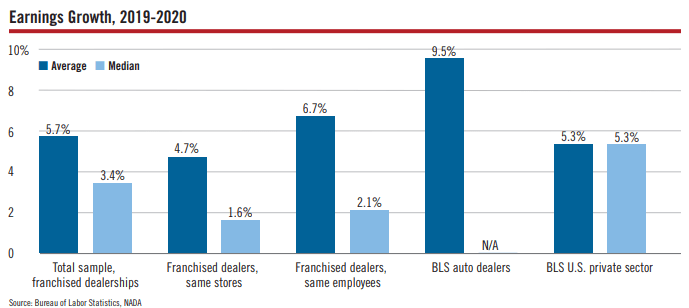

NADA’s Knowledge 2021 report exhibits the diploma to which dealerships thrived between 2019 and 2020, regardless of, or maybe due to the pandemic:

Supply: Knowledge 2021

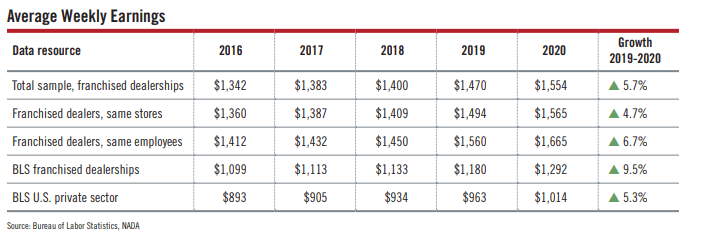

The report additionally exhibits, nonetheless, that this pattern of earnings development predates the pandemic. The chart under exhibits that the typical weekly earnings of automotive dealerships have been rising since a minimum of 2016:

Supply: Knowledge 2021

I’m not the primary one to note this. When Berkshire Hathaway purchased the Van Tuyl Group in 2014, Amy Wilson of Automotive Information reported that,

“In 2013, the typical U.S. dealership produced a return on fairness of 29 %, in line with the Nationwide Car Sellers Affiliation. That determine has risen in 4 of the previous 5 years and is now greater than double the 12 % return recorded in 2008 when U.S. automobile gross sales collapsed.”

There are apparent explanation why dealerships have such favorable economics. On the micro stage, the enterprise mannequin makes it troublesome to not be worthwhile. A dealership doesn’t require numerous invested capital, and dealerships can scale their volumes and earn excessive returns on capital regardless of having very skinny margins.

Returns have improved partly as a result of the variety of dealerships has tumbled over the a long time, from over 30,000 virtually 60 years in the past, to round 16,700 immediately. This discount has occurred regardless of the variety of cars available on the market rising together with the inhabitants. Consequently, the typical vendor can push via extra autos immediately than was potential 60 years in the past. With {industry} consolidation and an already asset-light enterprise mannequin, the typical dealership can take pleasure in rising profitability.

I anticipate that the worldwide provide chain disruption will result in additional consolidation. Many sellers have struggled to get cars, with customers having to go nice lengths to acquire automobiles. Sellers have suffered from very low inventories, emphasizing the significance of being a big vendor for securing inventories. The provision chain disruption is unlikely to finish quickly and the Ukrainian disaster has most likely lengthened it. Meaning precedence might be given to nationwide chains over small chains, driving {industry} consolidation. For small sellers, that may be a tragedy. For big sellers, that may enhance returns.

Asbury’s Actual Property Portfolio Provides It Draw back Safety

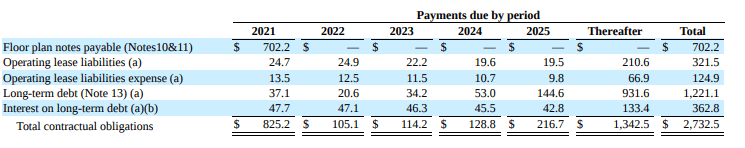

Retailers sometimes don’t personal a lot of the land that their companies function from, leading to massive working lease bills. Asbury, like many automotive dealerships, is completely different. The group owns the vast majority of the actual property its dealership operates from, leading to low working lease bills. An instance of the corporate’s low working lease expense is proven under:

Supply: 2020 Annual Report

Consequently, the enterprise has important draw back safety within the occasion that its automotive dealerships have been to show uneconomical: they may promote parts of their actual property portfolio, or convert their use. Though traders sometimes see Asbury’s purely as an automotive vendor, the corporate itself thinks when it comes to its “dealership and actual property portfolio”.

Ecommerce disruption will present the significance of proudly owning actual property, as Asbury will be capable to convert vendor places into supply facilities the place customers acquire autos purchased on-line. Retooling actual property can work in numerous methods, however basically, Asbury has optionality via possession.

Asbury’s Profitability Leads Its Friends

The corporate’s gross margins are industry-leading. Asbury enjoys the very best 5-year gross margin and the second highest 5-year returns on invested capital (ROIC) within the {industry}. Total, the corporate’s gross margins and ROIC are greater than peer-average (Supply: Firm Filings):

|

Ticker |

5-year Gross Margin |

5-12 months ROIC |

|

|

Asbury |

ABG |

16.55% |

11.17% |

|

AutoNation |

AN |

16.55% |

7.94% |

|

Lithia Motors Inc. |

LAD |

9.06% |

15.86% |

|

Group 1 Automotive |

GPI |

15.32% |

7.67% |

|

Penske Automotive Group |

PAG |

15.32% |

7.65% |

|

Sonic Automotive |

SAH |

14.62% |

5.84% |

|

Peer Common |

14.57% |

8.28% |

If the corporate achieves its 5-year goal of 20% income development compounded throughout 5 years, will probably be in a position to widen its lead over its friends. The corporate believes that it will possibly obtain this goal by rising similar retailer revenues by $2 billion, rising income from Clicklane to $5 billion. Between 2018 and the trailing twelve months (“TTM”), Asbury grew income from $6.87 billion to $9.42 billion, compounded at 8.42%. But, the corporate’s 2021 outcomes recommend that the corporate’s targets could also be inside attain. Income was up 38%, whereas gross revenue rose 55% in comparison with 2020.

If margins fall to the {industry} common, the corporate may generate earnings per share (“EPS”) within the low-30s, and if they will preserve their margins, that appears extra just like the low-40s.

Clicklane Provides Asbury a Aggressive Benefit

Because the Wall Avenue Journal famous, automotive dealerships have modified considerably because the begin of the pandemic. Though on-line gross sales predate the pandemic, because the pandemic, on-line gross sales have shot up. Increasingly more Individuals are shopping for autos on-line, making automotive dealerships look increasingly more like these different elements of the retail {industry} disrupted by ecommerce. Asbury is prepared for this.

In 2020, Asbury launched its new communications expertise ecosystem, Clicklane. Clicklane permits clients to purchase or lease each new and used automobiles on-line. Clicklane was unrolled throughout the nation, with implementation being accomplished in Q1 2021. The platform is a part of the corporate’s try to enhance the client expertise and enhance its digital footprint.

Asbury’s friends haven’t been in a position to match its potential to promote new automobiles on-line. This offers it an edge over Carvana, Shift and Vroom who promote used-cars. Carvana, Shift and Vroom nonetheless symbolize a small portion of the used-car market, however they present what the long run may appear to be. Like Clicklane, they will promote used automobiles on-line with out restrictive franchise legal guidelines which stop new automotive gross sales. Clicklane is ready to additionally succeed with new automotive gross sales given its franchise agreements with unique tools producers (“OEMs”). It does so by ramping up its footprint inside a geography to maximise its potential to push volumes, all of the whereas taking market share from smaller sellers.

Clicklane will enable Asbury to seize a unique sort of buyer, and to increase its drive for brand new clients to a brand new entrance. This omnichannel strategy ought to have a constructive impact on its income development.

The shift to digital will result in additional {industry} consolidation. Small chains will be unable to match the power of Asbury and different chains to supply each new and used automobiles on-line. Secondly, even when they will safe franchise agreements with OEMs, manufacturers will change into extra essential than ever. Up to now, location was all the pieces, however in a extra digital world, small sellers who thrived as a result of they have been in strategic places will see much less site visitors as customers take to the web first.

The dealership worth chain is more likely to change. As we famous above, the dealership market is more likely to skew towards nationwide chains as OEMs and sellers prioritize nationwide chains over smaller chains. Ecommerce will scale back the necessity for stock, however this won’t assist small chains: on-line, manufacturers are all the pieces, and community results come into play. Though corporations like Tesla and Rivian have embraced a dealer-free mannequin and wish to promote on to clients in all states, clients will nonetheless want vendor platforms as a hub to view a number of varieties of automobiles. Ecommerce has proven that direct-to-customer fashions won’t change intermediaries like sellers.

Might Lithia Be a Match?

Though Lithia has the next 5-year ROIC and has lots of the similar options as Asbury, one essential factor to notice is that the 2 corporations shouldn’t have a lot overlap. Thus, Asbury doesn’t have to fret about Lithia utilizing its superior ROIC to drive its profitability down. Certainly, it’s notable that the 2 corporations are very comparable, regardless of little geographic and model overlap. This implies to me that each corporations may viably merge, consolidating the {industry} additional.

Lithia has aggressively purchased up sellers with a view of getting a Lithia dealership inside 100 miles of each automobile shopper. It could be fascinating to see if that interprets right into a transfer for Asbury, which might be a pure match. Underneath present antitrust sentiment, that deal could also be arduous to push via. Nonetheless, we’ve got to notice that Asbury’s most competent and full potential competitor would not actually compete in the identical house as Asbury.

Valuation

On a relative foundation, the corporate has a price-earnings (“PE”) ratio of 6.91 and a 5-year PE ratio of 9.47. That is typical of dealerships, which have had low valuations for a few years. Traders have merely not understood dealerships and their highly effective {industry} dynamics. Consequently, like a lot of its friends, the corporate is cheaper than the market, which trades at a a number of of 24.46.

Conclusion

Asbury operates in an {industry} that has undergone consolidation even because the variety of automobiles bought and the nation’s inhabitants has risen. As well as, the worldwide provide chain disruption is more likely to speed up consolidation additional. In consequence, the typical vendor goes to see extra volumes and even larger profitability. Asbury’s is without doubt one of the finest run and most worthwhile sellers. Clicklane provides it a bonus in an {industry} the place ecommerce is turning into a extra essential a part of how clients purchase their autos. The corporate’s relative cheapness mixed with {industry} dynamics make this a really engaging inventory.