What GAO Discovered

Decrease-income, less-educated, and minority households usually tend to be unbanked (not have a checking or financial savings account) or be underbanked (have a checking account however use various monetary companies, which will be expensive), in accordance with GAO evaluation of Federal Deposit Insurance coverage Company (FDIC) survey knowledge (see desk). Customers won’t use banks for causes together with lack of cash, surprising or excessive financial institution charges, lack of belief, and privateness considerations, in accordance with FDIC’s survey and market members and observers.

Banking Standing by Family Revenue, Schooling, and Race, 2015–2019 (share)

|

|

Unbanked |

Underbanked |

Totally banked |

|

|---|---|---|---|---|

|

Revenue |

Lower than $15,000 |

25 |

22 |

53 |

|

|

$15,000–29,999 |

12 |

23 |

66 |

|

|

$30,000 or extra |

2 |

18 |

81 |

|

Schooling |

No highschool diploma |

22 |

26 |

51 |

|

|

Highschool diploma or extra |

5 |

18 |

77 |

|

Race and ethnicity |

Black |

16 |

31 |

53 |

|

|

Hispanic |

14 |

30 |

56 |

|

|

White |

3 |

14 |

83 |

|

Whole |

— |

6 |

19 |

75 |

Supply: GAO evaluation of Federal Deposit Insurance coverage Company (FDIC) knowledge. | GAO-22-104468

Notice: For extra particulars, see desk 2 in GAO-22-104468. Totals don’t all the time add to one hundred pc as a result of rounding.

A number of legal guidelines and regulatory components could deliberately or unintentionally have an effect on the price and availability of primary banking companies. For instance, two research discovered massive banks could have elevated checking account charges to offset regulatory limits on their charges for processing debit card transactions. Against this, rules requiring customers to decide on to obtain overdraft safety could have lowered overdraft charges paid by customers who didn’t choose in, in accordance with market observers and three research by the Client Monetary Safety Bureau.

Actions of the chosen regulators GAO reviewed associated to unbanked and underbanked households typically targeted on analysis, schooling, and oversight. However some regulators lack outcome-oriented measures of their efforts to extend banking entry or their measures don’t cowl all their key initiatives. For instance, FDIC piloted a public consciousness marketing campaign on the advantages of financial institution accounts. But, its measures point out solely whether or not a activity was accomplished and don’t incorporate info on the outcomes (which might be used to evaluate the actions). The Nationwide Credit score Union Administration (NCUA) measures how lengthy it takes to course of credit score union charters, which helps assess timeliness however doesn’t present info to evaluate company efficiency in facilitating entry to credit score union companies. The Workplace of the Comptroller of the Forex (OCC) launched an initiative to extend entry to credit score, together with small-dollar loans. However OCC didn’t incorporate efficiency measures for a key initiative to reinforce banking entry. By utilizing outcome-oriented efficiency measures for his or her efforts to extend entry to banking companies, FDIC, NCUA, and OCC may higher establish alternatives for enchancment throughout all key initiatives and set priorities accordingly.

Why GAO Did This Research

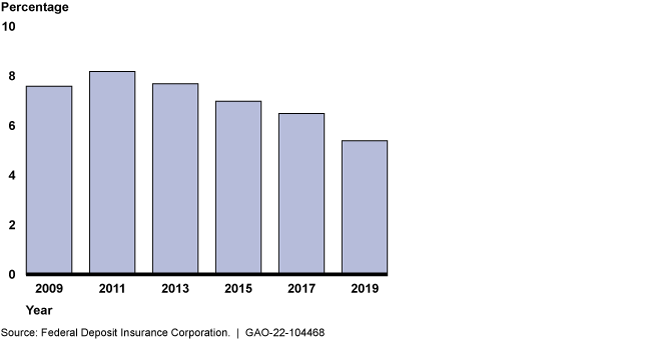

Entry to dependable and reasonably priced banking companies is crucial for family monetary well-being. In 2019, FDIC estimated that 5.4 p.c of surveyed U.S. households had been unbanked. GAO used the survey knowledge to estimate one other 17.9 p.c had a checking account however used various monetary companies, reminiscent of test cashing or payday loans that may have excessive charges or rates of interest.

GAO was requested to overview components affecting family entry to primary banking companies. Amongst different aims, this report examines components related to households’ use of primary banking companies, statutory and regulatory components affecting service availability and value, and the efforts of chosen federal monetary regulators to handle these points. GAO analyzed survey knowledge from FDIC on unbanked and underbanked households, reviewed research on legal guidelines and regulatory components, examined company documentation, and interviewed market members and observers and company officers.