House Shopping for

FHA and FHFA increase limits in a transfer that displays pinch of upper property costs.

Shopping for a house with out having to take out a “jumbo mortgage” has simply gotten simpler.

The Federal Housing Administration and the Federal Housing Finance Company, which oversees the Federal Nationwide Mortgage Affiliation and the Federal House Mortgage Mortgage Company, amongst different establishments, have raised their ceilings on typical loans for 2023. Jumbo loans exceed these ceilings, typically have totally different rates of interest, and “have stricter underwriting pointers, equivalent to increased credit score and down cost necessities,” in keeping with Bankrate.com.

Shant Banosian, government vp of gross sales at Assured Fee, mentioned he anticipated the federal businesses to boost the bounds as a result of house costs have risen so dramatically in recent times. This may assist first-time house patrons particularly, Banosian mentioned. Why? It helps the present homeowners of “starter houses” transfer up and so forth.

“Anyone shopping for a main residence with a decrease down cost, or a decrease FICO rating, can now qualify for a bigger FHA mortgage,” Banosian mentioned. “For instance, you should purchase a house, a single-family or condominium, with an FHA mortgage as much as $726,000 with a ten, 5, and even 3 p.c down cost. Our common purchaser’s down cost is 10 p.c.”

For instance, in 2022, patrons might borrow as much as $770,500 utilizing an FHA mortgage to buy a one-family house in Middlesex County with out turning to a jumbo mortgage. Now, these patrons can borrow as much as $828,000.

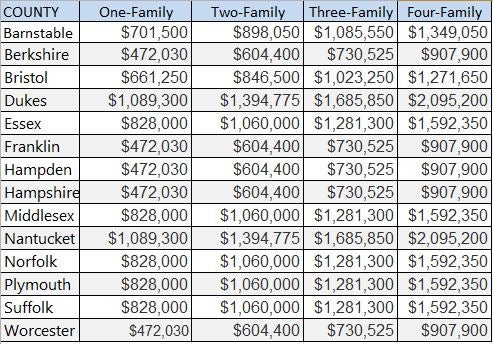

The FHA mortgage limits fluctuate, starting from $472,030 in Worcester, Franklin, Hamden, and Hampshire counties to $1,089,300 in Dukes and Nantucket counties. The will increase fluctuate barely by county however have been roughly 10 p.c over final yr’s limits.

FHA LIMITS

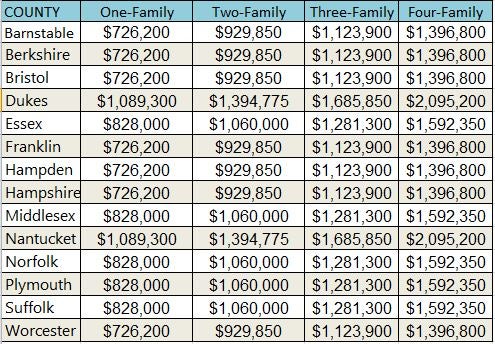

The brand new FHFA limits additionally fluctuate. In seven counties, the ceiling is identical because the FHA limits: Essex, Dukes, Middlesex, Nantucket, Norfolk, Plymouth, and Suffolk. Within the different seven, the FHFA enables you to borrow much more with out hitting the brink. In Worcester, for instance, one can borrow as much as $472,030 for a one-family house beneath the FHA limits however as much as $726,200 beneath the FHFA.

FHFA LIMITS

Richard J. Rosa, cofounder and co-owner of Consumers Brokers Solely, mentioned FHA loans are an amazing instrument for a lot of house patrons, however they have been raised to offset unhealthy information.

“The excellent news is that increased conforming mortgage limits give potential house patrons extra financing flexibility,” Rosa mentioned. “The unhealthy information for house patrons is that conforming mortgage limits rose as a result of house costs elevated once more in 2022.”

Rosa mentioned the loans themselves is usually a double-edged sword.

“With FHA loans, debtors with decrease credit score scores would possibly discover qualifying for a mortgage simpler and rates of interest decrease, however the total price of borrowing may be costlier due to the 1.75 p.c upfront mortgage insurance coverage cost,” he mentioned. “Most debtors must refinance to remove the month-to-month mortgage insurance coverage with an FHA mortgage. That’s nice if charges go down, however not a lot if charges go up.”

Banosian mentioned which program is true for patrons will depend on their scenario, noting that they’re “completely totally different merchandise with totally different necessities and charges.”

“FHA is a superb product for any person who has the next debt-to-income ratio or possibly had some credit score points previously. However [private mortgage insurance] is far more costly. … Quite a lot of instances the FHFA mortgage is a greater worth to the shopper, but it surely actually will depend on your scenario and your objectives. Elevating these limits provides customers extra choices.”

Jim Morrison might be reached at [email protected]. Comply with us on Twitter @GlobeHomes.

Handle e-newsletter

Get the newest information on shopping for, promoting, renting, house design, and extra.