What GAO Discovered

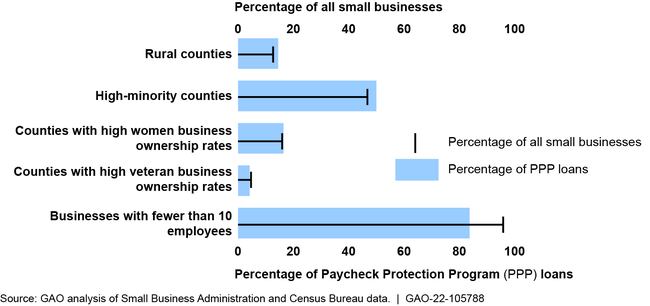

The Paycheck Safety Program (PPP) supported small companies by way of forgivable loans for payroll and different eligible prices. Early lending favored bigger and rural companies, in keeping with GAO’s evaluation of Small Enterprise Administration (SBA) knowledge. Particularly, 42 % of early loans (authorized April 3–16, 2020) went to bigger companies (10 to 499 staff), though these companies accounted for less than 4 % of all U.S. small companies. Bigger companies have been extra prone to have a preexisting lending relationship with a financial institution. Companies in rural areas additionally obtained a excessive share of early loans regardless of being historically underserved.

Different historically underserved companies—particularly, companies owned by self-employed people, minorities, girls, and veterans—confronted challenges acquiring loans, prompting Congress and SBA to make a collection of modifications shortly after this system launched. For instance:

- SBA admitted about 600 new lenders, together with nonbanks (usually, lending establishments that don’t settle for deposits).

- SBA developed steerage serving to self-employed people take part in this system.

- SBA focused funding to minority-owned companies partially by way of Neighborhood Growth Monetary Establishments.

Lending to historically underserved companies elevated noticeably after these modifications have been carried out. By the point PPP closed in June 2021, lending in historically underserved counties was proportional to their illustration within the total small enterprise neighborhood (see determine). Whereas lending to companies with fewer than 10 staff remained disproportionately low, it elevated considerably over the course of this system.

Paycheck Safety Program Loans, by Sort of Enterprise or County

Why GAO Did This Research

The COVID-19 pandemic resulted in vital turmoil within the U.S. financial system, resulting in non permanent and everlasting enterprise closures and excessive unemployment. In response, in March 2020, Congress established PPP below the CARES Act and in the end supplied dedication authority of roughly $814 billion for this system over three phases. When preliminary program funding ran out in 14 days, considerations rapidly surfaced that sure companies have been unable to entry this system, prompting a collection of modifications by Congress and SBA.

This testimony addresses (1) which small companies obtained early PPP loans and (2) how program modifications affected small enterprise participation in PPP. It’s based mostly on GAO’s September 2021 report on PPP (GAO-21-601). For that report, GAO analyzed loan-level PPP knowledge from SBA and county-level knowledge from the U.S. Census Bureau.

For extra info, contact William B. Shear at (202) 512-8678 or shearw@gao.gov.