Insurance coverage firms paid out billions for the 2021 Texas winter storm. How will that have an effect on your charges now?

DALLAS — A full 12 months after the devastating winter storm of February 2021, the prices are nonetheless including up.

The largest insurance coverage payouts (web page 16 right here) had been in Harris County (about $1.74 billion), adopted by Dallas County ($1.28 billion) and Tarrant County ($771.3 million). Travis County claims accounted for the fourth largest insurance coverage payout whole ($751.4 million), adopted by Collin County ($576.2 million) and Denton County ($392.4 million).

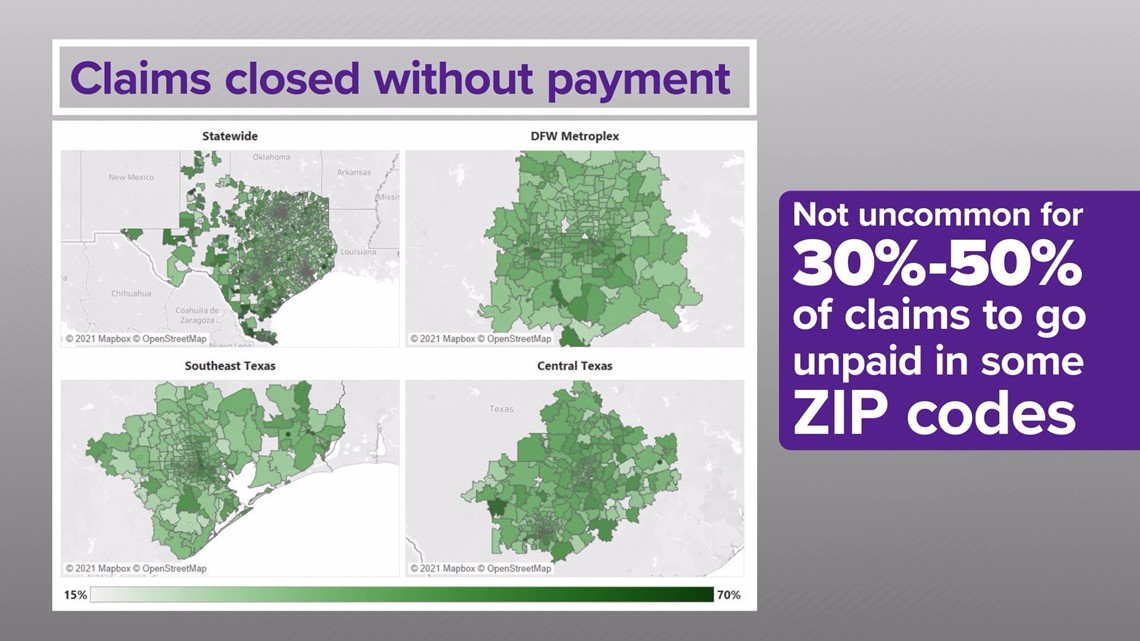

In whole, insurance coverage firms in Texas doled out $10.3 billion to cowl their clients’ damages from that storm. That’s some huge cash, however have a look at these maps on web page 44 right here. Satirically, the darker shades of inexperienced on these maps don’t point out more cash. These are the locations the place insurance coverage firms closed extra claims with out paying.

In some situations, between 60% and 70% of claims in a selected space had been closed with out insurance coverage fee. And it appears pretty widespread that 30% to 50% of claims went unpaid in lots of ZIP codes.

The underside line there’s that many individuals who had injury and had protection needed to pay for it themselves.

Even when your declare was paid – or if you happen to didn’t make a declare (and that features most of us) – you should still pay for that storm within the type of increased residence and auto insurance coverage charges. That is very true relying on the place you reside.

You understand how actual property is about location, location, location? Insurance coverage is, too.

A part of how insurers consider how dangerous you’re – and due to this fact how costly your premium needs to be – is by taking a look at your ZIP code and tallying up what number of claims have been filed by the individuals round you.

On web page 38 right here, there are extra maps from the 2021 winter storm. The darker the shade of inexperienced, the extra claims. And on web page 40 right here, the darker the shade of inexperienced, the more cash insurance coverage firms paid.

Folks with the high-dollar properties are getting it the worst, based on regionally based mostly MarketScout. They examined insurance coverage charges after final 12 months’s storm and located that householders premiums are up 5% to 12% for individuals in homes valued at $1.5 million and up.

The rationale: Loads of these properties have hearth sprinklers – in some circumstances that’s required – and we all know how nicely water pipes fared in that deep freeze.

MarketScout discovered post-storm premium will increase of three% to five% for properties valued $200,000 to $400,000. And that doesn’t even tackle what might need occurred together with your auto insurance coverage charges due to that storm.

If you wish to examine the declare numbers and the injury losses from the 2021 winter storm in your ZIP code, that is the hyperlink… and under is a brief tutorial for tips on how to discover the numbers in your ZIP code. Relying on the claims in your space, it might have an effect on your insurance coverage charges.