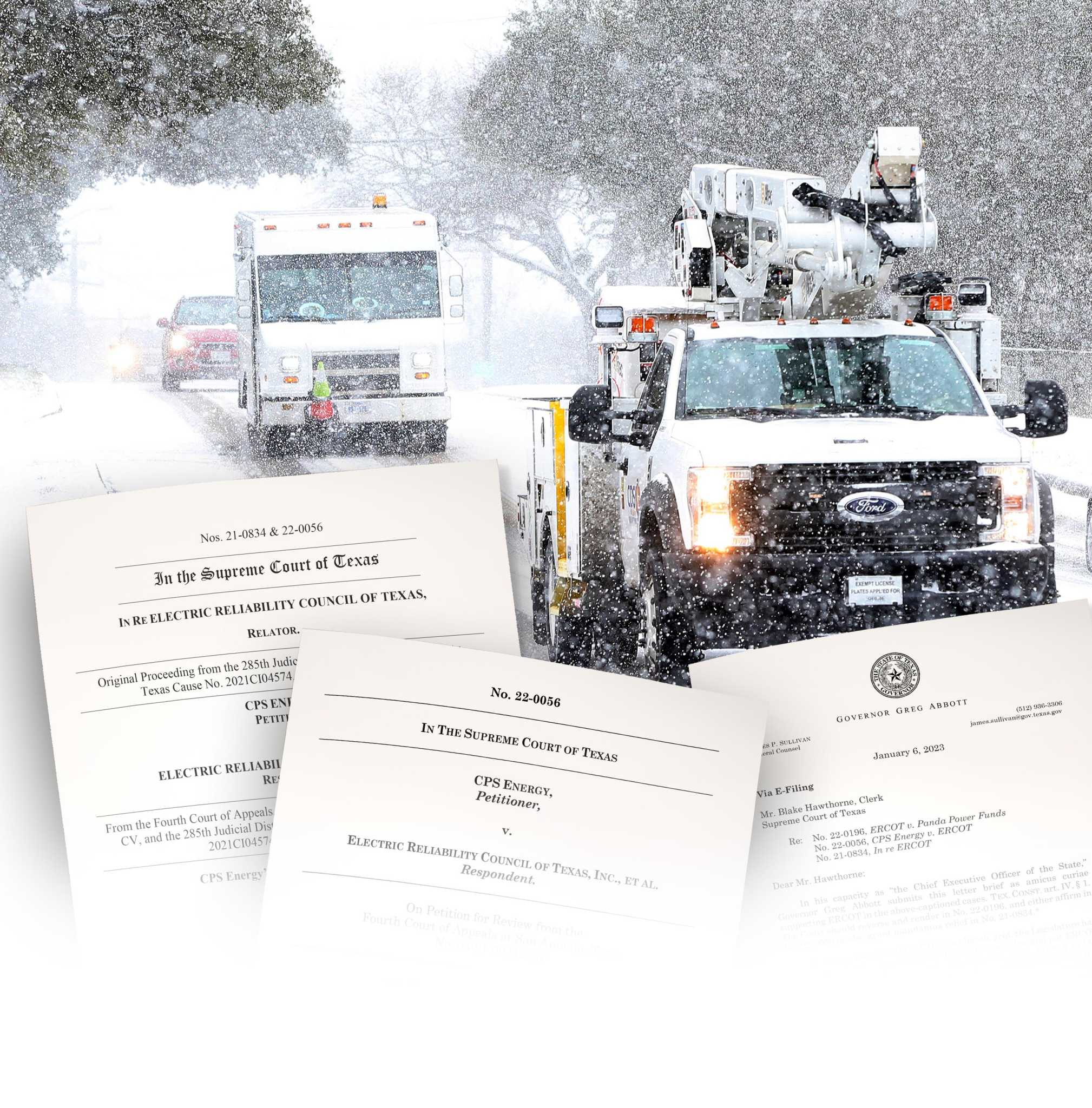

Practically two years since a lethal winter storm blanketed Texas in February 2021, city-owned CPS Vitality has spent tens of hundreds of thousands of {dollars} on myriad authorized fights to problem payments from pure fuel suppliers and the state grid operator.

Since launching a barrage of litigation in spring 2021, CPS Vitality has paid almost $27 million to eight regulation corporations and a guide for work on the circumstances, based on paperwork obtained by open information requests. CPS executives say the authorized work has paid for itself a number of occasions over due to the great offers the utility’s authorized crew has been capable of strike by settlements with fuel suppliers.

However the utility gained’t disclose particulars of these settlements. And Legal professional Common Ken Paxton final 12 months blocked an effort by the Specific-Information to acquire the agreements CPS has reached with 16 pure fuel suppliers.

In June 2021, simply three months after CPS Vitality launched maybe the largest collective authorized battle – involving 18 pure fuel suppliers – within the utility’s historical past, its basic counsel on the time, Carolyn Shellman, abruptly left the utility after working there since 2006. Two of her deputy basic counsels, Abigail Ottmers and Zandra Pulis, adopted Shellman out the door.

Whereas it is unsure why Shellman and her deputy attorneys left, a letter despatched by Ottmers within the closing days of her tenure at CPS that summer season steered the trio of legal professionals had been departing due to inside disagreements with the utility’s then-CEO, Paula Gold-Williams. Gold-Williams would later ignominiously resign from the utility in October 2021, simply months after the legal professionals departed, beneath strain from the monetary fallout of the February 2021 winter storm and revelations that her hand-picked lieutenant freely spent firm cash for private use.

“As you realize, I tried to resign a number of weeks in the past, however delayed my resignation when sure board members pleaded for me to remain whereas the board addressed sure claims lodged towards the CEO,” Ottmers wrote in a Could 25 letter to Shellman. “It’s clear to me now that I’m not capable of fulfill my skilled duties to the group beneath the working situations that exist right this moment.”

After the legal professionals resigned in June 2021, CPS mentioned on the time that the inner complaints towards Gold-Williams “arose primarily from variations in execution model that had been dropped at the forefront by the depth and complexity of Winter Storm Uri and its monetary aftermath.”

Ramirez was named basic counsel of CPS a couple of week after the legal professionals’ dramatic exit.

– Diego Mendoza-Moyers

The utility’s prime lawyer urges San Antonio clients to belief her.

“I wouldn’t have gotten that good of a deal if all people else out there knew the corporate was giving us that deal,” mentioned Shanna Ramirez, CPS Vitality’s basic counsel.

“I do know that I’m asking individuals to belief me. I’m doing this as a result of it’s in one of the best curiosity of our clients and it retains the prices they’re paying as little as I can probably get them.”

The prices started mounting through the winter storm, when CPS Vitality paid astronomical costs to purchase scarce electrical energy and pure fuel to energy and warmth houses in San Antonio. All informed, it spent about $850 million shopping for abnormally high-priced fuel and electrical energy the week of the storm — about the identical quantity it sometimes spends for gasoline in a 12 months.

CPS clients will probably be paying off the payments for years.

The lawsuits

Days after the storm handed, CPS sued 18 pure fuel suppliers, accusing them of worth gouging. A unit of fuel that offered for lower than $3 earlier than the chilly snap immediately value CPS lots of of {dollars} per unit through the deep freeze.

Since then, it has settled 16 circumstances and is combating two different firms — Dallas-based Vitality Switch and Houston-based Enterprise Merchandise — over about $357 million in pure fuel payments.

CPS settled a number of of its lawsuits in late 2021, and the utility mentioned final 12 months that it agreed to pay suppliers $418 million. The utility has been charging clients a median of $1.26 per 30 days since March to repay that debt — a payment they’ll see on their payments for the subsequent 25 years.

CPS didn’t make Ramirez obtainable to reply follow-up questions, nor did the utility reply to questions on precisely how a lot it has paid fuel suppliers to date.

Individually, the Texas Supreme Courtroom on Monday heard arguments in CPS Vitality’s case towards the Electrical Reliability Council of Texas over, amongst different issues, payments for wholesale electrical energy CPS purchased from the state grid operator through the winter storm.

RELATED: CPS argues its case that ERCOT might be sued for overcharging throughout lethal 2021 winter storm

CPS has argued that ERCOT owes the utility $10 million. And CPS desires to forestall ERCOT from charging CPS and different utilities hundreds of thousands of {dollars} to cowl the defaults of utilities that went bankrupt after the winter storm, such because the Brazos Electrical Energy Cooperative. CPS mentioned it “can’t decide the scope or magnitude” of the potential prices it may face from ERCOT.

The problem hinges on whether or not the Texas Supreme Courtroom guidelines that ERCOT is a governmental entity — a standing that may protect it from lawsuits — or a personal nonprofit that’s topic to CPS Vitality’s claims.

“Regardless of many alternatives, together with after the winter storm, the Legislature has by no means conferred authorities standing on ERCOT, which it is aware of find out how to do,” mentioned Harriet O’Neill, a former Texas Supreme Courtroom justice whom CPS employed for $230,000 to signify the utility as its appellate counsel within the ERCOT case.

“If ERCOT was decided to be a state actor, it might be a primary within the nation for an unbiased system operator,” she mentioned.

The state Supreme Courtroom can challenge a call on the case at any time.

Dealing with the debt

The $418 million in debt CPS conceded to pay fuel suppliers final 12 months was packaged right into a so-called regulatory asset, enabling the utility to pay it off over time and resulting in the brand new cost on clients’ month-to-month payments.

In the meantime, CPS and the town structured the regulatory asset to soak up as much as $1 billion in debt if CPS is compelled to pay your complete storm-related invoice. As a result of it gained’t disclose particulars of the settlements, it’s unknown whether or not that will probably be mandatory.

CPS has targeted largely on its battle towards Vitality Switch, by which the utility apparently remains to be contesting roughly $257 million. The swimsuit towards Enterprise includes $100 million in payments.

CPS is combating to maintain phrases of any settlement agreements secret. However the utility — having sued a large swath of the fuel suppliers working in Texas — might have agreed in its settlements to pay a premium on future pure fuel purchases as a strategy to preserve a provide of fuel whereas repaying its storm-related debt.

“We’ve resolved disputes in a manner that enables us to have a distinct buy construction than we’d in any other case on go-forward purchases,” Ramirez mentioned.

“We’re agreeing to resolve a previous debt that they declare is owed, however on the identical time buying companies that we’d have needed to buy going ahead,” she mentioned, explaining with hypothetical numbers. “The financial savings there are: You gave me a invoice for $100. I didn’t pay the entire $100; I truly solely gave you $50, and I’m getting greater than $50 price of stuff going ahead.”

Whereas CPS Vitality launched its authorized battle partly to problem the legality of such huge, swift worth will increase within the state’s pure fuel spot market, the lawsuits had been additionally a monetary maneuver by the utility.

Delaying tactic

No matter whether or not CPS’ authorized crew thought its worth gouging argument would prevail in court docket, it filed the lawsuits partly to keep away from having to right away pay lots of of hundreds of thousands of {dollars} in payments within the quick aftermath of the winter storm.

The one decisions CPS had on the time had been to go on the prices it incurred to San Antonio ratepayers — and certain increase the typical buyer’s month-to-month utility invoice by lots of of {dollars} for a number of months — or provoke a authorized battle that may stop CPS from having to deplete its money and credit score to cowl the fees for fuel and energy.

CPS held about $827 million in money as of final spring.

“Within the second, it was a liquidity disaster,” CEO Rudy Garza mentioned. “We might’ve exhausted each little bit of credit score, and that may have created vital monetary challenges for us.”

No matter CPS Vitality’s authorized technique was, the utility’s former longtime basic counsel, Carolyn Shellman, and two of her prime deputies exited from CPS lower than three months after it filed the spate of storm-related lawsuits in spring 2021. Their dramatic departure stemmed from disagreements with former CEO Paula Gold-Williams over “execution model,” CPS mentioned on the time.

Since then, nevertheless, Ramirez mentioned the utility has managed to create financial savings for CPS clients by the litigation.

“We’ve whittled down our disputes, and we’re left with our disputes towards Enteprise and the Vitality Switch entities,” she mentioned. “We’re executing the technique like we deliberate.”

diego.mendoza-moyers@express-news.internet