braclark/E+ by way of Getty Photographs

Table of Contents

Thesis: Time To Purchase Insurance coverage Once more

The saying goes that you should purchase residence insurance coverage earlier than your own home catches on fireplace. As soon as the home is on fireplace, you both cannot purchase insurance coverage or the price of it might be so excessive as to make it financially unfeasible.

One thing comparable holds true for a inventory portfolio. Historically, the monetary knowledge has referred to as for a portfolio of 60% shares and 40% bonds, the place the shares present upside, and the bonds present stability and earnings.

Nowadays, nonetheless, traders can be forgiven for avoiding bonds. In any case, bonds present little or no earnings (many dividend inventory ETFs provide increased yields than most bond ETFs), and bond costs appear to have a number of draw back threat with rates of interest rising. However bonds – Treasury bonds, particularly – do nonetheless have a priceless position to play in a single’s funding portfolio at instances.

That position is as insurance coverage. And there are few higher types of portfolio insurance coverage than the Vanguard Prolonged Length Treasury ETF (EDV).

Bond costs (and yields) transfer up or down primarily based on the gyrations of rates of interest, and 30-year bonds transfer essentially the most. When rates of interest rise, long-term bond costs are likely to drop (and yields rise). However when rates of interest fall, long-term bond costs are likely to rise (and yields fall).

When the financial system falters and traders get scared, essentially the most extremely sought secure haven throughout risk-off durations is the long-term U.S. Treasury bond. In any case, the Treasury can print its personal {dollars}, so the danger of default is zero. Naturally, then, when traders collectively get frightened of dropping cash in all places else, long-term Treasuries are the vacation spot of their risk-fleeing {dollars}.

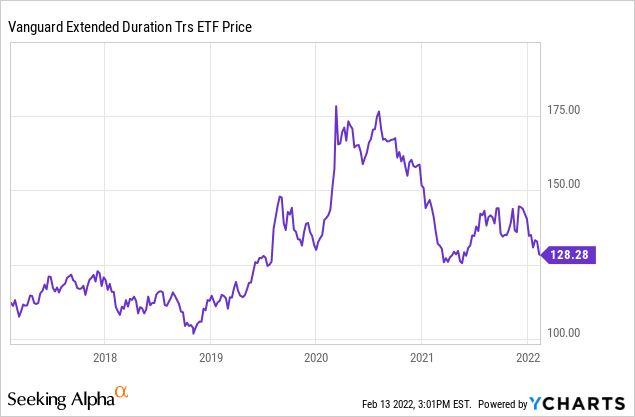

As such, EDV, which owns long-term Treasury bonds, makes an incredible type of portfolio insurance coverage. And this type of insurance coverage is reasonable proper now as traders bail on bonds within the face of excessive inflation and rising rates of interest.

This makes now a good time to purchase such insurance coverage.

The Lengthy-Time period Pattern

First, let’s simply take a look at the long-term development. How lengthy? Properly, rates of interest have been in a long-term downtrend for about 40 years. So, let’s begin by zooming out to the late Nineteen Eighties.

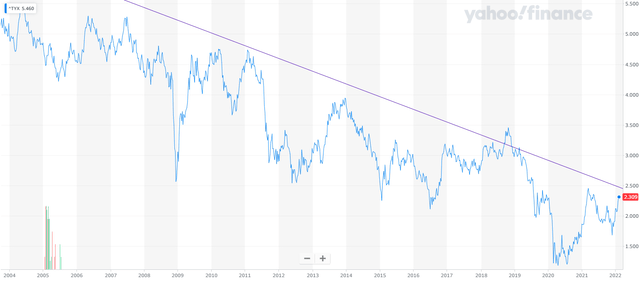

That is the market rate of interest on the 30-year Treasury invoice since 1988:

As you may see, completely nothing has damaged this long-term downward development. Throughout that point, the US has skilled a number of overseas wars, a number of recessions, a tech bubble bursting, a housing market crash, and a pandemic that killed (or performed a component within the loss of life of) over 800,000 Individuals.

And now the development is being examined by the best price of client inflation because the early Nineteen Eighties (extra on that under).

Largely due to the present inflationary atmosphere and the rising rates of interest as a consequence of it, the 30-year Treasury price has crept again up towards the highest finish of its development vary.

With a view to attain the higher certain of the long-term development hall (purple line), the 30-year Treasury price would want to succeed in about 2.6%. That compares to the present 30-year Treasury price of two.25%.

Granted, the higher certain of the long-term development is about 15% increased than right this moment’s 30-year rate of interest, so this might not be the precise high in charges or backside in costs. However examine this to the underside within the 30-year price in 2020 of round 1.2%. The present price is about 88% above the low from 2020.

If we zoom in additional, it is simpler to see that anytime the 30-year Treasury price has reached this near the higher certain of the long-term development, it has been time to purchase.

Personally, I’m not shopping for EDV , however over the previous week I’ve bought a bit of bit every buying and selling day. Calling the precise backside isn’t my specialty. However I might quite purchase close to the underside than attempt to time the precise backside and miss it.

Tried And True Portfolio Insurance coverage

The time period “portfolio insurance coverage” has adverse connotations for many who have been investing within the Nineteen Eighties when a monetary instrument by that title grew to become so broadly used as to create instability out there. What occurs when all owners use the identical insurance coverage firm to insure their houses and a forest fireplace burns all of them down directly?

For the insurance coverage enterprise mannequin to work, it requires some policyholders to be internet payers whereas others are internet beneficiaries. What occurs when all policyholders are beneficiaries ?

Lengthy-term Treasuries work a distinct approach. When nobody desires to personal them, they’re low-cost. And when everybody desires to personal them, the worth goes up and provides those that purchased cheaply a pleasant acquire.

That is precisely what one desires from portfolio insurance coverage. Shares are the supply of long-term features, however when all shares are promoting off directly, one desires their “insurance coverage” to offer a money infusion in an effort to purchase shares at decrease costs. That’s precisely what EDV accomplishes.

Simply check out some latest situations of fast inventory selloffs.

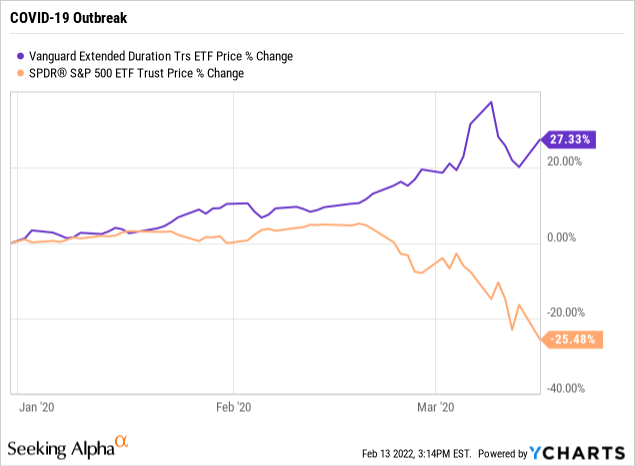

Through the preliminary COVID-19 outbreak at first of 2020, EDV’s efficiency was almost the mirror reverse of shares (SPY):

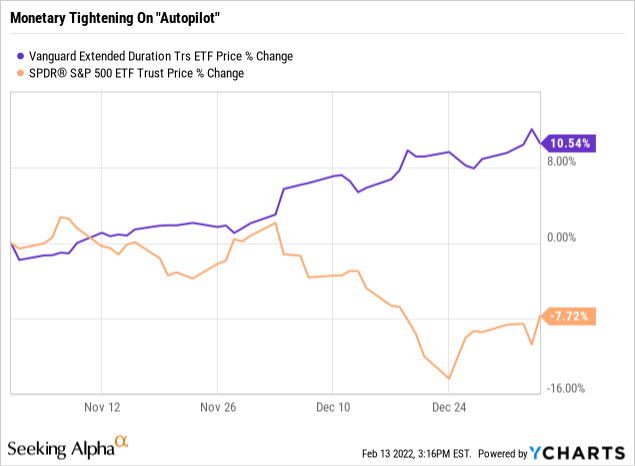

Equally, when Federal Reserve Chairman Jerome Powell said that financial tightening was on “autopilot” in late 2018, shares bought off exhausting. In the meantime, EDV gained over 10%.

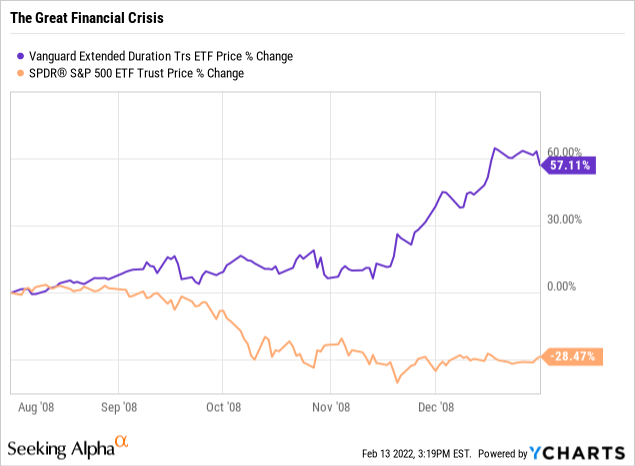

Likewise, throughout the market meltdown surrounding the monetary disaster in 2008, EDV gained over 60% even because the S&P 500 shed ~30%.

Will the present rising price atmosphere be totally different than the final a number of? Will the Fed have the ability to engineer the “delicate touchdown” that has evaded them in each price mountain climbing cycle because the early Nineteen Nineties?

I doubt it. Relatively, I’m of the identical view that was lately articulated by bond guru Jeff Gundlach: “My suspicion is that they’ll preserve elevating charges till one thing breaks, which is all the time the case.”

Certainly, 100% of price mountain climbing cycles since 1990 have ended with a inventory market selloff and/or a recession.

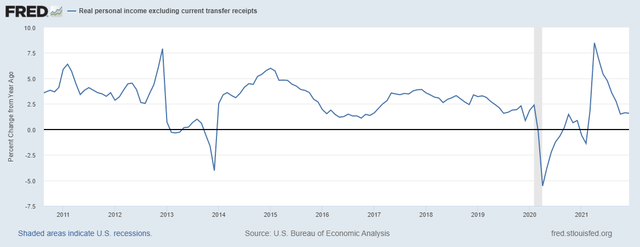

Furthermore, contemplate additionally that actual private earnings excluding switch funds diminished to round 1.5-1.6% within the latter months of 2021.

This anemic progress in non-transfer actual earnings doesn’t signify a strong financial backdrop to help rising long-term rates of interest. What’s extra, authorities switch funds (for essentially the most half) don’t drive client inflation however quite observe inflation. In any case, price of residing changes (“COLAs”) solely come after costs have gone up.

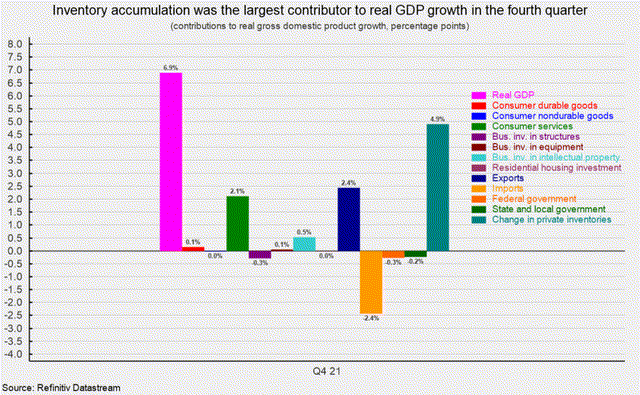

And although actual GDP grew 6.9% in This fall 2021, most of that acquire got here from accumulation of personal inventories. Spending on client providers was the one different signal of energy within the financial system.

Once more, this isn’t a robust backdrop to help rising long-term rates of interest.

Backside Line

Typically, one of the best asset courses to purchase are those that look the weakest or ugliest on the time they’re purchased.

With charges of inflation presently over 7%, a 30-year Treasury yield of two.25% sounds extremely unappealing. However by the point it features a widespread enchantment amongst traders, long-term Treasuries will not work as portfolio insurance coverage. You’ll be able to’t purchase insurance coverage when your funding portfolio is already on fireplace.

With the Ate up the verge of mountain climbing rates of interest and aggressively tightening financial coverage, now could be the time to purchase long-term Treasuries as a hedge. EDV is a good automobile to do this.