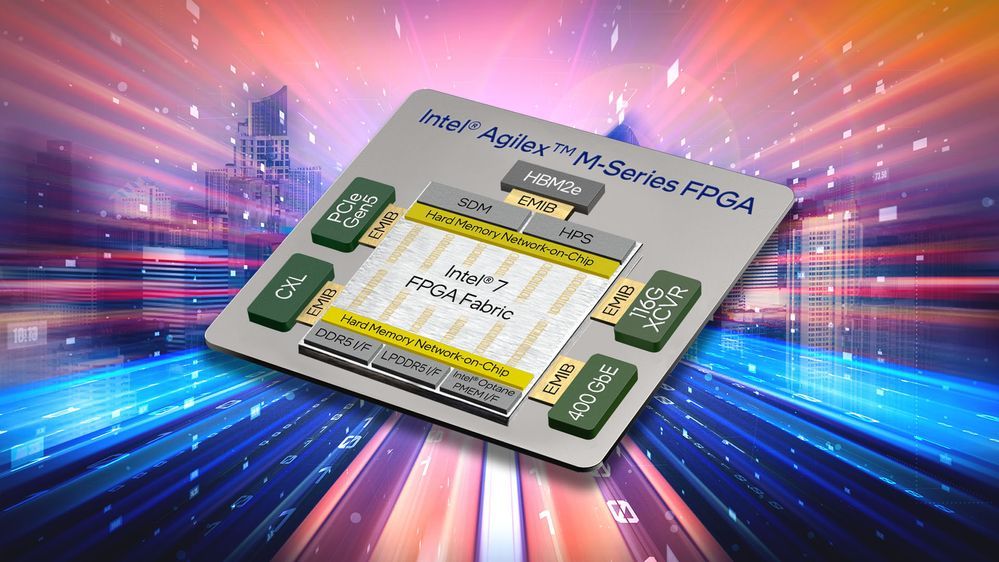

Intel introduced its new Agilex M-Sequence of FPGA (Discipline-Programmable Gate Array) merchandise, and on the similar time gave some very fascinating positioning towards cryptocurrency mining. Intel is claiming a number of “world-firsts” with the Agilex M-series, together with utilization of the Intel 7 (beforehand Intel 10 nm) manufacturing course of, assist for as much as 32 GB HBM2e DRAM (through twin reminiscence stacks), and a 60% efficiency enhance in comparison with previous-generation Stratix FPGAs. No claims on cryptocurrency mining efficiency had been made by Intel, nevertheless.

Designed by Intel’s Programmable Options Group (PSG), which included the expertise and design IP from Intel’s $16.7 billion Altera acquisition again in 2015, the brand new Agilex M-Sequence promise to supply the very best reminiscence bandwidth within the trade. That is because of a pair of HBM2e stacks configurable as much as 32 GB, which give as much as 820 GBps in reminiscence bandwidth (410 GBps per stack). That would show notably helpful for Dagger Hashimoto / Directed Acyclic Graph (DAG) workloads regularly related to cryptocurrency mining, e.g. Ethereum.

Moreover, intel says its new Agilex M-Sequence are the primary FPGAs supporting cache and reminiscence coherency with Intel’s Xeon CPUs through the Compute Specific Hyperlink interconnect customary. Agilex-M FPGAs are additionally the world’s solely options able to working with three sorts of reminiscence: HBM2e, DDR5, and Intel Optane — although to be honest, Intel has locked different distributors out of Optane implementations prior to now.

The brand new Agilex M-Sequence FPGAs supply the trade’s highest reminiscence bandwidth for an FPGA, because of the inclusion of HBM2e reminiscence and an exterior DDR5/LPDDR5 reminiscence financial institution, all managed through Agilex M’s hardened reminiscence controllers. Intel additionally claims the trade’s highest Digital Sign Processing (DSP) compute capabilities in an HBM-enabled FPGA, although word that Intel does not declare the very best compute density in non-HBM-enabled FPGAs.

The identical is true concerning Intel’s effectivity claims. The corporate says its Agilex M merchandise supply over twice the material efficiency per watt vs aggressive 7nm FPGAs (learn, Xilinx’s Versal). The satan, as at all times, is within the particulars: Intel is not claiming twice the efficiency per watt of its competitor’s choices, solely material effectivity, seemingly boosted by the corporate’s utilization of its EMIB expertise.

That is the primary time an Intel FPGA product is being marketed towards cryptocurrency-related workloads, and it is the second Intel product in a single month seeking to enter the blockchain area, after Intel’s Bonanza Mine ASIC (Software-Particular Built-in Circuit) was made public. Intel appears to be adopting a broader technique with regards to blockchain workloads, and the corporate will likely be providing not less than three distinct product segments that serve this area. Whereas the Bonanza Mine ASIC and its subsequent iterations are a given, the brand new Agilex M-Sequence FPGAs are additionally joined by Intel’s upcoming Arc Alchemist, which, as the corporate identified, will supply full efficiency in cryptocurrency mining workloads.

That Intel is advertising FPGAs for mining workloads does not detract from the extra standard use-cases for these chips, which embrace compute, cloud-to-edge infrastructure, pervasive connectivity, and AI. FPGAs are notably desired on account of their excessive flexibility, which permits for companies to rapidly iterate on semiconductor designs on the identical piece of silicon, as a substitute of spending the assets in a number of tape-outs of various approaches, options, and levels of a given chip’s design.

It’s fascinating that Intel is broadening the attraction of its FGPAs towards markets they beforehand weren’t in. That is occurring in opposition to the backdrop of the apparently diminishing competitiveness of its Altera-based merchandise in comparison with these made by Xilinx, which was just lately acquired by AMD, turning it into a much bigger firm (by market capitalization) than even Intel.

By itself, Xilinx showcased an especially spectacular 2021, raking in $3.15 billion in income for a cool 20% enhance YoY. Intel’s PSG group, in distinction, introduced in $1.9 billion in income, with solely a 4% income enhance YoY, signaling that the market discovered Xilinx’s choices to be preferable over Intel’s options. Nonetheless, Intel claimed that its PSG group might have introduced in an extra $500 million in income had been it not for the provision constraints felt all through the semiconductor market at massive — provide constraints that curiously weren’t talked about in Xilinx’s personal earnings report.

It stays to be seen if Intel’s “new” FPGA market, blockchain, will account for something greater than a product launch advertising transfer, or if the corporate’s options can certainly deliver added worth to a market dominated by ASICs.