Social enterprises need to make a big effect. To take action they want capital, however the unsuitable form of funding can pull them away from their core mission. The answer, say some, lies in an idea that mixes new and current instruments: impact-linked finance.

Affect-linked finance is a type of funding that rewards social enterprises for the optimistic impression they create. Meaning a social enterprise will take pleasure in higher financing phrases – a grant cost alongside a mortgage or fairness, or decrease rates of interest, for instance – in the event that they meet particular impression outcomes, and subsequently are incentivised to develop their impression.

“It’s higher phrases for higher impression,” says Lucas Tschan, head of advisory and partnerships at iGravity, a Zurich-headquartered agency specialised in impression investing and progressive growth finance, which manages two impact-linked funds.

However how does it work – and what impression can it have?

| Be part of the FASE Affect Fireplace Talks on 28 March – 1 April to debate incentivising impression, exit eventualities, behavioural bias and extra. |

Table of Contents

A household of economic instruments

Some impact-linked finance instruments contain a donor who “pays for impression” – with the assure that their cash can be used solely to the extent that impression outcomes are met. These are sometimes foundations, philanthropists or public sources of finance. In the meantime social enterprises receiving this type of impact-linked finance are enabled to tackle different investor capital to assist and develop their enterprise whereas remaining consistent with their impression targets. In different impact-linked finance instruments, buyers are able to make concessions on their monetary returns as soon as predefined outcomes are achieved.

The purpose of the mannequin is to make high-impact enterprises extra engaging to non-public sector funding, enabling them to generate additional impression.

Many social enterprise funds need the most effective of each worlds: to beat the market and to save lots of the world concurrently. In my expertise, this doesn’t occur too typically

Affect-linked finance differs from social impression bonds (SIBs) as a result of it’s designed to assist your entire social enterprise enterprise mannequin, whereas SIBs fund particular, time-bound initiatives.

The 2 sorts of impact-linked finance mostly used are social impression incentives (SIINCs) and impact-linked loans – though the precept of impact-linked finance will be embedded in a wide range of monetary devices, from fairness to ensures.

SIINCs, which had been pioneered in 2016 by impression advisory agency Roots of Affect (which later created the idea of impact-linked finance), are grants given to social enterprises on the situation that they obtain sure predefined impression outcomes. The investees should additionally elevate non-public financing alongside it.

Affect-linked loans are loans made to a social enterprise the place the compensation modalities depend upon the impression achieved by the enterprise: the larger the impression, the decrease the rates of interest.

There are alternatives to develop impact-linked finance past debt and towards fairness financing, Tschan explains, though that is nonetheless at an experimental stage.

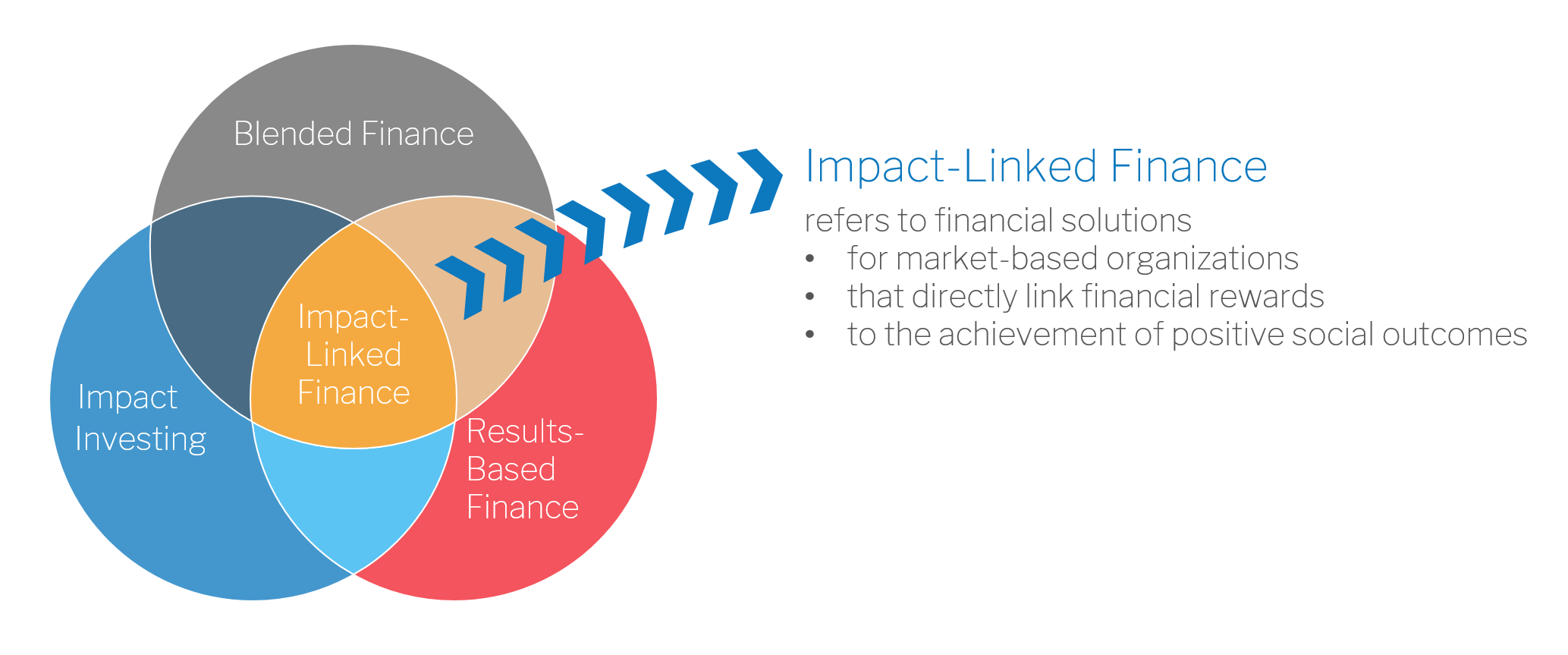

Diagram: Affect-linked finance sits on the intersection of impression investing (its purpose is to create optimistic social or environmental impression), blended finance (it mixes grants and repayable finance), and outcomes-based funds (the phrases of the transactions depend upon the impression generated).

Along with Roots of Affect, iGravity has launched two impact-linked funds, the Affect-Linked Fund for Training and the Affect-Linked Fund for Jap and Southern Africa. Their focus up to now is on the World South and particularly the least developed international locations, as a result of they really feel that is the place they are going to take advantage of impression, Tschan explains – though he recognises that there’s a want for it all over the place.

iGravity and Roots of Affect are at the moment concerned in additional than 50 impact-linked finance transactions which might be in varied levels, from pipeline to preparation to completion. Out of those transactions, 30 are utilizing SIINC and greater than 20 apply different devices similar to impact-linked loans, impact-linked income sharing agreements, impact-linked grants or impact-ready matching funds.

As a result of the observe is in its early levels, there are a restricted variety of instances to show that the idea works, however advocates are assured that these sign its potential to succeed. Extra of these examples are wanted, Tschan (pictured) says, though inevitably, to have extra case research, extra offers have to occur. “It’s all the time a little bit of a rooster and egg factor,” he provides.

As a result of the observe is in its early levels, there are a restricted variety of instances to show that the idea works, however advocates are assured that these sign its potential to succeed. Extra of these examples are wanted, Tschan (pictured) says, though inevitably, to have extra case research, extra offers have to occur. “It’s all the time a little bit of a rooster and egg factor,” he provides.

A 2021 research commissioned by the UK’s Esmée Fairbairn Basis discovered there was appreciable vitality and enthusiasm for impact-linked finance among the many impression investing neighborhood and particularly amongst practitioners, though the shortage of a monitor document meant some buyers remained sceptical of the strategy.

‘In our DNA’

To this point, buyers in impact-linked finance have been philanthropic-minded organisations, largely foundations, donors and the general public sector. For instance, iGravity has been working with the Zürich-based Jacobs Basis – which had been pioneering impression investing for a very long time – and Liechtenstein-based Medicor Basis. Public funders, similar to SDC, the Swiss growth company, have additionally been concerned in impact-linked finance.

DRK Basis has additionally been utilizing impact-linked finance instruments to spend money on early-stage social enterprises for the previous three to 4 years. The inspiration continues to be studying from different buyers and entrepreneurs, however for Kanini Mutooni (pictured), the inspiration’s managing director, it’s a no brainer.

“It is in our DNA,” she says. “That is how we deploy our capital, if we do not hyperlink our capital to impression, then we’re truly not aligned with our personal mission.” She sees it as the one method to deal with immediately’s most urgent points; and a assure that the non-public capital they mobilise can be linked to impression too.

Mutooni explains that linking financing with impression outcomes is now a consideration in all their offers. However she warns in opposition to a “blanket strategy” to impact-linked finance – totally different social enterprises will want various kinds of finance, so it’s about “integrating it in each deal” and customising approaches to the form of firm, the sector and the area they’re in – social entrepreneurs in Latin America won’t have the identical wants as these in sub-Saharan Africa, for instance.

There are other ways DRK makes use of impact-linked finance. Probably the most primary is to offer capital in “tranches”: the primary tranche is given upfront, however the next tranches are solely supplied if sure outcomes are met.

One other approach is to make use of revenue-based financing (or mezzanine financing, the place cost to buyers relies on the corporate’s monetary efficiency), however to hyperlink it to impression outcomes moderately than simply income, incentivising social entrepreneurs to extend their impression so as to decrease the price of capital.

That is how we deploy our capital, if we do not hyperlink our capital to impression, then we’re truly not aligned with our personal mission

Affect-linked finance additionally guards in opposition to mission drift, advocates say. For instance, social enterprises serving bottom-of-the-pyramid prospects may need to shift their companies to the middle- and higher-income teams in the event that they’re seeking to develop their earnings; however that may decrease their impression. If their impression is a situation to getting funding, or to getting higher phrases for funding, then the social enterprise can be incentivised to prioritise its mission.

Affect-linked finance in motion: Clínicas del AzúcarIn Mexico, Clínicas del Azúcar is a social enterprise offering inexpensive specialist medical companies for diabetic sufferers. It was granted SIINCs by the Swiss Company for Improvement and Cooperation (SDC) on the situation that it proceed to serve prospects in lower-income teams, rewarding it for its impression, whereas on the identical time enabling it to tackle non-public funding to develop its exercise. This prevented the corporate from shifting its focus in the direction of higher-income prospects to develop its income, a route it might have pursued with out the motivation supplied by the SIINC grant. |

Troublesome query

The necessity for a grant component in impact-linked finance is at odds with the assumed knowledge that impression buyers could make market-rate returns whereas making a deep social impression. However for iGravity’s Tschan, buyers have to simply accept that having the most effective of each worlds isn’t all the time sensible.

“It’s kind of of a troublesome dialogue, as a result of we’re actually specializing in the impression created and enjoyable the financing phrases. For impression buyers, more often than not, it is the opposite approach round: they need to assure the monetary return and on the identical time, get some social or environmental impression. So I believe what must occur is a little bit of a change of thoughts.”

Transaction prices alone, that are comparatively excessive as a result of offers are small-scale and should be tailored for every social enterprise, could be troublesome to simply accept for an asset supervisor, Tschan says. However for a basis, impact-linked finance is already a giant step ahead from the “minus 100% return” of their conventional grants.

Markus Freiburg (pictured), the co-founder and managing director of the Financing Company for Social Entrepreneurship, a Germany-based advisory agency specialised in serving to social enterprises elevate impression funding (typically impact-linked finance), additionally says that there’s a specific amount of trade-off between the impression created and the extent of economic return that buyers can anticipate.

Markus Freiburg (pictured), the co-founder and managing director of the Financing Company for Social Entrepreneurship, a Germany-based advisory agency specialised in serving to social enterprises elevate impression funding (typically impact-linked finance), additionally says that there’s a specific amount of trade-off between the impression created and the extent of economic return that buyers can anticipate.

For him, whereas the “lockstep mannequin” often works (i.e. the extra lively a social enterprise is, the extra money it makes and the extra impression it creates), there’s a misunderstanding concerning the extent of the monetary return that impression buyers can obtain. “We see many social enterprise funds which might be actually searching for traditional enterprise capital sorts of return – they actually need to have the most effective of each worlds: to beat the market and to save lots of the world concurrently. And in my [experience], this doesn’t occur too typically.”

The holy grail: defining impression

Affect-linked finance nevertheless comes with a standard headache: how do investee and investor know for certain when the impression has been achieved? Affect measurement is “the holy grail for this sector,” says Tschan. However there is no such thing as a straightforward answer: smaller organisations lack capability to measure impression, and the quantity of funding secured (investments vary usually between US$200,000 and $600,000) doesn’t justify spending a lot of it on impression measurement.

Tschan explains that the extent of necessities must be proportionate to the dimensions and capability of the social enterprise, and it’s a matter of balancing the reporting necessities of the donors – who need to belief that their cash is used for impression – with the truth of what social enterprises on the bottom are literally in a position to present.

At DRK Basis, all social enterprises are required to comply with a selected impression measurement methodology – that appears each on the broad consequence (for instance, how many individuals have gained entry to wash water) after which particular concerns (what number of of these had been girls, what number of might enhance their livelihoods in consequence, and many others). The inspiration gives hands-on coaching and assist to assist social enterprises measure impression.

Knocking on doorways

Mutooni stresses that impact-linked finance, regardless of its effectiveness, is but to take off. “The business has been speaking about it for some time, however there’s been totally different levels of utility and execution. So I believe there’s been extra speak than there was observe to this point.”

A serious barrier that impact-linked finance advocates face is the lack of know-how. Some foundations are fairly superior, coaching their employees and speaking about it, however a lot of iGravity’s work, Tschan explains, is to knock on foundations’ doorways to clarify the idea. The agency can also be constructing connections with accelerators to achieve potential investees.

Typically entrepreneurs distrust buyers so it’s important to construct that belief relationship to have the ability to present why that instrument is smart

Mutooni says that in her expertise, few entrepreneurs find out about impact-linked finance, so there’s plenty of work to be carried out in explaining the mechanisms and constructing belief, and a few may also be postpone by the complexity of the product. “Typically entrepreneurs distrust buyers so it’s important to construct that belief relationship to have the ability to present why that instrument is smart,” she explains.

One huge a part of the inspiration’s work, she provides, is reaching out to the high-potential social enterprises which can most profit from impact-linked finance. “Sourcing is the factor that we spend most of our time doing,” says Mutooni.

To speed up the usage of impact-linked finance, Mutooni says, the most effective factor to do is to point out it in motion, by sharing case research – to point out how impression finance works in observe, and why it really works, so individuals can study from this and begin serious about doing the identical. “If we do a deal, we must always share it,” she says. “Speak about it and actually push it into the ecosystem to point out what’s doable.”

This function was produced in partnership with FASE. Lucas Tschan, Kanini Mutooni and Markus Freiburg can be talking about impact-linked finance on Monday 28 March, as a part of subsequent week’s FASE Affect Fireplace Talks. Join this and extra talks right here.

High image: social enterprise Clínicas del Azúcar, which gives inexpensive specialist medical companies for diabetic sufferers in Mexico, benefited from impact-linked finance (credit score: Clínicas del Azúcar)

Thanks for studying our tales. As an entrepreneur or investor your self, you will know that producing high quality work would not come free. We depend on our subscribers to maintain our journalism – so in the event you assume it is value having an unbiased, specialist media platform that covers social enterprise tales, please think about subscribing. You may even be shopping for social: Pioneers Publish is a social enterprise itself, reinvesting all our earnings into serving to you do good enterprise, higher.