iQoncept/iStock by way of Getty Pictures

Table of Contents

Introduction

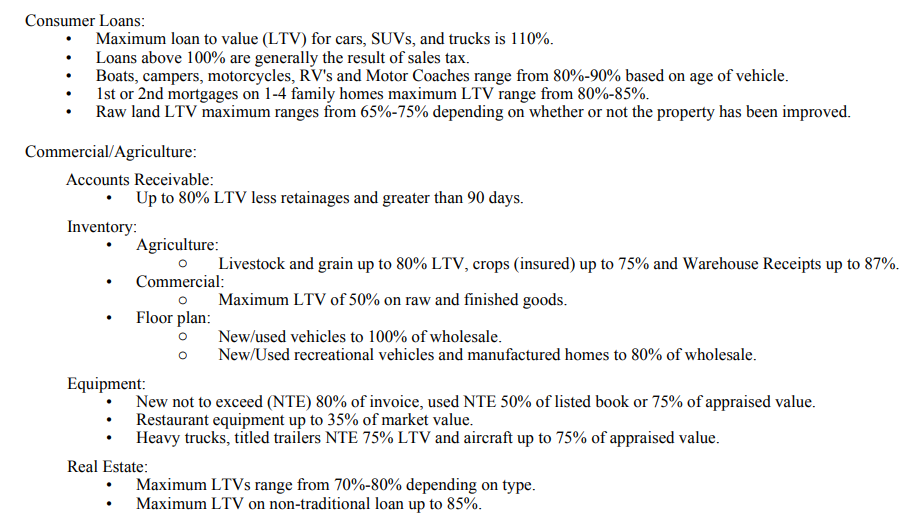

Farmers & Retailers Bancorp (FMAO) is an Ohio-based financial institution with roots relationship again to the late 1800s when it began to serve the Ohio and Indiana markets. The financial institution focuses on agricultural, business and residential lending and makes use of strict LTV ratios earlier than underwriting a mortgage.

FMAO Investor Relations

Please word, this text is on Farmers & Retailers Bancorp buying and selling with (FMAO) as its ticker image, to not be confused with different banks with the identical identify.

A really wholesome lead to 2021

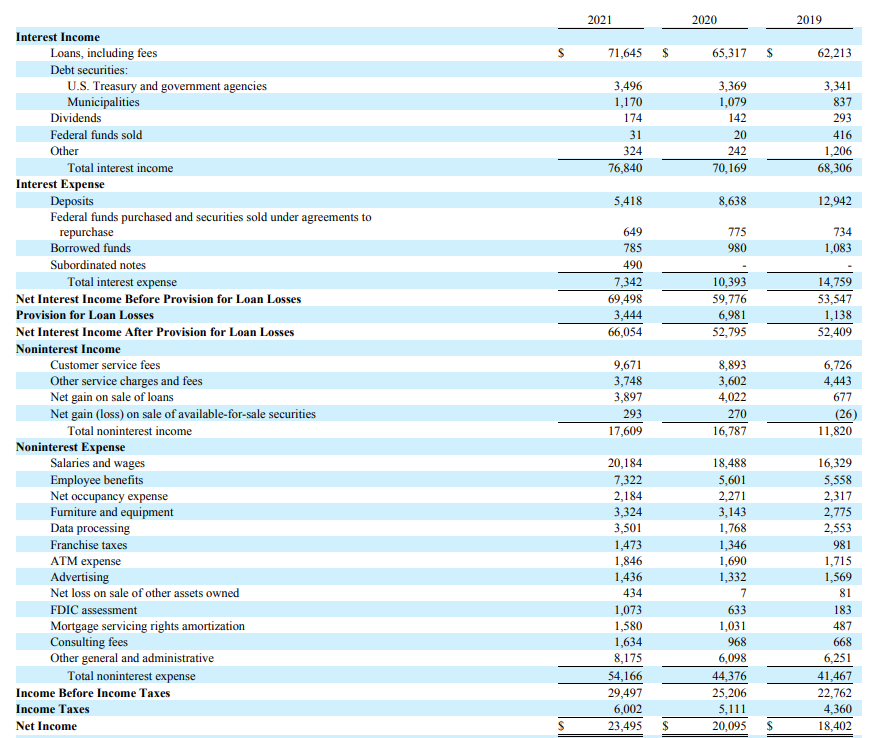

FMAO was within the uncommon place to see its curiosity revenue improve in 2021 whereas its curiosity bills decreased. As you may see within the picture under, the curiosity revenue elevated from $70.2M to $76.8M whereas the online curiosity expense decreased from in extra of $10M to lower than $7.5M. The mixture of each parts bolstered the affect and the online curiosity revenue elevated by greater than 15% to simply below $69.5M.

FMAO Investor Relations

The financial institution additionally reported a noninterest revenue of $17.6M and a noninterest expense of $54.2M, which implies the overall web non-interest bills have been roughly $36.5M. This brings the pre-tax and pre mortgage loss provision revenue to simply round $33M.

That’s a very good consequence, particularly as a result of the mortgage loss provisions stay comparatively low. Certain, the availability stage is elevated in comparison with 2019 however the mortgage e book has expanded fairly significantly (together with the acquisition of Perpetual Federal Financial savings Financial institution in This fall 2021 for a complete consideration of $100M) so extra losses are to be anticipated. Moreover, the financial institution didn’t aggressively e book provisions in 2020 which signifies that – not like another banks – it has little or no when it comes to provisions it may possibly reverse. The pre-tax revenue was $29.5M and after making the suitable tax funds the online revenue was $23.5M or $2.01 per share.

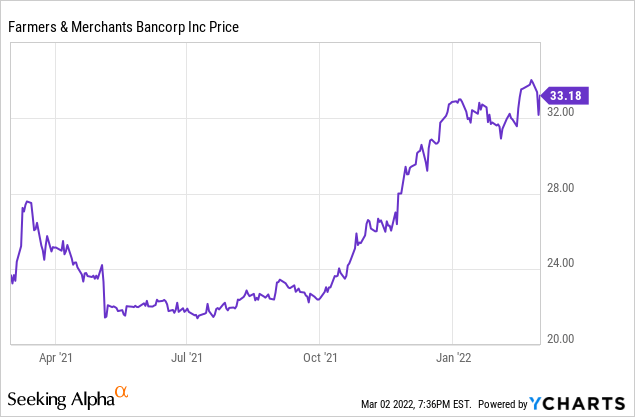

Farmers not too long ago hiked its dividend to $0.19 on a quarterly foundation (up 1 cent from the earlier quarterly dividend of $0.18). The dividend of $0.76 on an annualized foundation at the moment represents a dividend yield of two.25%. Whereas that’s on the decrease finish of the spectrum within the banking sector, traders are giving up revenue in return for a really secure and dependable dividend because the payout ratio is lower than 40% whereas the steadiness sheet seems to be very sturdy.

Probably the most exceptional merchandise of the mortgage e book? The exceptionally low ‘overdue’ ratio

Because of the slightly strict mortgage underwriting insurance policies which I discussed in the beginning of this text, FMAO’s mortgage e book is definitely fairly sturdy. Defaults are low and this additionally means the quantity of mortgage loss provisions can stay very restricted.

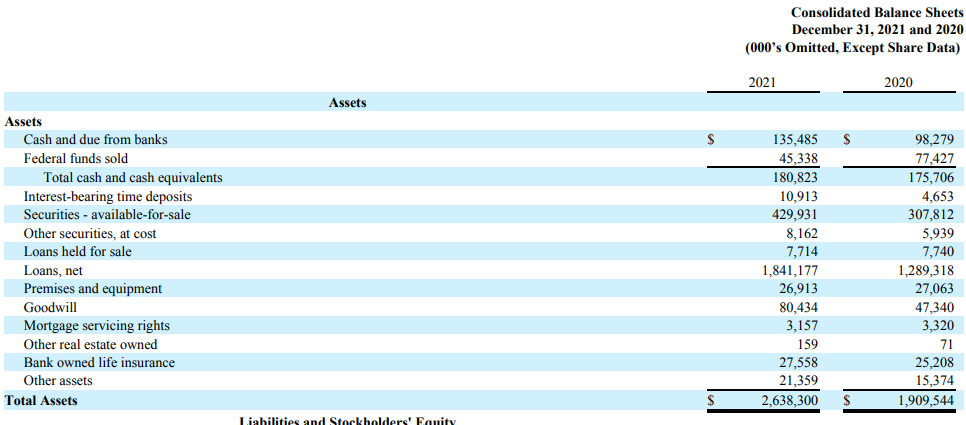

Earlier than diving into the mortgage e book, let’s take a look at the asset aspect of the steadiness sheet.

FMAO Investor Relations

As you may see, the steadiness sheet has a complete dimension of $2.64B, of which $180M is held in money and federal funds. An extra $11M is invested in time deposits whereas about $430M has been invested in securities (primarily authorities bonds as $250 of this consists of US Treasury and authorities businesses securities).

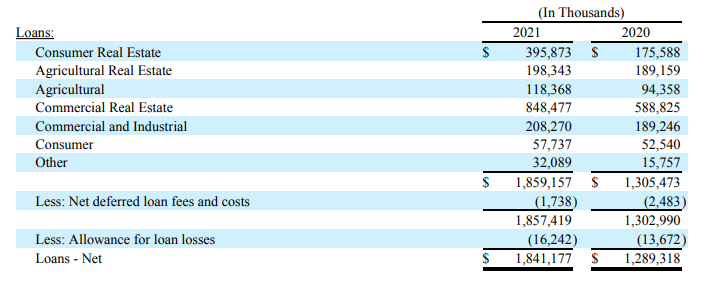

So roughly 24% of the property is invested in property that needs to be slightly liquid. The rest of $1.84B primarily consists of economic actual property however as talked about in the beginning of this text, FMAO has strict LTV ratios it adheres to.

FMAO Investor Relations

And that high quality management is paying off. The whole allowance for mortgage losses is lower than 1% of the mortgage e book and that doesn’t imply the financial institution is underestimating its dangers. Let’s take a look on the loans which might be overdue.

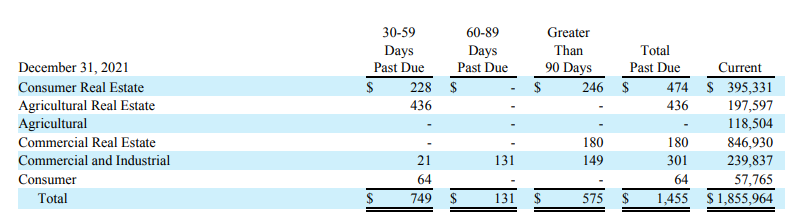

FMAO Investor Relations

As of the tip of 2021, lower than $1.5M of the loans reached a overdue stage. Certainly, lower than 0.1% of the loans is non-current and the overall quantity of provisions is in extra of 10 occasions greater. So whereas the publicity to business actual property appears to be excessive, the standard of the mortgage e book appears to be fairly good.

Funding thesis

It’s comprehensible not everybody desires to pay 14-16 occasions the earnings (the FY 2022 earnings will possible improve to $2.3-2.35/share as a result of expanded asset base) for a financial institution and the present premium to the tangible e book worth of $217M may be a deterrent.

Whereas it’s certainly not simple to pay these multiples (14 occasions earnings and about 2X tangible e book), FMAO appears to supply a sure stage of security given its constantly low mortgage loss provisions and quantity of loans overdue. I at the moment don’t have a place however I’ll add this regional financial institution to my shortlist.