Private mortgage originations are anticipated to rise 11% in 2022 amongst non-prime debtors with truthful or spotty credit scores, in response to TransUnion. (iStock)

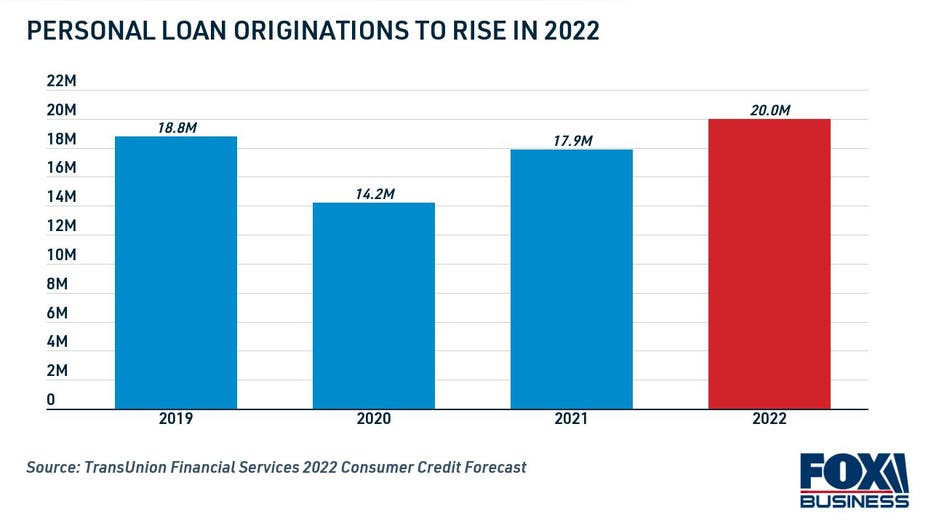

Private loans supply quick, lump-sum funding that can be utilized to consolidate high-interest debt, pay for house enhancements and finance giant purchases. On the onset of the coronavirus pandemic, private mortgage originations dropped off abruptly — however they’re anticipated to make a sturdy comeback in 2022.

Demand for private loans is forecasted to rise to all-time highs on this 12 months as customers search for methods to repay rising bank card balances, in response to the 2022 Client Credit score Forecast from the credit score bureau TransUnion. Lenders are anticipated to extend private mortgage originations to each prime debtors with glorious credit score and subprime debtors with credit score scores beneath 660.

“Lenders are desperate to pursue development, together with increasing again into the non-prime client phase,” stated TransUnion Senior Vice President Charlie Sensible.

YOU COULD SEE A LOWER TAX REFUND THIS YEAR, AND THIS IS WHY

Private mortgage originations are anticipated to exceed pre-pandemic ranges, with TransUnion predicting 20 million originations in 2022. That is up dramatically from 14.2 million originations in 2020.

“This development can be boosted by an eventual return of demand for bank card consolidation loans as card balances develop,” stated TransUnion Senior Vice President Liz Pagel.

Maintain studying to study extra about TransUnion’s predictions for the unsecured lending market in 2022, and go to Credible to buy private loans throughout a number of lenders without delay.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Private mortgage lenders will renew deal with subprime debtors

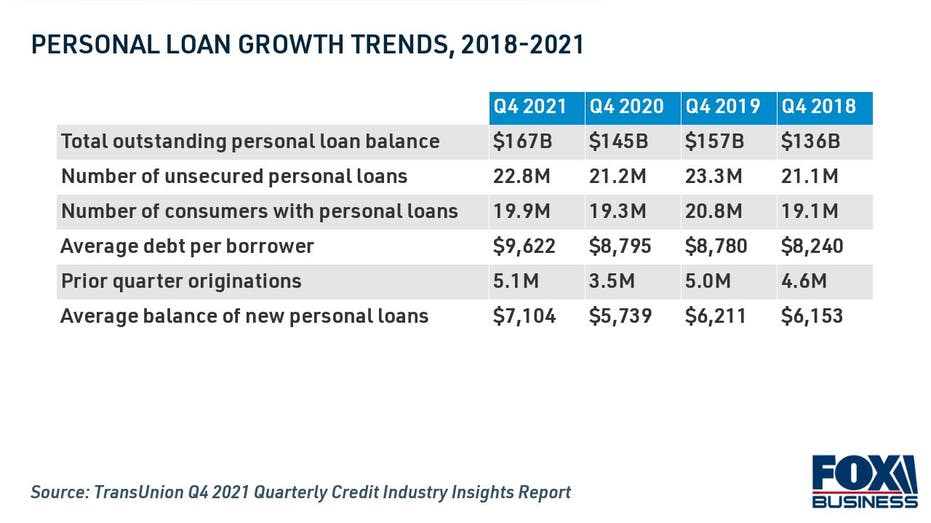

Previously 12 months, the non-public mortgage trade has seen important development amongst debtors with credit score scores between 300 and 660. Within the fourth quarter of 2021, private mortgage originations to non-prime debtors skyrocketed 47% from a 12 months earlier, in response to TransUnion’s This autumn 2021 Quarterly Credit score Business Insights Report.

TransUnion expects this pattern to proceed in 2022, with lenders persevering with to extend short-term mortgage originations to debtors with subprime credit score histories.

“The financial system is normalizing and continues to broaden, and people indicators of renewed energy are encouraging lenders to not simply deal with the least dangerous customers, however to supply better entry to these individuals that could be considered as larger credit score dangers,” Sensible stated.

WHAT THE FED’S NEW ECONOMIC POLICY MEANS FOR MORTGAGE RATES

TransUnion expects private mortgage originations to develop 11% for non-prime debtors in 2022, which is marginally decrease than the 14% development anticipated amongst prime customers. However because of extra subprime lending, delinquencies are anticipated to extend considerably.

“Whereas the rise in subprime originations has led to a slight improve in delinquencies, they nonetheless stay properly beneath pre-pandemic ranges, and delinquencies by threat tier stay pretty steady,” Pagel stated.

This renewed deal with subprime loans will give customers with truthful or poor credit score an opportunity to borrow private loans to repay higher-interest debt and finance giant bills. Subprime debtors with low credit score scores who’re contemplating taking out a private mortgage ought to store round with a number of lenders to keep away from spotty credit loans with excessive rates of interest.

You’ll be able to browse present private mortgage charges within the desk beneath, and go to Credible to see your estimated mortgage phrases without cost with out impacting your credit score rating.

93% OF PAYDAY LOAN BORROWERS REGRET TAKING OUT THEIR LOANS

Bank card consolidation will drive private mortgage development in 2022

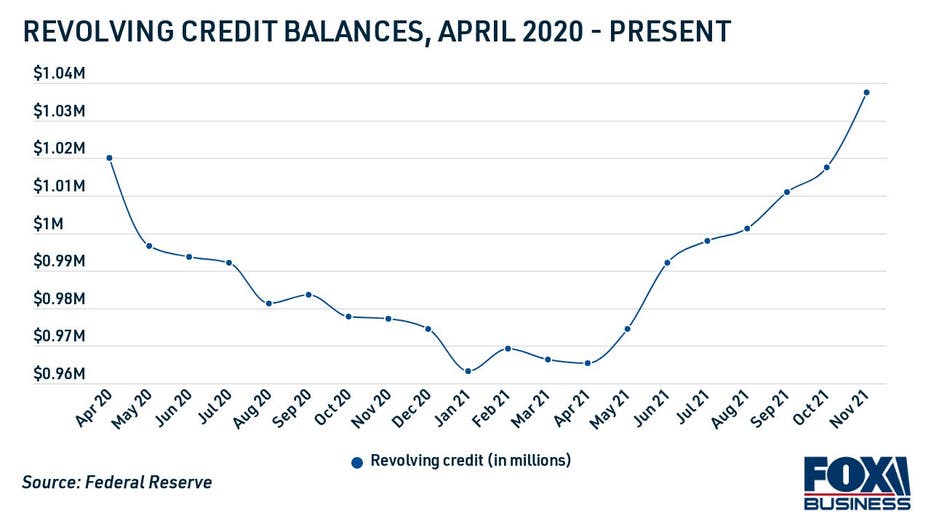

Demand for private loans remained low by early 2021 as customers acquired stimulus checks and decreased their spending. However amid financial restoration, client spending and revolving credit score balances proceed to rise — and plenty of debtors can be in search of unsecured loans to repay bank card debt.

“With client spending anticipated to extend in 2022, TransUnion’s forecast tasks this will result in a continued rebound within the client lending market, particularly as customers resume searching for unsecured private loans to consolidate rising card balances,” the report reads.

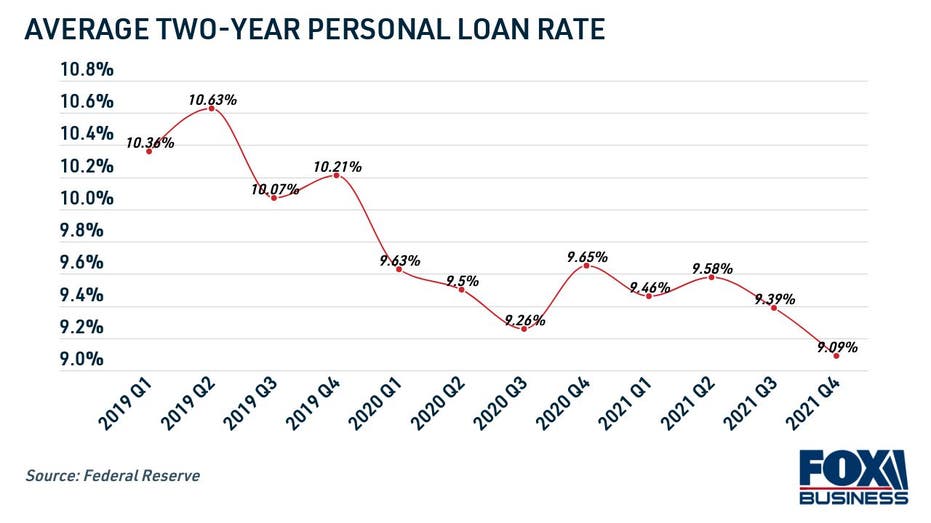

Unsecured private loans give debtors the chance to repay high-interest bank card debt at a low, mounted charge. Whereas the common bank card rate of interest is 16.44%, in response to the Federal Reserve, the common charge on a two-year private mortgage is at a historic low of 9.09%.

Private loans make it simpler to repay revolving bank card balances, since they’re repaid in mounted month-to-month funds. Due to decrease rates of interest, well-qualified debtors might be able to save practically $2,400 in curiosity prices by consolidating bank card debt with this kind of mortgage, in response to a latest Credible evaluation.

You’ll be able to study extra about bank card consolidation loans by getting in contact with a educated mortgage officer at Credible. You can too use a private mortgage compensation calculator to see if this debt payoff technique is best for you.

CAN YOU USE A PERSONAL LOAN TO PAY OFF YOUR AUTO LOAN?

Have a finance-related query, however do not know who to ask? E mail The Credible Cash Skilled at moneyexpert@credible.com and your query is likely to be answered by Credible in our Cash Skilled column.