Regardless of robust wage progress and a low unemployment charge, customers are feeling the impacts of upper costs. The Fed is planning a March charge hike to deal with inflation, nevertheless it may affect private mortgage charges. (iStock)

The Federal Reserve stored its benchmark charge close to zero since March 2020 to spice up financial restoration amid the COVID-19 pandemic. However with record-high annual inflation and a powerful labor market, the Fed is planning to implement a number of charge hikes in 2022 beginning this month.

When the central financial institution raises the federal funds charge, rates of interest are more likely to edge up on plenty of monetary merchandise, together with bank cards, non-public pupil loans, house fairness traces of credit score — and private loans.

Hold studying to be taught extra about how the Fed’s financial coverage might affect private mortgage charges, in addition to easy methods to get a low rate of interest on a private mortgage. A method is to evaluate charges throughout a number of lenders directly on Credible’s on-line market.

WHAT THE FED’S NEW ECONOMIC POLICY MEANS FOR MORTGAGE RATES

What Fed charge hikes may imply for private loans

Lenders set shopper borrowing charges primarily based on the prime charge, which is an financial index monitoring the charges that banks cost their most creditworthy business debtors. The prime charge is essentially impacted by the federal funds charge.

A gaggle of high-ranking Fed policymakers on the Federal Open Market Committee (FOMC) decide the federal funds charge, modifying the central financial institution’s financial coverage to match present circumstances. The FOMC is maintaining a detailed eye on inflation, which rose at an annual charge of seven.5% in January — practically triple the Fed’s 2% goal.

Fed Chair Jerome Powell informed lawmakers final week that he’ll suggest a quarter-point charge hike throughout the March 15-16 FOMC assembly to curb excessive inflation. He added that Fed officers are “ready to maneuver extra aggressively by elevating the federal funds charge by greater than 25 foundation factors” at future conferences.

“With inflation nicely above 2% and a powerful labor market, we count on it will likely be acceptable to lift the goal vary for the federal funds charge at our assembly later this month,” Powell stated.

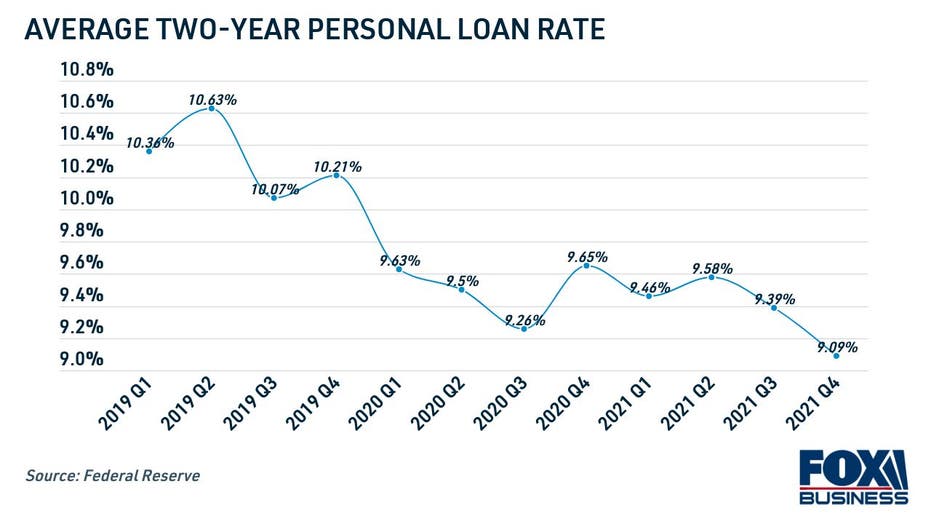

The upcoming charge hikes will affect the prime charge and sure trigger borrowing prices to edge larger on plenty of shopper borrowing merchandise, together with private loans. Common private mortgage charges reached historic lows in late 2021 due partially to the Fed’s reasonable financial coverage, however they could start to edge up on account of charge hikes in 2022.

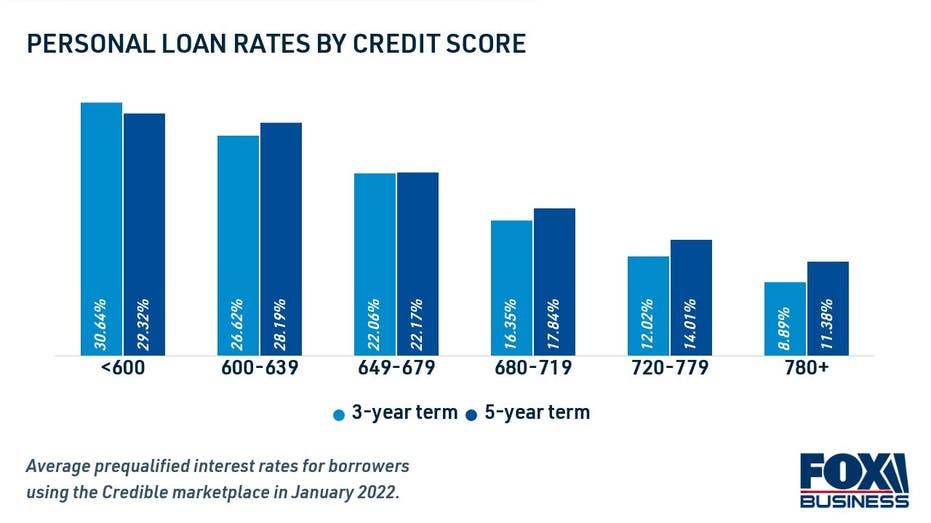

Whereas private mortgage lenders take the prime charge under consideration, they lean extra closely on different components like an applicant’s credit score rating and debt-to-income ratio (DTI) to find out rates of interest. And since charges differ from one lender to the subsequent, it is necessary to buy round throughout a number of lenders.

You’ll be able to go to Credible to evaluate private mortgage charges tailor-made to you without spending a dime with out impacting your credit score rating.

PERSONAL LOAN RATES ARE MUCH LOWER IN 2022 THAN THEY WERE A YEAR AGO, DATA SHOWS

How you can get a low private mortgage charge

Though the Fed’s March charge hike might affect common private mortgage charges, there are a variety of things inside your management that lenders think about when setting rates of interest. Private mortgage lenders lean closely in your creditworthiness, together with credit score rating and DTI, to find out your rate of interest and eligibility

Candidates with superb to wonderful credit score, outlined by the FICO scoring mannequin as 740 or larger, will see the bottom private mortgage charges. However, these with low credit score might even see larger charges — in the event that they qualify in any respect.

Listed here are a couple of ideas for getting a low rate of interest on a private mortgage:

- Work on constructing your credit score rating. Enhance your on-time cost historical past and decrease your credit score utilization, which is the quantity of revolving debt you owe in comparison with the credit score restrict accessible to you. Additionally think about enrolling in free credit score monitoring providers on Credible.

- Scale back your debt burden. Ideally, lenders wish to see a DTI ratio of 36% or decrease. When you have extreme ranges of debt, think about dedicating money windfalls like tax refunds and work bonuses to paying down your present loans. Alternatively, you possibly can seek for methods to extend your earnings.

- Store round with a number of lenders. Most private mortgage lenders allow you to prequalify to see your estimated rate of interest with a mushy credit score inquiry, which will not have an effect on your credit score rating. That manner, you possibly can store for the bottom charge attainable.

You’ll be able to browse present private mortgage charges within the desk beneath. Then, you possibly can go to Credible to get prequalified by way of a number of lenders directly, so you possibly can store round for one of the best supply to your monetary scenario.

FORECAST: HERE’S WHAT THE HOUSING MARKET WILL LOOK LIKE IN 2022, ACCORDING TO AN EXPERT

Have a finance-related query, however do not know who to ask? E-mail The Credible Cash Knowledgeable at moneyexpert@credible.com and your query is likely to be answered by Credible in our Cash Knowledgeable column.