Mastercard

It occurs to many people in some unspecified time in the future — a month-to-month invoice comes due however the cost does not undergo as a result of the funds aren’t accessible on time. For a small month-to-month cost, resembling a division retailer invoice, it is an annoyance that could possibly be resolved with a telephone name (with an extended ready time to succeed in customer support). However for bigger month-to-month funds which might be extra impactful to at least one’s credit score rating, resembling hire, mortgage, or scholar loans, a lacking or late cost will be painful, not only for the delinquent payer, however for the corporate anticipating the cost, as either side try to discover a method to finalize the transaction — usually with a large late payment connected to it.

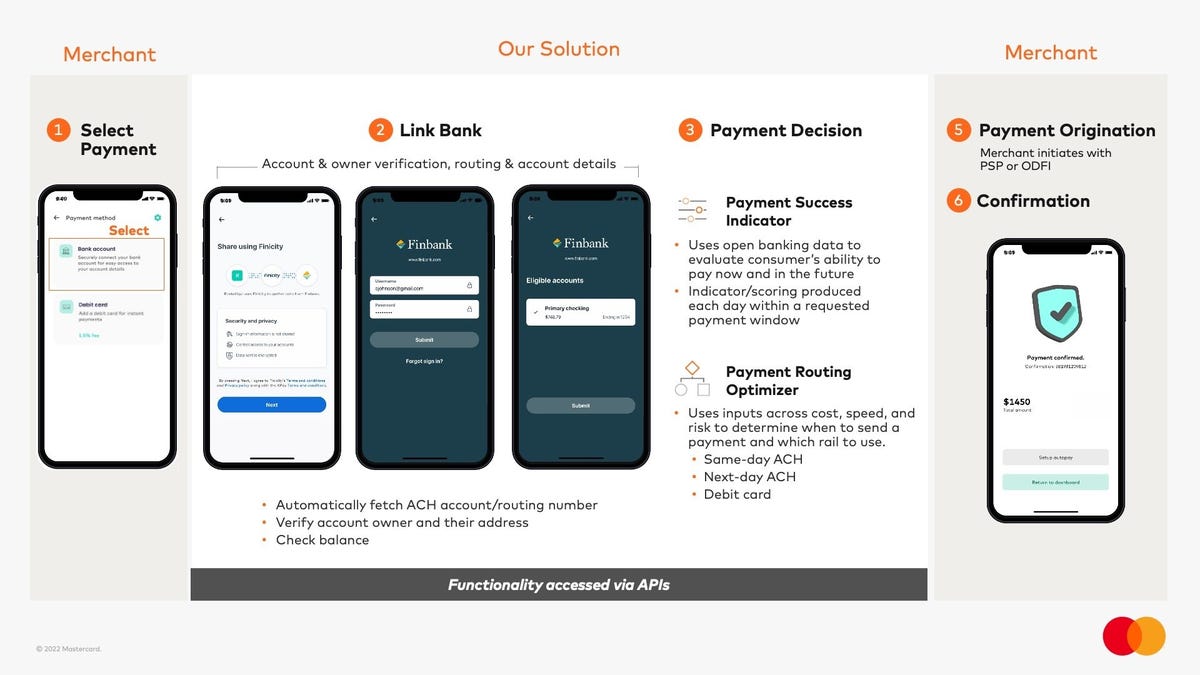

However now, as a part of its initiative to make the most of open banking options — utilizing superior knowledge analytics and machine studying instruments — Mastercard as we speak introduced the introduction of two Good Cost Decisioning instruments beneath its Finicity open banking division, that may assist facilitate cost transactions extra seamlessly and securely: Cost Success Indicator and Cost Routing Optimizer. “It is all about shopper comfort, offering shopper alternative and actually listening to shoppers’ wishes to have entry to completely different safety varieties and ease of use — that is on the middle of those information instruments,” says Silvana Hernandez, senior vice chairman of Digital Funds for Mastercard in an interview with ZDNet.

The kind of cost rail on the middle of Mastercard’s new Good Cost Decisioning instruments is the Automated Clearing Home, or ACH Community, used for automated invoice funds, brokerage account deposits, and direct payroll deposits. Hernandez advised ZDNet that when growing its instruments, Mastercard found by its analysis that ACH funds, whereas gaining recognition within the period of digital banking, nonetheless have many ache factors that have an effect on each shoppers and retailers.

The 2 most prevalent ache factors for ACH funds are the complexity of creating ACH funds (discovering and coming into account and routing numbers appropriately) and clients having inadequate funds on the time the cash is withdrawn, often as a result of they do not have sufficient money of their account on the time the transaction is due (improper timing of money move and stability of their account). “It has to do with the essential incontrovertible fact that ACH has a latency course of; you set off a transaction as we speak, but it surely will not settle within the subsequent two to 5 days, and in order that creates a timing mismatch that is painful for each retailers and shoppers,” says Hernandez, who provides that retailers are affected with heavy operational burdens together with managing groups to trace down late funds.

The way it works

Cost Success Indicator and Cost Routing Optimizer work hand-in-hand. The Cost Success Indicator leverages open banking knowledge — consumer-permission knowledge that the buyer controls however Mastercard manages — and makes use of AI and machine studying to course of the info and supply the service provider with a greater rating and prediction when figuring out if a transaction might be profitable or not, based mostly on the timing, the quantity and the kind of transaction.

However, Good Routing Optimizer takes the info, prediction, and analytics and determines one of the simplest ways to execute a transaction. Reasonably than sticking with one cost rail, resembling ACH, it is going to discover the perfect answer to set off a transaction, recommending one other cost rail that is extra suited to the buyer. So, for instance, if Cost Success Indicator reveals that the stability for a transaction is on the market as we speak however might not be within the subsequent few days, then Cost Routing Optimizer will advocate utilizing Identical Day ACH. The aim is to search out the fitting rail for the buyer and service provider to execute the transaction in one of the simplest ways attainable.

“We’re constructing these options for the good thing about the banking ecosystem,” Hernandez says. “Banks do not need a cost to be declined from a shopper simply due to unhealthy timing. So, it is attempting to handle everybody’s wants within the ecosystem by leveraging the info the buyer offers us permission to make use of, working the analytics on that knowledge and offering insights and proposals for the good thing about retailers, monetary establishments and shoppers,” she says.

Present launch

Cost Success Indicator and Cost Routing Optimizer are presently restricted to the rental dwelling house, with basic availability scheduled for later this yr, Mastercard mentioned. The primary buyer of those instruments now’s Bilt Rewards Alliance, which is a group of greater than two million rental properties within the US that permits renters to earn factors by paying hire. “Our mission is to assist renters get probably the most worth out of one among their largest bills, and returned funds create vital expense and friction for each residents and landlords,” says Ankur Jain, CEO and founding father of Bilt Rewards. In Mastercard’s press launch, Jain notes that he expects Cost Success Indicator to cut back the potential for returned funds.

Though these two new instruments are restricted to just one shopper now, Hernandez says Mastercard will carry in additional companions later this yr. “Proper now, our options are supposed to deal with the ache factors of verticals that as we speak have significant reliance on ACH. Schooling, well being care, insurance coverage — these can be the targets,” she mentioned.

Each Cost Success Indicator and Cost Routing Optimizer are made attainable by the idea of open banking, which allows third-party monetary service corporations the flexibility to have open entry to shopper banking, transaction, and different monetary knowledge from banks and non-bank monetary establishments utilizing software programming interfaces, or APIs. So, by open banking, shoppers, monetary establishments, and third-party service suppliers will use a community of accounts and knowledge throughout establishments. Utilizing networks somewhat than centralization, open banking may help monetary companies clients share their monetary knowledge with different monetary establishments extra securely.

In Mastercard’s latest research, “The Rise of Open Banking,” almost three-fourths (74%) of American shoppers mentioned they’ve or would join their financial institution accounts to automate monetary duties. What’s extra, 90% of GenZ and Millennial shoppers are already connecting their financial institution accounts to apps, Mastercard mentioned.