Pgiam/iStock through Getty Pictures

Table of Contents

Our Funding Thesis

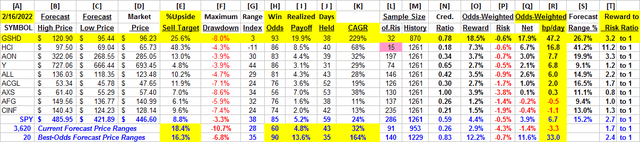

Is expressed within the above bullet-points, the place odds for, and dimension of near-term capital positive factors are placed on a comparable foundation with various funding candidates.

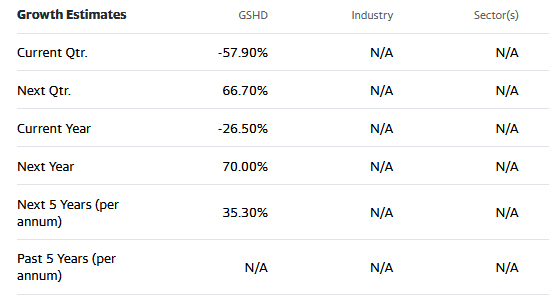

The dominance of Goosehead Insurance coverage, Inc. (GSHD) in following the end result of that evaluation in comparison with investment-comparable alternate options makes studying the remainder of this text price your effort and time in case you are taken with charges of near-term capital positive factors. Good points that are prone to be multiples of what market-index averages often supply.

Description of Principal Funding Topic

“Goosehead Insurance coverage, Inc. operates as a holding firm for Goosehead Monetary, LLC that gives private traces insurance coverage company providers in the US. The corporate operates in two segments, Company Channel and Franchise Channel. It affords house owner’s, automotive, dwelling property, flood, wind, earthquake, extra legal responsibility or umbrella, bike, leisure automobile, normal legal responsibility, property, and life insurance coverage services. As of December 31, 2020, the corporate had 1,468 whole franchises. Goosehead Insurance coverage, Inc. was based in 2003 and is headquartered in Westlake, Texas.”

supply: Yahoo Finance

Yahoo Finance

Various Funding Competitor Rewards and Dangers

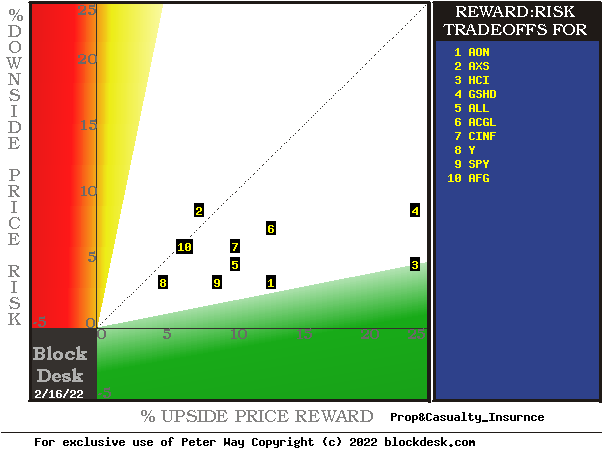

Determine 1

blockdesk.com

Used with permission

Upside value rewards are from the behavioral evaluation (of what to do proper, not of errors) by Market-Makers [MMs] as they defend their at-risk capital from potential damaging future value strikes. Their potential reward forecasts are measured by the inexperienced horizontal scale.

The danger dimension is of precise value draw-downs possible at their most excessive level whereas being held in earlier pursuit of upside rewards much like those at the moment being seen. They’re measured on the crimson vertical scale.

Each scales are of p.c change from zero to 25%. Any inventory or ETF whose current threat publicity exceeds its reward prospect shall be above the dotted diagonal line.

Greatest reward-to-risk tradeoffs are to be discovered on the frontier of alternate options down and to the best. As a market-index “norm” at the moment, the S&P 500 Index ETF (NYSEARCA:SPY) is at location [3]. The present “frontier” trade-off of Danger vs. Reward extends from Y at [8] to SPY at [9] to AON at [1] and to HCI at [3]. Our current major curiosity is in GSHD at location [4].

Is the added reward of GSHD definitely worth the added threat in comparison with SPY or to HCI at [3]? A fuller description of investing issues ought to add to buyers’ choices of the suitability and credibility of the accessible funding alternate options.

Extra worth perspective info

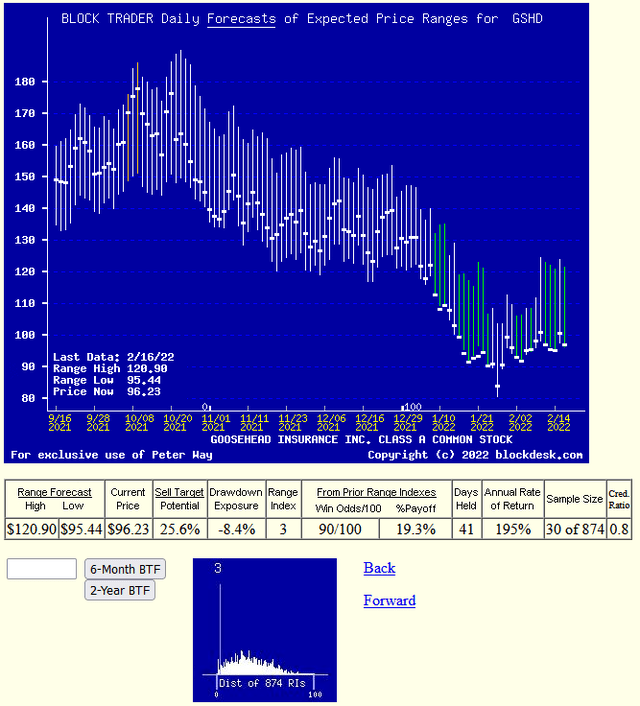

Determine 2 presents a few of these issues, drawn from outcomes of prior MM forecasts having the identical up-to-down earlier expectation proportions as these of right this moment.

Determine 2

used with permission

The benefit of figuring out Market-Maker forecasts for coming inventory costs is that they provide many dimensions greater than typical “avenue analyst” forecast of a single target-price at one cut-off date. As an alternative of just one greater (or decrease) future value, the MM forecasts are drawn from market knowledge legitimate throughout related (usually shorter) durations of time for each the higher and cheaper price limits seen as prone to be encountered in such a interval.

That vary of coming costs for every funding candidate is clearly break up into upside and draw back prospects by its right this moment market value. We word what quantity of that entire forecast value vary is between the right this moment market quote and the low-end prospect, the draw back publicity. We label that % of the vary because the Vary Index [RI] and word it in column [G] of Determine 2. It will get used to determine and common all prior RIs of comparable dimension as an appropriate pattern of subsequent market outcomes in column [L], as a proportion of all price-range forecasts for the inventory previously 5 years of market days [M].

With these samples, scaled individually to every candidate’s related prior-sample outcomes, we now could make acceptable direct comparisons of solutions to questions of:

How huge a capital achieve is likely to be anticipated from this inventory within the subsequent few months? [ I ] Out of the pattern, what are the Odds (how possible) that anyone shall be worthwhile? How lengthy, on common, [J] may it take for a typical pattern holding to return to a disciplined termination? In that common holding interval, how dangerous an interim value drawdown is likely to be skilled? How credible [N] is the present upside forecast [E] in comparison with what historical past realized [ I ]? Given [E] and [F], what’s the present Reward to Danger [T] ratio?

Key attention-grabbers ought to be column [E], the % upside value adjustments between [D] and [B], and (based mostly on previous forecasts like right this moment’s) how possible these forecasts are to return about within the subsequent 3 months: Column [H], Win Odds.

These odds are from [L] Pattern Dimension prior forecasts with upside-to-downside value change balances like right this moment’s, indicated by [G] Vary Indexes, the place the numeric tells what % proportion of the complete [B] to [C] vary lies between [D] and [C].

We additional take these [H] odds, and their complement, 100 – H, as weights to the value drawdown Danger experiences of the pattern [L] throughout its varied makes an attempt to realize the [E] rewards, as proven in [ I ]. The web of that mixture, as [O] + [P] = [Q], will get put in RATE of RETURN measured in “foundation factors per day” [R] by [Q] / [J], the place a foundation level = 1/one centesimal of a p.c. In different phrases, a % of a %.

These [R] column measures present a common comparability means for the attractiveness of investment-capital, so the rows of Determine 2 are all ranked, with GSHD on the prime rank.

Provided that we’re posed with a choice beneath the inevitable uncertainty of the long run, no assortment of solutions or precise outcomes will be anticipated to show perfection. However on stability they need to assist buyers to tailor their candidate decisions to greatest handle the diploma to which the information leads every investor to essentially the most satisfying outcomes, more often than not.

The place the target is to seek out from the candidates in Determine 2 the largest, quickest, more than likely capital achieve within the subsequent 3 months with the least interim value drawdown misery, it seems that the logical alternative is with GSHD.

Latest Developments in GSHD Worth-Vary Forecasts

Determine 3

(used with permission)

With historic odds for a worthwhile expertise of 9 out of each 10 and prior expertise holdings of lower than 2 months (of 21 market days) the prospect of robust triple-digit achieve charges is highly effective as compared with different insurance coverage trade funding alternate options and aggressive compared with averages of the very best 20 of a giant price-forecast inhabitants.

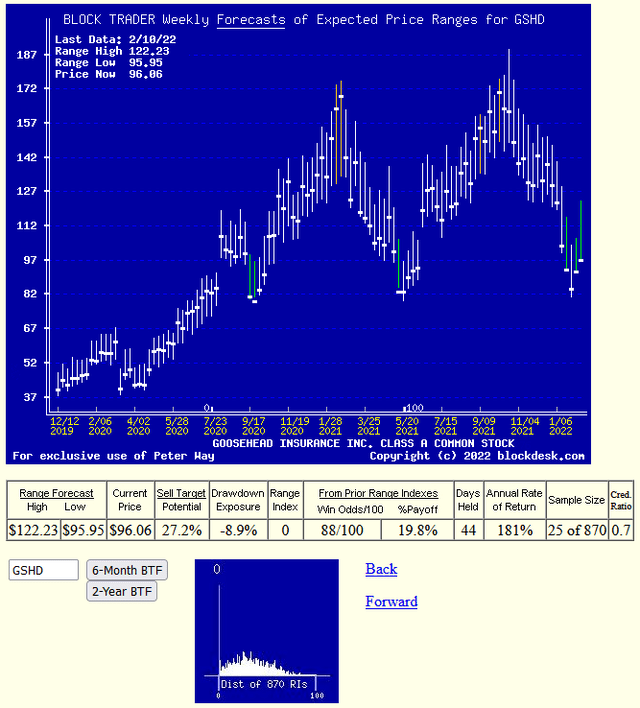

Some higher perspective comes from once-a-week copies of MM forecasts over the previous two years.

Determine 4

used with permission

Conclusion

Evaluating these funding candidates to decide on the very best near-term capital achieve prospect, Goosehead Insurance coverage, Inc. seems to be much better suited than all of the others.