A putting lack of affordability held regular for first-time residence patrons within the last quarter of 2021. After a slight uptick in listings within the third quarter, the variety of houses available on the market fell additional right into a gap to shut out the yr.

In final quarter’s first-time purchaser evaluation for Q3, we cautioned patrons in opposition to getting overly optimistic within the face of small enhancements. With fourth quarter record costs up 14% nationwide over the previous couple of years even after adjusting for inflation, and stock depleted, an interlude of worth stability with a small listings bump was unable to vary the dynamics of this vendor’s market.

By and huge, any stock enhancements within the third quarter (up 31% throughout essentially the most populous metropolitan areas) had been buffered as listings fell 14% within the fourth quarter. For patrons, incremental worth enhancements aren’t sufficient to make houses inexpensive, and still-falling stock solely additional complicates issues.

Table of Contents

Individuals are additionally studying…

Affordability throughout the nation’s greatest metros

Common affordability remained secure from the third to the fourth quarter of 2021 within the nation’s largest 50 metropolitan areas. Houses had been listed at 5.5 instances median first-time residence purchaser revenue in these metro areas, on common, and 5.3 instances throughout the nation as an entire.

As a reminder, residence patrons have traditionally been suggested to take a look at houses listed at roughly 3 times their revenue. For first-time patrons, staying inside funds is especially essential, as they’re much less more likely to have wiggle room of their month-to-month bills. However as this evaluation has proven over the previous few years, the “3 times your revenue” adage could also be as outdated as dial-up web.

Probably the most inexpensive metros for first-time patrons remained within the Rust Belt and Midwest. Detroit joined this lineup, nudging out Minneapolis and Baltimore. Inaugural patrons within the fourth quarter would see their cash go the furthest in Pittsburgh, the place houses had been listed at 2.9 instances median first-time purchaser revenue, Cleveland (3.1), St. Louis (3.3), Buffalo, New York (3.5), and Detroit (3.5).

For the primary time since early 2020, the least inexpensive metros included one outdoors of California, as Miami had the same affordability ratio to Riverside. Los Angeles, perennially on the backside of the affordability record, discovered houses priced at 11.2 instances first-time purchaser revenue, in contrast with 12.1 final quarter. Others at this finish of the record embrace San Diego (9.2), San Jose (8.3), Sacramento (7.7), Riverside and Miami, each 7.6.

First-time purchaser steering: Much more necessary than adhering to a generalized guideline is knowing your private monetary image and the way a lot house is real looking, given your funds and the situation you’re purchasing in. Dwelling patrons ought to take ample time earlier than they start purchasing to ascertain their homebuying funds. This step doesn’t imply accounting for under the acquisition worth of your house, but additionally how a lot you’ll pay in mortgage curiosity — charges are already rising in 2022 — householders insurance coverage, taxes, and residential upkeep and maintenance, to not point out contemplating different monetary obligations equivalent to debt. A residence affordability calculator may help with this course of.

After a tiny bump, stock falls once more in This fall

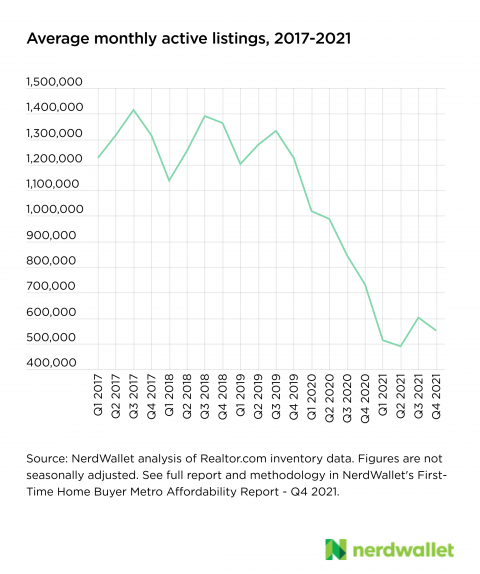

The variety of month-to-month energetic listings available on the market within the nation’s largest metros fell 14% from final quarter. This drop got here on the heels of a touch of aid, as listings rose 31% from Q2 to Q3. However that aid was modest, at greatest, and — as we see now — short-term. Nationally, listings fell 9% from final quarter. The chart under reveals simply how deep in a housing scarcity we’re. It could take many quarters of appreciable progress to get stock again to pre-pandemic ranges.

A number of the most unaffordable markets noticed the most important drops in common month-to-month stock. Sellers in these areas could also be apprehensive about itemizing, understanding they’d discover themselves on the customer’s facet in a dear and unfavorable market. In San Diego, common month-to-month listings fell 48% within the fourth quarter, together with 39% in San Jose and 37% in Los Angeles. In all, eight metros noticed stock fall 20% or extra quarter over quarter.

Nationally, listings fell 25% in contrast with the fourth quarter of 2020. And year-over-year decreases had been much more dramatic in a handful of metros. In Hartford, Connecticut, energetic listings fell 60% yr over yr; in Miami, they fell by 51%; and in Raleigh, North Carolina, the variety of houses available on the market fell by half.

First-time purchaser steering: Looking for a house when there are so few obtainable makes the buying course of much more advanced. Your funds isn’t all that you should be involved about; your want record and desired location might carry simply as a lot weight. In case you will be versatile about this stuff, you’re higher suited to purchasing within the present market, the place listings are scant.

Nevertheless, when you’re totally dedicated to a particular kind of residence in a sure neighborhood, you’ll have higher luck ready for it to hit the market than chasing houses that gained’t delight you. On this case, let an agent know precisely what you’re searching for to allow them to tip you off in the event that they see a list that checks your packing containers. This method takes some inevitable disappointment off the desk, as you’re much less more likely to waste your time going to showings and open homes that simply don’t match the invoice. Nevertheless it does imply it can take you longer to turn out to be a home-owner.

Common costs comparatively secure, however some metros stand out

As within the third quarter, costs among the many nation’s largest metro areas fell 1% quarter over quarter and a couple of% yr over yr, on common, once more. The seemingly infinite upward climb has slowed, however these modest decreases are too small to imply that costs are on their manner down. And inside these averages are some fairly vital modifications.

From the earlier quarter, the most important worth lower got here in Detroit, the place costs fell 13%. The most important increase was seen within the New York Metropolis metro space, the place costs climbed 8% over the quarter.

Usually, the fourth quarter marks a housing market slowdown, because the climate cools and the vacation season captures everybody’s consideration. Throughout this time, costs usually start creeping down to achieve their lowest factors in January and February. However the present housing market is something however typical, and seasonal patterns aren’t as dramatic or predictable as they as soon as had been.

First-time purchaser steering: Costs aren’t anticipated to climb as a lot in 2022 as they’ve over the previous two years. Nevertheless, if typical seasonal traits maintain even barely, they’ll rise later this spring because the climate warms. As a hopeful purchaser, you shouldn’t get too optimistic while you see costs leveling within the fourth and probably first quarters. As an alternative, it’s greatest to organize for sustained excessive costs in most massive markets throughout the nation. That mentioned, there are areas the place your homebuying greenback goes additional, and costs haven’t grown as a lot. Much less populous cities and rural areas are sometimes insulated from the steepest worth will increase, so in case you have the pliability to search for houses in much less crowded markets, you’ll have higher luck staying inside funds.

Pittsburgh: The one ‘inexpensive’ metro

If discovering a home 3 times your revenue is the brink to satisfy, the Pittsburgh metro space holds essentially the most promise for first-time patrons. It’s the one metro analyzed the place houses had been priced lower than 3 times that metropolis’s typical first-time purchaser revenue within the fourth quarter. That is solely the second time a metro dipped under this threshold within the historical past of this evaluation — courting to the primary quarter of 2020, earlier than the pandemic took maintain. And again then, it was Pittsburgh too.

Within the fourth quarter, houses had been listed at 2.9 instances first-time purchaser revenue in Metal Metropolis, at about $219,000, on common. There have been about 3,800 houses available on the market in any given month of the quarter, and whereas this can be a 33% decline for the reason that first quarter of 2020, it’s a much more modest drop than different metro areas.

The article First-Time Dwelling Patrons Confronted Headwinds Once more in This fall initially appeared on NerdWallet.