Month-to-month life insurance coverage premiums have been steady coming into the brand new 12 months, in keeping with Policygenius knowledge. (iStock)

The life insurance coverage trade has stored costs steady coming into 2022, in keeping with Policygenius. Most non-smokers noticed small charge will increase of lower than 1% between December 2021 and January 2022, whereas people who smoke did not see any adjustments of their month-to-month premiums.

Common life insurance coverage premiums have stayed regular regardless of an increase in mortality associated to the coronavirus pandemic. Loss of life profit payouts rose 15.4% in 2020, in keeping with the American Council of Life Insurers (ACLI). Nevertheless, Policygenius knowledge suggests that customers haven’t got to fret about rising life insurance coverage premiums right now.

Maintain studying to be taught extra concerning the common life insurance coverage price monthly, in addition to how life insurance coverage premiums are decided. When you’re contemplating taking out a life insurance coverage coverage, go to Credible to get free life insurance coverage quotes.

IS PERMANENT LIFE INSURANCE A GOOD IDEA FOR YOU?

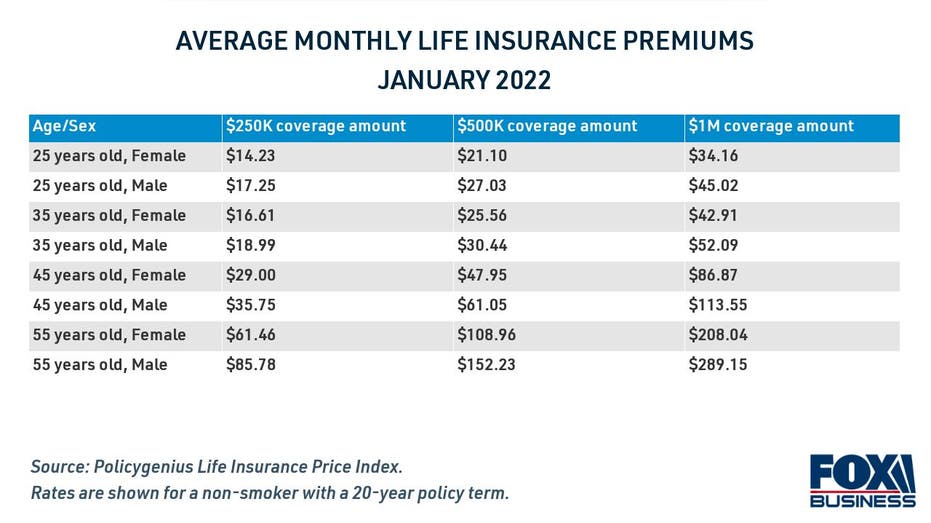

Common price of life insurance coverage by age and gender

Month-to-month life insurance coverage premiums remained regular coming into the brand new 12 months, in keeping with Policygenius knowledge, with a minimal enhance from December 2021 to January 2022.

Life insurance coverage prices are lowest for younger policyholders with low well being dangers, whereas charges are likely to rise with a policyholder’s age. For instance, it prices $25.56 monthly to insure a wholesome 35-year-old girl with a 20-year time period life insurance coverage coverage price $500,000. That very same coverage would price $152.23 month-to-month for a 55-year-old man in good well being.

Common life insurance coverage charges are additionally considerably greater for people who smoke than they’re for non-smokers. The coverage used within the instance above would price $224.46 monthly for a 45-year-old man who smokes, in comparison with simply $61.05 for a non-smoker of the identical age.

Regardless of an individual’s age or well being score, although, life insurance coverage charges have stayed comparatively steady into 2022. When you’re looking for life insurance coverage, you’ll be able to browse insurance policies and see month-to-month charges tailor-made to you on Credible.

LIFE INSURANCE COST BREAKDOWN BY AGE, TERM LENGTH AND POLICY SIZE

How are life insurance coverage premiums calculated?

The month-to-month price of life insurance coverage is dependent upon a policyholder’s life expectancy. Life insurance coverage corporations take a lot of elements into consideration, akin to age, intercourse, well being, medical historical past and even leisure hobbies. Customers who’re riskier to insure ought to anticipate to pay greater month-to-month premiums, whereas low-risk policyholders will price much less to insure.

To find out your well being threat, life insurers might require you to bear a medical examination. Well being situations like hypertension or weight problems can issue into the general price of a life insurance coverage coverage.

Premiums are additionally depending on the kind of life insurance coverage coverage you will have. Longer coverage phrases could have greater month-to-month prices, whereas shorter coverage phrases with decrease protection quantities will likely be cheaper.

It is sometimes really helpful to buy life insurance coverage with a protection quantity equal to 10-15 instances your annual particular person earnings, in keeping with Policygenius. The coverage time period needs to be lengthy sufficient to cowl you into retirement age.

For instance, a 45-year-old mom who earns $65,000 yearly might need to take into account a 20-year time period coverage with a $1 million protection quantity. That is about 15 instances her annual earnings, which can be crucial to handle dependents if she dies unexpectedly.

Then again, a 35-year-old married man with no children who earns $50,000 per 12 months would possibly take into account a 30-year life insurance coverage time period with a protection quantity of $500,000. That coverage is lengthy sufficient to get him to retirement age, and the dying profit quantity could also be enough to cowl bills for his partner.

In relation to selecting a life insurance coverage coverage, there is no one-size-fits-all strategy. You may want to contemplate one of the best coverage to your life-style and monetary state of affairs. Get in contact with a monetary professional at Credible to find out your life insurance coverage wants.

GETTING LIFE INSURANCE WHILE YOU’RE YOUNG AND HEALTHY CAN SAVE YOU THOUSANDS

Have a finance-related query, however do not know who to ask? E mail The Credible Cash Knowledgeable at moneyexpert@credible.com and your query may be answered by Credible in our Cash Knowledgeable column.