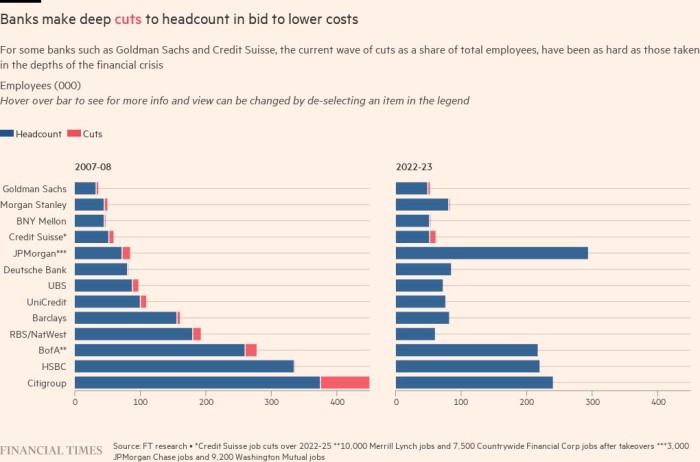

Banks are gearing up for the largest spherical of job cuts for the reason that international monetary disaster, as executives come underneath stress to slash prices following a collapse in funding banking revenues.

The lay-offs — that are anticipated to be within the tens of 1000’s throughout the sector — reverse the mass hirings banks remodeled the previous few years and the reluctance to fireside workers through the Covid-19 pandemic.

“The job cuts which are coming are going to be tremendous brutal,” stated Lee Thacker, proprietor of economic companies headhunting agency Silvermine Companions. “It’s a reset as a result of they over-hired over the previous two to a few years.”

Banks together with Credit score Suisse, Goldman Sachs, Morgan Stanley and Financial institution of New York Mellon have begun to chop greater than 15,000 jobs in current months, and trade watchers count on others to comply with go well with, emboldened by the headline-grabbing plans already introduced.

“We’ve seen some warning pictures from the US,” stated Thomas Hallett, an analyst at Keefe, Bruyette & Woods.

“Traders have to see administration performing on price and making an attempt to keep up an inexpensive return profile. The Europeans will are likely to comply with the US banks.”

Ana Arsov, co-head of world banking at Moody’s, stated she anticipated the job cuts to be much less extreme than through the monetary disaster, however heavier than the collapse within the markets after the dotcom crash in 2000.

“What we’re seeing is a catch-up of regular financial institution lay-offs that had been placed on pause over the previous few years,” she stated. “We’ll see trimming in European franchises, however not as large as at US banks.”

Financial institution executives stated Goldman’s eye-catching lay-offs — a part of its greatest cost-cutting drive for the reason that monetary disaster that features every part from company jets to bonuses — had set a precedent that different banks would look to comply with.

“The Goldman headlines are accelerating resolution making,” stated an trade government with information of a number of banks’ plans. “It’s a superb time to announce painful cuts for those who simply comply with Goldman.”

The Wall Road financial institution started a technique of firing as much as 3,200 workers final week, equating to six.5 per cent of the workforce, as stress mounts on chief government David Solomon to enhance the financial institution’s return on tangible fairness.

Goldman is chopping the same variety of workers because it did in 2008 through the depths of the worldwide monetary disaster, however its workforce then was two-thirds of its present dimension.

Morgan Stanley laid off 1,800 workers in December, simply over 2 per cent of its workforce. Regardless of having a sturdy wealth administration enterprise, the lender’s funding financial institution suffered together with its fierce rival Goldman Sachs from a close to halving of M&A revenues final yr.

Morgan Stanley stated no additional workers cuts had been imminent.

“We had been frankly just a little overdue,” chief government James Gorman informed analysts. “We hadn’t accomplished something for a few years. We’ve had lots of progress, and we’ll proceed monitoring that.”

Financial institution of New York Mellon, the world’s greatest custody financial institution, plans to chop slightly below 3 per cent of its workforce — round 1,500 workers — within the first half of the yr.

Chief government Robin Vince informed the Monetary Occasions that the financial institution had been “very cautious to recognise” that letting individuals go through the Covid pandemic would have “damaged the social contract” with workers.

However he added that “within the odd course of enterprise we evaluation staffing ranges. As a well-run enterprise we’ve to be good stewards of our expense base.”

By far the largest cuts introduced to date are by Credit score Suisse, which is in the course of a radical strategic revamp geared toward solidifying the scandal-plagued Swiss financial institution. Final October, the financial institution stated it could be cleaving 9,000 roles from its 52,000 workforce over the following three weeks.

Whereas 2,700 of the cuts had been deliberate final yr, the financial institution has already begun redundancy consultations over 10 per cent of funding banking roles in Europe, the Monetary Occasions reported final week.

The scale of the restructuring at Credit score Suisse is larger than the financial institution went by way of through the monetary disaster, when it was compelled to put off greater than 7,000 workers in 2008 however averted a state bailout.

Not all banks count on to make giant reductions to headcount, although they’re taking different measures to maintain prices down.

Financial institution of America, which employs 216,000 globally, stated it didn’t “have any plans for mass lay-offs”, although it was taking a disciplined method to prices and would solely rent for essentially the most essential roles.

Chief government Brian Moynihan informed Bloomberg in Davos that fewer individuals had left the financial institution than it anticipated final yr, which was affecting its recruitment coverage.

“We overachieved on the hiring facet and we went previous our goal headcount,” he stated. “And now we will do a slowdown in hiring.”

Citigroup has to date given few particulars about what number of of its 240,000 international workforce will probably be affected by lay-offs, however chief monetary officer Mark Mason informed journalists that there was stress to chop prices inside its funding financial institution, following the division’s 22 per cent fall in earnings.

“As a part of [business as usual], we’re always combing expertise to verify we’ve the correct individuals in the correct roles and the place essential to restructure, we do this as nicely,” he stated.

But not less than one international financial institution is trying to beef up its ranks, albeit in a focused manner. UBS chief government Ralph Hamers stated at Davos that the Swiss lender was “bucking the development” when it got here to recruitment.

In contrast to its rivals, UBS has not employed aggressively lately and so just isn’t underneath the identical pressures to chop roles.

It has additionally devoted extra assets to wealth administration over the previous decade and senior executives on the financial institution really feel now is an effective time to take a position extra within the funding financial institution — together with hires in wealth and asset administration — as rivals pull again.

These efforts embrace choosing off disgruntled dealmakers from boutique advisory companies, senior figures at UBS informed the FT.

By comparability, UBS was compelled to chop 10 per cent of its workforce in 2008 — with most roles coming from its funding financial institution — because the lender was bailed out by the Swiss authorities after struggling heavy losses on subprime mortgages.

A number of of the largest job cuts in 2008 got here from banks that had rescued rivals dropped at their knees by the monetary disaster. When Financial institution of America took over Merrill Lynch, for instance, it fired 10,000 workers, whereas additionally making 7,500 employees redundant at mortgage lender Countrywide Monetary.

JPMorgan let 9,200 Washington Mutual workers go when it took on the US’s largest financial savings and mortgage affiliation, along with chopping a tenth of its personal workforce.

In the meantime, the collapse of Lehman Brothers and Bear Stearns led to tens of 1000’s of bankers out of labor. In whole, greater than 150,000 bankers misplaced their jobs through the monetary disaster.

And identical to 15 years in the past, the prospect of rapidly discovering re-employment for these now out of labor is bleak, in keeping with recruiters.

“You’ve gotten this horrible flood of high quality approaching to the market, however who picks them up?” stated Thacker. “The buyside isn’t there to rent these individuals this time. They only don’t have the capability.”