Automobiles are displayed on the market at an AutoNation automobile dealership on April 21, 2022 in Valencia, California.

Mario Tama | Getty Pictures

DETROIT — New automobiles are slowly turning into extra broadly obtainable, as provide chain bottlenecks lastly begin to ease. However now, an rising variety of People won’t need them or be capable to afford them.

With the Federal Reserve aggressively mountain climbing rates of interest to combat inflation, shoppers are discovering that the price of financing a brand new automobile is immediately quite a bit greater than it was even earlier this yr. That is anticipated to chop demand and add new stress to the auto business, which had been fighting depleted inventories through the pandemic.

“The irony for the auto market is that simply because the business is poised to begin seeing volumes enhance from supply-constrained recession-like low ranges, the speedy motion in rates of interest is lowering demand,” Cox Automotive Chief Economist Jonathan Smoke wrote in a weblog put up Wednesday.

On the finish of third quarter, Cox Automotive discovered the brand new automobile mortgage fee was 7%, up 2 proportion factors for the yr. The mortgage fee within the used market was up by the identical quantity, to 11%, in response to Cox Automotive.

The upper price for automobile financing comes as family budgets are already being squeezed by decades-high inflation. Meaning many People could now not to have the ability to afford the brand new automobiles which are beginning to arrive on supplier heaps.

And the price of financing is anticipated to maintain climbing. Already this yr, the Fed has aggressively elevated curiosity mortgage charges to three% to three.25%, and it has indicated it plans to proceed mountain climbing charges till the the fed funds fee hits 4.6% in 2023.

Automakers might offset prices with financing offers and reductions, however the latter is one thing corporations have vowed to not return to amid report earnings.

Recovering stock

Fleet and business gross sales notably elevated within the third quarter, indicating that demand from shoppers could also be waning. That is a priority as a result of retail gross sales to shoppers are extra worthwhile, and automakers had been relying on pent-up demand from the pandemic to persist within the close to time period.

However Kristin Dziczek, automotive coverage advisor for the Federal Reserve Financial institution of Chicago’s Detroit department, stated fleet gross sales aren’t essentially as dangerous of an indication as they’ve been previously.

“There’s a whole lot of pent-up fleet demand as a result of fleets have been starved in favor of shoppers,” she stated, including that many authorities and huge business fleets are paying sticker worth for battery-electric and hybrid autos to satisfy native emissions requirements.

The rise in fleet orders comes as as stock ranges are lastly rising from report lows.

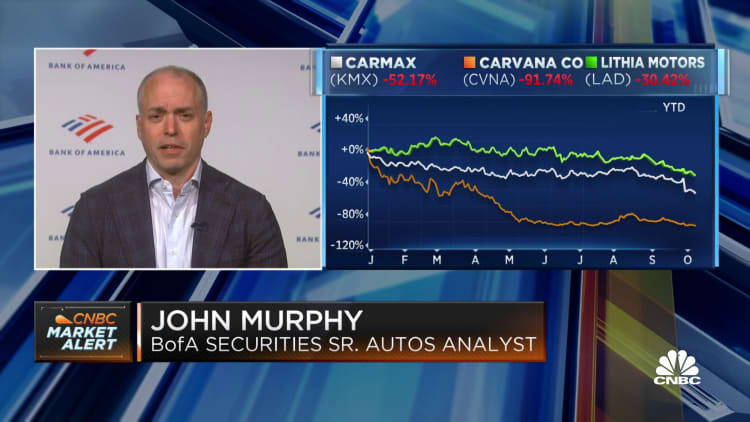

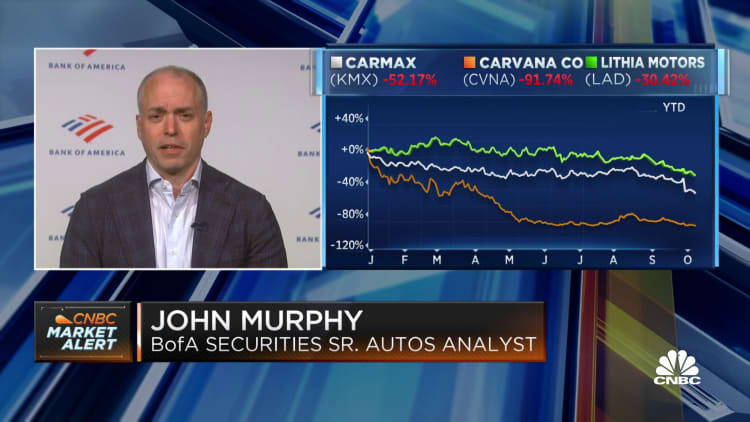

Complete automotive stock elevated to about 1.43 million models on the finish of September, the best stage since Might 2021 and up 160,000 models from the tip of August, in response to BofA Securities.

“We proceed to consider that the gross sales weak point over the previous yr+ is a perform of restricted stock,” analyst John Murphy stated in a Wednesday be aware to traders.

However he additionally famous that demand might soften primarily based on inflation, weak client confidence and the issues a couple of recession.

Largely because of the Fed’s actions, Cox lately lowered its new automobile gross sales forecast for the yr to 13.7 million, down from an already lowered 14.4 million and a stage not seen in a decade. At that gross sales tempo, Smoke stated decrease manufacturing and earnings might additional stress the availability chain, which can result in bankruptcies and additional stock disruptions.

Within the meantime, nevertheless, worth will increase for brand spanking new automobile costs have been slowing. Common buy costs for brand spanking new automobiles rose 6.3% in September to a report of greater than $45,000, J.D. Energy estimates. Earlier within the yr, costs had surged at report ranges of 17.5% and 14.5%.

Costs preserve climbing

To make up for decrease gross sales, automakers have been specializing in producing their costliest autos, that are additionally their most worthwhile. That, mixed with rising rates of interest, is pushing extra automobile consumers to have a look at used autos.

Edmunds reviews the typical quantity financed for brand spanking new autos hit a report of $41,347 through the third quarter. That is up from $40,602 through the second quarter and $38,315 a yr earlier. The typical month-to-month cost on a brand new automobile stayed above $700 through the third quarter. Of these patrons, greater than 14% dedicated to a month-to-month cost of $1,000 or extra for brand spanking new autos — the best stage that Edmunds has ever recorded.

“Stock is usually a bit tenuous, but it surely seems like possibly it’ll get higher and never essentially worse, which comes at an fascinating time, as a result of now it seems like there may very well be a little bit of hassle on the demand due to greater costs, greater rates of interest and the questions of whether or not we’re in a recession or not,” stated Jessica Caldwell, government director of insights at Edmunds.

Cox Automotive economist Charlie Chesbrough stated he would not anticipate new automobile pricing to ease anytime quickly, if ever, as automakers vow to maintain leaner inventories to spice up earnings.

“I do not know that there is any return to regular. I feel we’re simply at a brand new regular,” he stated.

Pricing within the used automobile business has been declining, however the rate of interest will increase might offset that, relying on the phrases.

After peaking in January, Cox Automotive’s Manheim Used Car Worth Index, which tracks costs of used autos offered at its U.S. wholesale auctions, has fallen about 13% this yr by means of September. And final month, wholesale values had their first year-over-year drop since Might 2020, Cox stated Friday. However costs stay elevated from historic ranges.

The typical worth of a financed automobile is over $31,000, a stage nearer to new automobile costs than used automobiles and vehicles, in response to Edmunds.

“There simply aren’t a whole lot of good choices,” Caldwell stated. “Used would not current itself as an excellent choice, actually, except you’ll find one thing with a decrease rate of interest.”