The transition to decarbonize the world is going on, and ignoring the river of capital flowing to low-emissions firms, particularly expertise and healthcare, can be a missed stock-market alternative, BlackRock says.

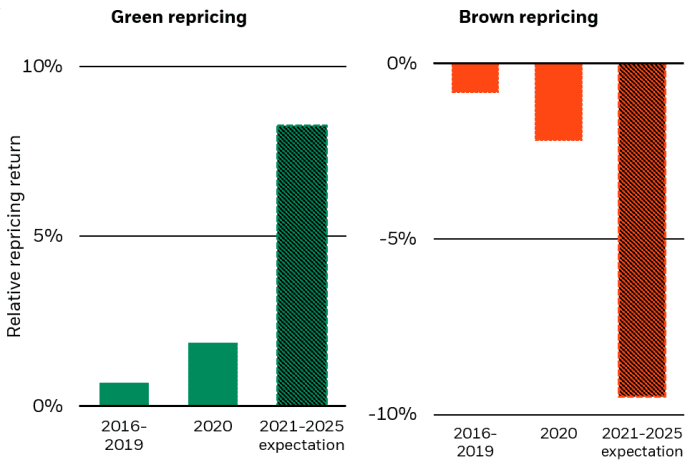

“Growing investor preferences for sustainable belongings are resulting in an incredible repricing that has plenty of room to run, in our view,” the analysts stated in a Monday word that highlights a easy bar chart displaying a flip to “inexperienced” from “brown” — the latter a label specifically for oil

CL00,

gasoline

NG00,

and choose utility

XLU,

shares.

“This doesn’t preclude browner belongings similar to conventional vitality shares

XOP,

from staging rallies at occasions,” the analysts stated. “This can be a function of transition, we imagine, as they will profit from mismatches in provide and demand because the economic system is being rewired to succeed in net-zero carbon emissions.”

The analysts clarified that their comparability deliberately strips out widespread drivers of returns, similar to information on earnings, or the affect of momentum and progress.

As a substitute, they remoted the price of capital and measured the way it’s being affected by altering investor preferences for sustainable belongings. They valued the publicity of an organization to the transition by measuring its carbon-emission depth, or direct CO2 emissions as a share of enterprise worth.

Shifting — “youthful” — demographics that may help demand for a greener world had been additionally counted.

And the findings? Comparatively inexperienced sectors, similar to tech, repriced positively (left chart) starting in 2020, whereas browner ones, like utilities, confirmed the mirror picture (proper chart).

BlackRock

If this view is correct, the analysts surprise, why have browner belongings similar to fossil gas firms staged such a rally up to now 12 months?

Context is essential. The BlackRock view controls for components in a roundabout way tied to the long-run transition, similar to surging restoration demand for vitality as companies and companies resumed after the darkest days of the COVID-19 shutdown. That bounce emerged concurrently to a mixture of geopolitical components, most notably gas-giant Russia’s rigidity with the West over Ukraine, and since weather-related provide disruptions hit simply as European inventories had been low.

“‘The efficiency of conventional vitality shares tells you one thing about how the economic system is presently wired. Nevertheless it doesn’t say something about the place it’s going.’”

“The efficiency of conventional vitality shares tells you one thing about how the economic system is presently wired,” the analysts wrote. “Nevertheless it doesn’t say something about the place it’s going.”

The analysts repeated their earlier view that the inventory market would worth within the sustainable shift quicker than the sector would truly ramp up. And, they stated, additional funding in renewables

PBW,

has not but saved tempo with the discount in capability at conventional vitality issues.

“‘The inexperienced transition comes with prices and better inflation, but the financial outlook is unambiguously brighter than a state of affairs of no local weather motion or a disorderly transition.’”

Learn: Oil climbs towards $100, settles at highest since 2014 on Russia-Ukraine tensions

“The upper fossil gas costs rise, the extra aggressive renewables turn out to be,” the analysts stated. “The outlook for renewables is shiny, and we additionally see lower-carbon fossil fuels enjoying a key position in guaranteeing continuity of reasonably priced vitality through the transition. The world might want to cross by means of shades of brown and inexperienced to succeed in net-zero by 2050, we imagine.”

Associated: Don’t rule out pure gasoline within the clean-energy transition, commerce group says

The underside line: BlackRock sees the transition driving a relative return benefit for greener sectors similar to tech and healthcare over browner sectors similar to vitality for years to return, all else equal.

“The inexperienced transition comes with prices and better inflation, but the financial outlook is unambiguously brighter than a state of affairs of no local weather motion or a disorderly transition,” the analysts stated. “Each would generate decrease progress and better inflation.”

Associated: Beat inflation with 3 shares that wager towards oil in favor of EVs and the renewable-power grid