This yr it may very well be tougher for People to gauge how large — or small — their tax refund could be.

With pandemic-era modifications gone, many taxpayers may see smaller refunds, particularly lower-income households. However an enhanced credit score included in final yr’s Inflation Discount Act could imply bigger ones for a handful. Different developments — such because the expiration of a key tax break for householders, crypto funding losses, and life modifications — might also have an effect on how large or small a taxpayer’s refund may very well be.

For a lot of People, the scale of their tax refund is essential as a result of it’s usually their largest windfall of the yr that they earmark for financial savings, holidays, debt funds, and even protecting fundamental wants.

“Refunds obtained at tax time might be a chance for a lot of to save lots of, pay down debt, and put money into long-term belongings,” Joanna Ain, affiliate director of coverage for nonprofit Prosperity Now, advised Yahoo Finance. “They will make up as a lot as 30% of a low-income household’s annual revenue.”

Table of Contents

American Rescue Plan advantages expired

The typical refund final yr was $3,176 as of Oct. 28, in line with the newest knowledge out there from the IRS, up practically 13% from $2,815 on the finish of 2021. The rise was largely as a consequence of enhanced credit launched by the American Rescue Act which have now expired.

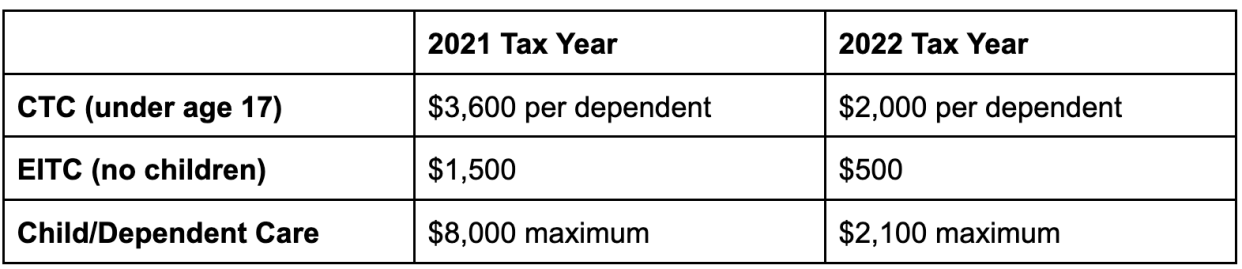

Notably, the Baby Tax Credit score (CTC), Earned Revenue Tax Credit score (EITC), and the Baby and Dependent Care Credit score have returned to pre-COVID ranges.

The improved CTC credit score was not prolonged, so taxpayers can obtain solely $2,000 per youngster dependent in contrast with final tax season’s $3,600. Additionally not like final yr, it’s not refundable, which means taxpayers gained’t obtain the complete credit score if it’s bigger than the tax they owe.

“For the reason that Baby Tax Credit score won’t be refundable in 2022, many households with decrease incomes might be reduce out of the credit score fully,” Ain stated. “In different phrases, the lowest-income households, the households who want it essentially the most, can now not obtain the complete credit score.”

Others who nonetheless qualify for the CTC may very well see a bigger refund this yr, despite the fact that the credit score is value much less. That is as a result of the superior funds for the CTC have additionally disappeared.

“Since there are now not month-to-month funds, people may see a bigger refund quantity at tax time as a result of all the Baby Tax Credit score portion of 2022 will are available in one lump sum throughout tax season,” Ain stated, “slightly than being delivered month-to-month for six months—because it was in 2021.”

Final yr, the EITC revenue threshold was additionally elevated for single filers with no youngsters, with many receiving as a lot as $1,502 for the credit score. That expanded credit score was not prolonged, so eligible single filers with no youngsters qualify for a most of $500 beneath the EITC this tax season.

Equally, the Baby and Dependent Care Credit score — which incorporates out-of-pocket bills for youngster care and day camps — additionally was scaled again for this yr. Final yr, the credit score was value $8,000 for one dependent. This tax season, it’s $2,100.

Different pandemic-era tax breaks went away

As a result of many nonprofits and charities have been impacted by the COVID pandemic, in 2020 the CARES Act allowed single filers and married {couples} submitting collectively to deduct as much as $300 in charitable donations with out having to itemize their return. Married taxpayers submitting individually may deduct as much as $150.

In 2021, that above-the-line deduction was expanded much more. Single filers and people married submitting individually may get a deduction as much as $300, whereas married {couples} submitting collectively may deduct as much as $600.

Taxpayers submitting their 2022 tax returns this yr, they have to itemize utilizing the Schedule A type to deduct any charitable contributions. The above-the-line deduction has been eradicated.

Higher tax break within the Inflation Discount Act

The Inflation Discount Act (IRA) of 2022 elevated the tax credit score for photo voltaic panels from 26% of the prices to 30% and applies retroactively to panels purchased in 2022, with no cap on the credit score and no revenue limitations.

As well as, the act eliminated the principal residence restriction, which means that householders who put in photo voltaic panels on second houses are additionally eligible. This might enhance a refund for householders who put in photo voltaic panels in 2022.

The act, although, made it a bit tougher for drivers to reap the benefits of the Certified Plug-in Electrical Drive Motor Automobile Credit score. Those that purchased a brand new electrical car (EV) final yr are eligible for the credit score, which is value a most of $7,500 relying on the capability of the battery.

Whereas this credit score may enhance a taxpayer’s refund, those that purchased the car between August 17, 2022 and December 31, 2022, should present that the car underwent last meeting in North America to qualify. That requirement doesn’t apply to autos bought earlier in 2022 when the act hadn’t been signed.

Mortgage insurance coverage premium deduction expired

Householders who pay a mortgage insurance coverage premium (MIP) or for personal mortgage insurance coverage (PMI) can now not deduct this on their itemized taxes. Lenders typically require mortgage insurance coverage as safety in case of default for householders who put lower than 20% down when buying a house.

The deduction — which was enacted beneath Part 419 of the Tax Aid and Well being Care Act of 2006 and prolonged yearly via 2021 — was not renewed for the 2022 tax yr and is now not out there for itemization. This may increasingly decrease a refund for impacted householders.

Promoting bitcoin or crypto at a loss

If the crypto winter did injury to your digital belongings, you’ll be able to deduct a few of these losses for those who bought the cash, decreasing your taxable revenue and doubtlessly rising your tax refund.

These losses can first be used to offset any capital features a person could have. If losses exceed the features, taxpayers can deduct as much as $3,000 in capital losses per tax yr in opposition to bizarre earned revenue, corresponding to wages, salaries, and enterprise revenue.

The IRS additionally permits taxpayers to hold ahead any remaining capital losses indefinitely into the longer term, with the restrict of web $3,000 capital loss per yr.

Private modifications

Lastly, one more reason your tax refund could also be greater or smaller this yr is dependent upon your life modifications. Getting married or divorced alters your tax-filing standing, whereas having youngsters or caring for getting older mother and father permits you to reap the benefits of totally different credit.

Any time you may have a serious life occasion, it’s additionally essential to revisit your paycheck withholdings to ensure sufficient is being taken out for taxes, so that you don’t find yourself with a smaller-than-expected refund or, worse, owing the IRS subsequent yr.

“Slightly tax planning now can go a good distance towards serving to you retain extra of your cash,” Dwight Nakata, a licensed monetary planner and CPA at YNCPAs, advised Yahoo Finance. “Take into consideration modifications that occurred in your life which will change your tax methods — like retirement, paying off your mortgage, beginning a brand new enterprise, a brand new youngster, divorce, or loss of life in your loved ones.”

Ronda is a private finance senior reporter for Yahoo Finance and legal professional with expertise in legislation, insurance coverage, training, and authorities. Comply with her on Twitter @writesronda

Learn the most recent private finance tendencies and information from Yahoo Finance.

Comply with Yahoo Finance on Twitter, Instagram, YouTube, Fb, Flipboard, and LinkedIn

Gabriella Cruz-Martinez and Rebecca Chen contributed to this text.