Scholar mortgage debtors shall be anticipated to renew funds in Might after two years of federal forbearance. Here is what to know. (iStock)

Federal pupil mortgage funds will resume in Might for the primary time because the COVID-19 pandemic started in March 2020. This provides debtors simply two months to begin making ready their funds after two years of federal forbearance.

Democrats have warned President Joe Biden that resuming funds with out pupil mortgage cancelation can be “disastrous” forward of the 2022 midterm elections. And though polling knowledge suggests that the majority Individuals need the coed mortgage fee pause prolonged by means of the tip of the 12 months, the Biden administration has not introduced plans to increase forbearance once more.

Hold studying to learn to put together for federal pupil mortgage compensation, together with income-driven compensation, extra federal deferment and pupil mortgage refinancing. You possibly can evaluate pupil mortgage refinancing charges on Credible totally free with out impacting your credit score rating.

STUDENT LOAN PAYMENT PAUSE HAS COST THE GOVERNMENT $100B

The right way to put together for the tip of pupil mortgage forbearance

Federal debtors shall be anticipated to renew making funds on their pupil mortgage debt in simply two quick months. Missed funds could also be reported to the main credit score bureaus, which might ding your credit score rating. Prolonged intervals of delinquency make you ineligible for federal advantages like deferment or forbearance, and will ultimately lead to wage garnishment.

For those who’re not able to resume federal pupil mortgage funds, here is how one can begin making ready now:

- Examine your mortgage compensation phrases. Go to the Federal Scholar Assist (FSA) web site to see your remaining mortgage stability, month-to-month fee quantity and your fee due date.

- Re-enroll in automated funds. Debtors whose pupil debt was transferred to a brand new mortgage servicer might want to re-enroll in auto-pay to keep away from lacking a fee in Might.

- Arrange an income-driven compensation plan (IDR). Federal pupil mortgage debtors might be able to restrict their month-to-month funds to 10-20% of their disposable revenue by means of an IDR plan.

- Apply for extra federal deferment. Financial hardship and unemployment deferment give eligible debtors an extra 36 months of federal forbearance, throughout which curiosity accrues.

- Refinance your pupil loans at a decrease charge. Scholar mortgage refinancing could assist you cut back your month-to-month funds by greater than $250, in keeping with a latest Credible evaluation.

It is necessary to notice that refinancing your federal pupil debt into a personal pupil mortgage will make you ineligible for choose protections, similar to IDR plans, administrative forbearance and federal pupil mortgage forgiveness packages. You possibly can study extra about pupil mortgage refinancing on Credible to find out if this debt compensation technique is true to your monetary scenario.

POLL: AMERICANS DOUBTFUL THAT PRESIDENT BIDEN WILL CANCEL STUDENT LOANS IN 2022

Personal lenders could supply extra aggressive pupil mortgage charges

Amongst all current pupil mortgage debtors, the common rate of interest is 5.8%, in keeping with the Schooling Information Initiative. The rate of interest you pay will depend on the kind of pupil loans you’ve gotten, similar to Direct Program Loans or Mother or father PLUS Loans. These are the common federal rates of interest by mortgage sort between 2006 and 2022, per Credible knowledge:

- Undergraduate Direct Loans: 4.60%

- Graduate Direct Loans: 6.16%

- Direct PLUS Loans: 7.20%

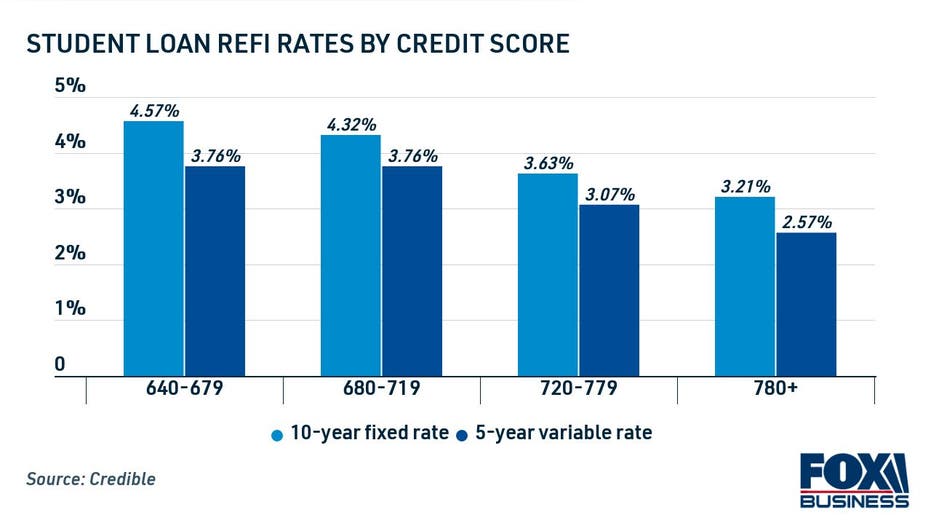

Compared, well-qualified debtors who refinanced their pupil loans on Credible through the week of Feb. 14 noticed common charges of three.75% for 10-year fixed-rate loans and three.10% for 5-year variable-rate loans.

Whereas federal pupil mortgage charges are primarily based on once you originated the mortgage, non-public pupil mortgage charges are likely to differ by credit score rating and debt-to-income ratio (DTI). Debtors with honest or weak credit could contemplate enlisting the assistance of a creditworthy cosigner to extend their probabilities of getting a low charge.

Scholar mortgage refinancing has the potential to save debtors hundreds of {dollars} over time, however it might not be the fitting transfer for everybody. For those who plan on making use of for pupil mortgage forgiveness packages like Public Service Mortgage Forgiveness (PSLF), then refinancing to a personal pupil mortgage would make you ineligible.

Debtors who do not plan on using federal pupil mortgage advantages could contemplate pupil mortgage refinancing whereas charges are low. Refinancing your pupil mortgage debt at a decrease rate of interest could assist you cut back your month-to-month funds, repay debt years quicker and get monetary savings over the lifetime of the mortgage.

As an additional advantage, non-public pupil mortgage lenders are prohibited from charging refinancing charges. The rate of interest you pay represents the overall price of borrowing the mortgage. A pupil mortgage refinance calculator will help you resolve if this monetary technique is best for you.

You possibly can browse present pupil mortgage refinancing charges throughout a number of on-line lenders within the desk under. Then, you possibly can go to Credible to see your estimated charge with a gentle credit score test, which will not hurt your credit score rating.

BIDEN ADMINISTRATION CANCELS ANOTHER $415M IN STUDENT LOAN DEBT: DO YOU QUALIFY?

Have a finance-related query, however do not know who to ask? E-mail The Credible Cash Professional at moneyexpert@credible.com and your query could be answered by Credible in our Cash Professional column.