yujie chen/iStock Editorial through Getty Pictures

Lloyds Banking Group (NYSE: LYG) will face new headwinds from weaker financial development and inflationary pressures following the Russian invasion of Ukraine. The financial institution delivered a powerful turnaround in income final 12 months, however the earnings momentum might stall attributable to an increase in credit score prices and a decrease rate of interest outlook over the medium time period.

Table of Contents

2021 Outcomes

Buoyed by a sooner than anticipated restoration within the UK financial system, Lloyds’ full-year income greater than quadrupled to £5.9 billion (~$7.7 billion). Its return on tangible fairness (RoTE), a key measure of profitability, rose to 13.8% – its highest degree for greater than a decade.

The discharge of £1.7 billion (~$2.2 billion) which had been beforehand put aside as mortgage loss provisions was by far the necessary issue for the rebound in profitability. And this was solely made attainable by the development within the UK’s macroeconomic outlook over the previous 12 months, which decreased the probability that debtors would default on their loans. The underlying impairment credit score for the 12 months was £1.2 billion (~$1.6 billion), in comparison with a £4.2 billion cost recorded in 2020 (~$5.5 billion).

However, higher-than-expected remediation prices for compliance failings induced Lloyds to miss analysts expectations on earnings. The Group reported an additional £1.3 billion (~$1.7 billion) cost with respect to historic fraud at its HBOS Studying department, previous dwelling insurance coverage renewals and different legacy points.

Medium-Time period Targets

Following a powerful set of outcomes, new administration steerage for its medium-term profitability was issued – RoTE is now anticipated to be greater than 10% from 2024 onwards, rising to above 12% by 2026.

As well as, it expects to ship the next:

-

Generate further revenues from strategic initiatives of round £0.7 billion (~0.9 billion) by 2024 and greater than double that to round £1.5 billion (~$2.0 billion) by 2026

-

Enterprise-as-usual prices flat in 2024 versus 2021, with a cost-to-income ratio of lower than 50% by 2026

-

Asset high quality ratio to be lower than 30 foundation factors over 2022 to 2024

-

Capital technology of round 150 foundation factors each year over 2022 to 2024, bettering to 175 to 200 foundation factors by 2026.

2022 Steering

The financial institution additionally gave steerage for the present monetary 12 months. For 2022, the financial institution expects:

-

Banking web curiosity margin to be above 260 foundation factors

-

Working prices of round £8.8 billion (~$11.5 billion) on the brand new foundation, with the rise from the 2021 equal of £8.3 billion (~$10.9 billion)

-

Asset high quality ratio to be round 20 foundation factors

-

RoTE of round 10%

-

Danger-weighted belongings on the finish of 2022 to be round £210 billion (~$275 billion)

Actual Family Incomes

The UK lender could discover it tougher to attain these targets following the Russian invasion of Ukraine. Spiraling commodity costs, amid provide considerations for key industrial and agricultural commodities, has clouded the restoration prospects of the UK financial system.

The current drop in long-dated sterling-denominated bond yields and a flattening of the yield curve suggests the probability of a recession is now considerably greater. Even when a recession doesn’t materialize, Lloyds can be impacted by a slower tempo of central financial institution fee hikes and longer for longer rates of interest.

It is because, as actual family incomes within the UK can be squeezed by the upcoming provide shock, mortgage demand and affordability can be impacted. Analysts anticipate family vitality payments might soar to greater than £3,000 (~$3,900) a 12 months from October this 12 months, up from round £1,200 (~$1,600) at the moment. Moreover, inflationary pressures from meals costs, freight prices and different industrial commodities would have an effect on virtually each different class of client spending.

On the similar time, deliberate tax will increase are additionally set to chunk – with the 1.25 proportion level enhance to Nationwide Insurance coverage contributions, the UK’s social safety scheme, attributable to take impact from April 6, 2022.

These pressures will seemingly take its toll on expectations for financial development, unemployment charges and home value development; and in flip, this may influence mortgage demand, charge income development and credit score high quality.

Curiosity Price Tailwinds

As issues stand, it’s nonetheless attainable for Lloyds to hit its medium-term RoTE targets. The rising rate of interest setting will nonetheless be a really significant tailwind, whilst expectations have not too long ago been pared again.

The construction of the stability sheet and low pass-through of fee hikes to depositors makes Lloyds notably delicate to rate of interest adjustments. An upwards parallel shift of fifty foundation factors within the rate of interest curve is predicted so as to add round £375 million (~$490 million) in web curiosity earnings within the first full 12 months. The cumulative profit would rise to round £800 million (~$1.0 billion) after three years.

Estimated cumulative influence to web curiosity earnings from parallel shifts within the rate of interest curve (£ tens of millions)

| 12 months 1 | 12 months 2 | 12 months 3 | |

| +50bps | 375 | 525 | 800 |

| +25bps | 200 | 275 | 400 |

| -25bps | (425) | (525) | (650) |

Supply: Lloyds Banking Group 2021 Outcomes Presentation

Administration’s rate of interest outlook seems to be conservative. Its base financial case places the Financial institution of England base fee at 1.0% by the top of the 12 months, suggesting a 75 foundation level enhance in 2022. This may be equal to 3 quarter-percentage level fee hikes (two extra following the February quarter-point enhance) – decrease than what many analysts predict and what the futures markets are pricing in for.

Presently, a complete of 4 quarter-point fee rises are priced in for 2022, down from 5 to 6 in February. This ought to be sufficient to offset a modest enhance in credit score prices and barely slower income development. In fact, this might all change if the chance of a recession continues to extend.

Downward Revisions

It will be tougher to attain its 2022 12 months steerage although, as the good thing about greater rates of interest takes a while to completely feed into its backside line. It’s due to this fact extra onerous that the financial institution achieves its asset high quality ratio goal of round 20 foundation factors within the 12 months, with the intention to meet its shorter-term RoTE goal of 10%. And this may be actually difficult amid a deterioration within the macroeconomic setting.

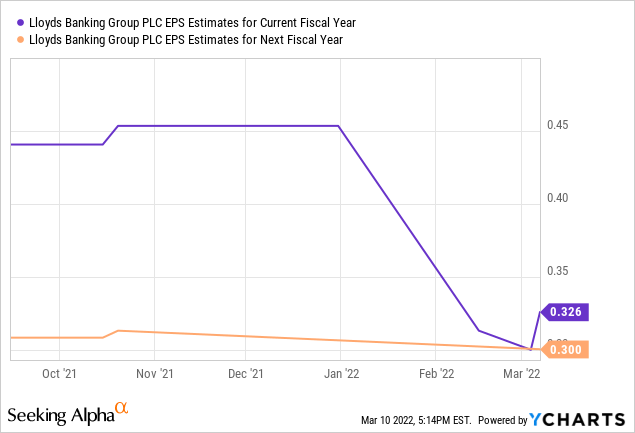

Assembly buyers’ expectations would then be much more tough. Proper now, the consensus forecast for earnings in 2022 and 2023 suggest the financial institution is predicted to generate a RoTE in extra of 11% in every of the subsequent two years. Reaching this greater profitability goal degree would seem like depending on the price of danger remaining traditionally very low, maybe, even requiring additional provision releases.

Additional downward revisions in earnings estimates are seemingly nonetheless to come back.

Enterprise Enlargement

To assist ship development within the medium time period can also be Lloyds’ bold plan to generate new sources of income. The technique includes increasing its mass prosperous wealth administration providing, broadening its finance proposition to draw greater company shoppers and scaling up Citra Dwelling, its non-public dwelling rental enterprise.

Administration expects the proposed strategic initiatives so as to add practically 10% to its annual revenues by 2026. However not like the good thing about greater rates of interest, these moreover revenues gained’t translate one-to-one to its backside line, attributable to greater working bills and funding prices wanted to develop these new enterprise strains.

Nonetheless, with restricted development prospects within the core retail lending enterprise, the financial institution is eager to place its extra capital technology to growth, fairly than merely return extra capital to shareholders. New income sources would additionally enhance diversification and develop its share of revenues from charges and commissions, lowering its sensitivity to rates of interest.

The financial institution definitely has the ecosystem and buyer relationships that it could actually leverage on to broaden its providing, which might give it a aggressive benefit over present rivals.

That stated, execution dangers are elevated. The group has lengthy struggled to search out new sources of development. That’s the reason, after failed forays into funding banking and worldwide growth earlier than the monetary disaster of 2007/8, the financial institution retreated to deal with its core retail banking operations within the UK, an space the place it has been a transparent market chief.

Lloyds’ current three way partnership with Schroders within the monetary planning and wealth administration market nonetheless has lots to show. It attracted simply £0.3 billion (~$0.4 billion) in web new enterprise in 2021 – simply roughly equal to its web outflows within the earlier 12 months.

Last Ideas

The earnings outlook for Lloyds Banking Group seems to be lots much less enticing than from just some weeks earlier. As a retail lender, its fortunes can’t be disentangled from the pressures confronted by its clients or the broader macroeconomic setting.

Though rate of interest tailwinds ought to nonetheless be an enormous driver to a restoration in its pre-provision profitability, it appears for now that the dangers are skewed in the direction of the draw back.