Our objective right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” beneath, is to provide the instruments and confidence you might want to enhance your funds. Though we do promote merchandise from our associate lenders who compensate us for our providers, all opinions are our personal.

The newest developments in rates of interest for private loans from the Credible market, up to date weekly. (iStock)

Debtors with good credit score searching for private loans through the previous seven days prequalified for common charges that had been decrease for 3-year fixed-rate loans and 5-year fixed-rate loans in comparison with the earlier seven days.

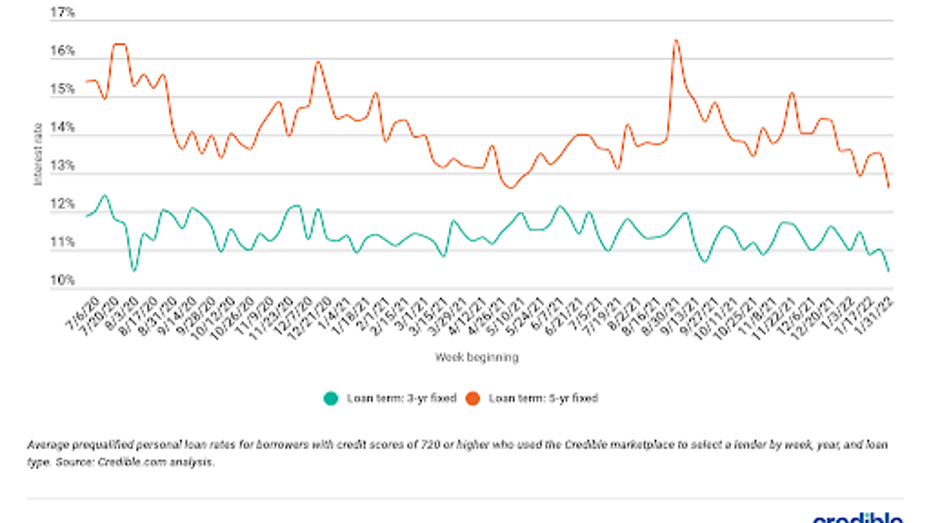

For debtors with credit score scores of 720 or increased who used the Credible market to pick out a lender between Feb. 3 and Feb. 9:

- Charges on 3-year fixed-rate loans averaged 10.22%, down from 10.81% the seven days earlier than and 11.11% a yr in the past.

- Charges on 5-year fixed-rate loans averaged 13%, down from 13.32% the earlier seven days and 14.33% a yr in the past.

Private loans have change into a well-liked approach to consolidate and repay bank card debt and different loans. They may also be used to cowl sudden bills like medical payments, deal with a serious buy or fund house enchancment tasks.

Charges for 3-year and 5-year fastened private loans fell once more over the previous seven days. Three-year private mortgage charges slid down 0.59% to their lowest common of 2022 thus far. In the meantime, 5-year charges dropped 0.32%. Charges for each phrases are additionally decrease than they had been on the similar time final yr. Debtors can take pleasure in vital curiosity financial savings with both a 3-year or 5-year private mortgage proper now. Their fastened rates of interest imply your charge received’t change over the lifetime of your mortgage.

Whether or not a private mortgage is best for you typically is dependent upon a number of components, together with what charge you may qualify for. Evaluating a number of lenders and their charges may assist make sure you get the very best private mortgage to your wants.

It is at all times a good suggestion to comparability store on websites like Credible to know how a lot you qualify for and select the best choice for you.

Listed here are the newest developments in private mortgage rates of interest from the Credible market, up to date weekly.

Table of Contents

Private mortgage weekly charges developments

The chart above exhibits common prequalified charges for debtors with credit score scores of 720 or increased who used the Credible market to pick out a lender.

For the month of January 2022:

- Charges on 3-year private loans averaged 11.09%, down from 11.29% in December.

- Charges on 5-year private loans averaged 13.40%, down from 14.12% in December.

Charges on private loans range significantly by credit score rating and mortgage time period. When you’re inquisitive about what sort of private mortgage charges chances are you’ll qualify for, you need to use a web based device like Credible to check choices from totally different non-public lenders. Checking your charges will not have an effect on your credit score rating.

All Credible market lenders supply fixed-rate loans at aggressive charges. As a result of lenders use totally different strategies to guage debtors, it’s a good suggestion to request private mortgage charges from a number of lenders so you may examine your choices.

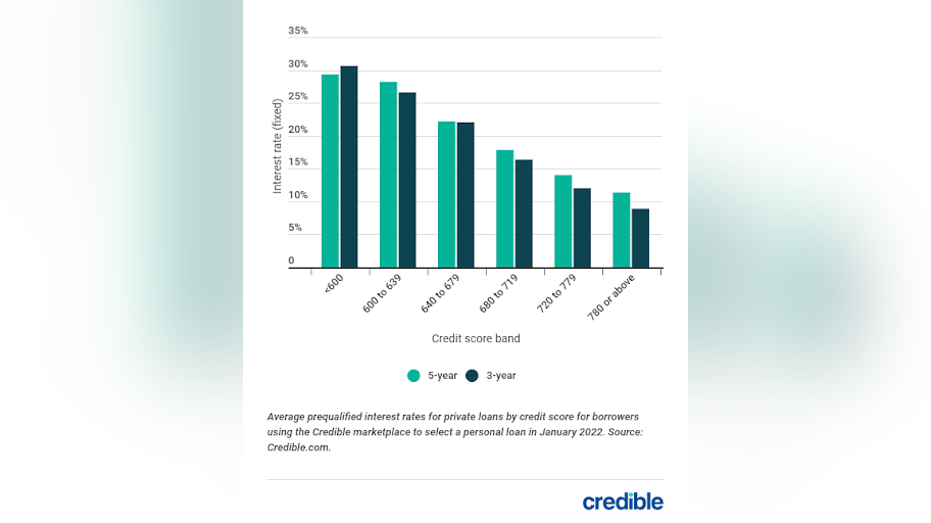

Present private mortgage charges by credit score rating

In January, the typical prequalified charge chosen by debtors was:

- 8.89% for debtors with credit score scores of 780 or above selecting a 3-year mortgage

- 29.32% for debtors with credit score scores beneath 600 selecting a 5-year mortgage

Relying on components resembling your credit score rating, which sort of non-public mortgage you’re searching for and the mortgage reimbursement time period, the rate of interest can differ.

As proven within the chart above, a very good credit score rating can imply a decrease rate of interest, and charges are usually increased on loans with fastened rates of interest and longer reimbursement phrases.

Easy methods to get a decrease rate of interest

Many components affect the rate of interest a lender may give you on a private mortgage. However you may take some steps to spice up your probabilities of getting a decrease rate of interest. Listed here are some techniques to attempt.

Improve credit score rating

Usually, individuals with increased credit score scores qualify for decrease rates of interest. Steps that may enable you enhance your credit score rating over time embody:

- Pay payments on time. Cost historical past is crucial consider your credit score rating. Pay all of your payments on time for the quantity due.

- Verify your credit score report. Have a look at your credit score report to make sure there aren’t any errors on it. When you discover errors, dispute them with the credit score bureau.

- Decrease your credit score utilization ratio. Paying down bank card debt can enhance this essential credit-scoring issue.

- Keep away from opening new credit score accounts. Solely apply for and open credit score accounts you really need. Too many arduous inquiries in your credit score report in a brief period of time may decrease your credit score rating.

Select a shorter mortgage time period

Private mortgage reimbursement phrases can range from one to a number of years. Usually, shorter phrases include decrease rates of interest because the lender’s cash is in danger for a shorter time frame.

In case your monetary scenario permits, making use of for a shorter time period may enable you rating a decrease rate of interest. Take note the shorter time period doesn’t simply profit the lender — by selecting a shorter reimbursement time period, you’ll pay much less curiosity over the lifetime of the mortgage.

Get a cosigner

It’s possible you’ll be conversant in the idea of a cosigner when you have scholar loans. In case your credit score isn’t adequate to qualify for one of the best private mortgage rates of interest, discovering a cosigner with good credit score may enable you safe a decrease rate of interest.

Simply keep in mind, should you default on the mortgage, your cosigner will likely be on the hook to repay it. And cosigning for a mortgage may additionally have an effect on their credit score rating.

Evaluate charges from totally different lenders

Earlier than making use of for a private mortgage, it’s a good suggestion to buy round and examine affords from a number of totally different lenders to get the bottom charges. On-line lenders sometimes supply probably the most aggressive charges — and could be faster to disburse your mortgage than a brick-and-mortar institution.

However don’t fear, evaluating charges and phrases doesn’t should be a time-consuming course of.

Credible makes it simple. Simply enter how a lot you wish to borrow and also you’ll be capable to examine a number of lenders to decide on the one which makes probably the most sense for you.

About Credible

Credible is a multi-lender market that empowers customers to find monetary merchandise which can be one of the best match for his or her distinctive circumstances. Credible’s integrations with main lenders and credit score bureaus enable customers to rapidly examine correct, customized mortgage choices ― with out placing their private info in danger or affecting their credit score rating. The Credible market gives an unequalled buyer expertise, as mirrored by over 4,500 constructive Trustpilot opinions and a TrustScore of 4.7/5.