The Nationwide Agriculture Statistics Service (NASS) just lately launched county yields. NASS county yields will not be the identical yields that shall be used to calculate Agriculture Threat Protection on the county degree (ARC-CO) funds, or to find out indemnities from the Supplemental Protection (SCO) and Enhanced Protection Choice (ECO) insurance coverage insurance policies. Nonetheless, they supply useful indicators of the prospect of funds. General, Illinois farmers shouldn’t anticipate ARC-CO funds for corn or soybeans. ECO on the 95% protection degree may make funds for corn in some counties of northwest Illinois. ECO-95% may pay on soybeans in a number of southern Illinois counties. ARC-CO, ECO, and SCO probably will set off funds in lots of North Dakota, South Dakota, and Minnesota counties.

Table of Contents

Corn Yields in Illinois

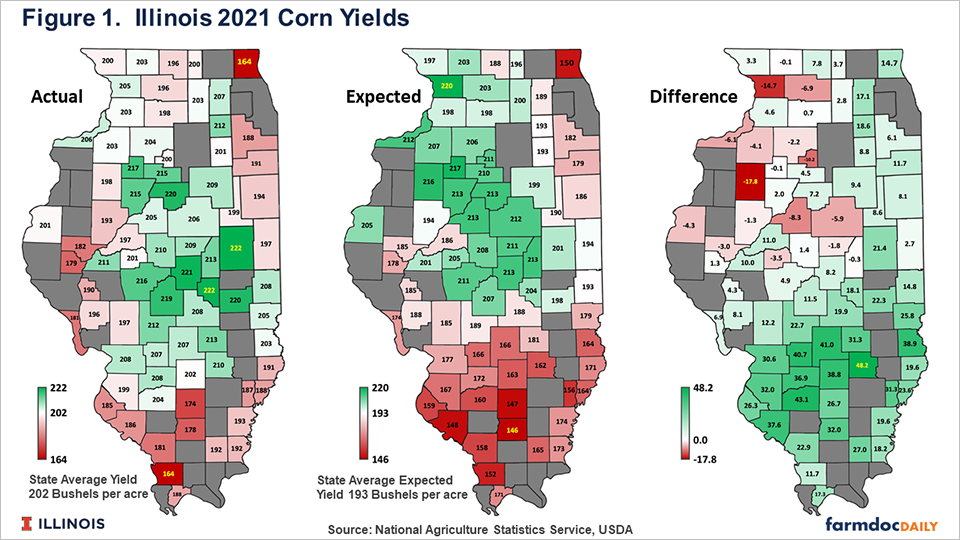

Determine 1 reveals a collection of three maps of Illinois counties. The left map, labeled “Precise,” offers 2021 county yields reported by the Nationwide Agriculture Statistics (NASS), an company of the U.S. Division of Agriculture. The best 2021 yields occurred in east-central Illinois: 222 bushels per acre in Champaign and Moultrie counties. The bottom yield of 164 bushels per acre occurred in Lake County (Northeast Illinois) and Union County (southern Illinois).

The center map is labeled “Anticipated”, giving the anticipated or pattern yields for 2021 earlier than any data was identified or realized concerning the 2021 rising season. If 2021 might be repeated many instances, the common of the ensuing yields can be near the pattern yield. These pattern yields are based mostly on linear regressions of the yields from 1972 to 2020. A 2021 pattern yield is then an extension of the pattern line match by information as much as 2020.

The proper-most map, labeled “Distinction,” offers the precise yield minus the pattern yields. Counties with above-trend yields had a great yr relative to expectations, whereas these with below-trend had a yr under expectations. In Illinois, yields had been above expectations in japanese and southern Illinois. The county with the very best distinction of 48.2 bushels was Clay County. The precise yield of 210 bushels per acre in Clay County was 48.2 bushels per acre larger than the pattern yield of 162 bushels per acre.

In Illinois, yields had been under pattern in northwest Illinois (see Determine 1). The bottom distinction of -17.8 bushels per acre occurred in Knox County. Carroll County, subsequent to the Mississippi River in Northern Illinois had the subsequent largest unfavorable distinction at -14.7 bushels per acre.

2021 ARC-CO Funds: Agriculture Threat Protection on the county degree (ARC-CO) is a Commodity Title alternative that could be a county income program. Funds happen when county income is under 86% of benchmark income. County income in 2021 equals 2021 county yield instances 2021 Market Yr Common Worth (MYA) worth, neither of that are identified. The Farm Service Company (FSA) doesn’t use NASS yields in its calculation if crop insurance coverage information is offered. In these circumstances, county yields are based mostly on crop insurance coverage information from the Threat Administration Company (RMA). The 2021 MYA worth relies on nationwide costs from September 2021 by August 2022.

Whereas not utilized in FSA calculations, NASS county yields in Determine 1 will present a great indication if 2021 ARC-CO funds will happen. The March 2022 World Agriculture Provide and Demand Estimate (WASDE) report contained an estimate of the 2021 MYA worth at $5.65 per bushel. If the 2021 MYA worth is $5.65, then the 2021 county yield have to be under 56% of its county yield (see appendix for the derivation of the 56%). Not one of the variations in Determine 1 would lead to an precise yield under 56% of its benchmark yield. Take Knox County, the county with the most important deviation under pattern, for example. Knox County’s ARC-CO benchmark yield is 232.5 bushel per acre, that means that the 2021 precise yield would should be under 130 bushels per acre earlier than ARC-CO makes a cost. The 2021 NASS yield is 198 bushel per acre, properly above the ARC-CO break-even yield. Due to this fact, this can be very uncertain that the county yield for ARC-CO will differ sufficient from 198 bushels per acre to set off an ARC-CO cost.

2021 ECO and SCO funds: Crop insurance coverage has two county degree merchandise that present county-level safety above the COMBO merchandise, resembling Income Safety (RP), RP with harvest worth exclusion (RPhpe), and Yield Safety (YP). These choices are:

- Supplemental Protection Choice (SCO) protects from 86% right down to the protection degree of the COMBO product.

- Enhanced Protection Choice (ECO) offers safety from both 90% or 95% to 86%.

The SCO and ECO choice takes the type of the underlying COMBO product. If the underlying product is RP, SCO and ECO; the 2021 insurance coverage assure will use the upper of the harvest worth reasonably than the decrease projected worth.

SCO and ECO funds will not be generally known as the Threat Administration Company (RMA) has not launched county yields. RMA’s county yields shall be based mostly on crop insurance coverage yields, which is able to differ from the NASS yields introduced above. Nonetheless, the variations between precise and pattern yields in Determine 1 will point out variations in RMA yields from RMA anticipated yields.

For 2021, the projected worth was $4.58 per bushel, and the harvest worth was $5.37 per bushel. Given the upper harvest worth, ECO and SCO with RP because the underlying product will set off underneath the next situations:

- ECO with a 95% protection degree will set off when the 2021 county yield is under 95% of the anticipated county yield. Two counties have precise NASS yields under 95% of their anticipated yields (see determine 1): Knox and Carrol counties. There’s a chance that these two counties set off funds for ECO-95%.

- ECO with a 90% protection degree will set off when the 2021 county yield is under 90% of the anticipated county yield. Not one of the counties have precise NASS yields under 90% of anticipated yields.

- SCO will set off when the precise county yield is 86% of the anticipated yield. Not one of the counties have precise NASS yields under 86% of anticipated yields.

When RP is the underlying product, ECO may set off in some counties in northwest Illinois since cost relies solely on a decline in yield. Equally, ECO with an underlying YP contract may pay in those self same counties. Nevertheless, ECO with an underlying RPhpe coverage probably won’t set off as a result of RPhpe doesn’t have a assure enhance provision permitting the upper harvest worth for use within the assure calculation.

Soybean Yields in Illinois

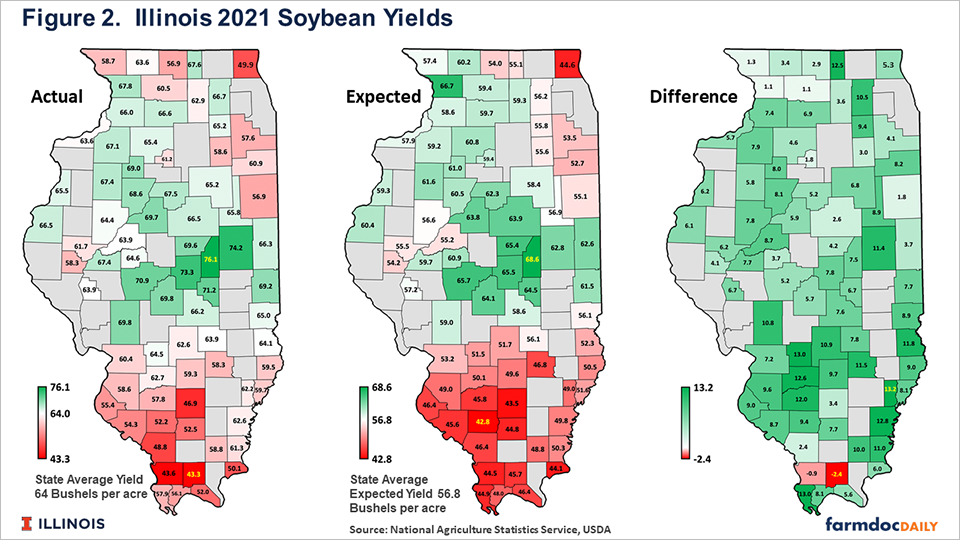

Determine 2’s format is much like Determine 1 however reveals soybean yields reasonably than corn yields. As proven within the left map of Determine 2, precise yields ranged from a excessive of 76.1 bushels per acre for Piatt County (central Illinois) to a low of 43.3 bushels per acre for Johnson County (southern Illinois). Anticipated yields vary from 68.6 for Piatt county to 42.8 bushels per acre for Perry Counties (proper map in Determine 2).

Besides for 2 counties, all Illinois Counties had precise yields above anticipated. The best distinction of 13.2 bushels per acre occurred in Edwards County (southeast’s Illinois) with a 62.2 precise yield and a 49.0 anticipated yield, giving the 13.2 distinction. The 2 counties with under pattern yields had been Union (-.9 bushels per acre) and Johnson Counties (-2.4 bushels per acre).

2021 ARC-CO Funds: The 2021 MYA worth projection contained within the March 2022 WASDE report was $13.25 per bushel, above the 2021 ARC-CO benchmark worth of $8.95. Given the 2021 MYA worth projection, precise county yield must be under 58% of benchmark yields (see appendix for derivation of .58). Illinois county yields won’t have these massive yield declines from anticipated ranges.

SCO and ECO Funds: The 2021 harvest worth for soybeans is $12.30, above the $11.87 projected worth for 2021. Consequently, RP-related merchandise may have a rise of their assure. Yield shortfalls then can generate SCO and ECO funds. Union and Johnson Counties may set off funds on the 95% protection degree for ECO, with RP and YP because the underlying product.

Nationwide Corn and Soybean Yields

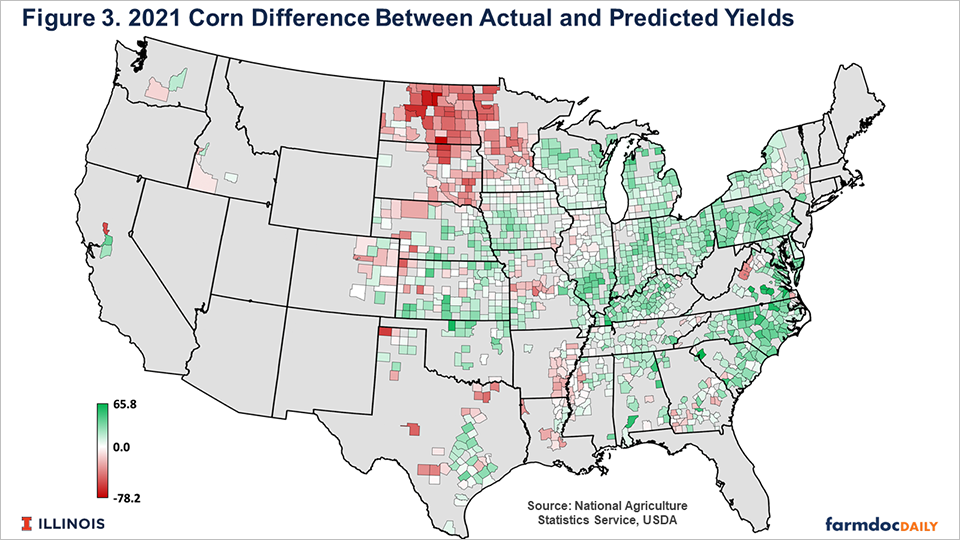

Nationwide analyses had been performed much like that for Illinois. Determine 3 reveals the distinction between precise and anticipated values for corn. These counties in inexperienced have precise yields above pattern, whereas crimson counties counsel yields under pattern. Most counties have yields above pattern, with notable expectations. The drought that impacted the northern Nice Plains is clear, with many counties in North Dakota, South Dakota and Minnesota having yields under 60% of anticipated yields.

ARC-CO for corn may make funds in lots of of those North Dakota, South Dakota, and Minnesota counties. Equally, ECO and SCO may additionally set off funds in these counties. Any county with a below-trend yield — counties with crimson shade — have the potential to obtain ECO funds.

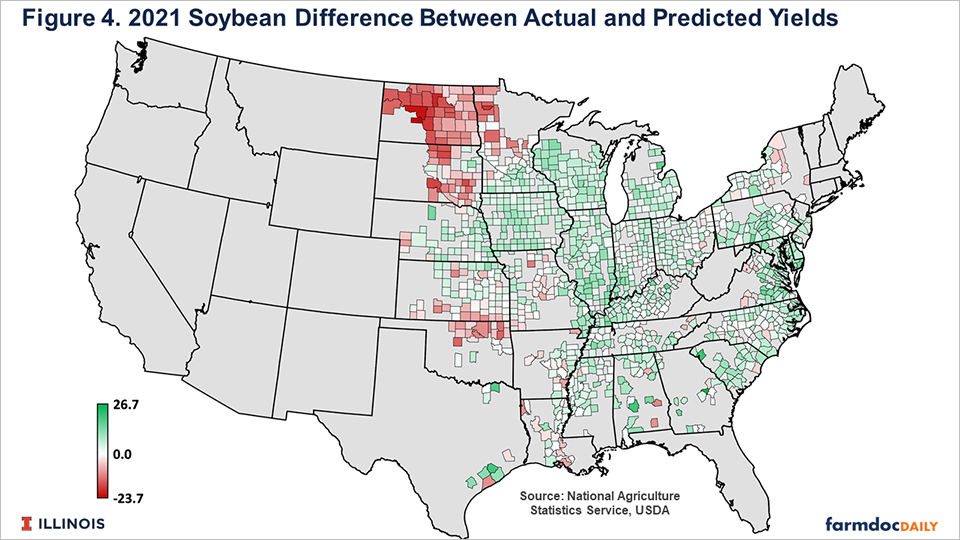

Determine 4 reveals the distinction between precise and pattern yields for soybeans. Once more, most counties have yields above pattern, with notable exceptions. The drought in North and South Dakota is clear, with many counties having precise yields lower than 60% of anticipated yields. Additionally, counties alongside the Kansas-Oklahoma border had yields considerably under pattern.

ARC-CO for soybeans may make funds in lots of North Dakota, South Dakota, and Minnesota counties. Equally, ECO and SCO may make funds in these counties. Any county with a below-trend yield — counties with crimson shad — has a excessive potential to make an ECO cost.

Abstract

In Illinois, 2021 corn yields had been usually above pattern apart from counties in northwest Illinois. Consequently, it’s uncertain that ARC-CO will make funds for corn in Illinois. Equally, soybean yields had been above anticipated for many of Illinois, and ARC-CO funds shouldn’t be anticipated. ECO may make funds in a small variety of counties if bought on the 95% protection degree with an underlying RP or YP product.

Many of the U.S. had above pattern yields for corn and soybeans, with the notable exception of the Dakotas and Minnesota. Yields had been low sufficient in these areas that ARC-CO may set off funds. ECO and SCO may additionally make funds in these areas.

Appendix: Calculation of break-even yields ratios for ARC-CO

A yield ratio could be calculated under which ARC-CO will make funds. ARC-CO will make funds when precise income is under the assure:

.86 x benchmark yield x benchmark worth < precise county yield x MYA worth

Rearranging phrases offers:

.86 x (benchmark worth / MYA worth) < (precise county yield / benchmark yield)

For corn in 2021, the benchmark worth is $3.70 and the March 2021 estimate of the 2021 MYA worth is $5.65, giving

.56 < (precise county yield / benchmark yield)

For corn, the precise county yield must be 56% of the benchmark yield earlier than funds happen.

For soybeans in 2021, the benchmark worth is $8.95 and the 2021 MYA worth is estimated at $13.25, giving

.58 < (precise county yield / benchmark yield)

For soybeans, the precise county yield must be 58% of the benchmark yield earlier than funds happen.

The .56 worth for corn and .58 for soybeans applies to your entire U.S. These may change if the MYA differ from March WASDE projections.