Legislation is a enterprise like every other, and which means you must receives a commission to ensure that your agency to succeed. Too many small and mid-size companies are nonetheless utilizing outdated fee processes that do little greater than throw up roadblocks to shoppers submitting funds. All too typically, which means getting paid is less complicated mentioned than achieved—till now.

Legislation is a enterprise like every other, and which means you must receives a commission to ensure that your agency to succeed. Too many small and mid-size companies are nonetheless utilizing outdated fee processes that do little greater than throw up roadblocks to shoppers submitting funds. All too typically, which means getting paid is less complicated mentioned than achieved—till now.

LawPay is altering the sport in terms of accepting funds. The fundamental premise of LawPay is straightforward: whenever you give your shoppers extra methods to pay, you’re going to extend your collections. By supporting quite a lot of totally different on-line fee mechanisms (together with the primary purchase now, pay later resolution developed particularly for the authorized business), LawPay removes the friction that always delays buyer funds.

LawPay is a win-win. Your shoppers have a number of simple choices for paying, and also you receives a commission quicker.

Simple On-line Funds with LawPay

Your highway to raised funds begins in your LawPay dashboard, the place you possibly can see and management all of your consumer funds.

With LawPay, you possibly can have as many customers as you need, and you’ll management what every can and can’t do. For instance, in order for you admins to have full performance however different customers to solely have the ability to settle for funds, you possibly can set that up.

Customers with full entry can see an inventory of costs to each your working and belief accounts. With LawPay, funds are at all times ethically dealt with, guaranteeing that there’s no improper commingling of funds together with your belief account. This lets you simply route payment funds to your working account and retainer funds to the belief account. All this exercise might be verified through month-to-month statements for each accounts.

To report a fee, you choose the type of fee from a drop-down menu that features examine, card, and a purchase now, pay later choice (extra on that in a bit). All it’s a must to do is enter the fee quantity, the bill quantity, and the related checking account or bank card quantity.

LawPay makes it simple to report funds wherever you’re—within the workplace, on the cellphone with the consumer, or on the go.

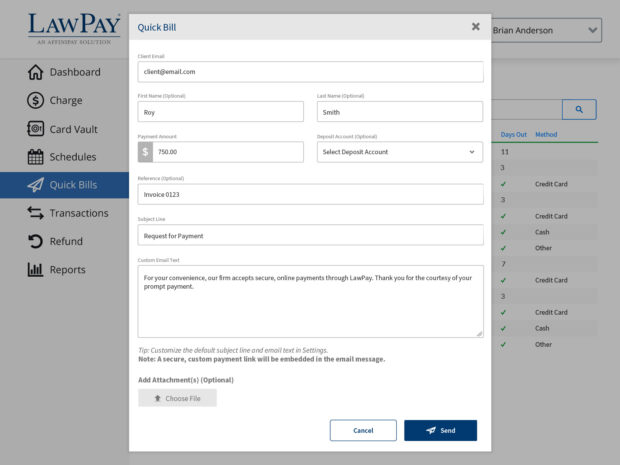

After all, it will be nice if shoppers at all times proactively paid their payments, however getting paid typically requires sending requests or reminders to your shoppers. LawPay permits that within the type of a Fast Invoice.

To create a Fast Invoice, you merely enter the consumer’s e-mail deal with, identify, the quantity owed, and whether or not the fee needs to be deposited to the belief or the working account. You too can embody any inside reference or bill numbers that you just want.

What this does is ship an e-mail on to your consumer with a hyperlink to pay the quantity designated. A Fast Invoice will not be an in depth, itemized bill, however a quick technique to ship a request and get a fee. Nevertheless, you possibly can at all times connect a extra detailed bill or no matter different information you wish to again up the request.

Your consumer will see the Fast Invoice as an e-mail together with your agency’s branding, coming from the agency’s system. The e-mail features a direct technique to pay and is preloaded with the quantity owed and the identify of the accountable particular person.

Fast Payments are an effective way to cost for one-off payments or remind shoppers about excellent balances. You may even embody a number of excellent payments in a single e-mail. You may monitor all of your open Fast Payments out of your dashboard, which is able to inform you not provided that the fee has been despatched or not, but in addition in case your consumer has opened the e-mail and considered the invoice.

One other method that LawPay makes it simple to receives a commission is by permitting you to imbed a fee button in your web site. The button will take your consumer to a web page the place they will enter their fee data. You may select whether or not shoppers have the choice to make a daily bill fee or a fee into your belief account (for instance, if they’re paying or replenishing a retainer), and the display screen might be custom-made to incorporate no matter fields you want in your finish.

Each Fast Payments and fee buttons permit companies to gather funds with minimal effort.

LawPay additionally features a Card Vault function, which lets you securely retailer consumer bank cards in LawPay’s system. You don’t have to fret about storing delicate knowledge and PII as a result of LawPay does it for you, and so they even replace card data if the cardboard expires. This can be a nice choice for shoppers that interact with the agency on a continuous however not essentially frequent foundation, resembling with tax work. If a cost comes due, you possibly can simply go into the Card Vault and cost the right card for that consumer.

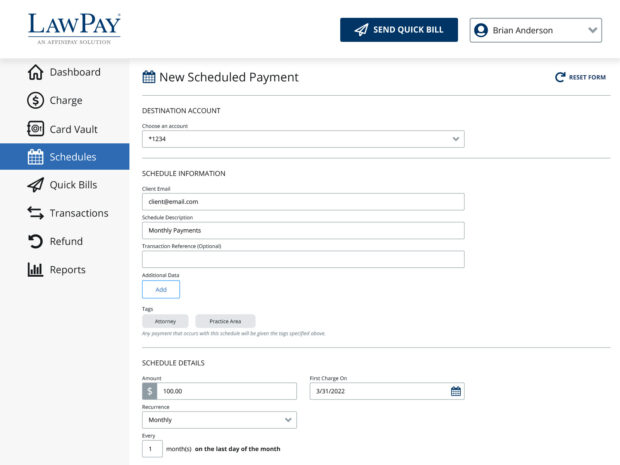

Along with making it simple to gather particular person funds, LawPay helps scheduled funds. Say, for instance, that your consumer owes $3,000 however can’t pay it unexpectedly. You may arrange a fee schedule in LawPay that can invoice your consumer $100 on the final day of each month till the stability is paid off.

You simply must enter the full quantity due, the time span of the fee plan, and LawPay will calculate the funds for you and schedule them in keeping with your directions. This function can be helpful for fixed-fee preparations. You may at all times see a working snapshot of all of your fee plans in chronological order, so you understand what has been paid, what remains to be excellent, and when it’s scheduled to return in.

Much like the Card Vault is the Recharge function, which lets you retailer bank card transaction data for six months so you possibly can add future costs to the identical card. You merely enter the quantity to be paid and LawPay will confirm the bank card data and course of the fee. That is a straightforward technique to course of just a few funds from a single consumer inside a six-month span. From the Recharge display screen, you too can void funds and concern refunds if crucial.

Higher but, LawPay can combine with most apply administration programs, making life even simpler. For bigger companies with extra complicated accounting buildings, LawPay can work with you to create a customized integration that meets your wants.

Purchase Now, Pay Later

LawPay is the primary supplier to supply a authorized payment financing choice included straight into a web-based fee resolution via a function referred to as ClientCredit.

With ClientCredit, your shoppers will entry the identical safe fee web page they use for different kinds of funds, placing within the fee quantity and their particulars and choosing the “Pay Later” choice.

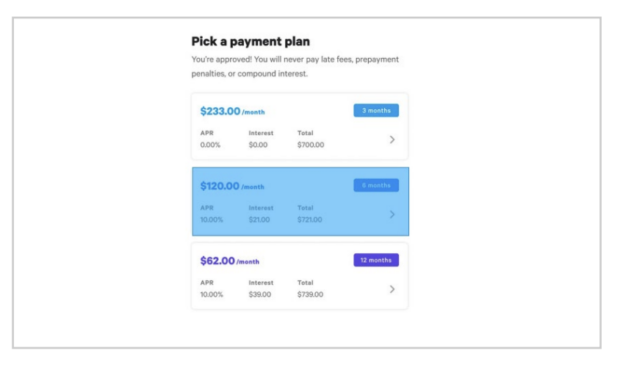

ClientCredit works via LawPay’s partnership with Affirm. By clicking “Pay Later,” the consumer is submitting a web-based software for funding via Affirm, who will entrance your complete quantity due. As soon as the applying is authorized and the account is created, the consumer is obtainable various fee plans to select from, primarily based on eligibility.

After choosing the specified fee plan choice and accepting its phrases and situations, the consumer will likely be redirected to the fee affirmation web page. As soon as every little thing is full, your consumer will get an e-mail confirming the Affirm financing transaction.

ClientCredit is actually a revolutionary method of dealing with authorized funds. The agency will get the cash they’re owed upfront, and the consumer will get the authorized providers they want with out the worry of costs they will’t pay. As soon as a consumer is authorized for ClientCredit, the regulation agency is taken out of the fee loop and the consumer in the end pays Affirm again for the quantity due. ClientCredit is at present obtainable wherever within the U.S.

Whereas fee fashions within the authorized business could also be shifting a bit, the processes round fee have remained largely unchanged. With quite a lot of handy fee options, together with the revolutionary ClientCredit, LawPay is shaking up the world of authorized funds to take away the friction that has lengthy stood in the best way of clean and well timed collections.

Getting paid for the work you do doesn’t need to be troublesome. LawPay makes it simple to gather what you’re owed so your agency can succeed.