Debtors with a great credit score rating could possibly save hundreds by consolidating bank card debt into a brand new mortgage. (iStock)

Making the minimal funds on high-interest bank card debt is an costly option to repay your balances. Bank card curiosity accrues each day, which provides to the entire price of debt reimbursement over time.

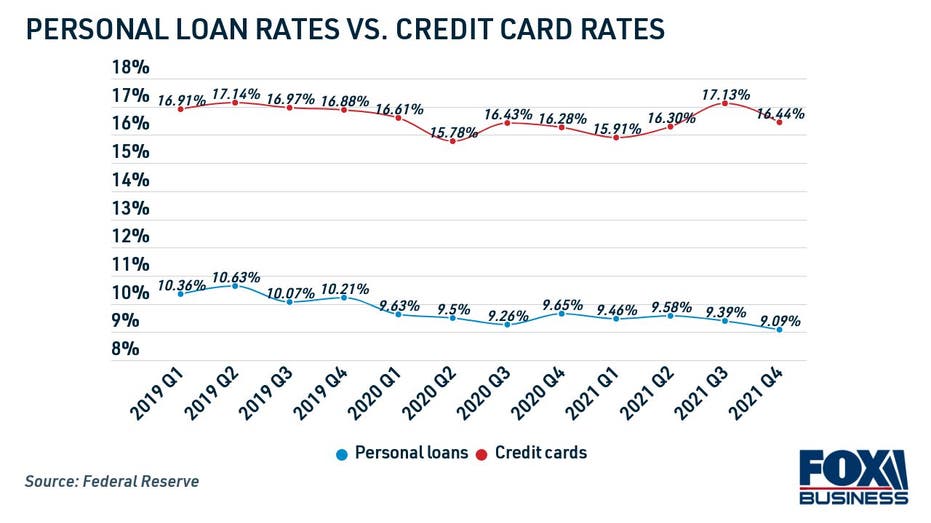

One widespread option to consolidate bank card debt is with a private mortgage. This can be a sort of lump-sum, unsecured mortgage that you just repay in mounted month-to-month installments at a decrease rate of interest. And since private mortgage charges are decrease than they’ve ever been, paying off bank card debt can prevent more cash than ever earlier than.

Within the fourth quarter of 2021, the typical charge on a two-year private mortgage set a brand new file low of 9.09%, based on the Federal Reserve. Throughout the identical interval, the typical bank card charge for accounts assessed curiosity was a lot increased, at 16.44%.

Maintain studying to be taught extra about bank card consolidation, and go to Credible to match private mortgage charges free of charge with out impacting your credit score rating.

MILLIONS OF AMERICANS FEAR MISSING DEBT PAYMENTS, NY FED REPORTS

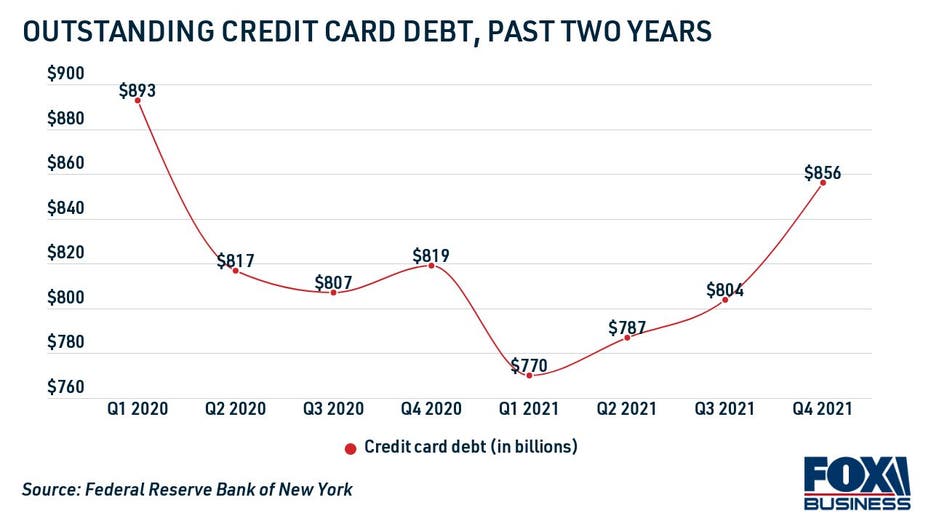

Regardless of surging bank card debt, consolidation is cheaper than ever

Individuals have gotten more and more reliant on bank cards as debt balances are skyrocketing, based on the Federal Reserve Financial institution of New York. The excellent bank card debt grew 6.5% within the fourth quarter of 2021 as shoppers added a file $52 billion to their balances.

At a time when bank card balances are hovering, it is extra helpful than ever to consolidate debt into a private mortgage at a decrease rate of interest.

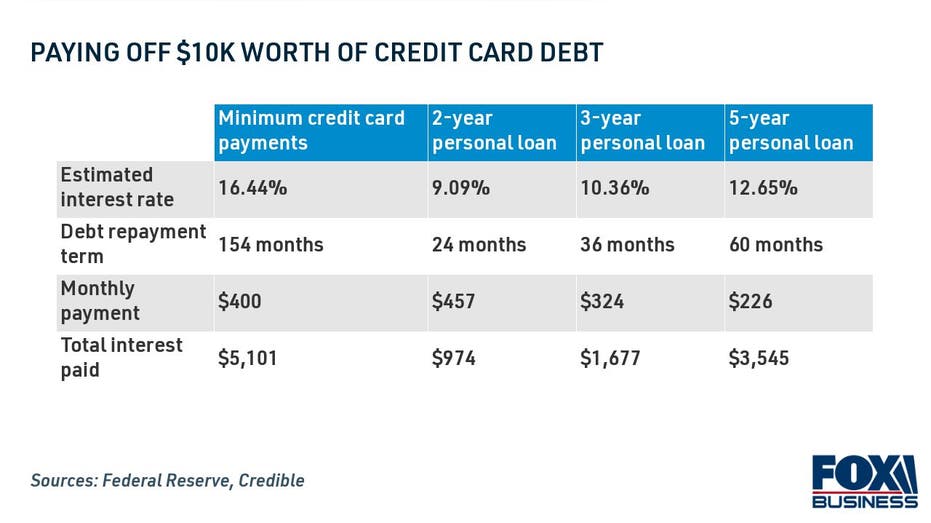

A latest evaluation estimates that paying off $10,000 price of bank card debt with a two-year private mortgage at a 9.09% charge can save debtors greater than $4,000 in curiosity expenses in contrast with simply making the minimal bank card funds. By refinancing utilizing this bank card reimbursement technique, debtors can repay their balances 10 years quicker by including simply $57 to their month-to-month funds.

It might even be doable lower your expenses over time and decrease your month-to-month funds by consolidating to a longer-term private mortgage. Needless to say longer private mortgage phrases sometimes end in increased charges, however you should still be capable to get a decrease, mounted rate of interest than what you are at present paying in your bank cards.

The common mounted charge on a five-year private mortgage was 12.65% for well-qualified candidates who borrowed a private mortgage on Credible through the week of Jan. 31. Paying off $10,000 price of bank card debt below these private mortgage phrases can doubtlessly decrease your month-to-month funds by $174 whereas nonetheless saving you greater than $1,500 over the reimbursement interval.

You’ll be able to estimate your private mortgage reimbursement phrases free of charge on Credible, and see how a lot it can save you through the use of a bank card consolidation mortgage calculator.

HOW TO GET A BALANCE TRANSFER CREDIT CARD

The right way to consolidate bank card debt with a private mortgage in 5 steps

Utilizing a private mortgage for bank card debt consolidation could show you how to lower your expenses whereas paying off your debt in predictable month-to-month funds. This is what the private mortgage utility course of appears like:

- Add up all of your bank card balances. This may show you how to decide the non-public mortgage quantity that you must borrow to repay your bank card debt. You’ll be able to consolidate the balances of a number of bank cards right into a single private mortgage fee.

- Examine your credit score rating. Since private loans are unsecured and do not require collateral, lenders use your credit score historical past to find out your danger and eligibility. Candidates with superb to wonderful credit score, outlined as by the FICO mannequin as a credit score rating of 740 or increased, will see the bottom private mortgage charges.

- Store for private mortgage charges. Most lenders will allow you to see your mortgage phrases, together with estimated rates of interest, with a mushy credit score verify via a course of referred to as prequalification. You’ll be able to examine private mortgage charges throughout a number of lenders without delay through the use of Credible.

- Select the perfect private mortgage. When evaluating provides, you will wish to take into account the rate of interest, origination payment, mortgage quantity and mortgage size. As soon as you’ve got chosen a lender, you will have to submit a proper utility, which would require a tough credit score inquiry.

- Use the mortgage to repay your bank cards. If you happen to’re authorised, you will obtain private mortgage funding as quickly as the subsequent enterprise day. It may sometimes be deposited proper into your checking account. You’ll be able to then use your private mortgage stability to repay your bank cards.

HOW TO CHECK YOUR CREDIT REPORT FOR FREE WITHOUT PENALTY

Though your bank card balances may be wiped to zero, it is necessary to keep away from racking up extra debt when you repay your private mortgage. It’s best to at all times prioritize paying your bank card debt in full every month to keep away from paying curiosity.

You’ll be able to be taught extra about debt consolidation loans from on-line lenders by visiting Credible. Plus, browse present private mortgage rates of interest within the desk under to determine if this debt reimbursement technique is true in your monetary scenario.

BALANCE TRANSFER CARDS WITH 0% APR INTRODUCTORY PERIODS ARE DISAPPEARING FAST

Have a finance-related query, however do not know who to ask? E mail The Credible Cash Skilled at moneyexpert@credible.com and your query is perhaps answered by Credible in our Cash Skilled column.