PashaIgnatov/iStock by way of Getty Pictures

By SchiffGold

Banks are within the technique of restocking gold at a tempo not seen in years.

This evaluation focuses on gold and silver throughout the Comex/CME futures alternate. The charts and tables beneath particularly analyze the bodily inventory/stock knowledge on the Comex to indicate the bodily motion of steel into and out of Comex vaults.

Registered = Warrant assigned and can be utilized for Comex supply, Eligible = No warrant hooked up – proprietor has not made it obtainable for supply.

Table of Contents

Present Developments

Gold

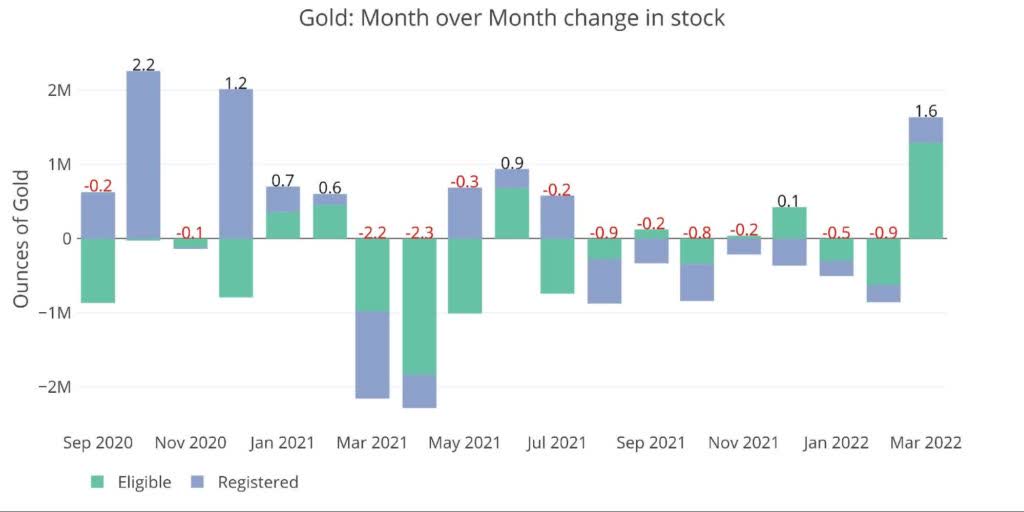

In a latest article, I speculated that the large gamers is perhaps ready to let the worth of gold run. A part of this can imply elevated supply quantity in April after a really robust March. The Comex vaults have been steadily depleted over the past a number of months, nevertheless, 1.6M ounces of gold simply confirmed up since March 1 as proven beneath. That is the biggest influx since October 2020 and we’re solely midway via March!

Writer

This can be merely a restock of the steel misplaced in Jan and Feb. It’s additionally potential that is getting used to assist the large supply quantity being seen within the traditionally quiet month of March. However a 3rd risk is that the banks are making ready for large supply quantity in April.

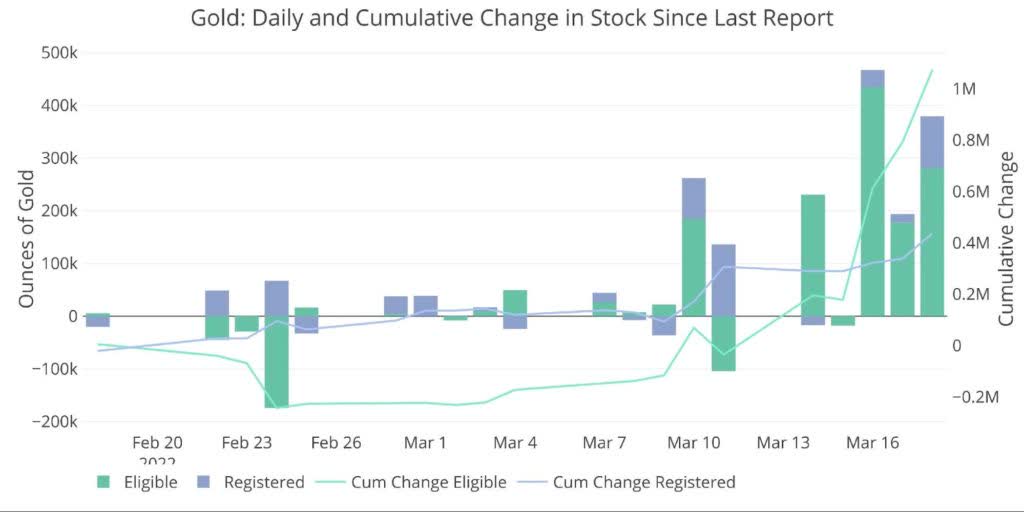

In any case, as proven beneath, this steel has simply proven up within the final three days and is primarily in Eligible. Most of it’s not but obtainable for supply, however it may be moved over instantaneously if the proprietor so needs.

Writer

Silver

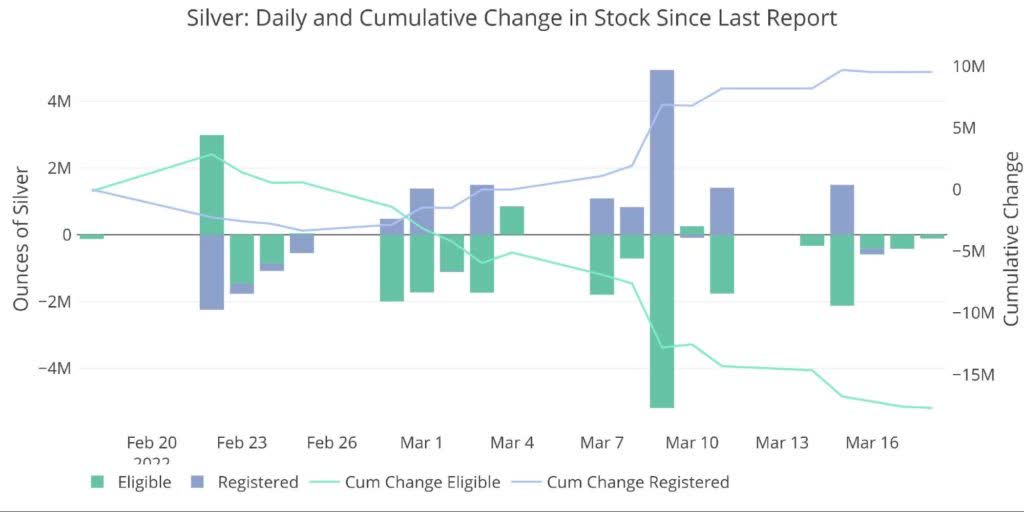

Silver continues to indicate a special pattern than gold. It’s as if the large gamers are totally centered on gold for the second. Practically 3.9M ounces left Comex vaults in simply the previous few days.

Writer

Wanting on the detailed report exhibits the mechanics. Steel that was listed as Eligible was being moved to Registered to fulfill the extraordinarily robust supply demand being seen in March. Not like gold, this steel has not been restocked and continues to depart Comex vaults. In combination, the Eligible class has misplaced 17.7M ounces over the past month!

Writer

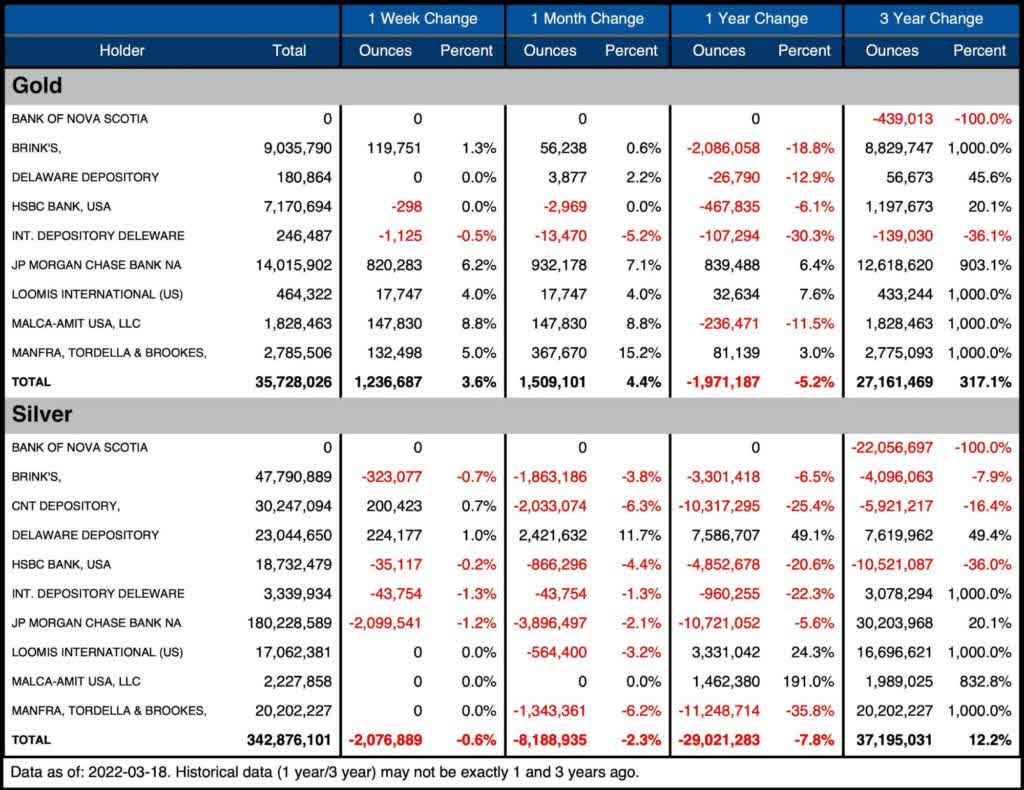

The desk beneath summarizes the motion exercise over a number of time intervals.

Gold

- Gold has reversed a 50% of the 12-month motion of steel out of the vault in a matter of days

- Eligible has elevated 7.2% in a single week

- In complete, Registered may assist 192k contracts standing for supply. That is 3.5 instances bigger than the most important month on file (June 2020 at 55k contracts)

- The info exhibits the banks properly capitalized to deal with greater supply quantity

- It needs to be famous that almost all of that is in all probability nonetheless from the London vaults that got here to New York within the depths of the April 2020 liquidity disaster

Rhetorical questions: Why are the banks bolstering gold reserves if they seem so well-capitalized? How a lot steel is definitely there prepared for supply? If it’s the total 19.2M, then why a sudden flood of latest steel? Whether or not it’s restocking March or preparation for April, there needs to be sufficient steel to fulfill demand. Proper?

Silver

- Silver has seen inventory deplete by 29M ounces over the past yr or 7.8%.

- This has been concentrated fully in Registered however the final month has seen a serious pattern change with Eligible seeing the biggest outflows

- The final month outflows from eligible undid 85% of the inflows over the past yr

Writer

The subsequent desk exhibits the exercise by financial institution/Holder. It particulars the numbers above to see the motion particular to vaults.

Gold

- Virtually each vault is now including to stock which is an entire reversal from final month

- JPMorgan and Manfra are main the way in which with will increase of seven.1% and 15.2% over the past month respectively

- JPMorgan now has optimistic flows over the past yr. Once more, the web achieve of JPMorgan stock over the past yr has been added within the final week

Why is each vault including steel abruptly? Why is JPMorgan aggressively restocking its stock? What are the banks making ready for?

Silver

- Over the past month, solely Delaware Depository has optimistic inflows whereas 6 vaults have seen vital outflows

- CNT has misplaced 8.2% of its stock in a single month!

Writer

As postulated within the margin evaluation, all eyes appear to be on gold. The banks are clearly making ready for a big supply quantity. The present open curiosity positioning, mixed with the shortage of enhance in margin charges suggests this might be allowed to occur proper now. Add the present stock enhance as extra proof.

Silver continues to be the forgotten steel. This isn’t fully stunning although. Gold is the true historic foreign money of the world. Central banks personal hordes of gold (Russia needs they’d extra). If the market have been to begin shifting in an enormous means, it’s going to occur in gold first.

The query now turns into: why is that this being allowed to occur? Not one of the powers that be need a surging gold value. It calls into query all the fiat system. My working idea is that the banks decide their instances when to battle it and when to trip it. Proper now, the momentum is robust and they seem like making ready to trip the wave. Costs declined this week, however there may be clearly a bullish pattern afoot.

Be cautious although, there are levers in place (e.g., margin and quick promoting) that may trigger the market to activate a dime. Anticipate these levers for use after they can actual essentially the most impression (e.g., hypothesis reaches a fever pitch). This was on show on March 9 when margin necessities have been raised on the similar time gold fell by $80.

Maybe now isn’t the time to strike, however no query that point will come. The query is, how quickly. The info hints at late summer time (after the June contract), however a possibility may current itself a lot sooner given the market volatility. Gold costs have been beneath stress all week.

Historic Perspective

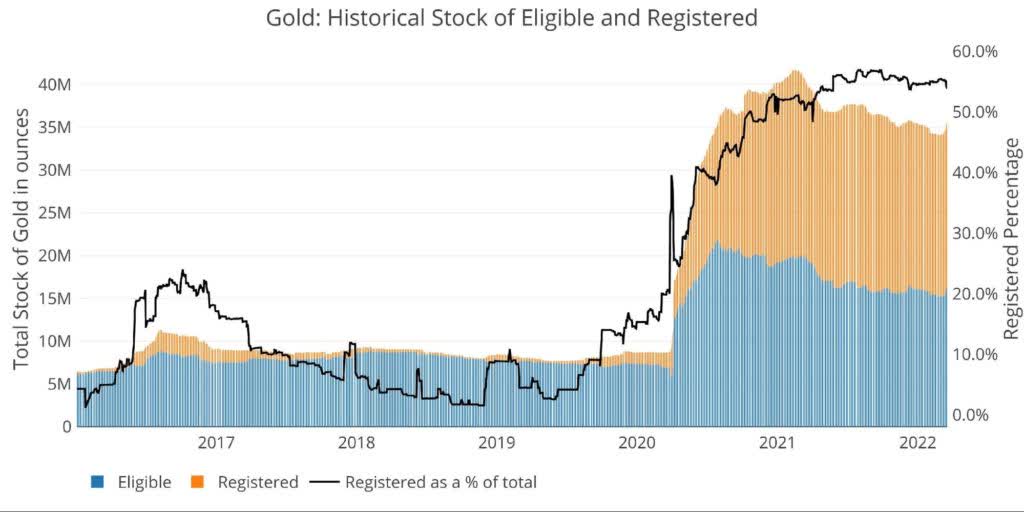

Zooming out and looking out on the stock for gold and silver since 2016 exhibits the impression that Covid had on the Comex vaults. Gold had nearly nothing within the Registered class earlier than JPMorgan and Brinks added their London stock with practically 20M ounces.

The gold stock peeked in February of final yr and has been steadily falling ever since except for transient will increase that don’t appear to final. Will the present enhance comply with the identical destiny (see spike on far proper)?

Writer

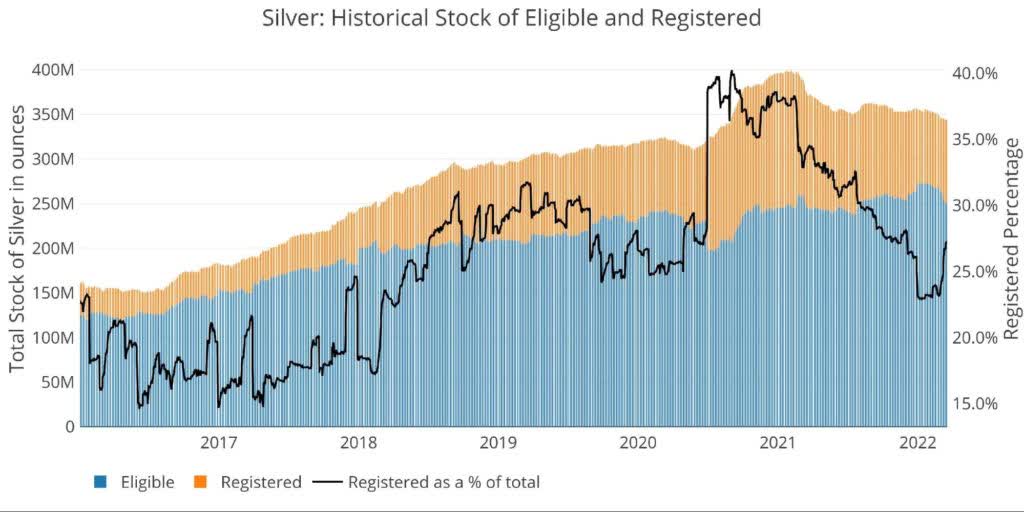

Silver additionally noticed a rise in Registered round March 2020 however has been draining, albeit extra slowly than gold.

The latest uptick in Registered as a % of the whole (far proper spike within the black bar) is as a result of latest flip of Eligible to Registered famous above.

Writer

Obtainable provide for potential demand

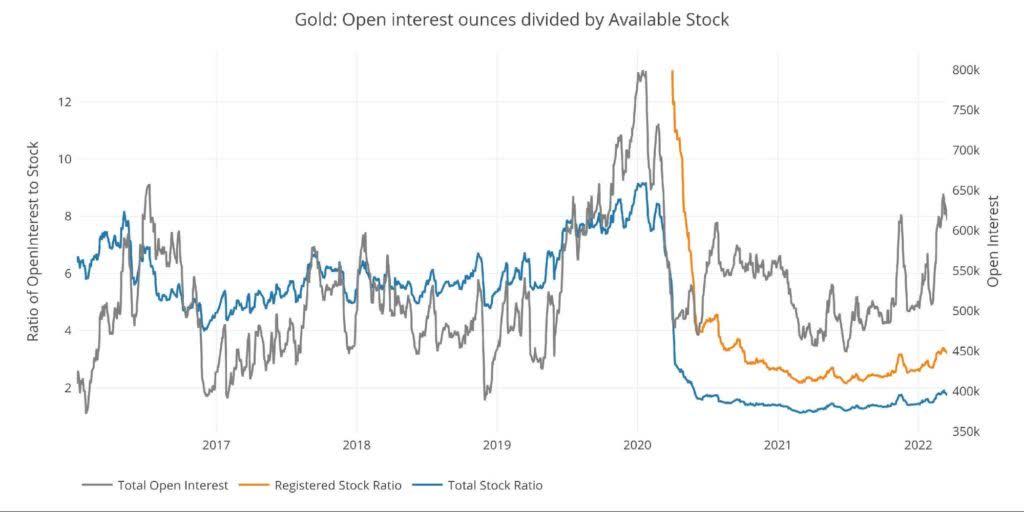

As may be seen within the chart beneath, the ratio of open curiosity to complete inventory has fallen from over 8 to 1.5. By way of Registered (obtainable for supply in opposition to open curiosity), the ratio collapsed from nostril bleed ranges (assume Nov 2019 the place 100% stood for supply) down to three.26 within the newest month. That is as a result of latest surge in open curiosity.

On March 7, the ratio hit 3.41. This was the very best since September 2020. The present restocking has helped carry this ratio down together with open curiosity falling some.

Writer

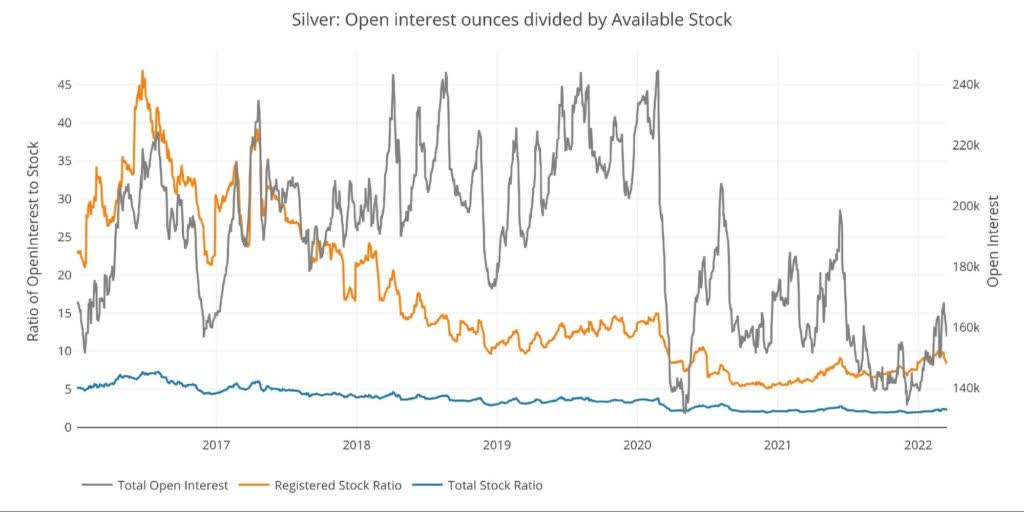

Protection in silver is weaker than in gold with 8.4 open curiosity contracts to every obtainable bodily provide of Registered (down from 9.8 on March 8). That is close to the highs from June 2020. The present dip may be fully attributed to open curiosity falling from 168k on March 8 to 157k at present. This drop-in open curiosity occurred with out margin charges going up in any respect.

Writer

Wrapping Up

The Comex gold market has been flashing warning indicators since early January. This continues to be the case. The most recent inflow of steel additional helps the notion that banks are making ready for greater supply quantity and probably greater costs. That being stated, with over 12 years of expertise watching this market, nothing is ever straightforward or easy. The bullish setup is there, however one thing tells me this sport has a couple of extra twists forward. Let’s see how the info unfolds.

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.