Persons are addicted to bank cards — and it’s no surprise, given the profitable rewards that lots of them supply. However for retailers, bank cards are usually much less interesting. That’s as a result of they’re on the hook for interchange charges, or transaction charges a service provider’s financial institution should pay every time a buyer makes use of a card to make a purchase order. Some interchange charges can exceed 3%.

That obtained Eric Shoykhet and Edward Lando pondering. The 2 entrepreneurs — buddies since their first day as Wharton undergraduates — for years carefully adopted the adoption of open banking and financial institution account-based funds in Europe. They got here to the conclusion the identical factor would in the end transpire within the U.S., and that the timing was proper to launch a stateside startup — Hyperlink — to journey the wave.

“It turned evident via early discussions with companion retailers that [our idea] was a recreation changer for them,” Shoykhet mentioned. “That made us step on the pedal and recruit a product, engineering and gross sales workforce throughout San Francisco, Austin, Miami and New York Metropolis with funds information from a spread of backgrounds.”

Hyperlink claims to be one of many first corporations within the U.S. to allow clients to make on-line funds utilizing their financial institution accounts. Since its founding, it’s attracted curiosity from traders together with Valar Ventures, Tiger International, Amplo, Pareto Holdings, Quiet Capital and Shutterstock co-founder and CEO Jon Oringe. Valar led a $20 million Sequence A funding spherical in Hyperlink whereas Tiger led a $10 million seed spherical; up to now, Hyperlink’s raised $30 million.

“Hyperlink successfully combines the very best of playing cards with the advantages of ACH through open banking,” Shoykhet advised TechCrunch in an e-mail interview. “From day one, Hyperlink targeted on constructing an enterprise-grade answer that’s all the time accessible and works as anticipated each time so retailers can belief us with their fee processing,”

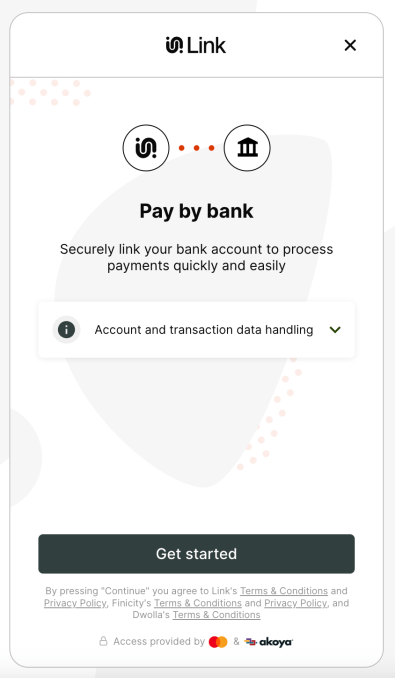

Retailers can construct Hyperlink into their present buy flows, whether or not web- or app-based. (Hyperlink additionally provides a Shopify app.) Alternatively, retailers can settle for funds through a Hyperlink-hosted checkout web page utilizing a “dynamic hyperlinks” function to generate and share fee hyperlinks with clients.

Hyperlink clients pay by financial institution switch, sending funds straight from their financial institution to a service provider’s enterprise account. Hyperlink ensures the funds, taking over clients’ credit score threat — an AI mannequin tries to determine probably fraudulent or dangerous transactions earlier than they’re processed.

The Hyperlink expertise. Prospects join with their checking account data and pay throughout the move.

“We provide numerous dashboards that enable retailers to simply monitor fee exercise, generate experiences and extra,” Shoykhet mentioned. “We additionally supply APIs for retailers which have particular must devour their transaction knowledge in a sure method.”

Hyperlink is promising quite a bit, together with diminished chargebacks, diminished churn and protection of roughly 95% of all financial institution accounts within the U.S. Whether or not it delivers on all these fronts stays to be seen, however many retailers — who collectively paid $25 billion in charges final yr — seem satisfied. Shoykhet says that Hyperlink is already processing “a number of billion” in fee quantity for manufacturers together with Misfits Market, Play By Level, Thrivos and Passport Parking.

“LinkPay is a fancy product that entails interacting with a number of third-party companies and managing the state of transactions. Nonetheless, this complexity is hidden behind a easy software program growth equipment, which is what issues to retailers most,” Shoykhet mentioned.

Shoykhet acknowledges that there’s formidable competitors within the funds area — not solely from incumbents like Venmo, Amazon and PayPal however from purchase now, pay later distributors equivalent to Afterpay and Klarna. Just lately, Uncover dove into the accounts-to-accounts area, partnering with funds fintech Purchase It Mobility in order that its companion retailers can settle for card-free funds,

One report has the digital funds market rising to a whopping $20 trillion by 2026, pushed each by new and present distributors. Different knowledge suggests quantity on ACH — the spine of U.S.-based digital cash and finance knowledge transfers — elevated 8.7% year-over-year alone in 2021, and that transactions facilitated by open banking might hit $116 billion globally by 2026. However Shoykhet welcomes the rivalry.

“LinkPay itself has extraordinarily restricted competitors within the U.S. at present. There is just one different supplier providing one thing comparable — Trustly — nonetheless, their fundamental geographic focus is Europe,” Shoykhet mentioned. “[That said,] we anticipate pay-by-bank and account-to-account taking share as retailers look to cut back their funds prices.”

To Shoykhet’s credit score, he’s not the one one predicting an increase in account-to-account funds quantity. In its 2020 International Funds Report, FIS’ predicted that account-to-account transfers would make up 20% of world ecommerce funds by this yr. And the Open Banking Implementation Entity within the U.Okay., which creates the software program requirements to attach banks and fintech corporations, reported a 232% improve from March 2021 to March 2022 in “open banking”-enabled account-to-account funds; an estimated 45% of all shopper electronics funds in Europe are actually bank-based.

Requested about macroeconomic headwinds, Shoykhet mentioned that he doesn’t anticipate a serious impression to Hyperlink’s enterprise. He declined to disclose income, however — in a probably encouraging signal — he mentioned that Hyperlink plans to develop its workforce from 40 individuals to 60 by the top of 2023.

“We began within the pandemic, so there isn’t a measurable impression,” Shoykhet added. “An financial slowdown is prone to speed up adoption of pay-by-bank and Hyperlink as corporations look to chop prices and focus extra on profitability.”

With the funds from the recently-closed Sequence A, Shoykhet says that Hyperlink will launch account verification, which can confirm financial institution accounts and possession data to convey retailers in compliance with Nacha’s new account validation rule. (Nacha is the group that manages the event and governance of the ACH community.)