Latest bipartisan automotive insurance coverage reform in Michigan will lead to refund checks being delivered on to drivers’ pockets. (iStock)

Eligible Michigan drivers will obtain a $400 automotive insurance coverage refund per car this spring on account of a surplus held by the Michigan Catastrophic Claims Affiliation (MCCA).

“The $400 per-vehicle refund is a results of the reforms handed with bipartisan help by the Legislature and signed into regulation by Gov. Gretchen Whitmer, in addition to sound monetary returns on investments made by the MCCA,” in response to a press launch.

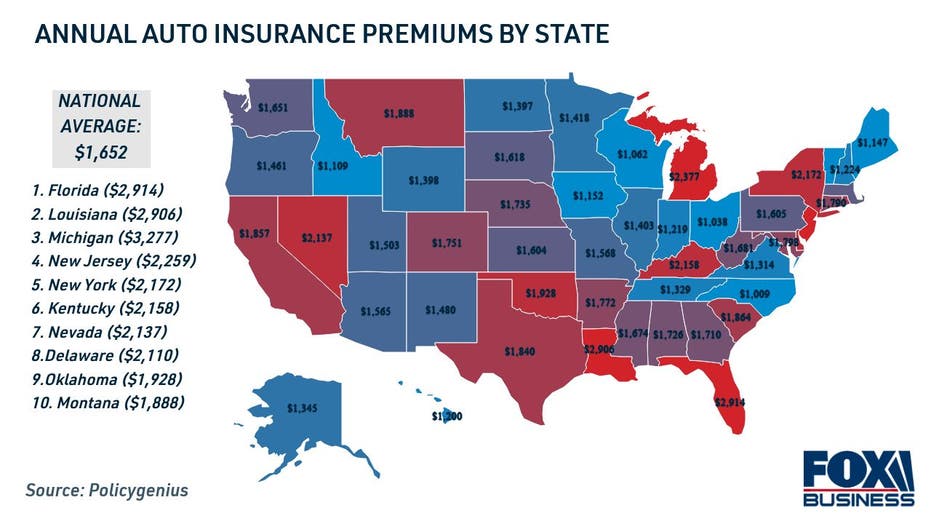

Nonetheless, Michigan has the third-highest auto insurance coverage charges within the nation after Florida and Louisiana, in response to Policygenius information. Drivers paid a mean of $2,377 per yr in automotive insurance coverage premiums, effectively above the nationwide common of $1,652.

Preserve studying to study extra about these automotive insurance coverage refunds. And should you’re fascinated with switching your automotive insurance coverage, you possibly can go to Credible to store round for the proper coverage in your wants.

CAR ACCIDENTS SPIKED NEARLY 8% IN 2020, SAYS DOT

Who will get an auto insurance coverage refund and when?

Michiganders who had automotive insurance coverage as of Oct. 31, 2021, will start to obtain $400 refund checks from their auto insurance coverage firm beginning within the second quarter of 2022, in response to the state’s insurance coverage division. In whole, Michigan drivers will obtain an estimated $3 billion value of automotive insurance coverage refunds.

The MCCA’s choice to refund surplus cash to drivers is because of auto insurance coverage regulation reform by Michigan’s legislature in 2019. This decreased the minimal insurance coverage necessities for private harm safety medical protection.

“Michiganders have paid into the catastrophic care fund for many years, and I’m happy that the MCCA developed this plan so shortly after unanimously approving my request to return surplus funds to the pockets of Michiganders,” Gov. Whitmer stated in a press release to NPR.

Eligible drivers need not take any motion to get the payout. The state stated the MCCA will ship the funding to automotive insurance coverage firms in early March, and the cash should be despatched to drivers inside 60 days.

The MCCA really helpful that Michigan motorists who imagine they meet the eligibility necessities for a refund ought to get in contact with their auto insurance coverage agent for extra details about their refund timeline and standing. For those who do not qualify for a refund, you would take into account different strategies for saving cash in your auto insurance coverage coverage.

One technique is to match quotes throughout a number of automotive insurance coverage firms to make sure you’re getting a aggressive price. You’ll be able to go to Credible to get free auto insurance coverage quotes.

IF YOU’RE BUYING AN RV, HERE’S WHAT YOU NEED TO KNOW

How one can scale back the price of insurance coverage

Even with the refund, Michigan policyholders pay a number of the highest auto insurance coverage charges within the nation. Michigan is only one of 8 states the place drivers pay greater than $2,000 yearly for automotive insurance coverage, joined by Florida, Louisiana, New Jersey, New York, Kentucky, Nevada and Delaware, in response to Policygenius information.

Overpaying for auto insurance coverage can take funds out of your month-to-month price range that can be utilized to cowl different crucial bills, like groceries or utility payments. For those who’re on the lookout for methods to economize on automotive insurance coverage, take into account the next methods from the Insurance coverage Data Institute (III):

- Increase the deductible. A better deductible will decrease your month-to-month premium, however it can price you extra out of pocket if it’s important to file a declare.

- Bundle insurance coverage insurance policies. Insurance coverage firms that provide auto and residential insurance coverage, for instance, might supply a multi-policy low cost.

- Search for different reductions. Chances are you’ll qualify for a reduction for protected driving, low mileage and even good grades for college kids. Taking a defensive driving course may additionally decrease your month-to-month price.

- Keep good credit score. Drivers with a well-established credit score historical past might profit from decrease automotive insurance coverage prices.

- Store round throughout insurers. Automotive insurance coverage premiums differ from one firm to a different, so it is good to get not less than three quotes from completely different insurers.

It is potential to examine quotes throughout a number of auto insurers without delay on Credible. Go to the net monetary market to study extra about automotive insurance coverage and see should you can decrease your prices.

BIDEN CRITICIZES REPUBLICANS FOR ‘DANGEROUS’ DEBT CEILING INACTION

Have a finance-related query, however do not know who to ask? E mail The Credible Cash Professional at moneyexpert@credible.com and your query is likely to be answered by Credible in our Cash Professional column.