No two residence patrons are alike. So it is smart that there’s no one-size-fits-all residence mortgage.

In at the moment’s market, there are lots of various kinds of mortgages that may be tailor-made to every purchaser’s distinctive wants — from debtors with good credit score and 20% all the way down to these with decrease earnings and small down funds.

Unsure which kind of residence mortgage it is best to use? Reply a couple of questions beneath and we’ll match you with as much as three loans that might suit your wants.

Table of Contents

Get matched with a house mortgage

Forms of residence loans: Overview and necessities

Many first-time residence patrons — and even repeat patrons — suppose you want glorious credit score and 20 p.c down to purchase a house. However that’s not the case.

At the moment’s debtors can select from a large vary of residence loans to match their wants.

The most effective mortgage for you’ll depend upon a number of elements, like your FICO rating, down cost, credit score historical past, and the kind of residence you need to purchase. However that will help you get began, right here’s an summary of the ten finest residence loans in at the moment’s market:

| Mortgage Kind | Minimal Credit score Rating | Minimal Down Cost |

| Standard 30-12 months Fastened-Price | 620 | 5% |

| Standard 15-12 months Fastened-Price | 620 | 5% |

| Standard 97 Mortgage | 620 | 3% |

| FHA Mortgage | 580 | 3.5% |

| FHA 203K Mortgage | 580 | 3.5% |

| VA Mortgage | 580-620* | 0% |

| USDA Mortgage | 640 | 0% |

| Jumbo Mortgage | 680-720* | 10-20%* |

| 5/1 Adjustable-Price Mortgage (ARM) | 620 | 5% |

| 80/10/10 Mortgage (“Piggyback Mortgage”) | 680-720* | 10% plus a ten% HELOC |

*Varies by mortgage lender. Store round for the very best mortgage phrases

Fortunately, you’re not by yourself when selecting a house mortgage. Your mortgage officer or mortgage dealer will enable you to consider your choices whenever you apply for pre-approval.

Nevertheless, it helps to know what you’re on the lookout for so you possibly can come ready and ask the proper questions.

Wish to get a head begin? The mortgage calculator above will match you with as much as three mortgage sorts primarily based in your solutions to some easy questions.

This doesn’t assure your approval, however it is going to enable you to perceive which mortgage sorts can be found — and provide you with an thought of the minimal necessities to qualify for a mortgage.

Get matched with a house mortgage. Begin right here (Feb 18th, 2022)

10 Forms of residence loans for each purchaser

Now let’s take a more in-depth take a look at every of the main residence mortgage sorts.

30-12 months fixed-rate mortgage

A 30-year fixed-rate mortgage (FRM) is by far and away the most well-liked kind of residence mortgage.

Just like the title suggests, fixed-rate mortgages have set rates of interest that by no means change over the lifetime of the mortgage. And since you’ve 30 years to repay the stability, you’d have decrease month-to-month funds than with a 15-year mortgage.

Most mortgage sorts can be found with a 30-year time period.

As an illustration, you will get a standard, FHA, VA, or USDA mortgage with a 30-year fixed-rate time period. The identical goes for nearly some other mortgage program.

When most individuals consider a ‘commonplace’ mortgage, they’re picturing a 30-year standard mortgage. These begin at 3-5% down and require a credit score rating of at the least 620.

Standard mortgages are additionally very versatile. You should buy a property with anyplace from 1-4 items, and it doesn’t need to be your major residence. You would additionally use this program for a trip residence or actual property funding.

15-12 months fixed-rate mortgage

A 15-year fixed-rate mortgage works identical to a 30-year fixed-rate mortgage. Your rate of interest is fastened over the lifetime of the mortgage, and your month-to-month funds won’t ever change until you select to refinance.

The one distinction is the mortgage time period.

A 15-year mortgage is paid off over — you guessed it — 15 years. And because you’re repaying the mortgage quantity in half the time, your mortgage funds might be a lot greater than with a 30-year mortgage.

Householders have a tendency to decide on a 15-year mortgage if they’ve good money stream (to afford the upper funds) and need to lower your expenses in the long term.

With a 15-year FRM, you’ll find yourself paying loads much less curiosity — doubtless saving you tens of 1000’s of {dollars} in whole curiosity funds.

Standard 97 mortgage

The standard 97 mortgage is a conforming mortgage. Meaning it conforms to lending guidelines set by Fannie Mae and Freddie Mac.

Since conforming loans will be bought by Fannie or Freddie, they’re much less dangerous for mortgage lenders. Meaning lenders can provide favorable phrases and aggressive rates of interest — even to debtors with no large down cost or good credit score.

In consequence, standard 97 loans can be found with simply 3 p.c down. And also you solely want a 620 credit score rating to qualify.

Comparable applications embrace the Fannie Mae HomeReady mortgage and the Freddie Mac Dwelling Doable mortgage. Each choices have a minimal down cost requirement of three p.c and permit for versatile earnings and credit score qualification.

FHA mortgage

An FHA mortgage is a mortgage backed by the Federal Housing Administration. This kind of mortgage is meant for debtors with decrease credit score and/or decrease earnings, who want a bit additional assist qualifying for a mortgage.

For the reason that FHA insures these loans, mortgage firms can lend to debtors with imperfect credit score with out taking up an excessive amount of danger.

Due to this backing, you will get an FHA mortgage with a FICO rating of simply 580. And also you solely want a 3.5 p.c down cost.

What’s extra, FHA lenders are a bit extra versatile about your debt-to-income ratio (DTI). So if you have already got plenty of debt — possibly from scholar loans or automotive loans — you might need a better time qualifying for a mortgage through the FHA program.

FHA 203k mortgage

Just like the FHA mortgage program, FHA 203k loans are backed by the Federal Housing Administration. However the 203k mortgage is tailor-made to patrons who need to buy a fixer-upper residence.

With an FHA 203k mortgage, you possibly can finance your private home buy and the price of repairs on the similar time. This leaves you with a single, low-rate mortgage and just one month-to-month cost — reasonably than shopping for a house and taking out a separate mortgage to pay for renovations.

The 203k program has lots of the similar necessities as a typical FHA mortgage. You solely want 3.5 p.c down and a 580 credit score rating to qualify generally.

Nevertheless, notice that the mortgage course of will take a bit longer as a result of your lender must approve the renovation plans and price estimates when underwriting the mortgage.

VA mortgage

The VA mortgage program is backed by the U.S. Division of Veterans Affairs. It’s obtainable to:

- Lively-duty service members

- Veterans

- Reservists

- Nationwide Guard members

- Surviving spouses

For many who qualify, the VA mortgage program is normally the very best mortgage choice.

Rates of interest are low, there’s no personal mortgage insurance coverage (PMI), and better of all, there’s no down cost requirement. VA-eligible residence patrons should buy actual property with $0 down.

Simply notice there’s a one-time funding payment required by the VA. This may be paid upfront or rolled into your mortgage stability.

USDA mortgage

USDA loans, like VA loans, don’t require any down cost. In addition they have below-market mortgage charges and inexpensive mortgage insurance coverage.

To qualify for this program, you could purchase a house in an eligible rural space. The U.S. Division of Agriculture, which insures USDA loans, determines which areas qualify. Many of the U.S. landmass is eligible, excluding large cities and densely populated suburbs.

The USDA additionally imposes earnings limits. Debtors can’t make greater than 115% of the native median earnings of their space.

Jumbo mortgage

Most residence loans need to be inside conforming mortgage limits set by Fannie Mae and Freddie Mac. For a single-family residence, these limits max out at $647,200 in a lot of the U.S.

However for residence patrons in high-priced markets — and people shopping for luxurious houses — there’s one other resolution: the jumbo mortgage.

A jumbo mortgage is any mortgage that exceeds conforming mortgage limits. (This may also be known as a ‘nonconforming mortgage.’)

Relying on the lender and your private funds, it’s potential to borrow into the thousands and thousands with a jumbo mortgage.

As a result of jumbo loans should not regulated by Fannie and Freddie, mortgage lenders get to set their eligibility necessities. Most require a FICO rating of 680-700 or greater and at the least 10-20% down cost. Nevertheless, low-down-payment jumbo loans can be found beginning at 5% from choose lenders.

5/1 ARM

An adjustable-rate mortgage (ARM) is a mortgage mortgage with a variable rate of interest. The speed is normally fastened for the primary few years, after which it may well regulate as soon as per yr relying on the broader rate of interest market.

The preferred kind of adjustable-rate mortgage is a 5/1 ARM.

A 5/1 ARM has a complete mortgage time period of 30 years, however your rate of interest is simply fastened for the primary 5. After that, your fee can change yearly.

If mortgage charges generally are rising, your ARM fee may doubtlessly go up every year. And your month-to-month mortgage funds would enhance, too. That makes an ARM loads riskier for long-term owners than a fixed-rate mortgage.

Most debtors solely select an ARM in the event that they know they’ll self the house earlier than the fastened rate of interest interval is up — usually throughout the first 5 years.

Standard loans, FHA loans, VA loans, and jumbo loans are all obtainable with an adjustable-rate construction.

80/10/10 Piggyback mortgage

Many debtors have by no means heard of an 80/10/10 mortgage, often known as a “piggyback mortgage.” However this kind of mortgage has distinctive advantages for the proper borrower.

An 80/10/10 mortgage is definitely two separate loans:

- A major mortgage, usually for 90% of the house’s worth

- A house fairness line of credit score (‘second mortgage’) price 10% of the house’s worth

Utilizing this construction, the house purchaser makes a ten% down cost. And the house fairness line of credit score (HELOC) acts as one other 10% down cost.

So, in impact, the borrower is placing 20 p.c down with out really having to avoid wasting up the complete 20 p.c in money.

The principle advantage of this technique is which you can keep away from personal mortgage insurance coverage (PMI).

PMI is charged on most loans with lower than 20 p.c down, and it provides a further month-to-month expense for the home-owner. Avoiding it may prevent a pair hundred {dollars} per thirty days.

The draw back of a piggyback mortgage is that you simply’re taking out two separate residence loans without delay. So that you’ll have two month-to-month funds, each with curiosity.

Should you’re on this technique, discuss to a mortgage officer or mortgage dealer who may help calculate your funds and decide whether or not a piggyback mortgage would prevent cash.

Get matched with a house mortgage. Begin right here (Feb 18th, 2022)

Forms of mortgage loans FAQ

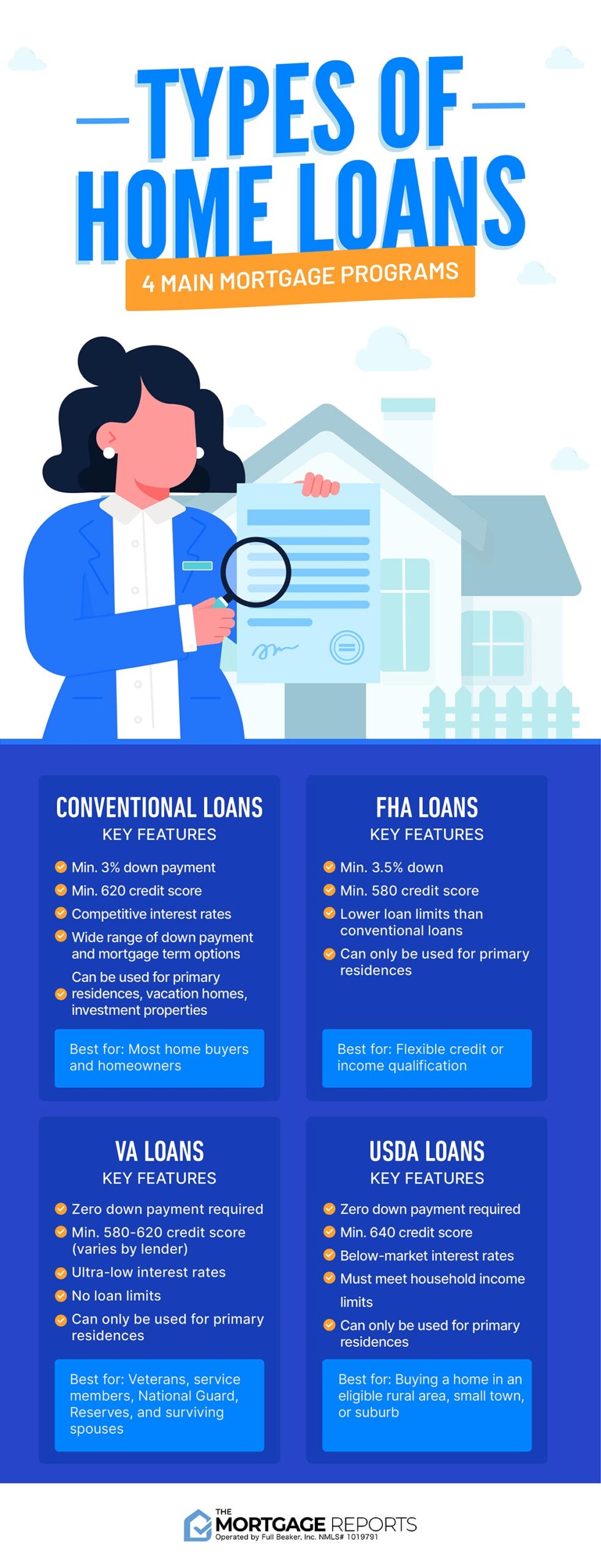

The 4 primary sorts of residence loans are standard loans, FHA loans, VA loans, and USDA loans. Standard loans should not backed by the federal authorities, however most want to satisfy lending tips set by Fannie Mae and Freddie Mac. FHA, VA, and USDA loans are all backed by the federal authorities however provided by personal lenders. Most main lenders provide all 4 mortgage applications, although USDA loans generally is a little tougher to come back by.

The most typical kind of residence mortgage is a standard mortgage, which is any mortgage not backed by the federal authorities. That is what most individuals consider as a ‘commonplace’ mortgage. Standard loans are versatile; down funds can vary from 3 to twenty p.c or extra, and also you solely want a 620 credit score rating to qualify with most lenders. These loans make up about 80 p.c of the mortgage market, in response to the ICE Mortgage Expertise Origination Report.

The most effective kind of residence mortgage is determined by your state of affairs. When you’ve got nice credit score and a 20 p.c down cost, standard loans normally provide the very best worth. Should you want additional assist qualifying because of decrease credit score scores or earnings, an FHA mortgage could be higher. And in the event you’re a qualifying veteran or army member, a VA mortgage is nearly at all times the very best guess. Your mortgage officer may help you evaluate mortgage choices and discover the proper mortgage to your wants.

VA loans usually have the bottom rates of interest. Nevertheless, the VA program is simply obtainable to eligible service members and veterans. For non-VA patrons with sturdy credit score, a standard mortgage will usually provide the bottom charges.

For first-time residence patrons with a 20 p.c down cost and good credit score, a typical standard mortgage is normally finest. Should you’re on the lookout for a low down cost, the VA, USDA, and FHA mortgage applications are all good choices. VA and USDA permit zero down cost for eligible patrons. And an FHA mortgage may help you qualify with a credit score rating as little as 580.

Sure! The VA mortgage program, obtainable to veterans and repair members, permits for no down cost. So does the USDA mortgage program. To qualify with USDA, you could purchase in a professional rural space and your family earnings have to be inside native earnings limits.

The minimal credit score rating to qualify for a mortgage is 580, through the FHA mortgage program. VA loans may permit scores as little as 580, nonetheless, VA necessities range by lender and a few need to see a rating of 620 or greater. Standard and conforming loans require a rating of at the least 620, and USDA loans usually require 640 or greater. If you would like a jumbo mortgage, you’ll doubtless want a rating above 700.

A hard and fast-rate mortgage is finest for most householders. That’s as a result of it protects you type rate of interest and cost will increase over the lifetime of the mortgage. With a fixed-rate mortgage, your rate of interest will solely change in the event you resolve to refinance. An ARM can prevent cash in the event you solely plan to remain within the residence a couple of years. However in the event you outlast the preliminary fixed-rate interval on an ARM, you possibly can be topic to fee and cost hikes that make your mortgage rather more costly in the long term.

There are many totally different refinance choices. The most effective one will rely in your present mortgage and your monetary objectives. If you wish to pull money from your private home fairness, a standard, FHA, or VA cash-out refinance could possibly be finest. Should you merely need a decrease fee and cost, look into a typical rate-and-term refinance. Householders with government-backed loans can even make the most of the Streamline Refinance program, which has simpler qualification necessities and decreased closing prices.

Under no circumstances! There are a selection of low- and even no-down-payment mortgage choices in at the moment’s market. VA and USDA loans permit for zero down cost; standard loans begin at 3 p.c down; and FHA loans solely require 3.5 p.c. Simply remember the fact that in the event you put lower than 20 p.c down, you’ll doubtless need to pay for mortgage insurance coverage. This could enhance your month-to-month funds a bit bit.

Qualifying for a mortgage is less complicated than it was once. At the moment’s residence loans permit credit score scores beginning at 580-620 and down funds of three and even 0 p.c in some instances. Simply attempt to intention for a great stability in your private funds. In case your credit score is low, for instance, making a much bigger down cost may help you qualify. Or when you’ve got a excessive debt-to-income ratio (DTI), you may want additional money reserves to make up for it. Lastly, do not forget that lenders set their very own necessities. So in the event you don’t qualify with the primary lender you discuss to, test with a couple of others.

Which sort of mortgage do you have to select?

To recap, listed below are the primary sorts of residence loans in at the moment’s market:

- Standard 30-year mortgage — The preferred mortgage kind, 5-20% down

- Standard 15-year mortgage — A shorter mortgage time period and cheaper curiosity, 5-20% down

- Standard 97 — 3% down, min. 620 credit score rating

- FHA mortgage — 3.5% down, min. 580 credit score rating

- FHA 203k mortgage — Finance renovations on fixer-upper houses

- VA mortgage — For veterans and repair members, 0% down

- USDA mortgage — For rural properties, 0% down

- Jumbo mortgage — 10-20% down, min. 680 credit score rating

- 5/1 ARM mortgage — Variable rates of interest

- 80/10/10 mortgage — Use a second mortgage to keep away from PMI

The underside line is that mortgage applications are versatile. You don’t want good funds to purchase a home; you simply want to search out the proper mortgage kind to your wants.

Should you’re able to take the following step towards homeownership, it’s price speaking to a lender about your choices.