Bitcoin (BTC) has gained almost 28% this month, hitting the best since early November. The favored narrative on Crypto Twitter is that merchants from Coinbase (COIN) have powered the cryptocurrency increased. Nonetheless, the Nasdaq-listed change hasn’t been the one supply of bullish pressures for the cryptocurrency.

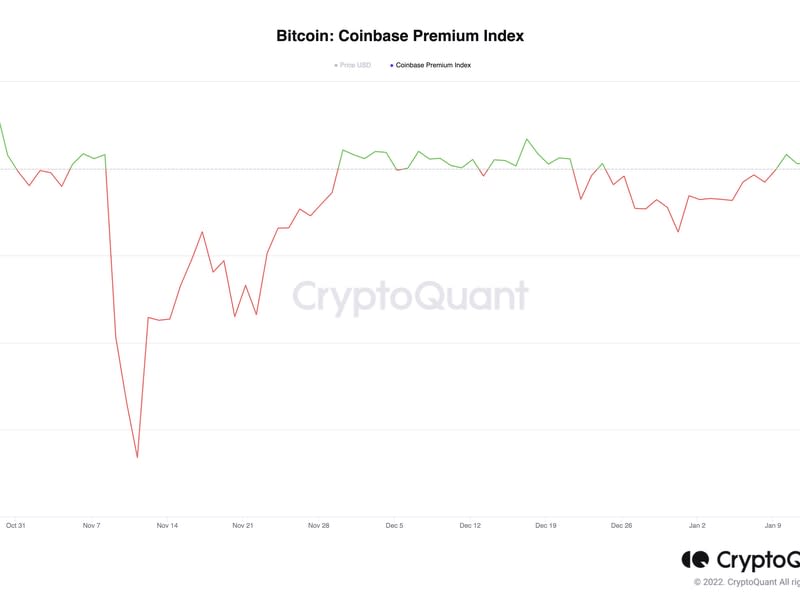

The Coinbase premium index, which measures the unfold between Coinbase’s BTC/U.S. greenback (USD) pair and Binance’s BTC/USDT pair involving the tether stablecoin, turned constructive final week and rose to 0.039 over the weekend, the best since late October, per knowledge sourced from blockchain analytics agency CryptoQuant.

In different phrases, the indicator suggests the shopping for strain on Coinbase has been comparatively stronger.

“The value premium between Bitcoins traded on Coinbase vis-à-vis these traded on Binance (Coinbase-Binance premium) continued to be constructive all through the week, which is indicative of elevated shopping for curiosity from institutional traders vis-à-vis retail traders,” André Dragosch, head of Deutsche Digital Property, wrote in a observe to purchasers.

Establishments favor publicly traded and controlled Coinbase over offshore entities like Binance, that are thought of a proxy for retail investor participation. Binance is now taking steps to determine itself as an institutional-focused platform.

Nonetheless, one other indicator referred to as the cumulative quantity delta (CVD), which measures the online capital inflows into the market, suggests the rally started with Binance-based entities bidding for bitcoin with BUSD, a fiat-backed stablecoin issued by Binance and Paxos, within the perpetual futures market. And patrons from Coinbase and different exchanges joined the fray later.

A rising CVD means extra patrons are in motion, whereas a negative-sloping line implies there are extra sellers.

The chart sourced from Coinalyze.web and tweeted by pseudonymous analyst exitpump (@exitpumpBTC) compares the cumulative quantity delta (CVD) for BTC/BUSD pair listed on Binance (yellow line) with the CVD BTC/USD and BTC/USDT pairs listed on different exchanges and Binance.

The yellow line has been trending upwards since Jan. 11, whereas the inexperienced line started rising three days later. In different phrases, bitcoin’s preliminary enhance from $17,000 was primarily fueled by stable bidding in Binance’s BTC/BUSD market whereas patrons from different exchanges, together with Coinbase, stepped in later.

“From my observations, it was largely one entity [from Binance] bidding and absorbing promote strain and making an attempt to make a breakout market shopping for and always consuming the promote partitions with no indicators of exhaustion, which result in brief squeezes pumping the worth,” exitpump tweeted.

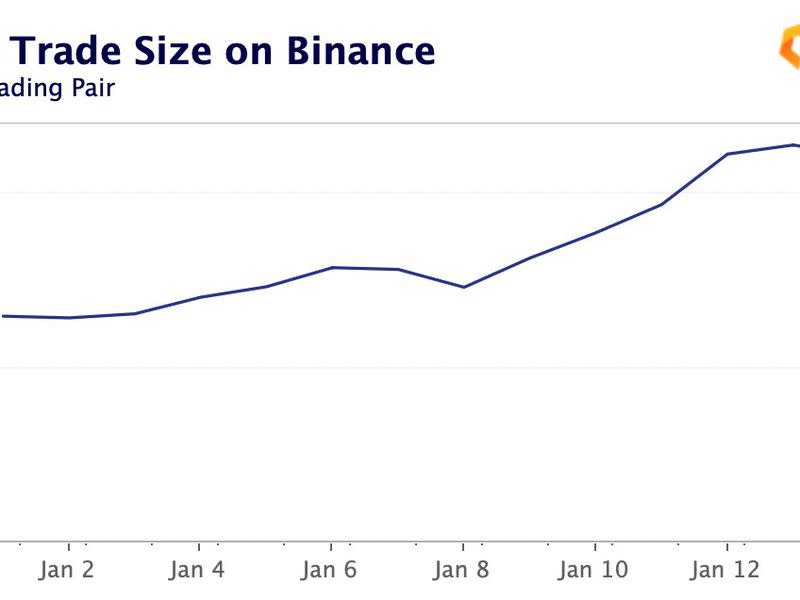

In the meantime, different metrics, like the typical commerce dimension, recommend an absence of clear management and an across-the-board uptick in whale exercise.

“Concerning the typical commerce dimension, there was a notable enhance on Bitstamp, Kraken, Bitfinex and LMAX Digital and a slight enhance on most different exchanges, together with Binance, which recommend extra whale-driven value motion,” Clara Medalie, analysis director at Paris-based crypto knowledge supplier Kaiko, informed CoinDesk in an electronic mail.

The typical commerce dimension on Binance has elevated from $700 to $1,100 since Jan. 8.

Bitcoin modified palms at round $21,150 at press time, having risen almost 22% final week. The rally stemmed from the assumption that worse macroeconomic dangers could also be behind us.

“It isn’t simply the acceptance that peak inflation is behind us and that charges most likely do not have that a lot additional to rise. It is also that almost all sellers have been flushed out of the market,” Noelle Acheson, writer of the favored “Crypto Is Macro Now” publication, mentioned within the weekend’s version of the publication, explaining the worth rally.