The “huge six” U.S. banks have all reported their fourth-quarter outcomes, wrapping up a troublesome 2022, when hovering rates of interest pressured a decline in a number of areas of enterprise.

Citigroup Inc.

C

has the excellence of being the one considered one of these banks to commerce under its tangible ebook worth and it additionally has the bottom ahead price-to-earnings ratio.

Beneath is a display screen of valuations and analysts’ sentiment for the large six banks, which additionally embody JPMorgan Chase & Co.

JPM,

Financial institution of America Corp.

BAC,

Wells Fargo & Co.

WFC,

Goldman Sachs Group Inc.

GS

and Morgan Stanley

MS.

That is adopted by a glance into the group’s publicity to downside loans.

For a rundown of how the large banks have fared this earnings season, see the next protection from Steve Gelsi:

It might already be restoration time for large banks’ shares

There was no scarcity of ache factors for the banking business, together with rising rates of interest; declining volumes for securities buying and selling, underwriting and M&A offers; and concern of a potential recession. However buyers are wanting forward, and as we are going to see decrease down, mortgage high quality stays robust.

Right here’s how the S&P 500

SPX

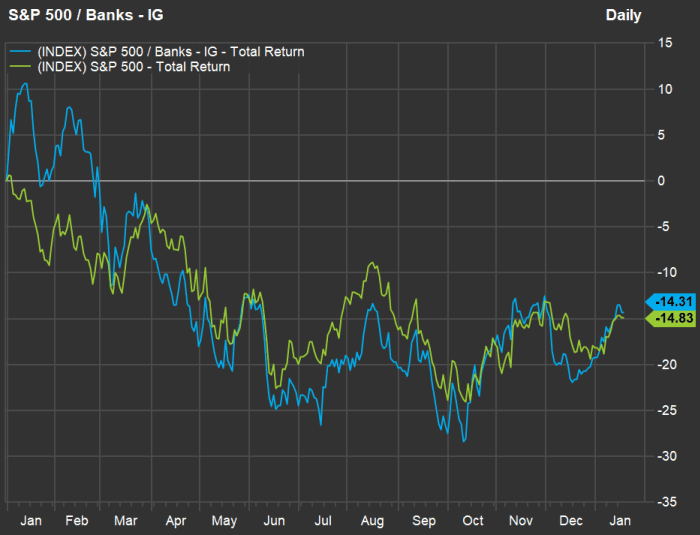

banking business group has carried out for the reason that finish of 2021, with dividends reinvested, in response to FactSet:

FactSet

The banks have solely outperformed the complete index barely for the reason that finish of 2021. However the banks fell more durable than the broad market did final yr, and so they have staged a pointy restoration since mid-December. To date in 2023, Citi’s inventory is up 11%, which has solely been exceeded among the many huge six by Morgan Stanley’s 14% return.

Screening the large banks’ shares

Listed here are the large six, sorted by market capitalization, with two valuation ratios:

| Financial institution | Ticker | Market cap ($bil) | Ahead P/E | Worth/ tangible ebook worth | 2023 whole return | 2022 whole return | |

| JPMorgan Chase & Co. | JPM | $413 | 10.9 | 1.9 | 6% | -13% | |

| Financial institution of America Corp | BAC | $277 | 9.9 | 1.6 | 4% | -24% | |

| Wells Fargo & Co. | WFC | $168 | 9.2 | 1.3 | 7% | -12% | |

| Morgan Stanley | MS | $164 | 13.0 | 2.4 | 14% | -10% | |

| Goldman Sachs Group Inc. | GS | $118 | 10.3 | 1.3 | 2% | -8% | |

| Citigroup Inc. | C | $97 | 8.6 | 0.6 | 11% | -22% | |

| Supply: FactSet | |||||||

Tangible ebook worth (TBV) deducts intangible belongings, resembling goodwill and deferred tax belongings, from ebook worth.

Citi shouldn’t be solely the most cost effective by P/E and worth/TBV ratios, but in addition has the best dividend yield within the group:

| Financial institution | Ticker | Dividend yield | Jan. 18 worth | Present annual dividend fee | Estimated dividends for 2023 |

| JPMorgan Chase & Co. | JPM | 2.84% | $140.80 | $4.00 | $4.16 |

| Financial institution of America Corp | BAC | 2.55% | $34.52 | $0.88 | $0.93 |

| Wells Fargo & Co. | WFC | 2.72% | $44.12 | $1.20 | $1.32 |

| Morgan Stanley | MS | 3.19% | $97.08 | $3.10 | $3.18 |

| Goldman Sachs Group Inc. | GS | 2.86% | $349.92 | $10.00 | $10.45 |

| Citigroup Inc. | C | 4.05% | $50.31 | $2.04 | $2.08 |

| Supply: FactSet | |||||

Analysts polled by FactSet anticipate all six banks to lift dividends, not less than barely, this summer season. The consensus 2023 dividend estimates are for the complete yr, which suggests the annual dividend charges can be a bit larger, for the reason that payout will increase have been introduced in recent times together with second-quarter earnings.

It’s potential that the Federal Reserve will curtail dividend will increase this yr throughout its annual stress exams. Traders most likely gained’t see the complete outcomes of those exams till July, in response to Moody’s analytics. Increased payouts might also be much less possible as banks lay off workers members to chop prices. However dividend cuts appear unlikely as a result of the banks stay worthwhile and credit score high quality hasn’t change into an issue thus far on this financial cycle.

Leaving the group once more in the identical order, right here’s how analysts working for brokerage corporations really feel about these financial institution shares:

| Financial institution | Ticker | Share “purchase” scores | Jan. 17 worth | Cons. Worth goal | Implied 12-month upside potential |

| JPMorgan Chase & Co. | JPM | 62% | $140.80 | $156.67 | 11% |

| Financial institution of America Corp | BAC | 57% | $34.52 | $40.80 | 18% |

| Wells Fargo & Co. | WFC | 79% | $44.12 | $53.13 | 20% |

| Morgan Stanley | MS | 56% | $97.08 | $100.08 | 3% |

| Goldman Sachs Group Inc. | GS | 54% | $349.92 | $392.11 | 12% |

| Citigroup Inc. | C | 37% | $50.31 | $57.17 | 14% |

| Supply: FactSet | |||||

Citi is the least-loved amongst analysts polled by FactSet, with solely 37% ranking the shares a “purchase” or the equal. The entire different banks on the record have majority “purchase” scores.

Remember the fact that the scores are primarily primarily based on 12-month outlooks. That may be thought of a brief interval for an investor driving out an financial cycle. There have been many warnings of a recession because the Federal Reserve continues to tighten financial coverage to combat inflation. And company layoff bulletins are flowing nearly every day.

Among the many analysts with impartial scores on Citigroup is David Konrad of Keefe, Bruyette & Woods, who wrote in a be aware to shoppers on Jan. 16 that regardless of having “longer-term upside potential,” the inventory “lacks near-term catalysts and bills are anticipated to weigh on near-term returns.”

Whereas agreeing that Citi is “spending an excessive amount of,” Oppenheimer analyst Chris Kotowski charges the shares “outperform,” with a 12-18 month worth goal of $83, which might make for upside potential of 65% from the closing worth of $50.31 on Jan. 17.

In a be aware to shoppers, Kotowski pointed to Citi’s rising bills as an issue for the inventory, but in addition wrote that with a excessive stage of regulatory capital, he expects the financial institution to renew shopping for again shares within the third quarter. “It’s irritating, however at 61% of TBV, we predict the inventory is simply too low cost to disregard,” he added.

Credit score high quality could possibly be a silver lining

In his protection of the large banks’ earnings outcomes, Gelsi mentioned the decline in capital markets and associated income, in addition to the hit to earnings taken by the banks as they put aside more cash to cowl anticipated mortgage loss reserves.

Let’s take a better take a look at the credit score indicators. Right here’s how a lot the large six added to their mortgage loss reserves through the fourth quarter, with comparisons to the earlier and year-earlier quarters. The numbers are in tens of millions:

| Financial institution | Ticker | This fall 2022 provision for mortgage loss reserves | Q3 2022 provision for mortgage loss reserves | This fall 2021 provision for mortgage loss reserves |

| JPMorgan Chase & Co. | JPM | $2,288 | $1,537 | -$1,288 |

| Financial institution of America Corp | BAC | $1,092 | $898 | -$489 |

| Wells Fargo & Co. | WFC | $957 | $784 | -$452 |

| Morgan Stanley | MS | $87 | $35 | $5 |

| Goldman Sachs Group Inc. | GS | $972 | $515 | $344 |

| Citigroup Inc. | C | $1,820 | $1,338 | -$503 |

| Whole | $7,216 | $5,107 | -$2,383 | |

| Supply: FactSet | ||||

Banks construct mortgage loss reserves to cowl anticipated credit score losses. These quarterly additions to reserves are referred to as provisions, and so they instantly decrease pretax earnings. Banks sometimes put aside extra for reserves because the economic system slows to get forward of anticipated mortgage defaults, and when the economic system recovers, the provisions could flip damaging and increase earnings.

The massive six put aside $7.2 billion for reserves through the fourth quarter, which was a big enhance from $5.1 billion within the third quarter. Trying again a yr, earnings had been enhanced through the fourth quarter of 2021 when the mixed provision was -$2.38 billion.

However even the $7.2 billion mixed provision through the fourth quarter wasn’t very excessive. Throughout the first two quarters of 2020, the six banks’ provisions totaled $44.7 billion — they couldn’t know at the moment how considerably the mix of stimulus efforts by the federal authorities, federal reserve, together with moratoriums in opposition to foreclosures and evictions, would help credit score high quality.

Then in 2021, the six banks collectively recorded -$21 billion in mortgage loss provisions, for a carry in earnings.

Trying even additional again to the Nice Recession and its aftermath, provisions for the group (excluding Goldman Sachs and Morgan Stanley which didn’t have mortgage publicity to require provisions to be made throughout these years) totaled $324 billion for 3 years via 2010.

It seems the large six aren’t very nervous about credit score throughout this financial cycle.

To help that, listed here are normal loan-quality and reserve ratios for the group:

| Financial institution | Ticker | Internet charge-offs/ common loans | Mortgage loss reserves/ whole loans | Nonaccrual loans/ whole loans | Mortgage loss reserves/ nonaccrual loans |

| JPMorgan Chase & Co. | JPM | 0.32% | 1.96% | 0.59% | 294% |

| Financial institution of America Corp | BAC | 0.27% | 1.36% | 0.38% | 338% |

| Wells Fargo & Co. | WFC | 0.22% | 1.43% | 0.59% | 231% |

| Morgan Stanley | MS | N/A | 0.63% | N/A | N/A |

| Goldman Sachs Group Inc. | GS | 0.40% | 3.81% | N/A | N/A |

| Citigroup Inc. | C | 0.72% | 2.90% | 1.07% | 241% |

| Supply: FactSet | |||||

Knowledge notes:

- Internet charge-offs are mortgage losses much less recoveries. That is an annualized determine. Over very lengthy intervals, charge-off ratios under 1% are typically thought of to be wholesome.

- The ratio of mortgage loss reserves to whole loans supplies a helpful gauge of protection in comparison with the web charge-off ratio.

- Nonaccrual loans are these for which a financial institution expects to gather neither curiosity nor principal, however hasn’t but charged-off. Reserve ranges for all 4 banks with nonaccrual publicity had been excessive as of Dec. 31.

Don’t miss: 10 easy investments that may flip your portfolio into an revenue dynamo