Our objective is to provide the instruments and confidence you should enhance your funds. Though we obtain compensation from our companion lenders, whom we’ll at all times establish, all opinions are our personal. Credible Operations, Inc. NMLS # 1681276, is referred to right here as “Credible.”

Faculty will be costly — however the excellent news is that there are a number of funding sources that may show you how to cowl your schooling prices, together with each federal and personal scholar loans.

There are a number of varieties of federal scholar loans out there to school college students: Direct Backed Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. If you should borrow for college, it’s normally finest to start out with backed loans earlier than turning to Direct Unsubsidized Loans and different choices.

When you’re questioning how a federal Direct Unsubsidized Mortgage works, right here’s what it’s best to know:

Table of Contents

What’s a federal Direct Unsubsidized Mortgage?

Federal Direct Unsubsidized Loans can be found to undergraduate, graduate, and graduate college students no matter monetary want. Because of this the vast majority of college students can apply for them it doesn’t matter what their monetary scenario is.

Have in mind: Not like with undergraduate backed loans, you’re accountable for the entire curiosity that accrues on unsubsidized loans — together with once you’re at school, in the course of the grace interval, and through any intervals of deferment.

Be taught Extra: Backed vs. Unsubsidized Scholar Loans: Know the Distinction

Direct Backed Loans vs. Direct Unsubsidized Loans vs. Direct PLUS Loans

The suitable federal scholar mortgage for you’ll rely in your yr at school and your monetary want. When you’re an undergraduate scholar with monetary want, it’s a good suggestion to depend on backed loans as a lot as potential earlier than turning to unsubsidized loans and PLUS Loans.

Right here’s how these three principal varieties of federal scholar loans work:

- Direct Backed Loans can be found to undergraduate college students who reveal monetary want. The federal government covers the curiosity on these loans whilst you’re at school.

- Direct Unsubsidized Loans can be found to undergraduate, graduate, {and professional} college students. Not like backed loans, unsubsidized loans are thought of non-need-based assist — which suggests you possibly can qualify for them with out monetary want. Nonetheless, take into account that you’ll must pay the entire curiosity that accrues on unsubsidized loans.

- Direct PLUS Loans are available in two classes: Grad PLUS Loans for college students who wish to pay for grad college and Dad or mum PLUS Loans for folks who wish to pay for his or her youngster’s schooling. These loans usually include increased rates of interest than backed and unsubsidized loans — and like unsubsidized loans, any accrued curiosity is your duty. PLUS Loans additionally require a credit score examine.

| Direct Backed Loans | Direct Unsubsidized Loans | Direct PLUS Loans | |

|---|---|---|---|

| Who qualifies? | Undergrad debtors with monetary want | Undergrad, graduate, {and professional} college students (no matter monetary want) |

|

| Curiosity coated by the Division of Training |

|

None | None |

| Out there to graduate or skilled college students? | No | Sure | Sure |

| Credit score examine required? | No | No | Sure, should not have an opposed credit score historical past (or will need to have an endorser) |

| Charges | 1.057%* | 1.057%* | 4.228%* |

| Rates of interest |

|

|

|

| Combination mortgage limits (for dependent college students) |

As much as college’s price of attendance (minus every other monetary assist acquired) |

||

| Combination mortgage limits (for unbiased college students) |

|

|

As much as college’s price of attendance (minus every other monetary assist acquired) |

| *Federal scholar mortgage charges and costs are for the 2021-22 educational college yr. | |||

It doesn’t matter what kind of scholar mortgage you get, it’s necessary to contemplate how a lot that mortgage will price you so you possibly can put together for any added bills. For instance, in the event you take out a Direct Unsubsidized Mortgage, you’ll must take note of that you simply’ll pay extra in curiosity.

Learn how a lot you’ll owe over the lifetime of your federal or personal scholar loans utilizing our scholar mortgage calculator beneath.

Enter your mortgage info to calculate how a lot you possibly can pay

Complete Fee

$

Complete Curiosity

$

Month-to-month Fee

$

With a

$

mortgage, you’ll pay

$

month-to-month and a complete of

$

in curiosity over the lifetime of your mortgage. You’ll pay a complete of

$

over the lifetime of the

mortgage, assuming you are making full funds whereas at school.

The way to qualify for an unsubsidized mortgage

To qualify for a Direct Unsubsidized Mortgage, you have to:

- Be a U.S. citizen or eligible noncitizen

- Be enrolled at the very least half time at a faculty that participates within the federal monetary assist program

- Be enrolled in a degree- or certificate-granting program awarded by that college

- Have a legitimate Social Safety quantity

- Have a highschool diploma or equal (comparable to a GED)

Test Out: Federal Stafford Loans

The way to get an unsubsidized mortgage?

If you wish to take out an unsubsidized mortgage, comply with these three steps:

1. Fill out the FAFSA

If you should pay for faculty, your first step needs to be finishing the Free Utility for Federal Scholar Help (FAFSA). Your college will use your FAFSA outcomes to find out what federal scholar loans and different federal monetary assist you qualify for.

Remember that some monetary assist is given on a first-come, first-served foundation — so it’s a good suggestion to finish the FAFSA as early as potential, particularly in case you have excessive monetary want.

2. Apply for scholarships and grants

Not like scholar loans, school scholarships and grants don’t must be repaid — which makes them a good way to pay for college. There’s no restrict to what number of scholarships and grants you will get, so it’s a good suggestion to use for as many as you possibly can.

- Nonprofit organizations

- Native and nationwide companies

- Skilled associations in your discipline

You may additionally qualify for school-based scholarships, relying in your FAFSA outcomes. Moreover, think about using web sites like Fastweb and Scholarships.com to simply search for awards that you possibly can be eligible for.

3. Take out federal scholar loans

If you should borrow for college, it’s normally finest to depend on federal scholar loans first. That is primarily since you’ll have entry to federal scholar mortgage advantages — comparable to income-driven reimbursement (IDR) plans and scholar mortgage forgiveness packages.

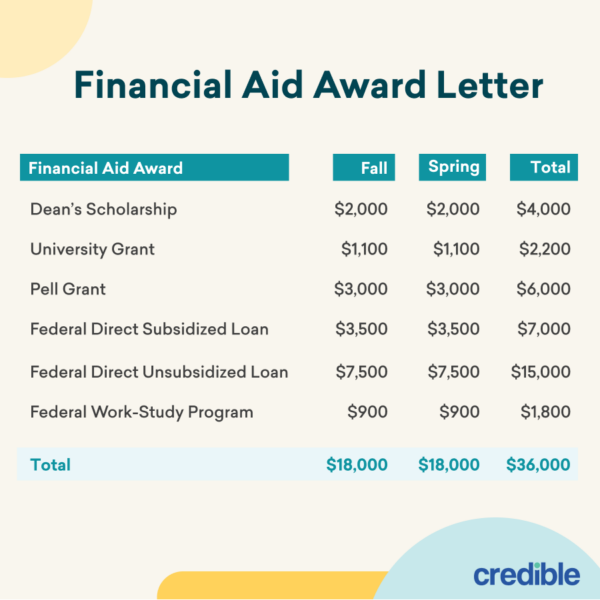

When you full the FAFSA, your college will ship you a monetary assist award letter detailing the federal scholar loans, federal monetary assist, and school-based scholarships you qualify for. You possibly can then select which assist you’d like to simply accept. Right here’s an instance of how an award letter would possibly look:

Mortgage charges for Direct Backed and Unsubsidized Loans

Federal scholar loans usually include a disbursement payment. That is taken out of your mortgage quantity when the funds are launched to your college.

For the 2021-2022 educational yr, this payment is 1.057% for each Direct Backed and Unsubsidized Loans — considerably lower than the 1.059% disbursement payment for the 2019-2020 educational yr.

Be taught Extra: Borrowing for Faculty? Begin with Backed Scholar Loans

How a lot are you able to borrow with an unsubsidized mortgage?

How a lot you possibly can borrow with an unsubsidized mortgage is determined by your yr at school in addition to in the event you’re a dependent or an unbiased scholar. Listed below are the scholar mortgage limits you possibly can count on:

- Direct Backed Loans: $3,500 to $5,500 per yr

- Direct Unsubsidized Loans (dependent undergraduate): $5,500 to $7,500 per yr ($31,000 combination restrict)

- Direct Unsubsidized Loans (unbiased undergraduate): $9,500 to $12,500 per college yr ($57,500 combination restrict)

- Direct Unsubsidized Loans (graduate or skilled): $20,500 per yr ($138,500 combination restrict)

- Direct PLUS Loans: As much as your college’s price of attendance (minus every other monetary assist you’ve acquired)

Test Out: Federal vs. Non-public Scholar Loans: 5 Variations

Non-public scholar loans: When federal funding isn’t sufficient

It’s potential that scholarships, grants, and federal scholar loans may not be sufficient to totally pay to your schooling. On this case, a personal scholar mortgage might be a useful choice to cowl any remaining bills.

However earlier than you apply for a non-public scholar mortgage, it’s necessary to grasp how they differ from federal scholar loans. Listed below are a few of the key factors to bear in mind as you weigh your choices:

- Who presents them: Non-public scholar loans are offered by personal lenders, together with on-line lenders in addition to conventional banks and credit score unions.

- Rates of interest: Charges on personal loans are set by particular person lenders based on market situations. The speed you get will even rely on different components, together with your credit score rating in addition to the reimbursement time period you select. With Credible companion lenders, fastened charges begin at

2.94%+

, and variable charges begin at

0.94%+

. - Compensation phrases: You’ll usually have 5 to twenty years to repay a non-public scholar mortgage, relying on the lender. It’s normally finest to decide on the shortest time period you possibly can afford to maintain your curiosity prices as little as potential. Many lenders additionally provide higher charges to debtors who go for shorter phrases.

- Credit score necessities: Not like most federal loans, personal scholar loans require a credit score examine. To qualify, you’ll usually want good to wonderful credit score. credit score rating is normally thought of to be 700 or increased. There are additionally some lenders that supply scholar loans for weak credit — however these loans normally include increased rates of interest in comparison with good credit score loans.

- Advantages: Non-public scholar loans don’t include federal protections, however they do provide some advantages of their very own. For instance, you possibly can apply at any time, and also you would possibly be capable of borrow greater than you’d get with a federal mortgage. And in case you have wonderful credit score, you possibly can get a decrease rate of interest on a non-public mortgage in comparison with a federal mortgage.

- Drawbacks: A significant disadvantage of personal scholar loans is their lack of federal protections. For instance, you gained’t have the opportunity to enroll in an IDR plan or pursue federal scholar mortgage forgiveness.

A cosigner will be anybody with good credit score — comparable to a mum or dad, one other relative, or a trusted pal — who’s prepared to share duty for the mortgage. Simply take into account that they’ll be on the hook in the event you can’t make your funds.

If a non-public scholar mortgage looks as if a great match to your wants, you should definitely take into account as many lenders as potential to search out the best mortgage for you. Credible makes this straightforward — you possibly can examine your prequalified charges from our companion lenders within the desk beneath in two minutes.

| Lender | Fastened charges from (APR) | Variable charges from (APR) | Mortgage quantities | Mortgage phrases (years) | Min. credit score rating |

|---|---|---|---|---|---|

|

3.36%+ |

1.46%+ |

$2,001 to $200,000 | 7 to twenty | 540 |

|

|||||

|

3.23%+1 |

N/A | $1,000 to $350,000 (relying on diploma) | 5, 10, 15 | 720 |

|

|||||

|

2.94%+2,3 |

0.94%+2,3 |

$1,000 as much as 100% of the school-certified price of attendance | 5, 8, 10, 15 | Doesn’t disclose |

|

|||||

|

3.2%+ |

1.03%+ |

$1,000 to $99,999 yearly ($180,000 combination restrict) |

7, 10, 15 | Doesn’t disclose |

|

|||||

|

3.02%+7 |

2.37%+7 |

$1,000 to $200,000 | 7, 10, 15 | 750 |

|

|||||

|

3.33%+8 |

1.69%+8 |

$1,001 as much as 100% of faculty licensed price of attendance | 5, 10, 15 | 670 |

|

|||||

|

3.75%+ |

N/A | $1,500 as much as college’s licensed price of attendance much less assist | 15 | 670 |

|

|||||

|

3.5% – 12.6% APR9 |

1.13% – 11.23% APR9 |

As much as 100% of the school-certified price of attendance | 15 | Doesn’t disclose |

|

|||||

your credit score rating. 100% free! |

|||||